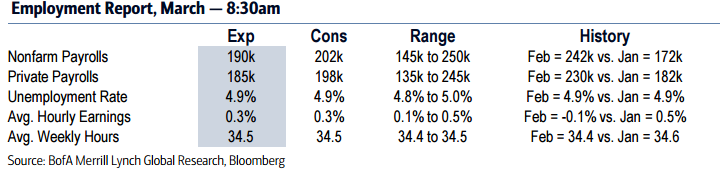

US Nonfarm Payrolls (MAR) - Fri 4/1 - 08:30 AM ET

BofAML: The March employment report likely showed another strong month for the labor market. We anticipate a healthy 190,000 gain in nonfarm payrolls, with the private sector contributing 185,000. Job cuts likely continued in the mining sector given low oil prices. Meanwhile, early signs from the manufacturing sector point to a rebound in activity this month, so we may see a pick-up in hiring after the decline in February. Elsewhere, construction and services likely saw further healthy gains. We expect the unemployment rate to hold in at 4.9%. An implicit assumption in our forecast is that the labor force participation rate flattens out or continues its uptrend since September. Considering how broad-based the improvement in the participation rate has been, it is difficult to attribute it to special factors. But if we do see a reversal of the recent gains, there is a risk that the unemployment rate heads lower to 4.8%. On wages, we think average hourly earnings posted a nice 0.3% mom gain, reversing the 0.1% decline previously. This would leave the yoy rate unchanged at 2.2%

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

Nordea: We expect a 200k gain in nonfarm payrolls in March after the surprisingly strong 242k rise in February, consistent with a continued healthy labour market improvement. Our forecast is below the 228k average gain over the past three months but close to the 205k consensus forecast.We expect the unemployment rate to remain at 4.9%, the 8-year low reached in January just above the new 4.8% median FOMC projection of the NAIRU. The consensus estimate is also 4.9%. Even a rise to 5% would be good news for the Fed if explained by a further rise in the labour force participation rate. We think, however, that the labour force participation rate remained at 62.9% in March after three straight increases.

SEB: We take the lowside on this one and forecast a 180k on the headline, 170k on private employment, 0.1% on average hourly earnings and 4.9% on the unemployment rate.