Critical Areas

- 지표

- Meryem Sabir

- 버전: 1.0

- 활성화: 10

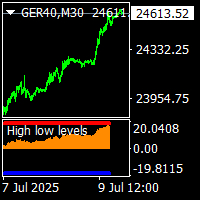

🔴 Critical Areas – Real-Time Support & Resistance Breakout Indicator

Critical Areas is a professional, real-time market structure indicator designed to identify key support and resistance levels and signal high-probability breakout opportunities with absolute clarity.

Built on a confirmed structure logic, the indicator focuses exclusively on validated price levels, ensuring that all signals are generated without repainting and remain reliable in both live trading and historical analysis.

🔍 What the Indicator Does

-

Automatically detects critical support and resistance areas based on confirmed market structure

-

Monitors price interaction with these levels in real time

-

Generates instant BUY / SELL breakout signals the moment a level is decisively broken

-

Filters out unconfirmed price noise by ignoring unstable or forming structures

Every signal represents a structural shift, not a temporary spike.

⚡ Non-Repainting, Real-Time Signals

All breakout signals are:

-

Based only on confirmed levels

-

Triggered on closed candles

-

Fully non-repainting

Once a signal appears, it never changes or disappears, making the indicator suitable for:

-

discretionary trading

-

automated strategies

-

signal services

-

backtesting and forward testing

🔔 Smart Alerts & Trade-Ready Notifications

Critical Areas includes configurable alerts that provide:

-

Direction (BUY / SELL)

-

Instrument and timeframe

-

Exact breakout entry level

Alerts are designed to be actionable, allowing traders to respond immediately without watching the chart continuously.

🎯 Best Use Cases

-

Breakout and continuation strategies

-

Trend expansion after consolidation

-

Market structure–based trading systems

-

Confluence with trend filters, momentum tools, or higher-timeframe bias

The indicator performs best in trending and expansion phases, helping traders avoid false signals during choppy or indecisive markets.

🧠 Designed for Serious Traders

Critical Areas is not a lagging indicator and does not attempt to predict price.

Instead, it reacts only when the market commits, providing traders with clear, objective, and repeatable signals.

Trade the break of structure — not the noise.