당사 팬 페이지에 가입하십시오

- 조회수:

- 7847

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

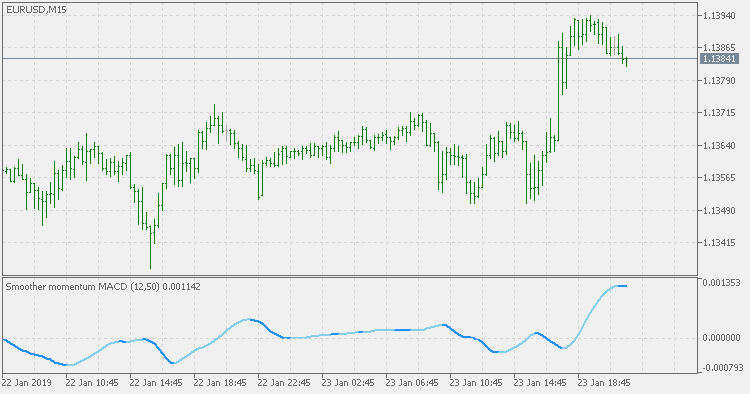

Theory :

MACD is calculated as a difference of two moving averages : a fast average - slow average. And that is about it. This is a completely different version : tit is a MACD of two momentum (fast and slow momentum). Even though the idea is strange, the results are logical and acceptable and can be used for trading decisions

Usage :

It can be used as "regular" macd too - zero crosses or slope direction can be used for signals

PS: for those checking the code - there is a "strange" thing in the calculation. And no - it is not an error :) That way the results are acceptable

CCI - Hull pre-filtered

CCI - Hull pre-filtered

CCI - standard deviation based using Hull for prices pre-filtering

ms-Candle-Index. Indicator of the strength of the direction of the candle.

ms-Candle-Index. Indicator of the strength of the direction of the candle.

The indicator determines the index of the direction of the bar prices and the Gap/breaks in them. It is a logical continuation of the ms-Candle indicator.

Smoother momentum MACD with floating levels

Smoother momentum MACD with floating levels

Smoother momentum MACD with floating levels

Asymmetric bands oscillator

Asymmetric bands oscillator

Asymmetric bands oscillator