How to Tackle the Bear in Oil Prices After Doha Talks Fail

Talking Points:

- The big mover on the day is Oil after talks in Doha failed to produce a production freeze. While this does little to change short-term fundamentals, the inability of producers to strike a deal could potentially bring back the down-trend in Oil prices. We go over an approach below that traders can use to get short if price action continues to fall.

- Trading reversals is tricky and could be a really costly endeavor, so the approach we go over below uses a conditional setup to wait for confirmation before looking to go short; but cogent risk management still needs to be used.

- If you’re looking for additional trading ideas, check out our Trading Guides; and if you’re looking for ideas more short-term in nature, check out our SSI indicator.

This weekend was circled on Oil trader’s calendars since mid-February, as it marked the first coordinated meeting between OPEC and non-OPEC oil producers in over 15 years. The wide hope was that an agreement would be reached on an oil production freeze that could dampen future supplies and, in turn, tilt prices higher. The simple news of this meeting had helped Oil recover with Brent Crude up by more than 45% since news of this meeting first began to circulate.

But as has become commonplace around the discussion of Oil prices, nationalistic interests have presented complications that make a coordinated freeze or production cap appear to be a distant possibility. On the eve of this Sunday’s meeting, Iran announced that they would not be attending. Shortly after that Saudi Arabia announced that no deal would be struck without all OPEC members signing on; which pretty much nullified the meeting as no deal would be possible under those circumstances.

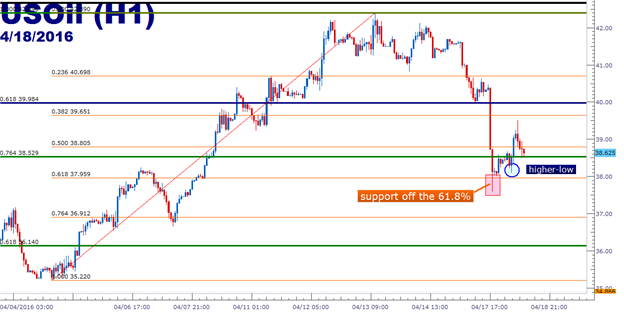

Oil prices were promptly slammed on this news, dropping by as much as -6.9% in the two hours after trading opened for the week; at which point, Oil caught support on the 61.8% Fibonacci retracement of the most recent major move (shown in orange on the below chart), and has begun to claw higher.

CONTINUE?

https://www.dailyfx.com/forex/fundamental/daily_briefing/session_briefing/daily_fundamentals/2016/04/18/how-to-tackle-oil-prices-after-doha-talks-fail.html