You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

China’s forex reserves rise for second month in a row in April to US$3.22 trillion (based on the article)

USD to China Offshore Spot - intra-day bullish breakout; daily ranging to the bullish reversal; weekly ranging bullish; 6.5289 is the key level

H4 price is on bullish breakout: the price is teasting 6.5289 resistance level for the bullish trend to be continuing. The key bearish reversal level is 6.4858, and if the price breaks this level to below so the reversal of the price movement from primary bullish to the primary bearish market condition will be started.

Daily price is on ranging condition waiting for direction: if the price breaks 6.5289 resistance to above so we may see the primary bullish trend on this timeframe without secondary ranging with good breakout piossibility.

Weekly price is on ranging bullish condition: if the price breaks 6.5289 to above so the bullish trend will be continuing, otherwise - ranging.

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, GBP/USD, USD/CNH, NZD/USD, AUD/USD and GOLD (based on the article)

Dollar Index - "From the most productive theme these past few years, monetary policy will be left to the natural winds of speculation. Speculation placing timing of the next Fed hike had peaked at December of 2016 before the recent round of data. Currently, those forecasts are pushed back out to mid-2017 before confidence is truly set. There is little reason for the dovish ranks to capitulate on their skepticism. The Fed’s official statement and numerous speeches from specific members have voiced frustration that market is significantly discounting the FOMC’s own outlook. If that persisted into an actual hike, the impact would be severe as it would catch the base majority by surprise. However, after consistent downgrades in projected pace for policy tightening, the market seems to need more than Fed ‘jawboning’."

USD/JPY - "Traders should otherwise watch upcoming Chinese Consumer Price Index inflation and Loans figures, Euro Zone Gross Domestic Product growth data, and an often market-moving US Advance Retail Sales report for foreseeable volatility risk. It could very well be a quiet week for the Japanese Yen, but this is far from guaranteed. The JPY stands to rally further if/when we see a notable turmoil in global financial markets."

GBP/USD - "The big question for the rate decision is whether or not we see a break from the bank’s unanimity in April when the MPC voted 9-0 in favor of holding rates at .5%. Should we see a dissenting vote in favor of cutting rates, we could see some Sterling weakness, although even that may be mitigated given how quickly matters may change in the next six weeks."

USD/CNH - "Next week, there are major event risks coming from China, which may add volatility in Yuan rates. The April Consumer Price Index (CPI) report is one such report: Pork prices, a major contributor to CPI, remain at elevated levels despite the government introducing policies in the effort to stimulating the supply. The consensus forecast for CPI by Bloomberg is 2.3%, the same as March. Higher-than-expected CPI prints could affect the Central Bank’s monetary policy and, in turn, impact Yuan rates. April’s New Yuan loan report is another indicator worthy of watching. The all-time high new yuan loan print of 4.61 trillion in the first quarter raised concerns that the Chinese government would attempt to continue using stimulus to boost the economy as they did during the 2008 global financial crisis. The government news agency responded that the country will not resort to large stimulus measure and the rapid increase in loans was temporary. The April new Yuan loans data will be a good gauge of that statement."

NZD/USD - "The consistent surprises in New Zealand’s economic data alongside increasing doubts of any rate increases from the Federal Reserve in 2016 has lead to an appreciation of ~11% since the January low in NZD/USD. Understandably, a commodity-reliant economy favors a weaker US Dollar, but a stronger currency does make exports less attractive to other nations. Therefore, we’ll need to be on the lookout for Wheeler’s tone about this development to see if the price of NZD/USD is outside of their tolerance level."

AUD/USD - "Turning to scheduled event risk, the RBA’s overt focus on flailing inflation readings may put outsized emphasis on May’s Consumer Inflation Expectations survey. A steep drawdown may encourage bets on continued easing, punishing the Aussie. Externally, a pickup in China’s headline inflation rate may compound selling pressure, hinting that Beijing has comparatively less room to expand monetary stimulus."

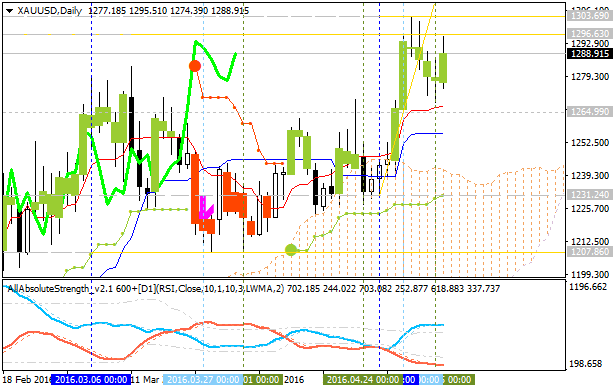

GOLD (XAU/USD) - "Looking ahead to next week, traders will be eyeing incoming data on Retail Sales and the May preliminary University of Michigan Confidence surveys. On the back of this week’s labor report, a fresh batch of Fed rhetoric from the likes of Boston President Eric Rosengren, Cleveland President Loretta Mester and Kansas City President Ester George (all voting members) will be in focus with the primary emphasis remaining on the timing for subsequent interest rate hikes. Remember, lower rates are a drag for the greenback & in turn should keep a floor in gold- especially if the risk outlook turns bleaker in broader equity markets."

Soros Chart Signals BOJ Bond Buying Already Enough to Weaken Yen (based on the article)

"The Bank of Japan’s bond buying has nearly trebled the monetary base in just over three years to more than 386 trillion yen ($3.6 trillion) as of April, a central bank report showed Friday. Base money in dollar terms is at its highest relative to the U.S. since 2006 at 96 percent, despite Japan’s economy being about a quarter the size. Some traders have dubbed the ratio a “Soros Chart,” after billionaire investor George Soros correctly predicted in the 1990s that burgeoning supplies of funds would weaken the yen."

"An expanding monetary base is a factor for yen weakness, making it hard to imagine that the one-way strength that we’ve seen in the yen will continue,” said Fumio Nakakubo, chief investment officer for Japan at UBS Group AG’s wealth management unit. “There is an excess of yen in the market -- like how juice gets diluted by adding too much water -- and it will cause the yen’s value to drop further and further.”

AUD/USD Technical Analysis: 50.0% Fibo level to be crossed to below for the daily bearish reversal to be started (adapted from the article)

Remarks by Vítor Constâncio, Vice-President of the ECB, at City Week, London, 9 May 2016 (ECB source)

USD/CNH Intra-Day Fundamentals: China's Producer Price Index and 28 pips price movement

2016-05-10 01:30 GMT | [CNY - PPI]

if actual > forecast (or previous one) = good for currency (for CNH in our case)

[CNY - PPI] = Change in the price of goods purchased and sold by producers.

==========

USDCNH M5: 28 pips price movement by China's Producer Price Index news event :

EUR/USD Intra-Day Fundamentals: FOMC Member Dudley Speech and 16 pips price movement

2016-05-10 07:15 GMT | [USD - FOMC Member Dudley Speaks]

[USD - FOMC Member Dudley Speaks] = Speech in a panel discussion about the international monetary system, in Zurich.

==========

"The dollar’s dominant reserve currency status has sometimes been referred to as the United States’ “exorbitant privilege,” implying that the U.S. benefits extraordinarily from this privileged status. I’d argue that the situation is much more nuanced. Yes, this status does allow the U.S. to benefit from seigniorage. More than half of all U.S. currency outstanding is held abroad. But, there are also costs of being the dominant reserve currency. For example, this can lead to shifts in the valuation of the dollar that are due primarily to developments abroad that affect risk appetites and international capital flows. In such cases, the dollar’s valuation can be pushed to levels inconsistent with U.S. economic fundamentals.

I welcome other countries’ progress toward achieving the preconditions necessary for their currencies to attain the stature of a reserve currency. However, we should not act as if this is sufficient to achieve a well-functioning global financial system. In particular, the current regime is inefficient in a number of important ways. Countries have found it necessary to self-insure against the risk of large capital flow reversals. This has led to a very sharp rise in aggregate foreign exchange reserve holdings. This form of self-insurance is very expensive—especially when the return on the foreign exchange reserve portfolio is less than the cost of the domestic liabilities that fund these holdings. As I have said in the past, I encourage more work to examine whether there are other more efficient regimes that, for example, would economize on required foreign exchange reserve buffers. In this regard, I think expanding the capacity of the IMF’s resources and working to further de-stigmatize drawing on the IMF’s liquidity facilities could be worthwhile steps in this direction."

==========

EUR/USD M5: 16 pips price movement by FOMC Member Dudley Speech news event :

The Baidu Crisis Could Be Over, Time To Buy Baidu? (based on the article)

From the technical points of view, Baidu shares is on daily breakdown with bearish reversal to be continuing and withweekly breakdown with the bearish reversal to be started. I think, it may be the time to wait for the key support level at 130.50 as the bottom to be tested, and after that only we may start to think about any "time to buy baidu" for example sorry.

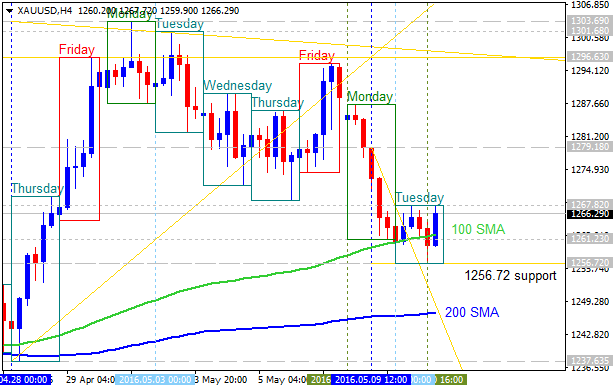

Gold Lower On Follow-Through Selling and Profit Taking (based on the article)

"Gold prices ended the U.S. day session modestly lower Tuesday, on some follow-through selling from the shorter-term futures traders, after the solid losses seen Monday. Some profit taking was also featured. The recent rebound in the U.S. dollar index has also been a bearish “outside market” force working against the precious metals bulls the past few sessions. June Comex gold futures were last down $4.80 an ounce at $1,261.90. July Comex silver was last down $0.009 at $17.08 an ounce."

As we see from the chart above - the intra-day price (H4) is breaking 100 period SMA (100 SMA) to below for the ranging market condition: if the price breaks 1,256.72 support level to below so the bearish reversal of the price movement will be started up to 1,237.63 level to re-enter.NZD/USD Intra-Day Fundamentals: Reserve Bank of New Zealand (RBNZ) Financial Stability Report and 68 pips price movement

2016-05-10 21:00 GMT | [NZD - RBNZ Financial Stability Report]

[NZD - RBNZ Financial Stability Report] = It provides insights into the bank's view of inflation, growth, and other economic conditions that will affect interest rates in the future.

==========

NZDUSD M5: 68 pips price movement by RBNZ Financial Stability Report news event :