You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Intra-Day Fundamentals: U.S. Building Permits and 16 pips price movement

2016-04-19 12:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

EUR/USD M5: 16 pips price movement by U.S. Building Permits news event :

USD/CAD Intra-Day Fundamentals: BOC Governor Stephen Poloz speech and 18 pips price movement

2016-04-19 15:00 GMT | [CAD - BOC Gov Poloz Speaks]

[CAD - BOC Gov Poloz Speaks] = The speech along with Deputy Governor Carolyn Wilkins before the House of Commons Standing Committee on Finance, in Ottawa.

==========

"In terms of the Bank’s primary mandate, total CPI inflation is currently below our 2 per cent target. The upward pressure on imported prices coming from the currency depreciation is being more than offset by the impact of lower consumer energy prices and the downward pressure coming from excess capacity in the economy. As these factors diminish, total inflation is projected to converge with core inflation and be sustainably on target sometime in the second half of next year."

"To sum up where we are, while recent economic data have been encouraging on balance, they’ve also been quite variable. The global economy retains the capacity to disappoint further, the complex adjustment to lower terms of trade will restrain Canada’s growth over much of our forecast horizon, and households’ reactions to the government’s fiscal measures will bear close monitoring. We have not yet seen concrete evidence of higher investment and strong firm creation. These are some of the ingredients needed for a return to natural, self-sustaining growth with inflation sustainably on target."

==========

USD/CAD M5: 18 pips price movement by BOC Governor Stephen Poloz speech news event :

GBP/USD Intra-Day Fundamentals: BoE Governor Mark Carney speech and 24 pips price movement

2016-04-19 14:35 GMT | [GBP - BoE Gov Carney Speaks]

[GBP - BoE Gov Carney Speaks] = The speech before the Lords Economic Affairs Committee, in London.

==========

GBP/USD M5: 24 pips price movement by BoE Governor Mark Carney speech news event :

USD/JPY Intra-Day Fundamentals: Japan Trade Balance and 23 pips price movement

2016-04-19 23:50 GMT | [JPY - Trade Balance]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

USD/JPY M5: 23 pips price movement by Japan Trade Balance news event :

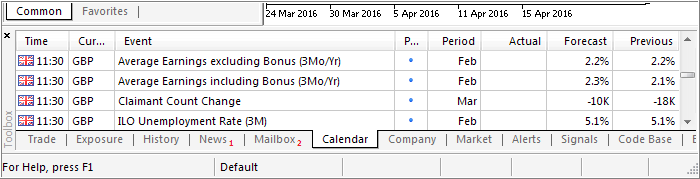

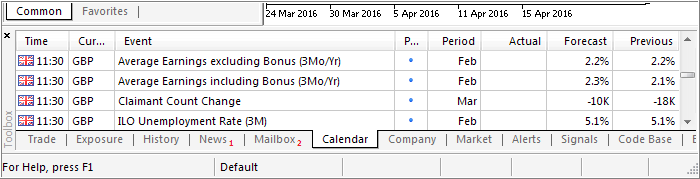

Trading News Events: U.K. Jobless Claims Change (based on the article)

What’s Expected:

Even though the Bank of England (BoE) remains upbeat on the U.K. economy, signs of weak wage growth may encourage Governor Mark Carney to retain the record-low interest rate throughout 2016 as the central bank struggles to achieve its 2% target for inflation.

Nevertheless, the slowdown in global growth paired with easing outputs may drag on the labor market, and a dismal employment report may drag on the exchange rate as market participants push out bets for a BoE rate-hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Job/Wage Growth Beat Market Expectations

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: Jobless Claims, Average Hourly Earnings Disappoint- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.20 09:16

Trading News Events: U.K. Jobless Claims Change (based on the article)

What’s Expected:

Even though the Bank of England (BoE) remains upbeat on the U.K. economy, signs of weak wage growth may encourage Governor Mark Carney to retain the record-low interest rate throughout 2016 as the central bank struggles to achieve its 2% target for inflation.

Nevertheless, the slowdown in global growth paired with easing outputs may drag on the labor market, and a dismal employment report may drag on the exchange rate as market participants push out bets for a BoE rate-hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Job/Wage Growth Beat Market Expectations

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: Jobless Claims, Average Hourly Earnings Disappoint- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBP/USD M5: 27 pips range price movement by U.K. Jobless Claims Change news event :

U.S. commercial crude oil inventories news event: Crude Oil Intra-Day Price Action Analysis - intra-day bullish trend to be continuing in the future with 44.89 level as a target

2016-04-20 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.1 million barrels from the previous week. At 538.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories decreased by 0.1 million barrels last week, but are well above the upper limit of the average range. Finished gasoline inventories increased whileblending components inventories decreased last week. Distillate fuel inventories decreased by 3.6 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 1.2 million barrels last week and are above the upper limit of the average range. Total commercial petroleum inventories decreased by 0.4 million barrels last week."

==========

Crude Oil M5: breakout with bullish reversal. The price broke 200 SMA/100 SMA reversal area to above on the recent commercial crude oil inventories news event for now: price was reversed to the primary bullish market condition with 43.75 resistance level for the bullish trend to be continuing, otherwise - ranging.

==========

Crude Oil H4: ranging bullish. The price is on bullish ranging condition within the following key support/resistance levels:

RSI indicator is estimating the ranging bullish trend to be continuing in the near future.

SUMMARY : bullish

TREND : rangingTrading the News: U.K. Retail Sales (based on the article)

What’s Expected:

Even though BoE warns that the next policy move will be to normalize monetary policy, the Monetary Policy Committee (MPC) may stick to the sidelines ahead of the U.K. Referendum in June, and the central bank may look to carry its accommodative policy stance into 2017 amid the uncertainty surrounding the economic outlook.

However, sticky wage growth paired with hopes for a stronger recovery may boost private-sector consumption, and a rebound in retail spending may put increased pressure on the BoE to normalize policy sooner rather than later as Governor Mark Carney sees a risk of overshooting the 2% inflation-target over the policy horizon.

How To Trade This Event Risk

Bearish GBP Trade: Retail Sales Falls Another 0.3% or Greater

- Need red, five-minute candle following the GDP report to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: Household Spending Tops Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 10 pips price movement

2016-04-21 08:30 GMT | [GBP - Retail Sales]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

==========

GBP/USD M5: 10 pips price movement by U.K. Retail Sales news event :

EUR/USD Intra-Day Fundamentals: ECB Minimum Bid Rate and 23 pips price movement

2016-04-21 11:45 GMT | [EUR - Minimum Bid Rate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Minimum Bid Rate] = Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

==========

"At today’s meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively."

==========

EUR/USD M5: 23 pips price movement by ECB Minimum Bid Rate news event :