You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forex Weekly Outlook July 13-17 (based on forexcrunch article)

EU Economic Summit, Inflation data in the UK and the US German Economic Sentiment, US Retail sales, Employment data from the UK and the US, Rate decision in Japan, the UK and Canada and Janet Yellen’s testimony are the main market movers on Forex calendar. Here is an outlook on the highlights of this week.

Last week the Federal Reserve released the minutes from its June meeting, showing policymakers were concerned about Greece’s debt crisis, saying failure to reach an agreement may result in disruptions in financial markets in the euro area and possibly ricochet into the US economy. The rate hike timeline was also discussed, as mixed economic data made it harder for the Fed to initiate such a move in June. Many members were determined to receive further solid data before deciding to raise rates.

Canadian Imperial Bank of Commerce: 'Fed Chair Yellen Speaks about the economic outlook at The City Club of Cleveland' (based on efxnews article):

Crédit Agricole about Week Ahead: Greece, Yellen, ECB, BoC, Buy USD, Sell GBP (based on efxnews article)

Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD (based on dailyfx article)

The Dollar may have closed the past week with a gain, but it certainly wasn’t showing the kind of bullish conviction that would project a lasting move. Indecision is likely to give way to a decisive move in the week ahead.

The Australian Dollar is looking to last-ditch Greek debt deal negotiations and testimony from Fed Chair Janet Yellen for direction clues.

The narrowing risk for a Euro-Zone breakup paired with signs of a stronger U.K. recovery should heighten the appeal of the British Pound

Gold prices plummeted this week with the precious metal down 2.2% to trade at 1174 ahead of the New York close on Friday

The Japanese Yen finished the week nearly unchanged as an early-week surge gave way to similarly dramatic late week reversal

EUR/USD: Make Or Break; Levels & Targets - Citi (based on efxnews article)

"The failure to set a new high on 18 June (1.1439 versus 1.1468 high on 15 May) raised the first question mark. Now, a close below 1.0819, if seen, would create a lower low and firmly suggest that the downtrend has resumed," Citi adds.

In that eventuality, Citi thinks that the present pattern could then be identified as either:

"1- A head and shoulders formation with a neckline at 1.1124 and a downside target of at least 1.0370 (new trend lows).

2- An effective double top with a neckline at 1.0819 and a minimum target of 1.0185-1.0200," Citi clarifies.

"While longer term (possibly summer 2016) we retain a target of .8800-.9000 we would envisage seeing the target rangers above in the weeks ahead if this break of 1.0819 takes place," Citi projects.

Merlin and John break down the weeks biggest topics including the huge selloff in the Chinese exchanges, the ongoing Greek debt restructuring saga, the issues with the New York Stock Exchange and much more!

Goldman Sachs for EUR/USD: 1.04 at year-end? EUR/USD will fall 'a lot further' (based on efxnews article)

Tech Setups For AUD/USD, NZD/USD, USD/CAD - Barclays (based on efxnews article)

AUD/USD: 'We are bearish and would use any upticks as opportunity to sell against resistance in the 0.7600 area. Our downside targets are towards support near 0.7335 and then the 0.7100 area.'

NZD/USD: 'Resistance in the 0.6820 area (21-dma) is expected to provide selling interest and helps keep us bearish in the short term. A move below 0.6620 would confirm downside towards our targets near the 0.6560 multi-month range lows.'

USD/CAD: 'No change. A move above resistance near 1.2780 would confirm upside towards the 1.2835 year-to-date highs. A break above 1.2835 would signal higher towards our greater targets near 1.3065.'

Trading News Events: U.K. Consumer Price Index (based on dailyfx article)

A further slowdown in the U.K. Consumer Price Index (CPI) may generate a near-term pullback in GBP/USD as it puts increased pressure on the Bank of England (BoE) to retain its current policy throughout 2015.

What’s Expected:

Why Is This Event Important:

However, the stickiness in the core rate of inflation may limit the downside risk for the sterling as BoE Governor Mark Carney anticipates faster price growth in the second-half of the year, and the central bank head may continue to prepare U.K. households and businesses for higher borrowing-costs should the fundamental developments show signs of a stronger recovery.

Nevertheless, improved confidence along with resilience in household consumption may prompt a strong inflation print, and a positive development may pave the way for a near-term advance in GBP/USD as the BoE remains on course to normalize monetary policy.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Headline & Core CPI Highlight Slower Price Growth

- Need red, five-minute candle following the release to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Inflation Exceeds Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

- Waiting for a break of the downward trend from June to

instill a more bullish outlook for GBP/USD as the RSI fails to retain

the bearish momentum.

- Interim Resistance: 1.5630 (38.2% retracement) to 1.5650 (38.2% expansion).

- Interim Support: 1.5330 (78.6% retracement) to 1.5350 (50% retracement).

Impact that the U.K. Core CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

GBPUSD M5: 68 pips price movement by GBP - CPI news event:

Royal Bank of Scotland - 'EUR/USD goes lower multi-month but in a choppy range over the next few weeks' (based on efxnews article)

RBS is thinking that EURUSD will be in more ranging condition for the next few weeks:

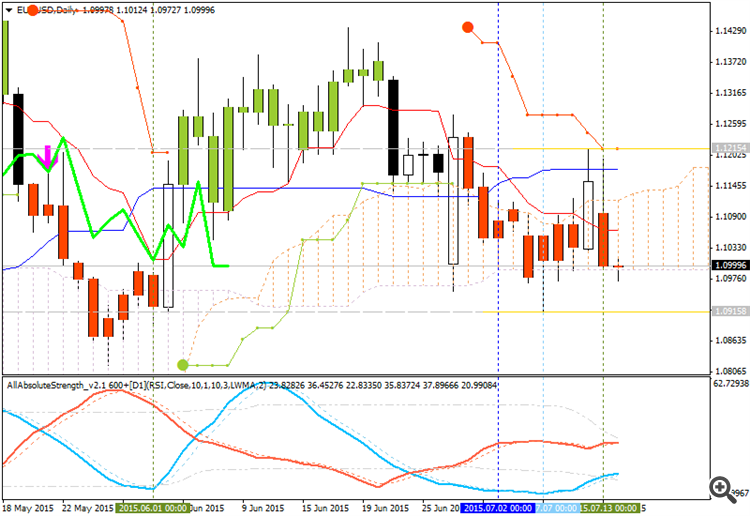

If we look at Ichimoku chart D1 timeframe so we can see the following:

Thus, I can confirm: we will see the choppy/ranging market condition within the primary bearish during the next few weeks.