Hmmm... See my reply there https://www.mql5.com/en/forum/46511

I have been down the same road over and over, optimize over 75% of data, walk forward on 25%. Nothing ever seems to work, not withstanding the issues surrounding keeping your data valid & backtesting with MetaTrader. I can only assume that I'm missing something rather large, also I'm not sure what point your trying to make Rosh.

Thanks Rosh, for the links to the two books. I've ordered "Fooled by Randomness:

The Hidden Role of Chance in Life and in the Markets" but the reviews on the

other one you recommended weren't that good unfortunately, so I'll try and get

that one from the library...

And thanks Craig, for your comments. Interesting to see that there is somebody else out there that's experiencing the same problems. I keep thinking I'm missing something rather large as well and just don't seem to get a handle on it.

But I (probably like lots of other people) have started to wonder whether the whole idea of building trading systems based on historical data is all a bit of a fallacy. Are the markets then actually random? One would instinctively say not when you start playing with trend lines etc but apart from that, all the usual technical analysis tools, chart patterns etc seem to deliver signals which pretty much work out to a 50/50 chance over the long term - from my experience anyway. This seems to be the case whether you talk about indicators, chart patterns etc or any form of TA, apart from trendlines. Is there anyone out there who is actually trading using purely technical analysis and has consistently made good profits over a long period of time?

So, is technical analysis then a total waste of time? Are automated trading systems a total waste of time? In fact is any form of prediction going to produce consistent, long term profits?

Ah, I hear you say - the trading competition! People made good money with their Experts. But is this also a fallacy? Could it maybe be the case that the market conditions were such that those experts that did well just happened to have the relevant signals in them that made them profitable for that particular period of time? i.e. if the market conditions had been different over that three month period, would a completely different set of Experts have "won"? The winner of the trading competition (Rich) wouldn't have traded his Expert in real-time because it had a 92% drawdown. How would that Expert have performed over 2-3 years? I think I've pretty much proven to myself that even using 7 years of historical data doesn't produce trading systems that are profitable in the future, unless a great deal of luck is involved.

If anyone reading this feels they would like to contribute to this thread, by all means, please do. I think it'd be good to get a frank discussion going as to whether anybody out there is actually doing well using purely technical analysis.

And thanks Craig, for your comments. Interesting to see that there is somebody else out there that's experiencing the same problems. I keep thinking I'm missing something rather large as well and just don't seem to get a handle on it.

But I (probably like lots of other people) have started to wonder whether the whole idea of building trading systems based on historical data is all a bit of a fallacy. Are the markets then actually random? One would instinctively say not when you start playing with trend lines etc but apart from that, all the usual technical analysis tools, chart patterns etc seem to deliver signals which pretty much work out to a 50/50 chance over the long term - from my experience anyway. This seems to be the case whether you talk about indicators, chart patterns etc or any form of TA, apart from trendlines. Is there anyone out there who is actually trading using purely technical analysis and has consistently made good profits over a long period of time?

So, is technical analysis then a total waste of time? Are automated trading systems a total waste of time? In fact is any form of prediction going to produce consistent, long term profits?

Ah, I hear you say - the trading competition! People made good money with their Experts. But is this also a fallacy? Could it maybe be the case that the market conditions were such that those experts that did well just happened to have the relevant signals in them that made them profitable for that particular period of time? i.e. if the market conditions had been different over that three month period, would a completely different set of Experts have "won"? The winner of the trading competition (Rich) wouldn't have traded his Expert in real-time because it had a 92% drawdown. How would that Expert have performed over 2-3 years? I think I've pretty much proven to myself that even using 7 years of historical data doesn't produce trading systems that are profitable in the future, unless a great deal of luck is involved.

If anyone reading this feels they would like to contribute to this thread, by all means, please do. I think it'd be good to get a frank discussion going as to whether anybody out there is actually doing well using purely technical analysis.

You have summed up my feelings on the subject rather eloquently. I have talked to

a few people who are being are doing profitable automated trading, and most of

them think indicator based TA is total bollocks.

Forums like this (& tsd) have a constant flux of new experts, none of them work out in the long run, Martingale is all the rage now, but that of course is a double edged sword.

This forum in particular gets a constant stream of account wiping experts posted, I wonder why people even bother.

I have started similar threads on other forums, but nobody really seems to be keen on facing the rather obvious truth, TA based automated trading just does not seem to work.

The level to which people are prepared to stick thier heads in the sand on this is bordering on farcical, there are still active threads on Firebird optimization!!

I'm happy to be proven wrong.

Forums like this (& tsd) have a constant flux of new experts, none of them work out in the long run, Martingale is all the rage now, but that of course is a double edged sword.

This forum in particular gets a constant stream of account wiping experts posted, I wonder why people even bother.

I have started similar threads on other forums, but nobody really seems to be keen on facing the rather obvious truth, TA based automated trading just does not seem to work.

The level to which people are prepared to stick thier heads in the sand on this is bordering on farcical, there are still active threads on Firebird optimization!!

I'm happy to be proven wrong.

Hi Craig,

Glad to hear somebody who is in touch with their sensible side! I've read more books, articles, and general hanky-panky magic recipes to trading success than you can shake a stick at - yet NOTHING actually seems to work for any length of time when tried in practice. Sure, I've come up with dozens of trading systems that have worked for a few months but nothing that'll work with any consistency. I'm a great believer in the adage: "Those who can trade, trade - those how can't, teach and write books" so theoretically taking that statement to it's logical conclusion - anything you see written, posted or taught is by definition bollocks!

But I am curious about these people you mentioned who are running supposed profitable automated trading systems. Firstly, have you been able to verify the fact that they are profitable? Are they friends of yours (i.e. are they being honest?). Have you seen any trading statements? One thing I've noticed with most investors/traders is that they have a tendancy to hugely overstate their profits or understate their loses. Sorry if I sound a bit sceptical, but I am!

If they are indeed profitable, do you know if they're plugging fundimentals into their algorithms?

And as you stated above, I am also happy to be proven wrong. In fact, somebody put me out of my misery and pleeeeassee prove me wrong! Only then will I be able to put the whisky bottle to one side and lead a normal, happy and fulfilled life again. ..

Glad to hear somebody who is in touch with their sensible side! I've read more books, articles, and general hanky-panky magic recipes to trading success than you can shake a stick at - yet NOTHING actually seems to work for any length of time when tried in practice. Sure, I've come up with dozens of trading systems that have worked for a few months but nothing that'll work with any consistency. I'm a great believer in the adage: "Those who can trade, trade - those how can't, teach and write books" so theoretically taking that statement to it's logical conclusion - anything you see written, posted or taught is by definition bollocks!

But I am curious about these people you mentioned who are running supposed profitable automated trading systems. Firstly, have you been able to verify the fact that they are profitable? Are they friends of yours (i.e. are they being honest?). Have you seen any trading statements? One thing I've noticed with most investors/traders is that they have a tendancy to hugely overstate their profits or understate their loses. Sorry if I sound a bit sceptical, but I am!

If they are indeed profitable, do you know if they're plugging fundimentals into their algorithms?

And as you stated above, I am also happy to be proven wrong. In fact, somebody put me out of my misery and pleeeeassee prove me wrong! Only then will I be able to put the whisky bottle to one side and lead a normal, happy and fulfilled life again. ..

The people I talked to were GrimFD & ~chaffcombe on the Oanda forums, both have

profit statements on thier sites. I think ~chaffcombe pursues a more traditional

TA approach were as GrimFD uses a risk management / reaction strategy. I don't

believe either of them look at fundimentals. There is also Soultrader, though how

far he is to be believed, I'm not sure, but his approach appears to be statistical

in nature.

As with anything, all these people could be lying, or telling the truth.

As with anything, all these people could be lying, or telling the truth.

cw1:

Thanks Craig - I may just check them out.... I also know a post-grad stats guru who I might have a talk to. If I discover anything, I'll attach it to this thread. I'm determined not to give up after so much invested time! But the time for giving up may come fairly soon...

Thanks Craig - I may just check them out.... I also know a post-grad stats guru who I might have a talk to. If I discover anything, I'll attach it to this thread. I'm determined not to give up after so much invested time! But the time for giving up may come fairly soon...

Hello:

I want to tell you that you are definetely NOT ALONE.

Many of us who know that the subjective side of technical analysis is useless, want to change the other side, the objective side of technical analysis, into a disciple based on the scientific method.

Please read the following mostexcelletn book by DAVID R. ARONSON entitled EVIDENCE BASED TECHNICAL ANALYSIS, applying the Scientific Method and Statistical Inference to Trading Signals.

And also, read http://www.meyersanalytics.com/publications/tricked.pdf

I think it will help you.

Regards,

EBTA FOLLOWER

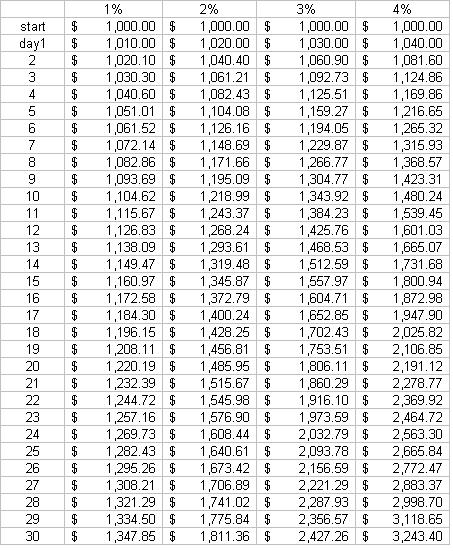

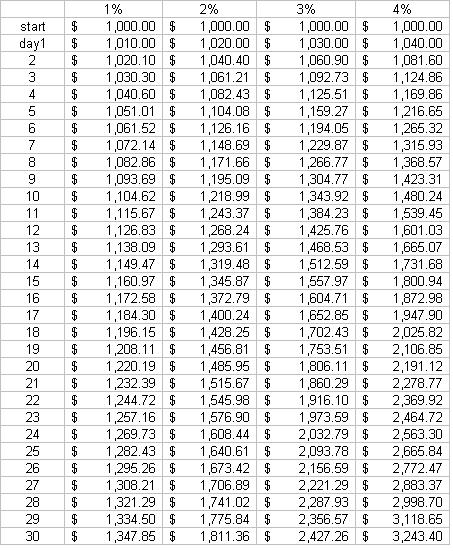

I think the number one reason for losing in FOREX is "maximizing" behavior.

"Satisfying" behavior will get you out of the weak side of technical analysis.

For example,

Start with $1,000 with just 200 leverage and 10% risk. You ONLY need 10 pips/day (without the spread) to raise your account 50% or more per month (with compound profit). By looking at any daily chart, there is rarely any wick that is smaller than 10 pips.

Use technical analysis, be EXTRA sure with your entery, hit your "satisfied" pips target, and get out.

For example,

Start with $1,000 with just 200 leverage and 10% risk. You ONLY need 10 pips/day (without the spread) to raise your account 50% or more per month (with compound profit). By looking at any daily chart, there is rarely any wick that is smaller than 10 pips.

Use technical analysis, be EXTRA sure with your entery, hit your "satisfied" pips target, and get out.

I only it were that simple, at 10% it won't take many losses to wipe the account & though the inter-day differences you get by comparing candles do look attractive the candle tells you nothing of the price movements within, the size of your stop loss is the real risk, if you need a 100pip stop loss to gain 10 then it does not take a genius to do the math.

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I'm curious to chat to anyone who has been seriously attempting to optimise their trading systems and very interested to know the sort of results they've managed to get. Personally, I'm beginning to wonder if optimisation is a bit of a fallacy?

The reason I'm suggesting this is as follows. I've been developing trading systems for a while now and was initially a great believer in optimisation. So, I bought plenty of data and got on with experimenting. My method is as follows:

1. I have 8 years of M5 data for each currency pair. I use the first 7 years for the actual optimisation process and the last year for forward testing.

2. I have created numerous trading systems that when optimised, return between 30 - 50% per year over the optimisation period. That means a total theoretical return of between 210 - 350% for the 7 year period. That 30% - 50% yearly return is a fairly linear return over that time period - i.e. the drawdown wouldn't be much more than 10% of the initial trading capital.

3. Approximately 2000-2500 trades take place over this 7 year optimisation period. I would have thought that this number of trades would have been statistically significant in a positive sense.

However, when I then run this optimised trading system on the last year of data (i.e. forward test the trading system), I'm lucky to break even. And this seems to happen EVERY TIME, with all sorts of different trading strategies!

Is there anyone out there who has managed to consistently achieve good, forward testing results after optimising a trading system? I know that decreasing the number of variables should decrease the chance of over-optimisation - I've been down that road. Anyone got any ideas/comments?