You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

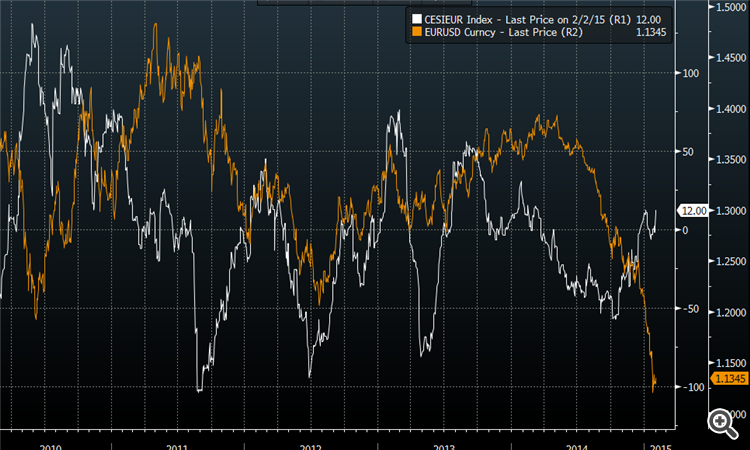

Two reasons to worry if you’re short EUR/USD (adapted from forexlive article)

Not many people out there are recommending euro longs but BAML is out with a couple of reasons to be worried if you’re short.

1) They note that last week’s inflows into European equities were the largest since June and included both the core and periphery. “We have argued that open-ended QE is negative for the Euro, but persistent equity inflows could slow and eventually even reverse the downward EUR trend,” they say.

2) Economic surprises are reversing. “US data surprises went into negative territory last week for the first time since August, whilst EZ data surprises are back in positive territory for the first time March 2014,” BAML says.

Gold Miners Are Off To A Hot Start In 2015 -- But That's Just The Beginning (based on forbes article)

The story has a lot less to do with the printing of money and money supply that traditionally drives gold and gold miners and more with the fact that the mineral in and of itself has not been found despite all the billions of dollars that have been put into discovery of gold over the last ten years.

In fact, the number of working mines is down to almost zero from 20 to 25 in 1995. So the real story is the fact that you’re not finding any new supply. Cash costs are high now, because you’re trying to extract the greatest grades. The industry in and of itself has done an extraordinarily poor job of asset allocation over the years with misallocation of capital and losing money on mines.

They seem to buy high, sell low and dilute their shareholders. They hedge at the wrong times. For all those reasons, these companies have been put at massive discounts to what I think is any kind of rational value. So the net sum of those dynamics that I just described leads me to believe that the question an investor needs to ask is, “How is a gold miner going to replenish their reserves?”

Teaching a Forex class this week, Mike McMahon joins Merlin for a look at what he and his students have been analyzing. Mike and merlin look at The Euro, Dollar, Swiss Franc, Oil, Gold and much more. Mike also offers his outlook on Oil, which he called to bounce on last week’s show. 24% bounce in 6 days isn’t bad! Where is it going next? Tune in and find out!

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.7 percent in January, 0.2 percentage point higher than the December reading of 56.5 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 61.5 percent, which is 2.9 percentage points higher than the December reading of 58.6 percent, reflecting growth for the 66th consecutive month at a faster rate. The New Orders Index registered 59.5 percent, 0.3 percentage point higher than the reading of 59.2 percent registered in December. The Employment Index decreased 4.1 percentage points to 51.6 percent from the December reading of 55.7 percent and indicates growth for the eleventh consecutive month. The Prices Index decreased 4.3 percentage points from the December reading of 49.8 percent to 45.5 percent, indicating prices contracted in January when compared to December. According to the NMI®, eight non-manufacturing industries reported growth in January. Comments from respondents vary by industry and company; however, they are mostly positive and/or reflect stability about business conditions."

EUR/USD Drops Below 1.1350 on Renewed Greece Worries (based on marketpulse article)

The euro took a spill early on Thursday after the European Central Bank said it will no longer accept Greek bonds as collateral for its liquidity operations, dealing a blow to Athens which is seeking debt relief from euro zone lenders.

The common currency last traded at $1.1331, having fallen as far as $1.1315. It has completely reversed a short-covering rally that lifted it to $1.1534 on Tuesday.

It shed a full cent after the ECB surprised markets late on Wednesday by announcing it would reimpose minimum credit rating requirements for Greek bonds, effectively shifting the burden on to the Greek central bank to finance its lenders.

Gold Price Today Sees Modest Gains – Higher Move on the Horizon (based on moneymorning article)

The gold price jumped $10, or 0.80% to $1,271 an ounce in morning trading. The gains came despite typical headwinds for the yellow metal: a stronger dollar and slipping oil prices.

The yellow metal gave back some of those gains in the afternoon session. Just before 1 p.m., gold was hanging on to a $2.70 rise at $1,263.80. This follows gold's sharp decline on Tuesday. Gold slumped $18.80, or 1.3%, yesterday as investors' appetite for riskier assets, including stocks, increased. The Dow Jones Industrial Average added $305.36, or 1.8%, Tuesday as oil continued to march over $50 a barrel

There were three factors boosting gold prices:

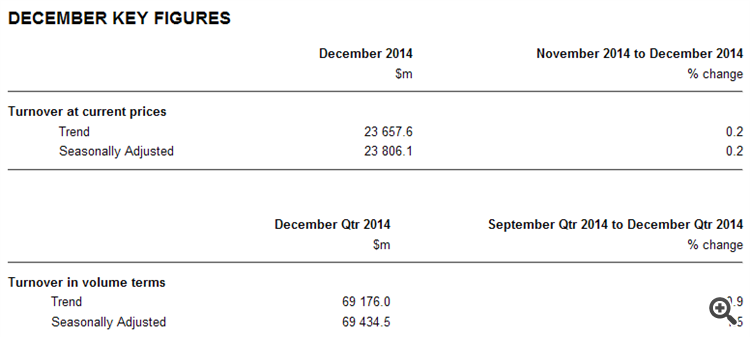

if actual > forecast (or previous data) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========

AUDIO - Facing the Future with Steve Bobbitt

Oil continued its roller coaster ride Wednesday, giving back much of its gains from the last 3 trading sessions. Trader, Steve Bobbitt joins Merlin to offer his insights into why this extreme volatility is happening and why it will persist. Steve also offers a forecast for the bottom in oil! The duo also look at the Euro, and the US equity market position going forward.

EUR/USD Technical Analysis: Further Euro Gains Expected (based on dailyfx article)

The Euro pulled back after rebounding against the US Dollar as expected following the formation of a bullish Morning Star candlestick pattern. Near-term support is at 1.1318, the 14.6% Fibonacci expansion, with a break below that on a daily closing basis exposing the 23.6% level at 1.1185. Alternatively, a push below the February 3 high at 1.1533 clears the way for a test of the 38.2% Fib retracement at 1.1659.

Trading News Events: U.S. Non-Farm Payrolls (based on dailyfx article)

A 230K rise in U.S. Non-Farm Payrolls (NFP) accompanied by faster wage growth may heighten the appeal of the greenback and spur a short-term selloff in EUR/USD as it boosts expectations of seeing the Federal Open Market Committee (FOMC) normalize monetary policy in mid-2015.

What’s Expected:

Why Is This Event Important:

Indeed, a further improvement in labor dynamics may put increased pressure on the Fed to raise the benchmark interest rate sooner-rather-than-later, but the subdued outlook for inflation may prompt the central bank to further delay its normalization cycle as price/wage growth remains weak.

However, the rise in planned job-cuts paired with the slowdown in private-sector consumption may generate a weaker-than-expected NFP print, and a dismal employment report may generate a larger correction in EUR/USD as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Job/Wage Growth Exceeds Market Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: U.S. Employment Report Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Long-term outlook for EUR/USD remains bearish as the RSI retains the downward trend carried over from back in October 2013.

- Interim Resistance: 1.1600 pivot to 1.6110 (61.8% expansion)

- Interim Support: 1.1300 (161.8% expansion) to 1.1310 (100% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

EURUSD M5: 46 pips price movement by USD - Non-Farm Employment Change news event :

U.S. Non-Farm Payrolls (NFPs) beat market forecasts as the economy added 252K jobs in December following an upwardly revised 353K expansion the month prior. At the same time, the unemployment rate narrowed more-than-expected to an annualized 5.6% to mark the lowest reading since August 2008. However, Average Hourly Earnings unexpectedly slowed to 1.7% during the same period amid forecasts for a 2.2% print, and the weakening outlook for inflation may push the Fed to further delay its normalization cycle as it struggles to achieve the 2% target for price growth. Nevertheless, the initial bullish reaction in the greenback was short-lived as EUR/USD worked its way back above the 1.1800 handle, with the pair ending the day at 1.1839.