Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.28 10:53

Forex Weekly Outlook Jun 30-Jul 4The US dollar was on the back foot in a week that saw quite a few breakouts. As the new quarter begins, top tier events are due in the busy calendar. The peak is the early Non-Farm Payrolls release, which happens at the same time that Draghi begins talking. Here is an outlook on the highlights of this week.

The divergence between past and present data became extreme: Q1 contraction was revised to a terrible 2.9% and it certainly hurt the dollar. How will the US reach 2.2% growth in 2014 this way? Well, Q2 continues to look good, with excellent home sales and rising consumer confidence. In the euro-zone, data remains weak, while in the UK, the BOE watered down its comments and sent GBPUSD down. NZD/USD stood out with a challenge of the yearly highs and the loonie continued recovering.

- Canadian GDP: Monday, 12:30. The Canadian economy continued to expand in March rising 0.1%, after a 0.2% increase in the previous month while growing at a yearly rate of 2.1% following 2.5% in February. The reading was in line with market forecast. The Bank of Canada maintained its interest rate in its last meeting in June but is under pressure to deliver some policy tightening in the face of an asset bubble that is forming in the housing market. The Canadian economy is expected to grow by 0.2% in April.

- US Pending Home Sales: Monday, 14:00. The index of pending U.S. home sales increased modestly in April up by 0.4% to 97.8, indicating the housing market is stabilizing after the harsh winter. The increase was below market forecast of 1.1% and followed a 3.4% jump in the previous month. The index has risen for two consecutive months. However, they fell 9.2% in the 12 months through April. U.S. pending home sales is expected to rise 1.4% this time.

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 2.50% in its June meeting. The reading was in line with market expectations posting the eight consecutive meeting of unchanged rates. The Bank’s statement was also the same as in the previous month. Financial conditions are accommodative and price volatility is low. Domestic economy is adjusting to the sharp decline in the resource sector investments and unemployment reaches record highs. No change is expected now.

- US ISM Manufacturing PMI: Tuesday, 14:00. The U.S. manufacturing sector continued to expand, in May reaching a revised 55.4 from an initial reading of 53.2. The figure was better than the 54.9 release posted in April, slightly below the 55.7 expected by analysts. This improvement indicated that the manufacturing sector had advanced more rapidly in May compared to April. The U.S. manufacturing sector is predicted to rise further to 55.6 .

- US ADP Non-Farm Employment Change: Wednesday, 12:15. US employers hired fewer workers than expected in May adding 179,000 positions from 215,000 in the previous month, but a growth trend was visible in the services sector suggesting the pick-up in economic growth continues after a sluggish start early this year. Nevertheless the ADP release did not forecast the strong job addition of 217,000 posted later that week in the Non-farm Payrolls. US employment market is expected to grow by 206,000 this time.

- Janet Yellen speaks: Wednesday, 15:00. Federal Reserve Chair Janet Yellen will speak in Washington D.C. at the International Monetary Fund. Fed Chair Yellen delivered mixed messages after the FOMC meeting leaving investors puzzled about a possible rate hike. Market volatility is expected.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank decided to act in its last meeting in June agreed to impose a negative interest rate of -0.10% on its overnight depositors, to encourage banks to lend rather than hoard cash with their central banks and prevent the euro zone from falling into deflation. The ECB was the first central bank to set negative interest rates on banks. The Central bank also cut rates to 0.15% from 0.25%. Economists expected the ECB to cut its rate to 0.10% and reduce deposit rate to -0.10% from zero. The ECB is not expected to make further changes at this point but we Draghi always rocks the markets, as he did last time by closing the door to more cuts.

- US Non-Farm Employment Change and Unemployment Rate: Thursday, 12:30. The U.S. economy created 217,000 jobs in May, backing claims that the five-year-long recovery accelerated this spring. The reading cane above forecast for a 214,000 addition, following a huge increase of 282,000 posted in the prior month. The jobless rate remained unchanged at 6.3% beating forecasts for a rise to 6.4%. An addition of 211,000 positions is expected, while the unemployment rate is expected to remain unchanged at 6.3%

- US Trade Balance: Thursday, 12:30. US trade deficit edged up 6.9% in April to a two-year high of $47.2 billion, amid a sharp increase in imported goods such as cars, cellphones, computers and networking gear, indicating consumer spending is picking up. However, slower than expected growth in the second quarter increases deficit. The 4-week moving average edged up 2,000 reaching 314,250. US trade deficit is expected to reach 45.1 million this time.

- US ISM Non-Manufacturing PMI: Thursday, 14:00. The U.S. service sector continued to expand in May, rising to 56.3 from 55.2 in April, exceeding market forecasts by 0.7 points. The majority of respondents were positive about current and future conditions. The employment index edged up to 52.4, from 51.3 in April, new orders rose to 60.5, from the previous reading of 58.2 and the business activity climbed to 62.1, from 60.9. The U.S. service sector is expected to reach 56.2.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.28 12:58

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Bearish- Status-Quo RBA Policy Announcement May Weigh on Aussie Dollar

- Upbeat US Data May Amplify Decline in the Aussie’s Yield Advantage

Domestic policy returns

to focus for the Australian Dollar in the week ahead as all eyes turn

to the RBA interest rate decision. Economists’ expectations suggest

Governor Glenn Stevens and company will leave the baseline lending rate

unchanged yet again. The markets seem to agree, with a Credit Suisse

gauge tracking the priced-in policy outlook putting the probability of

an adjustment at a mere 1 percent. That puts the spotlight on the

statement accompanying the announcement, with traders combing through

the document’s verbiage to tease out the central bank’s thinking on

where it intends to go in the months ahead.

For the past two months, the combination of the

post-meeting RBA statement and the subsequent release of minutes from

the sit-down have left investors with a dovish lean in their forward

outlook. The statements themselves have struck a fairly neutral tone,

steadfastly arguing for a period of stability in benchmark borrowing

costs. The minutes have added some dovish color, reflecting a central

bank uneasy about a return to tightening. That is not surprising:

Australian economic news-flow has dramatically deteriorated relative to

consensus forecasts since mid-April, warning against taking any steps

that might make matters worse.

July’s meeting seems likely to offer more of the

same. While the economy continues to look fragile, it does not seem to

have become substantially more so since policymakers convened in June.

That opens the door for the status quo to remain in place.

Interestingly, the absence of a change in the RBA’s posture may still

carry important directional implications for the Aussie. Having

previously moved tracked closely with Australia’s 2-year bond yield,

the currency has increasingly diverged in recent weeks. While the

Australia-US front-end yield spread has moved sharply lower, AUD/USD

has continued to oscillate in a range loosely defined between the 0.92

and 0.95 figures.

On balance, this seems to leave the door open

for a correction. Moving past the RBA announcement without material

changes to the landscape may put a spotlight on the increasingly

disconnect between the exchange rate and relative policy bets, forcing

the Aussie to correct downward. The move may be amplified by a set of

high-profile US data releases. Manufacturing- and service-sector ISM

figures as well as the closely-monitored Nonfarm Payrolls reading are

in the spotlight. Expectations call for only nominal changes on both

fronts, keeping the present setting of investors’ Fed policy bets

broadly intact. Cumulatively, the emerging narrative tells of a US

central bank that is cautiously reducing stimulus and an Australian one

that isn’t, prodding investors to take heed of the shifting landscape

and respond accordingly.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.30 15:16

The saga at 0.9400 in AUD/USD continues

We’ve had more episodes at 0.9400 than Dallas and we could have yet another failure on the cards.

We’ve just knocked below it but only by 4 pips but it’s looking like more upside disappointment for the bulls.

Since the beginning of the month the 100 h4 ma has acted as good support and at 0.9380 is worth watching.

Further down we have the 200 h4ma coinciding with the 55 dma at 0.9329/33.

While we remain below 0.9450 the risk of a bigger fall looms larger.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.30 17:34

2014-06-30 14:30 GMT (or 16:30 MQ MT5 time) | [USD - Dallas Fed Manufacturing Business Index]

- past data is 8.0

- forecast data is n/a

- actual data is 11.4 according to the latest press release

[USD - Dallas Fed Manufacturing Business Index] = The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state's factory activity. Firms are asked by Federal Reserve Bank of Dallas whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase.

==========

DALLAS FED MANUFACTURING HEATS UP

The Dallas Fed's latest manufacturing outlook survey is out, and the numbers look good.

The headline index jumped to 11.4 in June from 8.0 in May.

Economists were looking for a reading of 8.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 28 pips price movement by USD - Dallas Fed Manufacturing Business Index news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.06.29 15:49

AUD/USD weekly outlook: June 30 - July 4The Australian dollar edged higher against its U.S. counterpart on Friday, amid speculation the Federal Reserve will keep interest rates at record-low levels for a considerable time.

AUD/USD hit 0.9444 on Wednesday, the pair’s highest since April 10, before subsequently consolidating at 0.9423 by close of trade on Friday, up 0.09% for the day and 0.35% higher for the week.

The pair is likely to find support at 0.9353, the low from June 25 and resistance at 0.9444, the high from June 23.

Upbeat U.S. consumer sentiment data released Friday failed to dispel concerns over the outlook for the wider economic recovery.

The final reading of the University of Michigan's consumer sentiment index rose to 82.5 this month from 81.9 in May, compared to expectations of 82.2.

The report did little to alter expectations that the Federal Reserve will keep rates on hold for an extended period after data earlier in the week showed that U.S. first quarter growth was revised sharply lower.

The dollar weakened broadly after the Commerce Department said Wednesday that the U.S. economy contracted at an annual rate of 2.9% in the first three months of the year, compared to the consensus forecast for a decline of 1.7%.

U.S. first quarter GDP was initially reported to have increased by 0.1%, but was subsequently revised to show a contraction of 1.0%.

The dollar came under additional pressure after data on Thursday showed that U.S. consumer spending rose by just 0.2% in May, below forecasts for 0.4%.

In the week ahead, investors will be looking to the U.S. nonfarm payrolls report on Thursday for further indications on the strength of the labor market, while the Reserve Bank of Australia’s policy meeting on Tuesday will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, June 30

- The U.S. is to produce data on manufacturing activity in the Chicago region and a report on pending home sales.

- The Reserve Bank of Australia is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- Later Tuesday, the Institute of Supply Management is to publish a report on U.S. manufacturing activity.

- Australia is to release data on the trade balance, the difference in value between imports and exports.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on factory orders.

- Later Wednesday, Fed Chair Janet Yellen is to speak at an event in Washington; her comments will be closely watched.

- Australia is to publish data on building approvals and retail sales. RBA Governor Glen Stevens is to speak at an event in Hobart.

- The U.S. is to release data on the trade balance, as well as the weekly report on initial jobless claims. The U.S. is also to publish what will be closely watched government data on nonfarm payrolls and the unemployment rate, one day ahead of schedule due to the fourth of July holiday.

- Later Thursday, the ISM is to publish a report service sector activity.

- Markets in the U.S. are to remain closed for the Independence Day holiday

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.01 07:49

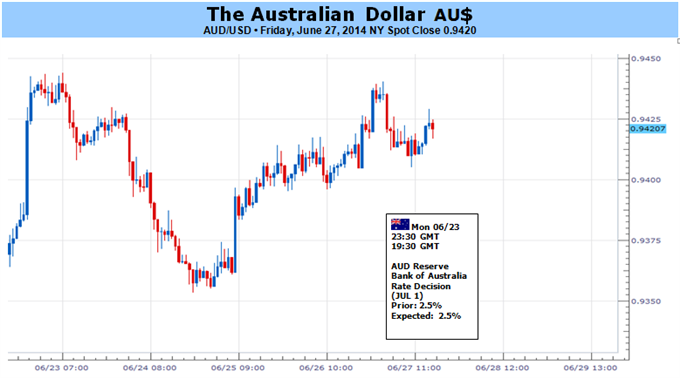

2014-07-01 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

- past data is 2.50%

- forecast data is 2.50%

- actual data is 2.50% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate for overnight money market deposits. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

RBA Leaves Key Rate Unchanged At Record Low

The Reserve Bank of Australia left its key interest rate unchanged at a record-low level as widely expected by economists.

The monetary policy board maintained the cash rate at 2.50 percent. The rate has been at the current level since August 2013.

The board assessed that the monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target, Governor Glenn Stevens said in a statement.

"On present indications, the most prudent course is likely to be a period of stability in interest rates," he said.

Looking ahead, continued accommodative monetary policy should provide support to demand and help growth to strengthen over time. Further, inflation is expected to be consistent with the 2-3 percent target over the next two years.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 43 pips price movement by AUD - Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.02 07:13

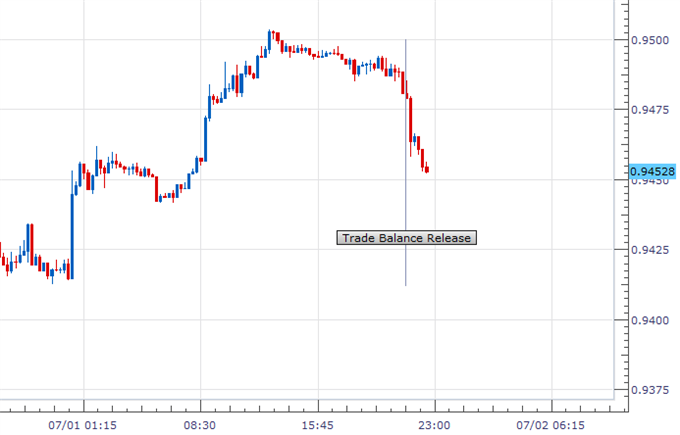

2014-07-02 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

- past data is -0.78B

- forecast data is -0.16B

- actual data is -1.91B according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Australian Dollar Drops as Trade Balance Figures Disappoint

- Australian Trade Deficit –A$1911M in May vs. –A$200M Expected

- Imports Fell by 1 Percent m/m, Exports Declined by 5 Percent m/m

- Australian Dollar Drops Sharply vs. USD After Trade Data Release

Australia’s Trade Balance for the month of May came in at –A$1911M today,whichmarks the largest trade deficit for the country since November 2012. This data was well below the market expectations of -A$200M.

The prior month’s figures were also significantly revised to reflect a

trade deficit of -A$780M, a downgrade from the previously reported

-A$122M shortfall.

Numbers released by the Bureau of Statistics showed that imports fell by 1 percent while exports fell by 5 percent. A deeper look into these numbers revealed a significant drop in exports of energy commodities like coal and natural gas as well as metals like copper and aluminum.

The Australian Dollar fell sharply against the USDollar after the data was released. Traders typically interpret a trade deficit as negative for the relevant currency, speculating that the underlying outflow of capital that the gap implies will put downward pressure on the exchange rate.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 31 pips price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.02 13:05

AUD/USD Elliott Wave AnalysisAussie found renewed buying interest at 0.9354 last week and has finally resumed recent upmove as price broke above resistance at 0.9461, bullishness remains for further gain to previous resistance at 0.9543, above there would encourage for headway to 0.9620-25 (50% Fibonacci retracement of the intermediate fall from 1.0582-0.8660), however, near term overbought condition should limit upside to 0.9690-00 and reckon 0.9750 would hold from here, bring retreat later.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.03 07:09

Dollar supported before jobs data, Aussie slides after RBA comments

- Dollar index holds above recent 8-week low Solid

- U.S. private-sector hiring lifts hope for nonfarm payrolls

- Aussie dollar falls after RBA's Stevens warns on currency strength

The dollar held firm above a recent eight-week low on Thursday, supported by hopes for a healthy rise in nonfarm payrolls, while the Aussie fell after Australia's central bank chief warned that markets are underestimating the risk of a sharp fall in the currency.

Figures from U.S. payrolls processor ADP released on Wednesday added to a string of bullish U.S. data ranging from manufacturing to auto sales, supporting the view that the U.S. economy has bounced back smartly after a first-quarter slump.

Benchmark U.S. Treasury yields rose to the highest in over a week at 2.63 percent on Wednesday in reaction to the data, which in turned helped lift the dollar against a basket of major currencies.

The dollar index inched up about 0.1 percent to 79.999 , having pulled up from an eight-week trough of 79.740 plumbed on Tuesday.

Against the yen, the greenback rose 0.1 percent to 101.87 yen, having only recently hit a six-week low near 101.23.

ADP said private employers added 281,000 workers to payrolls last month, the largest since November 2012, offering hopes for a healthy rise in nonfarm payrolls when the data is released later on Thursday.

"Our economists agree with market consensus looking for non-farm payrolls to rise by more than 200,000 for a fifth consecutive month," analysts at BNP Paribas wrote in a note to clients.

"If the forecast turns out to be correct, this will mark the first five-month run of above 200,000 prints since January 2000."

The euro eased 0.1 percent to $1.3648. The single currency hovered below a six-week high of $1.3701 set earlier this week, as the market turned its focus to a meeting by the European Central Bank later on Thursday, as well as the U.S. jobs data.

The ECB is unlikely to take fresh policy action at its July gathering after cutting interest rates to record lows last month - the deposit rate to below zero - and revealing a 400 billion-euro ($545.62 billion) loan programme.

"Although no action is expected from the ECB at its meeting today, we anticipate that it will maintain its dovish tone in the face of weak PMI prints, low inflation, and weak bank lending," said analysts at BNP Paribas.

AUSSIE STUNG

The Australian dollar fell 0.7 percent to $0.9377. The Aussie pulled further away from an eight-month peak of $0.9505 set on Tuesday, coming under pressure after Reserve Bank of Australia Governor Glenn Stevens warned investors they were underestimating the risk of a significant fall in the Australian dollar.

A weak reading on Australian retail sales also added to the already soft tone of the Aussie dollar, which had retreated on Wednesday on profit-taking in the wake of disappointing Australian trade data.

The Aussie's drop below $0.9400 triggered stop-loss selling, said Jeffrey Halley, FX trader for Saxo Capital Markets in Singapore.

"Basically, Governor Stevens timed his talking down of the Australian dollar perfectly to coincide with a soft market," Halley said.

While the Aussie may find some support at levels around $0.9370 and $0.9355, a drop to $0.9300 is now on the cards, Halley added.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is ranging between 0.9444 resistance and 0.9321 support levels with primary bullish market condition.

H4 price is ranging within 0.9396/0.9441 support/resistance levels with pimary bullish. And W1 price is located inside Ichimoku cloud and ranging within 0.9202/0.9437 support/resistance levels.

W1 price is on primary bullish with Chinkou Span line of Ichimoku indicator to be very near to be crossed with the price for good breakout.

If D1 price will break 0.9444 resistance level together with Chinkou Span line crossing H4 price from below to above so the primary bullish will be continuing in good breakout way.

If not so we may see ranging market condition within primary bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-06-30 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Private Sector Credit]

2014-06-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-06-30 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-06-30 23:30 GMT (or 01:30 MQ MT5 time) | [AUD - AIG Manufacturing Index]

2014-07-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-07-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-07-01 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-07-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-07-02 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

2014-07-02 11:05 GMT (or 13:05 MQ MT5 time) | [AUD - RBA Assist Gov Debelle Speech]

2014-07-02 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-07-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Factory Orders]

2014-07-02 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-07-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-07-03 01:00 GMT (or 03:00 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2014-07-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-07-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-07-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

2014-07-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-07-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-07-04 03:40 GMT (or 05:40 MQ MT5 time) | [AUD - RBA Assist Gov Edey Speech]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart