You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading the News: Canada Consumer Price Index (based on dailyfx article)

Despite expectations for a downtick in Canada’s Consumer Price Index (CPI), the stickiness in core inflation may spur a larger decline in the USD/CAD as it puts increased pressure on the Bank of Canada (BoC) to move away from its neutral policy stance.

What’s Expected:

Why Is This Event Important:

Even though BoC Governor Stephen Poloz talked down the risk for higher interest rates, the growing risk for a prolonged period of above-target inflation may push the central bank to adopt a more hawkish tone for monetary policy in an effort to promote price stability.

The pickup in private sector consumption may heighten price pressures in Canada, and a strong inflation print may spur a more meaningful correction in the USD/CAD as it boosts interest rate expectations.

Nevertheless, slowing wage growth paired with the ongoing weakness in private lending may spur a softer-than-expected CPI print, and a marked slowdown in price growth may trigger a more meaningful run at the 1.1100 handle as it dampens bets for higher interest rates.

How To Trade This Event Risk

Bullish CAD Trade: Core Inflation Expands 1.9% or Higher

- Need red, five-minute candle following the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish CAD Trade: CPI Report Falls Short of Market Forecast- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily

- Despite bullish break in RSI, downside remains favored given series of lower highs & lows.

- Interim Resistance: 1.1000 (38.2% retracement) to 1.1020 (23.6% retracement)

- Interim Support: 1.0820 (61.8% retracement) to 1.0830 (61.8% retracement)

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

June 2014 Canada Consumer Price Index (CPI)

USDCAD M5 : 46 pips price movement by CAD - CPI news event :

The annualized inflation rate hit a two-year high of 2.4%, beating an average estimate of 2.3%. The core Consumer Price Index (CPI) reading also exceeded market forecast and climbed 1.8% after expanding 1.7% in May. Bank of Canada Governor Stephen Poloz stressed that the faster rate of price growth was mainly due to transitory factors, including energy and import costs, and expects inflation to slow over the next two years as the central bank retains a “neutral” view for monetary policy. The Canadian dollar jumped following the better-than-expected print, with USD/CAD dipping below the 1.0710 handle. After a quick comeback, the pair moved sideways during the rest of the North American trade and closed at 1.0727.

The dollar dominated once again, with multi-month gains against major currencies. Is it time for a correction or will this trend continue? German Ifo Business Climate, US housing data, Durable Goods Orders and GDP are amongthe highlights of this week. Follow along as we explore the Forex market movers coming our way.

This was quite a week in financial markets: upbeat US data (especially housing) pushed the dollar higher, and it later got a boost from the not-too-dovish FOMC minutes. In Jackson Hole, Janet Yellen’s much awaited speech did not contain any major surprises, and that was enough to keep the ball rolling for the US dollar. EUR/USD dropped to an 11 month low, also due to ongoing tensions around Ukraine and despite not-too-shabby PMIs. The pound was hit hard by weak inflation and despite two members voting for a rate hike. The Aussie showed resilience, defying a weak Chinese figure.

The EUR/USD pair fell during the course of the week, breaking the back of three hammers that had formed in the previous weeks. Because of this, this market looks like it’s extraordinarily weak, and it could in fact continue to go much lower. We believe that this market will more than likely continue down to the 1.30 handle, which is an area that has much more significant on a longer-term chart as it is a large, round, psychologically significant number and has proven to be supportive in the past as well as resistive. With that, we should be talking about a significant amount of order flow there, and ultimately a reason to get involved for longer-term, big-money players.

The 1.30 level could very well be the absolute bottom, but if we break down below there, things get truly ugly for the Euro. Remember, the European Central Bank needs a relatively weakened Euro in order to boost economic activity, and with that we are very bearish of the Euro in general. The marketplace should offer plenty of selling opportunities every time we bounce, but the real question is going to be whether or not the bounces will be big enough in order for the longer-term trader to take advantage of them. In our opinion, that’s probably not going to be the case. We ultimately believe that the longer-term trader will probably catch the bigger move, perhaps a bounce. But we are very cautious to get involved until we see a clear-cut signal from the longer-term perspective. At this point in time, it’s just going to be simpler and much easier to short this market on the shorter-term charts.

You also have to keep in mind that we are in the middle of summer, and as a result not all major firms are putting a lot of money into the marketplace. The real answers will be shown in September as to what the market will probably do. With that being the case, we are hesitant to get involved long-term traders standpoint, but very cognizant of what’s happening on the weekly chart as it could give us a nice long-term trade soon.

The euro slumped to an 11-month low against the broadly stronger U.S. dollar on Friday, as investors digested comments made by Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi.

EUR/USD hit a daily low of 1.3221 on Friday, a level not seen since September 9, 2013, before subsequently consolidating at 1.3240 by close of trade, down 0.3% for the day and 1.33% lower for the week.

The pair is likely to find support at 1.3161, the low from September 9 and resistance at 1.3287, the high from August 21.

Speaking at the Fed's annual meeting of top central bankers and economists in Jackson Hole, Wyoming, Yellen said the U.S. economy is recovering and added the labor market is improving as well.

Meanwhile, European Central Bank President Mario Draghi told the Jackson Hole gathering that the central bank is ready to take more unconventional action if needed to stimulate a sluggish euro zone economy.

The comments highlighted the view that the paths of euro zone and U.S. monetary policies are diverging.

Minutes of the Fed’s July meeting published Wednesday showed that some officials believe the strengthening recovery and ongoing improvement in the labor market supports a move towards tightening monetary policy.

Meanwhile, tensions over the crisis in Ukraine remained in focus after NATO said it was observing an alarming increase in Russian forces near the border with Ukraine.

Ukraine declared on Friday that Russia had launched a "direct invasion" of its territory after Moscow sent a convoy of aid trucks across the border into eastern Ukraine where pro-Russian rebels are fighting government forces.

In the week ahead, investors will be looking ahead to key U.S. data for further indications on the strength of the economy and the possible future path of monetary policy.

The U.S. will produce data on second quarter gross domestic product, as well as reports on new home sales, durable goods orders and initial jobless claims.

Friday's preliminary reading of August euro zone inflation will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, August 25

- In the euro zone, Germany is to publish the Ifo report on business climate for August.

- The U.S. is to produce data on new home sales for the month of July.

Tuesday, August 26- The U.S. is to publish reports on July durable goods orders, as well as house price inflation and consumer confidence.

Wednesday, August 27- Germany is to publish the Gfk report on consumer climate for September.

Thursday, August 28- In the euro zone, Germany is to release preliminary

data on consumer price inflation as well as a report on unemployment for

August.

- Later Thursday, the U.S. is to release revised

data on second quarter GDP, as well as the weekly government report on

initial jobless claims and data on pending home sales for July.

Friday, August 29Weekend Edition with Merlin Rothfeld

Merlin wraps up an eventful trading week with a look at 6 stages of trader development. This is in response to a listener from NYC who has been struggling for the past 6 months. Merlin shares his trading evolution steps and outlines what traders can expect along the way to success. He also takes a look at the broad markets as well as Ford and Microsoft.

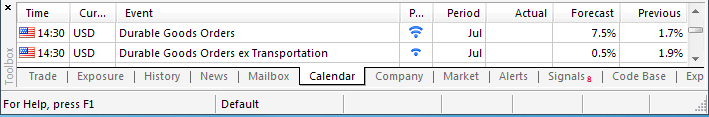

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

A 8.0% rise in demand for U.S. Durable Goods may spur a bullish reaction in the greenback (bearish EUR/USD) as it raises the scope for a stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is running out of arguments to retain its highly accommodative policy stance amid the ongoing improvements in the world’s largest economy, and the bullish sentiment surrounding the dollar may gather pace throughout the coming months should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

The pickup in household sentiment along with the resilience in private sector consumption may generate increased demand for U.S. Durable Goods, and a positive print may heighten the bullish sentiment surrounding the dollar as it raises the outlook for growth and inflation.

However, sticky inflation paired with subdued wage growth may drag on demand for large-ticket items, and a dismal development may serve as a fundamental catalyst to spur a larger correction in the reserve currency as it weighs on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Orders Increase 8.0% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Durable Goods Report Disappoints- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Downside targets remain favored as long as RSI holds in oversold territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

Impact that the U.S. Durable Goods report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

June 2014 U.S. Durable Goods Orders

GBPUSD M5 : 15 pips price movement by USD - Durable Goods Orders news event

NZDUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

Orders for U.S. Durable Goods accelerated at a rate of 0.7% in June, exceeding estimates for 0.5% rise. The print was also much better than that in May, which showed a revised 1.0% contraction. The strength mainly came from increase in demand for commercial aircraft and machinery. However, the better-than-expected figure had a limited impact on the dollar. During the rest of the North America trade, the EUR/USD fluctuated around 1.3430 and closed at 1.3429.

if actual > forecast = good for currency (for EUR in our case)

[EUR - GfK German Consumer Climate] = Level of a composite index based on surveyed consumers. Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity

==========

German Consumer Confidence Seen Falling in September

German consumer confidence is expected to decline in September as international upheaval weighs on sentiment, a survey showed Wednesday, casting doubt on hopes that domestic consumption will offset export weakness in Europe's largest economy.

The monthly GfK survey showed consumer confidence falling to 8.6 in September from 8.9 in August. It was the first decline in the consumer climate indicator since January 2013. GfK uses survey data from the current month to derive a figure for the month to come. Experts polled by The Wall Street Journal last week had predicted the indicator would be 9.0 in September.

The figure is still "at a rather high level," GfK said.

Trading the News: German Unemployment Change (based on dailyfx article)

Trading the News: German Unemployment Change

Germany’s Unemployment report may generate a more meaningful rebound in the EUR/USD should the data highlight an improved outlook the euro-area’s largest economy.

What’s Expected:

Why Is This Event Important:Despite fears of a slowing recovery in the monetary union, a further decline in unemployment may keep the European Central Bank (ECB) on the sidelines throughout the remainder of 2014, and a further improvement in the economic outlook may limit the downside risks for the EUR/USD as market participants scale back bets for more non-standard measures.

Stronger consumption paired with the pickup in business outputs may generate a larger-than-expected decline in unemployment, and a positive development may encourage a more meaningful rebound in the EUR/USD as it gives the ECB greater scope to retain its current policy throughout the remainder of the year.

However, the ongoing decline in business sentiment along with the weakening outlook for global trade may drag on the labor market, and an unexpected rise in unemployment may trigger a bearish reaction in the EUR/USD as it fuels bets for additional monetary support.

How To Trade This Event Risk

Bullish EUR Trade: German Unemployment Declines 5K or Greater

- Need red, green-minute candle following the print to consider a long EUR/USD position

- If market reaction favors a long Euro trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Labor Market Report Disappoints- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bullish Euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Despite the long-term bearish RSI momentum, may see a larger rebound as the oscillator rebounds from oversold territory.

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

Impact that Germany’s Unemployment report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

Unemployment in German shrank by 12,000 in July, more than the average estimate for a 5,000 decline, while the jobless rate was unchanged at 6.6% as in June. However, the Euro fell against the US Dollar after the release, though the pair came back later during the North America trade. Despite the better-than-expected data, it seems as though one single good print may not be strong enough to shift the near-term outlook for the EUR/USD as it remains in a downward trend.

if actual > forecast = good for currency (for EUR in our case)

[EUR - Spanish Flash CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate

==========

Spain Consumer Prices Fall Most Since 2009

Spain's consumer prices declined at the fastest pace since October 2009, flash data from the statistical office INE showed Thursday.

Consumer prices fell 0.5 percent year-on-year in August, this was the biggest fall since October 2009, when prices declined by 0.7 percent. Consumer prices dropped for the second consecutive month.

Economists had forecast prices to fall 0.6 percent annually after decreasing 0.3 percent in July.

The harmonized index of consumer prices decreased 0.5 percent from last year following a 0.4 percent drop in July. The index was expected to drop by 0.6 percent.

On a monthly basis, both consumer prices and harmonized prices edged up 0.1 percent each in August.

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

Trading the News: Euro-Zone Consumer Price Index (CPI)

Another downside in the Euro-Zone’s Consumer Price Index (CPI) may heighten the bearish sentiment surrounding the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to further embark on its easing cycle.

What’s Expected:

Why Is This Event Important:

ECB President Mario Draghi may show a greater willingness to implement more non-standard measures at the September 4th meeting should the CPI print show a larger threat for deflation, and the EUR/USD may continue to weaken throughout the second-half of 2014 as interest rate expectations deteriorate.

The slowdown in business outputs paired with the renewed weakness in private sector consumption may drag on price growth, and the growing risk for deflation may push the ECB to adopt more emergency measures in an effort to achieve its one and only mandate to deliver price stability.

The pickup in producer prices along with the expansion in the money supply may limit the downside risk for inflation, and a better-than-expected CPI print may encourage a more meaningful rebound in the EUR/USD as it gives the ECB greater scope to retain its current approach for monetary policy.

How To Trade This Event Risk

Bearish EUR Trade: Euro-Zone CPI Slips to 0.3% or Lower

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish EUR Trade: Headline Reading for Inflation Exceeds Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Remains at Risk for Further Losses as Long as RSI Holds in Oversold Territory

- Interim Resistance: 1.3510 (38.2% expansion) to 1.3520 (38.2% retracement)

- Interim Support: 1.3140 (38.2% retracement) to 1.3150 Pivot

Impact that the Euro-Zone CPI report has had on EUR during the last release(1 Hour post event )

(End of Day post event)

The Euro-Zone Consumer Price Index (CPI) narrowed to an annualized rate of 0.4% from 0.5% the month prior, hitting a 5-year low. The print was also below the average estimate of 0.5%. Even though the core rate of inflation held steady at 0.8% for the second-month, price growth remains well below the ECB’s 2.0% target. Nevertheless, the ECB argued that lackluster print was attributed to volatile components, such as food and energy. However, there is no evidence that the inflation would pick up with the target soon, since ECB just announced a rate cut in June. The pair EUR/USD declined slowly after the release of the Eurozone CPI, but came back soon after and ended the day at 1.3386.