Aleksey Ivanov / Профиль

- Информация

|

8+ лет

опыт работы

|

32

продуктов

|

146

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Трейдингом занимаюсь лет пятнадцать с акцентом на поисках математических закономерностей рынка.

----------------------------------------------------------------------------------------------------------------------------------

💰 Представляемая продукция:

1) 🏆 Индикаторы с оптимальной фильтрацией рыночных шумов (для выбора точек открытия и закрытия позиций).

2) 🏆 Статистические индикаторы (для определения глобального тренда).

3) 🏆 Индикаторы исследования рынка (для выяснения микроструктуры цены, построения каналов, идентификации отличий разворотов тренда от откатов).

----------------------------------------------------------------------------------------------------------------------------------

☛ Более подробная информация в блоге https://www.mql5.com/en/blogs/post/741637

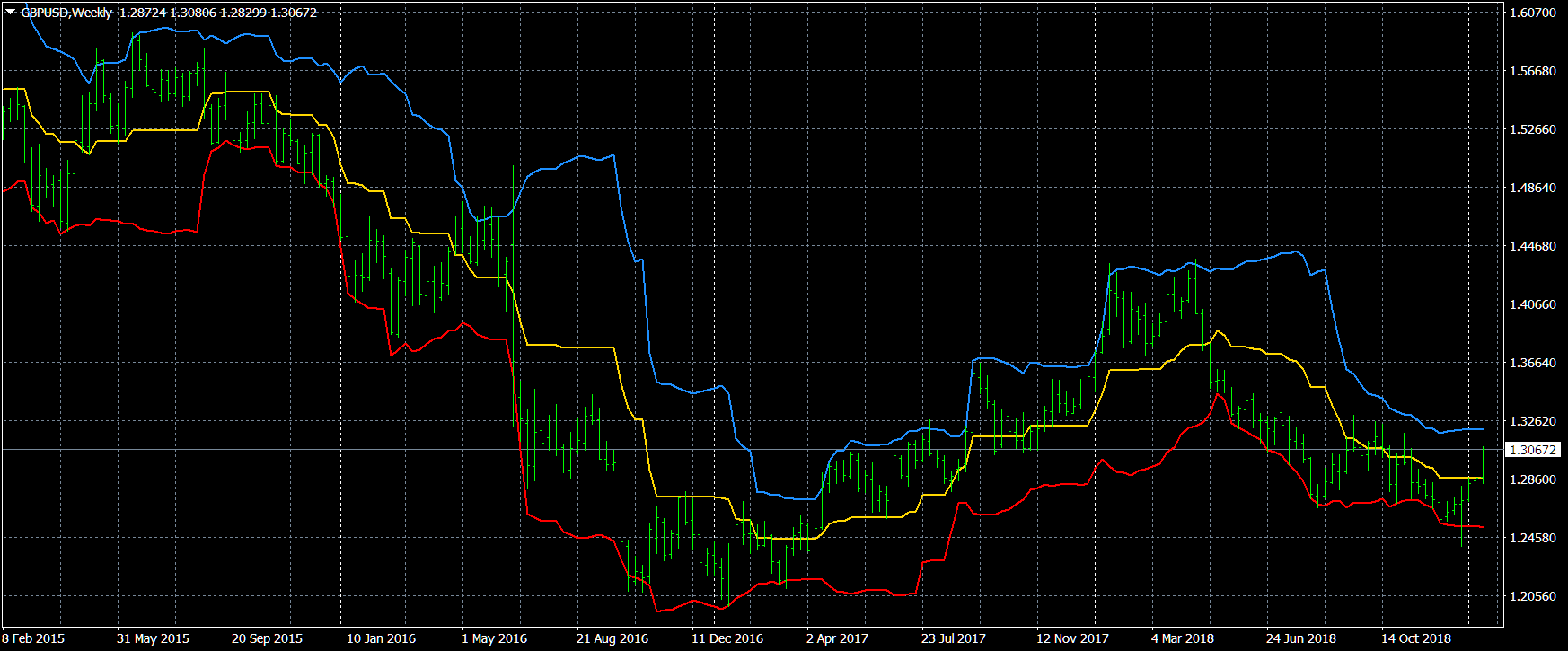

Индикатор Identify Trend , используя и довольно простые, но робастные методы фильтрации (основанные на скользящей медиане - алгоритм XM) и более сложные, разработанные автором, алгоритмы (XC, XF, XS, четыре вида не отстающих скользящих средних SMAWL, EMAWL, SSMAWL, LWMAWL), вместе с дополняющими их методами кластерной фильтрации (кластерный мультивалютный анализ используется для более надежной

https://www.mql5.com/en/market/product/34818

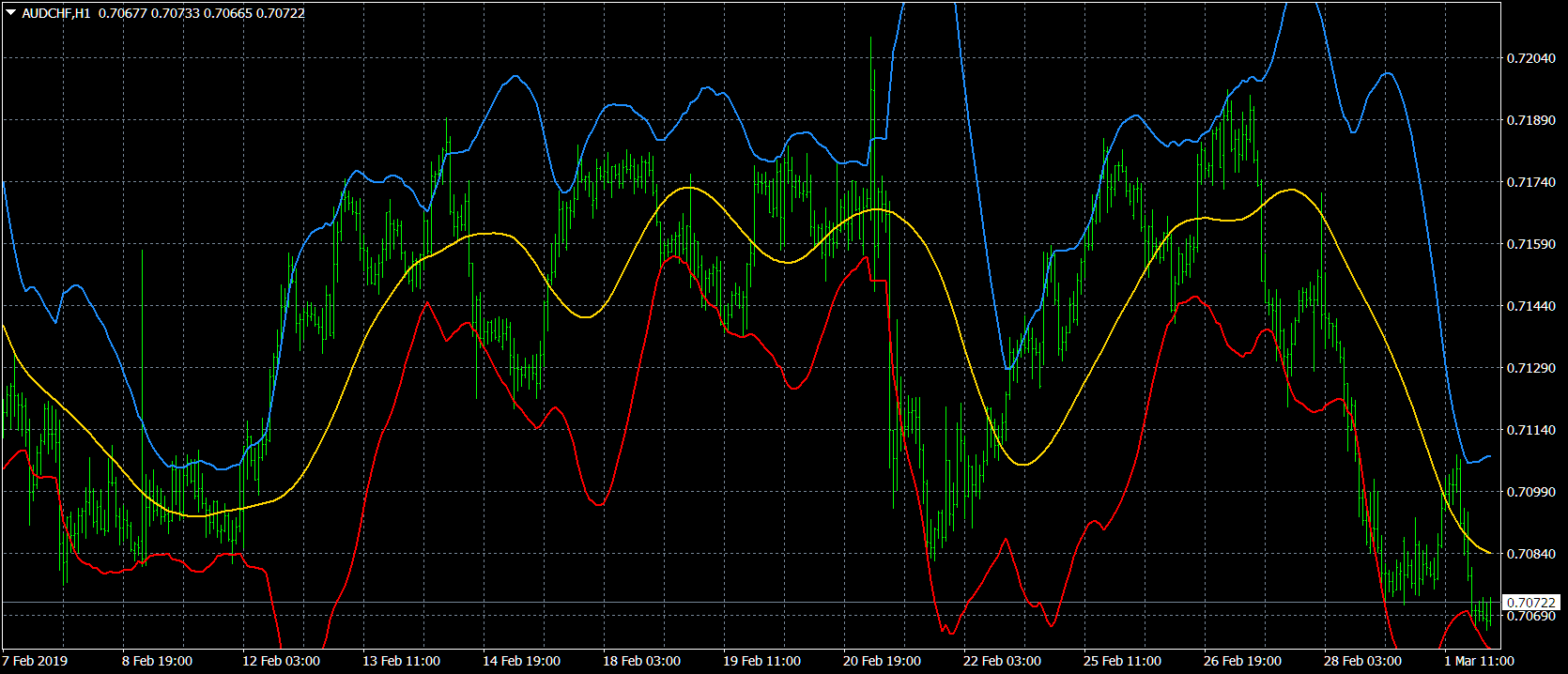

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line M.

The middle line M, besides the standard SMA, EMA, SMMA and LWMA averaging algorithms, can be Median = (Max + Min) / 2 sliding median (which is the default). In addition, for the calculation of MF and MS, the moving averaging algorithms (fast) and (slow) are used, which are developed by the author. These algorithms specifically filter out the harmful noise that is largely present in the highly volatile currency market. The filtering algorithm allows you to quickly identify the beginning of the trend. And the filtering algorithm allows you to better define the transition to flat. And, finally, CB allows you to build a weighted by the volume averaging of the price MV.

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The Absolute Bands (AB) indicator is reminiscent of the Bollinger Bands indicator with its appearance and functions, but only more effective for trading due to the significantly smaller number of false signals issued to them. This effectiveness of the Absolute Bands indicator is due to its robust nature.

https://www.mql5.com/en/market/product/34818

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line .

The middle line , besides the standard SMA, EMA, SMMA and LWMA averaging algorithms, can be Median = (Max + Min) / 2 sliding median (which is the default). In addition, for the calculation of , the moving averaging algorithms (fast) and (slow) are used, which are developed by the author. These algorithms specifically filter out the harmful noise that is largely present in the highly volatile currency market. The filtering algorithm allows you to quickly identify the beginning of the trend. And the filtering algorithm allows you to better define the transition to flat. And, finally, CB allows you to build a weighted by the volume averaging of the price .

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The Absolute Bands (AB) indicator is reminiscent of the Bollinger Bands indicator with its appearance and functions, but only more effective for trading due to the significantly smaller number of false signals issued to them. This effectiveness of the Absolute Bands indicator is due to its robust nature.

Представляю индикатор для профессионалов. ProfitMACD по виду и своим функциям сильно напоминает классический MACD , но строится на абсолютно иных алгоритмах (к примеру, у него только один период усреднения) и более робастный, особенно на малых таймфреймах, поскольку фильтрует случайные блуждания цены. Классический индикатор MACD ( Moving Average

-

42% (30)

-

58% (41)

Описание индикатора. Индикатор « Alligator Analysis » ( AA ) строит разные по типам усреднения и по масштабам « Аллигаторы» и их комбинации, что позволяет тонко анализировать состояния рынка. Классический « Аллигатор» Билла Уильямса строится на основе скользящих средних и чисел Фибоначчи , что делает его одним из самых лучших индикаторов. Классический « Аллигатор» представляет собой комбинацию из трех сглаженных

Queridos amigos, dar feedback y evaluar.

親愛なる友人、フィードバックを与え、評価する。

Liebe Freunde, geben Sie Feedback und bewerten Sie.

Queridos amigos, dê feedback e avalie.

亲爱的朋友们,给予反馈和评价。

Channel Builder FREE

https://www.mql5.com/en/market/product/34818