ScalpWings Trading

StepGard EA: The Path to Trading Excellence

Are you ready to take your trading to the next level? Say hello to StepGard EA, the robust Expert Advisor designed to conquer market challenges and help you achieve your financial goals.

Unleash the Power of Breakout Strategy:

StepGard EA employs a powerful breakout strategy, meticulously crafted to thrive in the ever-evolving world of trading.

With Stop Loss, Take Profit, Breakeven, Trailing Stop, Risk Percent, Spread Filter, and Time Management features, it's a comprehensive toolkit for success.

Rigorously Tested for Proven Performance:

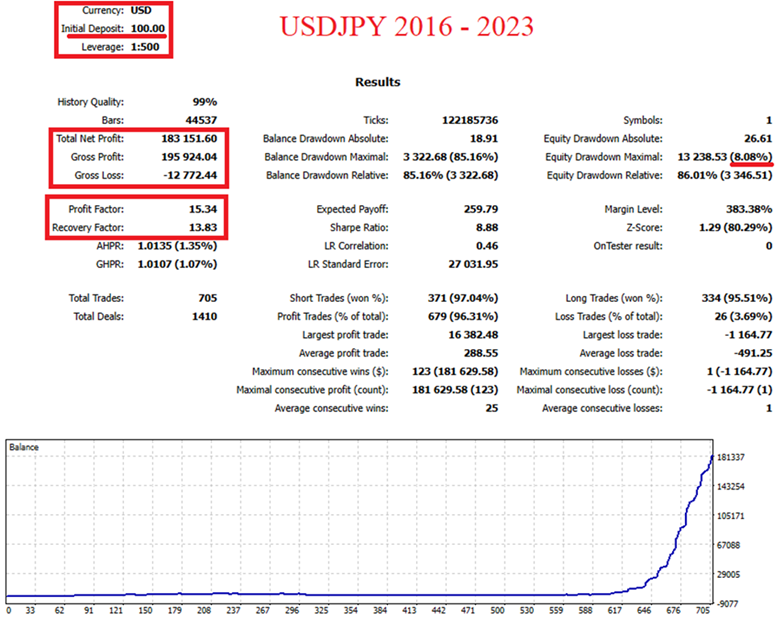

Our EA has undergone rigorous testing from 2016 to 2023, scrutinized against 99% tick data. This level of meticulous testing ensures its reliability and effectiveness.

Trades on the The way is also open for further improvement and development.

Setfiles:

Most Liqu

id Currency Pairs:

StepGard EA confidently navigates the currency market, focusing on GBPUSD and USDJPY, two of the most liquid currency pairs.

This makes it an ideal choice for traders of all levels, from beginners to seasoned professionals.

Safety First with Our No Martingale Policy:

Your investment safety is our top priority. We adhere to a strict No Martingale policy, steering clear of risky betting strategies.

We don't engage in arbitrage or other risky tactics, and we avoid scalping. Every trade is executed with meticulous care and precision.

Cutting-Edge Technology, Proven Strategies:

At StepGard EA, we believe in delivering results through a fusion of cutting-edge technology and time-tested trading strategies.

We understand the complexity of the currency market and have designed our EA to be user-friendly and intuitive.

Summary: Your Investment, Our Responsibility:

In summary, StepGard EA is your reliable companion, built on a robust breakout strategy.

Our No Martingale policy and advanced features ensure your investment's safety and steady growth.

Ready to take the step towards trading excellence? StepGard EA is here to guide you. Elevate your trading today!

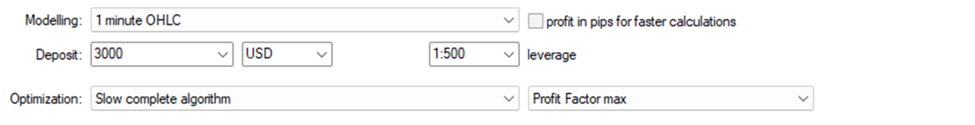

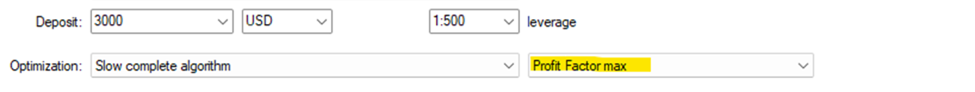

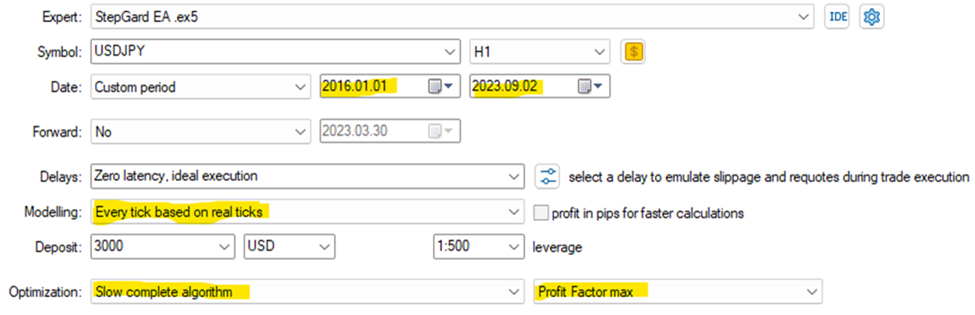

Optimization Settings in MT5:

MetaTrader 5 (MT5) offers optimization settings to refine your Expert Advisor (EA). Key components include:

Optimization Modes:

Choose from various methods like "1OHLC" (Open, High, Low, Close) or "Real Tick" for testing your EA.

Optimization Criteria:

Define criteria like net profit, profit factor, or drawdown to evaluate your EA's performance.

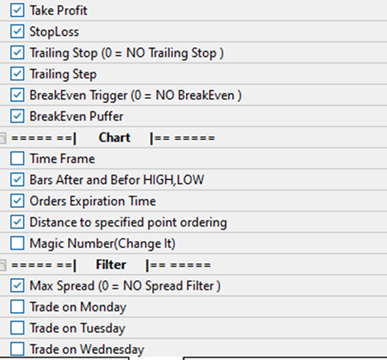

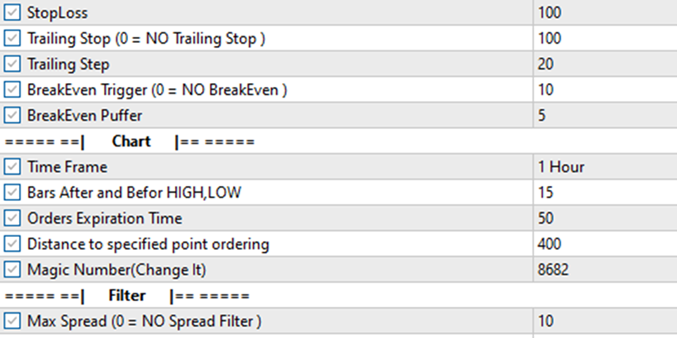

Parameters to Optimize:

Select input parameters (e.g., indicators, lot size, stop-loss) for testing different values.

Optimization Range:

Specify the value range for each parameter to explore during optimization.

Difference between 1OHLC and Real Tick Optimization:

1OHLC (Open, High, Low, Close):

Uses one-minute price bars for faster testing.

May lack precision in capturing detailed price movements.

Real Tick Data:

Utilizes actual tick-by-tick price data for precise simulations.

Slower due to analyzing each tick, but offers a highly accurate representation of market conditions.

Presentation on Your EA's Improvement:

"Unveiling Excellence: Elevating My EA with Real Tick Data

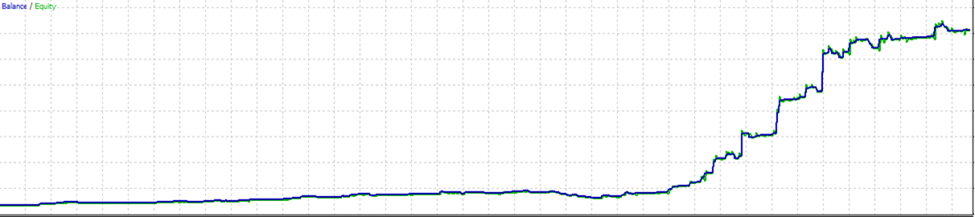

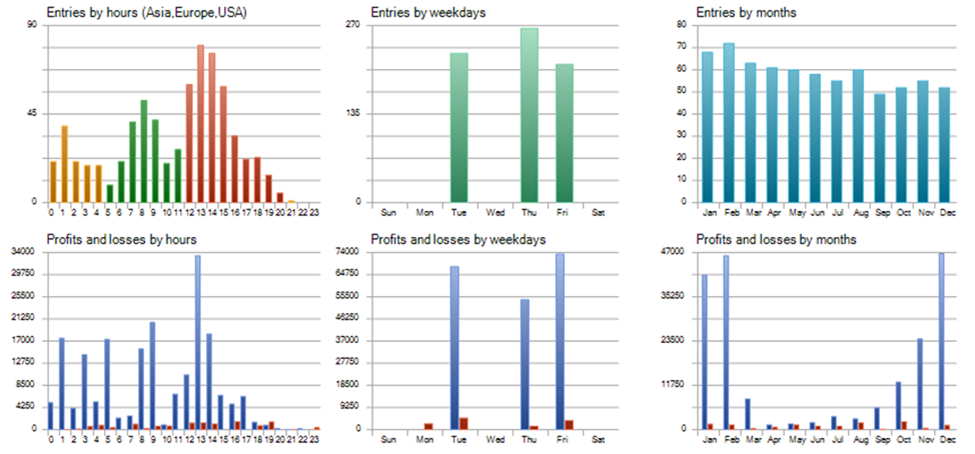

Embarking on a quest for excellence, I transformed my Expert Advisor (EA) into a trading powerhouse. Leveraging real tick data from 2016 to 2023, focusing on USDJPY and GBPUSD, I sculpted the perfect blend of performance and profitability. Here's how I achieved this remarkable feat:

Strategic Parameter Selection:

I meticulously handpicked key input parameters, including indicators and risk management rules, honing in on elements that wielded maximum influence over EA's performance.

Precision Optimization:

Opting for 'Real Tick' mode during optimization was my secret weapon. It allowed me to dissect each price movement with surgical precision, mirroring the real market conditions down to the minutest detail.

Cross-Validation Vigilance:

To guard against overfitting, I subjected my EA to the crucible of cross-validation, ensuring its brilliance extended beyond the confines of historical data.

Robust Risk Management:

I instilled resilient risk management strategies, creating a shield around my capital and minimizing drawdowns, thus ensuring that profitability walked hand in hand with prudent risk control.

Sustainable Adaptation:

Acknowledging the ever-changing tides of the market, I committed to periodic re-optimization with fresh data. This nimbleness ensured my EA stayed agile in the face of evolving market dynamics.

The result? An EA finely attuned to strike the elusive equilibrium between stellar performance and unwavering profitability. Through meticulous parameter selection, precision in real tick data optimization, and an unwavering commitment to ongoing refinement, I've unlocked a path to enduring trading success."

Finelly, I have selected several currency pairs including USDJPY, GBPUSD, BTCUSD

These are the results I reached:

The way is also open for further improvement and development.