Aleksey Ivanov / Профиль

- Информация

|

8+ лет

опыт работы

|

32

продуктов

|

146

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Трейдингом занимаюсь лет пятнадцать с акцентом на поисках математических закономерностей рынка.

----------------------------------------------------------------------------------------------------------------------------------

💰 Представляемая продукция:

1) 🏆 Индикаторы с оптимальной фильтрацией рыночных шумов (для выбора точек открытия и закрытия позиций).

2) 🏆 Статистические индикаторы (для определения глобального тренда).

3) 🏆 Индикаторы исследования рынка (для выяснения микроструктуры цены, построения каналов, идентификации отличий разворотов тренда от откатов).

----------------------------------------------------------------------------------------------------------------------------------

☛ Более подробная информация в блоге https://www.mql5.com/en/blogs/post/741637

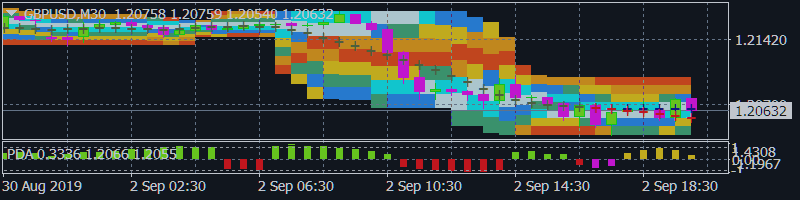

Индикатор служит для: определения распределения вероятностей цен. Это позволяет подробно детализировать строение канала и его границ и статистически корректно спрогнозировать вероятность пребывания цены во всех сегментах ее колебаний; определения момента смены канала. Принципы и особенности работы . Индикатор анализирует историю котировки на младших таймфреймах и просчитывает распределение вероятности цены на более старших таймфреймах. Прогнозирующие алгоритмы индикатора позволяют

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

PDP indicator is used for:

1.defining price probability distributions. This allows for a detailed representation of the channel and its borders and forecast the probability of a price appearing at each segment of its fluctuations;

2.defining the channel change moment.

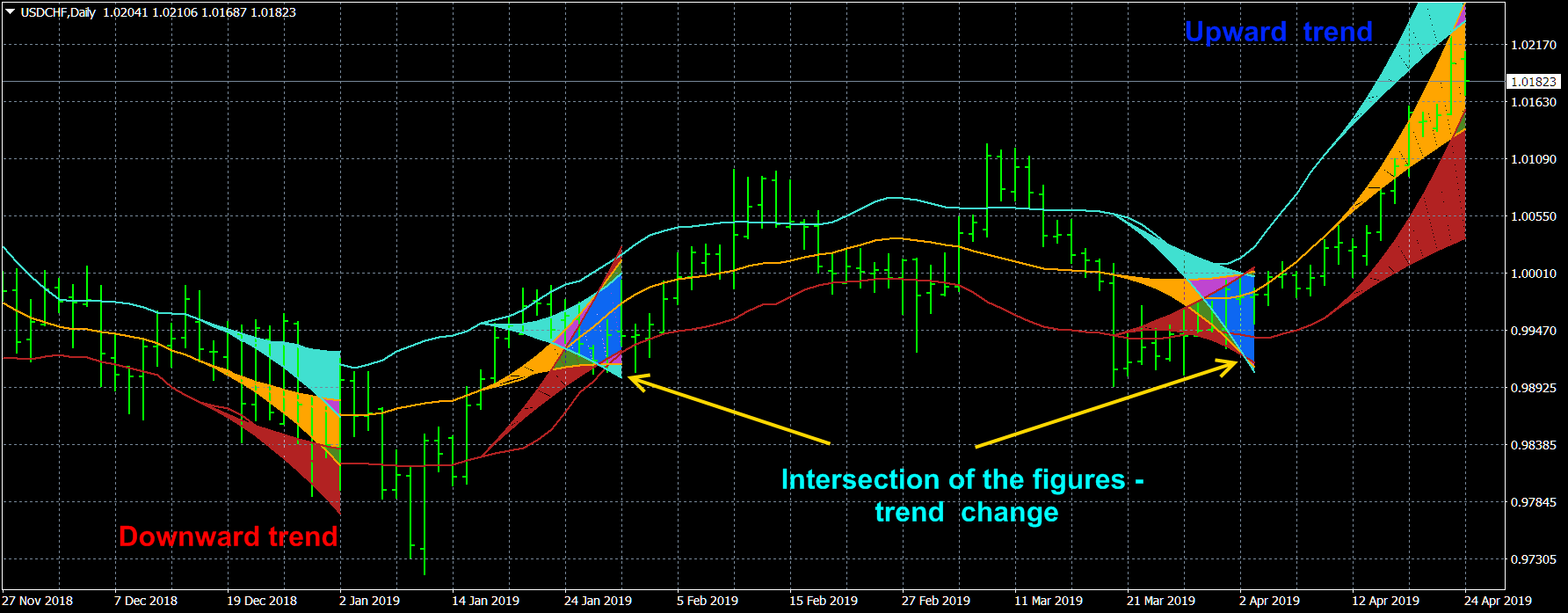

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

The Sensitive Signal (SS) indicator, using the filtering methods developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks.

Принцип работы индикатора. Индикатор Asummetry позволяет предсказывать начала изменения направления трендов, задолго до их визуального проявления на графике цены. Автором было статистически выявлено , что перед изменением направления тренда функция распределения вероятности цены делается

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

The indicator predicts the price in accordance with the prevailing trend and its own small statistical price fluctuations around this trend.

The StatChannel indicator is constructed in the same way as a classic Bollinger Bands indicator, but only on the basis of the non-lagging moving average. Such a curve is calculated at points (Inf, n + 1], as a moving average at the segment (Inf, 0], where 0 is the number of the last bar, shifted back by n bars, and at the points of the segment [n, 0] it is estimated. The estimate is a curvilinear sector (sweeping confidence interval) in which the line of the non-lagging moving average is laid with a given confidence level. The non-lagging average is also surrounded by non-lagging std, which is determined at points at points (Inf, n + 1) in the same way as the non-lagging moving average, and at points of the segment [n, 0] - by a special algorithm that calculates the set of values std, that will be within the specified value of the confidence interval.