You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

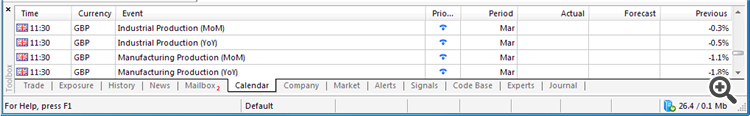

Trading News Events: U.K. Manufacturing Production (based on the article)

What’s Expected:

Why Is This Event Important:

Beyond the looming U.K. Referendum in June, positive data prints coming out of the region may put increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later as central bank officials see a risk of overshooting the 2% inflation target over the policy horizon.

However, waning demand from home and abroad may drag on business outputs, and an unexpected contraction in industrial & manufacturing production may drag on the British Pound as it gives the BoE greater scope to retain the record-low interest rate for an extended period of time.

How To Trade This Event Risk

Bullish GBP Trade: Industrial & Manufacturing Production Rebounds in March

- Need red, green-minute candle following the report to consider a long British Pound trade.

- If market reaction favors bullish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: U.K. Business Outputs Fall Short of Market Forecast- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for GBP/USD

Sergey Golubev, 2016.05.11 09:25

GBPUSD M5: 18 pips price movement by U.K. Manufacturing Production news event :

DAX Index Intra-Day Technical Analysis: the trend would no longer be bullish (based on the article)

H4 price is on ranging movement from 100 SMA to 200 SMA with 9960.3 support level to be crossed to below for the reversal of the price movement from the ranging bullish to the primary bearish market condition with 9736.8 nearest bearish target.

GBP/USD Intra-Day Fundamentals: NIESR GDP Estimate and 25 pips price movement

2016-05-11 14:00 GMT | [GBP - NIESR GDP Estimate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - NIESR GDP Estimate] = Change in the estimated value of all goods and services produced by the economy during the previous 3 months.

==========

GBP/USD M5: 25 pips price movement by NIESR GDP Estimate news event :

U.S. Commercial Crude Oil Inventories news event: intra-day bullish reversal with breakout and 46.83 resistance to be tested

2016-05-11 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.4 million barrels from the previous week."

==========

Crude Oil M5: bullish breakout. The price broke 100 SMA/200 SMA area from 45.24 to be reversed to the primary bullish market condition: price broke key levels for good breaking with 46.83 resistance to be tested for the intra-day bullish trend to be continuing.

AUD/USD Intra-Day Fundamentals: Melbourne Institute Inflation Expectations and 25 pips price movement

2016-05-12 01:00 GMT | [AUD - Inflation Expectations]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Inflation Expectations] = Percentage that consumers expect the price of goods and services to change during the next 12 months.

==========

"The expected inflation rate (30-per-cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, fell by 0.4 percentage points to 3.2 per cent in May 2016. In May, the proportion of respondents (excluding respondents in the ‘don’t know’ category) expecting the inflation rate to fall within the 0-5 per cent range fell to 68.3 percent (from 69.3 per cent in April). The weighted mean of responses falling in the 0-5 per cent range fell to 2.2 per cent in May from 2.4 percent in April. May’s weighted mean (of responses in the 0-5 per cent range) is below the 2.5 per cent 12-month average."

==========

AUD/USD M5: 25 pips price movement by MI Inflation Expectations news event :

What’s Expected:

Why Is This Event Important:

Indeed, Governor Mark Carney may continue to argue that the next move will be to normalize monetary policy, but the central bank may sound increasingly cautious this time around as the U.K. Referendum clouds the economic outlook for the region.

Nevertheless, sticky inflation paired signs of stronger wage growth may spur a dissent within the MPC, and a split vote to retain the current policy may generate a bullish reaction in the British Pound as it puts increased pressure on the BoE to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish GBP Trade: BoE Trims Growth & Inflation Forecast- Need red, five-minute candle following the GDP report to consider a short sterling trade.

- If market reaction favors bearish British Pound trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: MPC Adopts More Hawkish Outlook for Monetary Policy- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in the opposite direction.

Potential Price Targets For The ReleaseGBPUSD Daily

GBP/USD Intra-Day Fundamentals: BoE Official Bank Rate and 57 pips price movement

2016-05-12 11:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

Bank of England maintains Bank Rate at 0.5% and the size of the Asset Purchase Programme at £375 billion

==========

GBP/USD M5: 57 pips price movement by BoE Official Bank Rate news event :

EUR/USD Intra-Day Fundamentals: U.S. Jobless Claims and 20 pips price movement

2016-05-12 12:30 GMT | [USD - Jobless Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Jobless Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

"Initial claims for state unemployment benefits increased 20,000 to a seasonally adjusted 294,000 for the week ended May 7, the highest level since late February 2015."

==========

EUR/USD M5: 20 pips price movement by U.S. Jobless Claims news event :

hi, i checked this release on randoms sites and found the result of release is considered as a bullish for EUR but in meta trader calendar i found it

Red, is that true we can not consider always this as a true fact: Actual <>Forecast or Previous is Bullish or Bearish ???

isn't it a bug ??? or regardless of comparison between Actual Previous and forecast values, any value bellow zero is considered as a bearish for EUR ?

otherwise the actual is bigger than previous so it should be considered as good signal for EUR !

The color may be related to the country (or with anything else), and I think the color is not about 'Actual <>Forecast or Previous is Bullish or Bearish'.

I think - you are talking about Irish CPI (2016-05-12 10:00 GMT | [EUR - Irish CPI]) but there are few news events at this time: monthly CPI (0.2% actual vs 0.4% previous), yearly CPI (-0.1% actual vs -0.3% previous), HICP and more. So, this idea is good one:

if actual > forecast (or previous one) = good for currency (for EUR in our case)

but it is more related to high or medium impacted news events (news events with medium/high priority). For example, monthly CPI is more impacted than yearly value, and core value is more impocted than simple one, CPI is more impacted than HICP, and so on. And if we look at the monthly CPI (most impacted news event in that time) so it was as the following:

0.2% actual < 0.4% previous one = bad for EUR (bearish for EUR/USD):

But anyway, Irish CPI is not significant news event - this is low impacted news event - means: news event with low priority (I do not think that the market or pair was moved based on some value of Irish CPI ...).