Overview and dynamics

The continuing geopolitical tensions continue to put pressure on profitable but risky assets, forcing investors to withdraw funds into safer assets - yen, government bonds, gold. June gold futures on the basis of trading on COMEX rose by 1.5% to 1,272.00 dollars per troy ounce, the highest level since early November. Quotes of gold rose to new annual and monthly highs. This year, gold prices rose by about 10%. At the beginning of the European session, the spot price for gold is near the mark of 1275.00, and prices do not seem to be going to retreat.

Gold began to rise sharply after it became known about the US missile strikes in Syria at the end of last week. And now, despite the Fed's tough position to raise the interest rate and reduce its balance of $ 4.5 trillion, gold is rising in price.

Gold is cheaper in the situation of an increase in the interest rate in the US, t. It is difficult for him to compete with interest-bearing assets. The cost of its acquisition and storage with a tightening of monetary policy is growing.

According to some economists, gold will grow this year in price above $ 1,300 per troy ounce and to $ 1,400 in 2018.

The focus of traders today will be a speech by US President Donald Trump (10:00 GMT) and the publication of the Bank of Canada's interest rate decision (14:00 GMT). A little later (15:15), the Bank of Canada's press conference will begin, and at 20:15 the speech of the head of the Bank of Canada Stephen Poloz will begin.

Today, the highest volatility in the foreign exchange market is expected, especially at the above time intervals.

Technical analysis

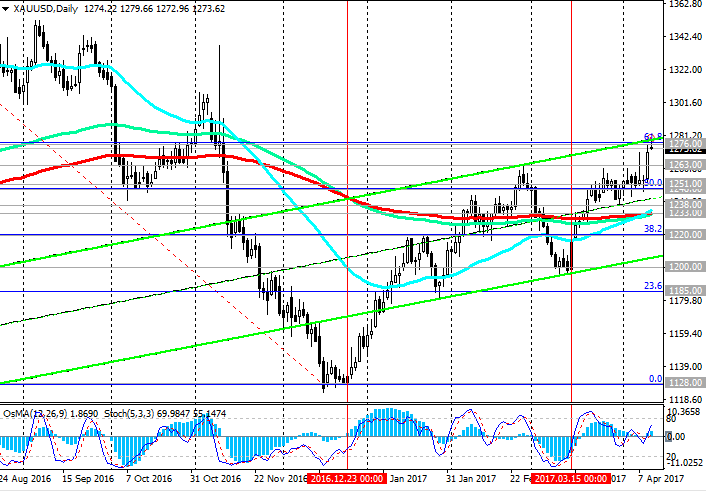

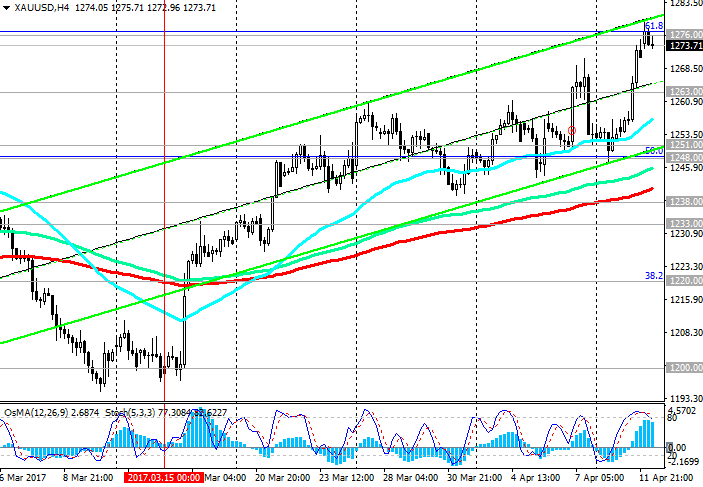

The pair XAU / USD has closely approached the upper border of the rising channel on the daily chart and the level of 1276.00 (the Fibonacci level of 61.8% correction to the wave of decline since July 2016). Since mid-March, against the background of the weakening of the dollar, the pair XAU / USD is actively growing, blocking the decline observed at the beginning of last month.

The price of gold has reached the next annual maximum near the current mark. As long as the pair XAU / USD is above the support levels of 1233.00 (EMA200 on the daily chart), 1248.00 (Fibonacci level of 50.0%), it keeps positive dynamics.

The indicators OsMA and Stochastics on the 4-hour, daily and weekly charts are on the buyers side.

The closest target in case of breakdown of the level of 1276.00 and continuation of the growth of the pair XAU / USD will be 1300.00.

The reverse scenario will be associated with breakdown of support levels of 1263.00 and further decrease to key support levels of 1248.00, 1233.00. Securing the pair XAU / USD below the level of 1220.00 (the Fibonacci level of 38.2%) will cancel the uptrend.

Support levels: 1251.00, 1248.00, 1238.00, 1233.00, 1220.00, 1200.00, 1185.00

Levels of resistance: 1276.00, 1280.00

Trading recommendations

Sell Stop 1268.00. Stop-Loss 1278.00. Take-Profit 1251.00, 1248.00, 1238.00, 1233.00

Buy Stop 1278.00. Stop-Loss 1268.00. Take-Profit 1280.00, 1290.00, 1300.0