Analytical Expert Pro

- Experts

- Tatiana Savkevych

- Versione: 1.1

- Aggiornato: 9 febbraio 2026

- Attivazioni: 5

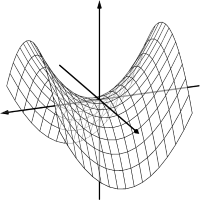

Expert Mind Core: Statistical Probability Engine

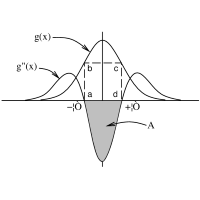

The Expert Mind Core algorithm is based on a high-order mathematical model designed to analyze structural market imbalances. Unlike standard indicators, this system utilizes a multidimensional approach to price action, evaluating the rate of change in volatility (Gamma-analysis) and its deviation from the equilibrium point. The core logic functions by identifying exhaustion zones where the probability of a corrective movement significantly outweighs the continuation of the current pulse.

The system integrates a sophisticated liquidity scanning module. By processing historical bar depth and current curvature, it builds a dynamic grid that adapts to the fractal nature of the market. During periods of low liquidity, the bot tightens its filtering constraints to avoid "false breakouts," while in high-volatility environments, it expands its operational range to capture broader movements.

Extended Parameter Breakdown

-

System Core & Security: Manages the bridge between the algorithm and the terminal. Includes the IdentifierID for tracking orders and ExecutionPolicy to handle different broker fills (FOK/IOC).

-

Risk & Position Control: Regulates financial exposure. CapitalReference defines the equity step for volume scaling, while directional toggles allow the user to lock the bot into Long or Short modes.

-

Algorithm & Filters: The mathematical brain. CurvatureIndex and DeviationMultiplier define the sensitivity of the trend-detection envelope. BarDepthLimit sets the historical depth for market state analysis.

-

Signal Execution: Defines the trigger precision. MainSignalSens acts as a filter for market noise, ensuring only high-probability setups initiate a trade.

-

Profit & Loss Management: A multi-layered exit system. It combines GlobalTP/SL for hard protection with TrailActivation, which shifts the exit point into a "hidden" mode once a profit threshold is reached.

Implementation Recommendations

-

Latency: Use a VPS with a latency of less than 5ms for optimal execution.

-

Pairing: Best suited for high-liquidity pairs with stable average daily ranges.

-

Optimization: Recalibrate the WindowPeriod every 3 months to match changing market cycles.

Notice: All market risks and capital management decisions are the sole responsibility of the operator.