Current trend

After yesterday’s statement by the Bank of England regarding the possibility of interest rates hikes in the UK as inflation is rising, the GBP grew. At the same time, the USD is strengthening against all major currencies except for the GBP.

The pair is supported by increasing demand for the GBP in GBP/JPY and EUR/GBP pairs.

Today, Average Earnings and Unemployment data for May-June is out in the UK, due at 11:30 am (all times stated in GMT +3). The pair is going to strengthen if data comes out positive.

Important news from the US for today include Producer Price index and NY Empire State Manufacturing index, due at 3:30 pm, the Fed Chair Janet Yellen speech at 5 pm, and the Fed’s Beige Book at 9 pm.

Support and resistance

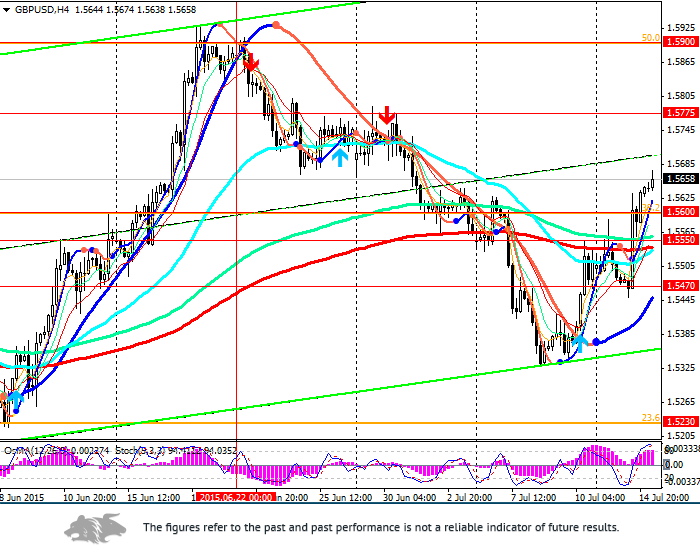

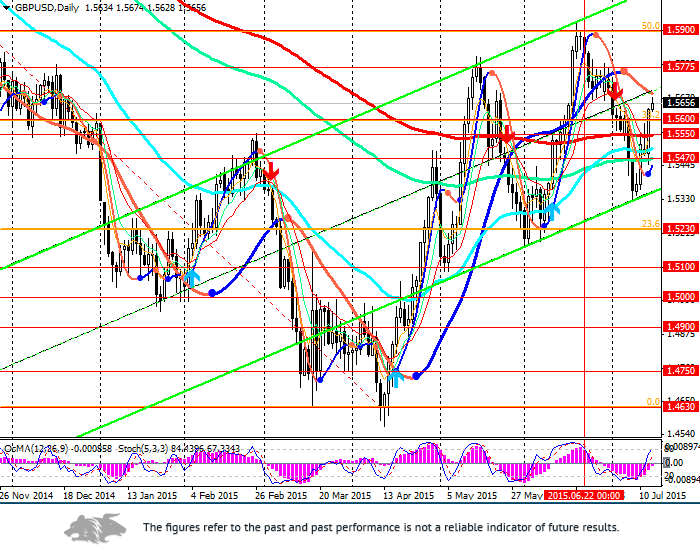

The pair broke out strong resistance levels at 1.5550 (EMA200 on the daily chart) and 1.5600 (38.2% Fibonacci) and continues growing within an upward channel towards its upper border at 1.6025.

The price might reach local highs at 1.5775 today, as the average daily price volatility is 188 points.

On the 4-hour and daily charts, OsMA and Stochastic give buy signals. However, on the hourly chart they signal purchases.

Support levels: 1.5470, 1.5550, 1.5600.

Resistance levels: 1.5775, 1.5800, 1.5865, 1.5900, 1.6025.

Trading tips

Place pending buy stop orders at 1.5675 with targets at 1.5775, 1.5900 and stop-loss at 1.5635.

If data comes out negative for the GBP and positive for the USD, place pending sell stop orders at 1.5625 with targets at 1.5600, 1.5550, 1.5470 and stop-loss at 1.5660.

Recommendation length – 1 day.