Unisciti alla nostra fan page

- Visualizzazioni:

- 51002

- Valutazioni:

- Pubblicato:

- Aggiornato:

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

Description:

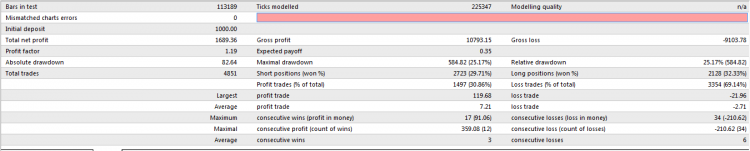

MMA_Breakout_strategy_Volume I - coded by WhooDoo22 (Multi Moving Average Breakout Strategy Volume I).

Author:

WhooDoo22.

Strategy Instructions:

Currency pair: EUR/USD.

Time-frame: M30.

(Be sure to run EA from years 2003.01.01-2012.06.01 and be sure to run strategy in strategy tester using "Open prices only" instead of "Every tick" to speed up testing)

Strategy Explained:

Strategy is based on the

equation resistance over support (R/S) and the theory that the market

moves in trends (containing smaller ranges) or consolidated horizontal

movement (containing smaller ranges).

Strategy Objective:

Capture profits of trends and ranges.

1. To capture small range profits, the EA uses small moving averages like an EMA period of 5 and an SMMA period of 25.

2. To capture large trend profits, the EA uses larger moving averages such as an SMMA period of 50 and an SMMA period of 200.

Strategy Open Signal:

Open buy/sell order of 0.04 lots when SMMA period of 1 crosses above/below SMMA period of 200.

Strategy Close Signal:

Close buy/sell orders of 0.01 lots when

SMMA period of 1 crosses back below/above slower moving averages of EMA

5, SMMA 25, SMMA 50, and SMMA 200.

(partial order close function included )

Strategy Strengths:

1. Big Breakouts = Good signal for closing big profits for smaller moving averages of EMA 5 and SMMA 25.

2. Strong Trends = Good signal for closing big profits for larger moving averages of SMMA 50 and SMMA 200.

Strategy Weaknesses:

1. Fake Outs = Bad signal for closing orders creating small losses. Remember, multiple small losses accumulate a large loss. Typically a large moving average of 200 in a consolidated horizontal movement where the moving average of 1 crosses above 200, then quickly crosses back below 200, then quickly back above 200 can give the EA bad signals. This type of market condition ( consolidated price movement) therefore can be a moving average crossover of 1 and 200 worst nightmare!

Decrease Weakness to Increase Strength:

If you choose to improve this strategy and use it to further improve

your MQL4 education, you can incorporate the following two updates.

1. Use an icustom indicator which draws multiple moving averages that

adjust its moving averages to a certain period of bars in history ago

(example: Multiple Moving Averages icustom indicator will count the last

sixty bars and write its moving averages to "spear" through the

ranges.)

2. Adjust the order close functions to close orders more efficiently. (A.

Sell order example. Sometimes when the SMMA 1 crosses below SMMA 200,

the slower moving averages of 5,25, and 50 are still above the 200

moving average. The problem is this: If the SMMA 1 crosses back above

the SMMA 200, only 0.01 lots are closed. This leaves 3/4ths of the

orders open. This should be fixed so that all orders (0.04 lots) are

closed when SMMA 1 crosses back above SMMA 200. The reason is to

minimize losses. If orders 0.03 are left open, this means more loss

(with a small possibility of profit). B. Incorporate a

consolidated price movement filter to remove "Bad signals" in

consolidated price movements. (Consider coding the EA to let it "wait"

for a breakout during consolidated price movements, because breakouts

are this strategy's strength )

Credits:

Me and the MQL4 community.

Thank You!

Delete All Pending Orders in a row.

Delete All Pending Orders in a row.

Execute Script only one time and it will delete all pending orders i.e Limits and Stops by this script at once. No Need to run script for each order separately.

Renko EA

Renko EA

Renko Expert Advisor.

MAonMA

MAonMA

Moving Average on Moving Average

The example of using the Named Pipes in MetaTrader 4

The example of using the Named Pipes in MetaTrader 4

Many developers face the same problem - how to get to the trading terminal sandbox without using unsafe DLLs. One of the easiest and safest method is to use standard Named Pipes that work as normal file operations.