Liquidity Seeker

- Utilitaires

- Augustine Mwathi

- Version: 2.1

- Mise à jour: 19 septembre 2025

- Activations: 10

Liquidity Seeker EA

Why You MUST Have This EA

Unlock the power of ICT (Inner Circle Trader) methodology with the most advanced Smart Money Concept trading system available. This EA transforms complex institutional trading concepts into automated precision, giving you the unfair advantage that professional traders use to consistently profit from liquidity manipulation and market structure shifts.

START trading WITH market makers using their own playbook.

You don't need to do much other than to attach the EA to 5m timeframe, and the EA will start trading. VPS is highly advisable.

Product Overview

Liquidity Seeker EA is a sophisticated automated trading system built on authentic ICT (Inner Circle Trader) principles and Smart Money Concepts. This EA implements professional-grade algorithms for detecting institutional order flow, liquidity sweeps, and high-probability trade setups that consistently outperform traditional technical analysis.

Key Features & Advantages

Advanced ICT Strategy Suite

-

Silver Bullet Strategy: Automated detection of ICT Silver Bullet setups during specific time windows (3-4 AM, 10-11 AM, 2-3 PM NY time)

-

One Trade Setup for Life: The ultimate ICT strategy focusing on session liquidity sweeps with institutional confirmation

-

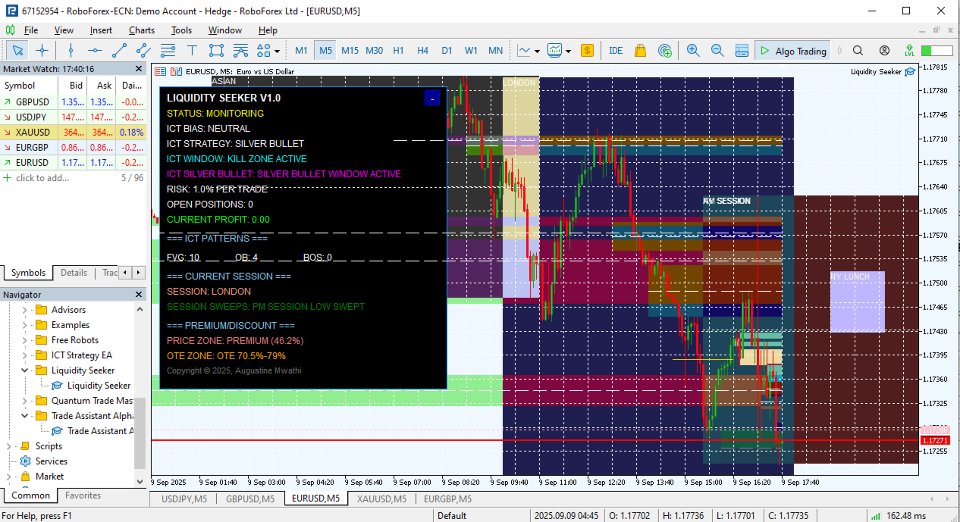

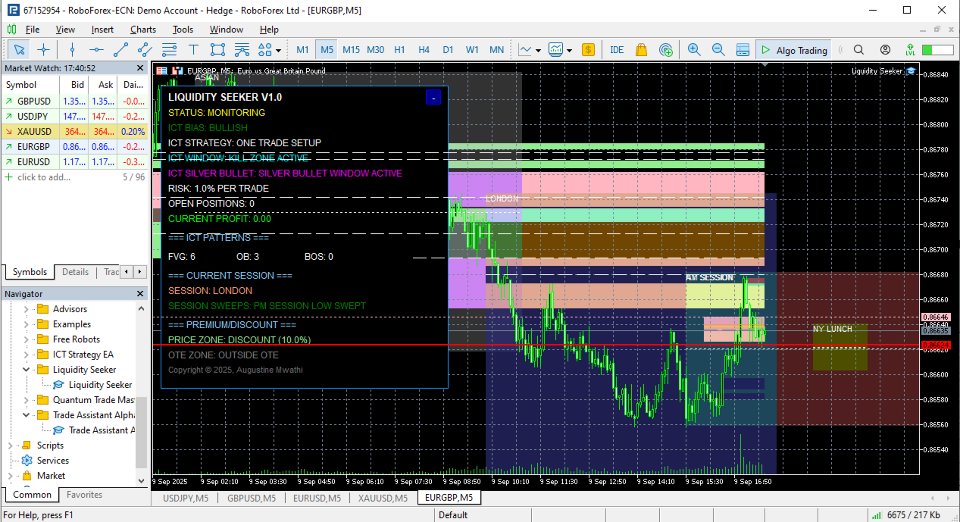

Full ICT Integration: Complete implementation of Fair Value Gaps, Order Blocks, Break of Structure, and Premium/Discount arrays

Smart Money Concept Detection

-

Fair Value Gap (FVG) Analysis: Automatically identifies and trades institutional imbalances with Consequent Encroachment levels

-

Order Block Recognition: Detects high-probability institutional order zones with advanced quality filtering

-

Break of Structure (BOS): Real-time detection of market structure shifts with inducement confirmation

-

Liquidity Sweep Identification: Monitors session highs/lows for Stop Loss sweeps (SSL/BSL)

Professional Time-Based Filtering

-

ICT Kill Zones: London (2-5 AM), NY AM (8:30-11 AM), NY PM (1-4 PM) session filtering

-

Silver Bullet Windows: Precise 1-hour windows for highest probability setups

-

Session Range Analysis: Tracks Asian, London, NY AM/PM, and NY Close session ranges

-

Dynamic Session Sweep Detection: Real-time monitoring of institutional liquidity hunts

Institutional-Grade Risk Management

-

Multi-Tier Profit Taking: 30% at 1:1, 50% at 2:1, 20% at 3:1 risk-reward ratios

-

Smart Stop Loss Management: Automatic breakeven and trailing stops based on market structure

-

Position Scaling: Professional partial close system mimicking institutional trade management

-

Dynamic Risk Calculation: Percentage-based risk with ATR and volatility adjustments

Advanced Market Analysis

-

Daily Bias Determination: Automated higher timeframe bias analysis for trade direction

-

Premium/Discount Zones: Real-time calculation of institutional price zones

-

OTE (Optimal Trade Entry): 62%-79% Fibonacci retracement zone identification

-

Market Structure Tracking: Comprehensive swing analysis across multiple timeframes

Safety & Protection Systems

-

News Filter: Automatic trade suspension during high-impact economic events

-

Weekend Protection: Smart position management before market close

-

Spread Control: Symbol-specific maximum spread limits (including Gold optimization)

-

Disconnect Recovery: Automatic trade backup and recovery system

-

Maximum Position Limits: Prevents over-leveraging and excessive exposure

Professional User Interface

-

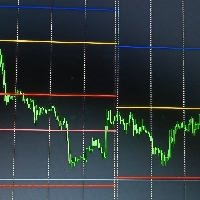

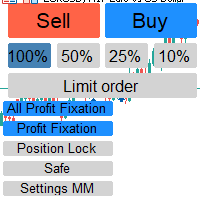

Real-Time Dashboard: Live display of all ICT patterns, session data, and trade status

-

Pattern Visualization: Automatic chart marking of FVGs, Order Blocks, and session ranges

-

Performance Monitoring: Live P&L tracking with detailed trade statistics

-

Minimize/Maximize Controls: Customizable dashboard for optimal screen usage

Input Parameters

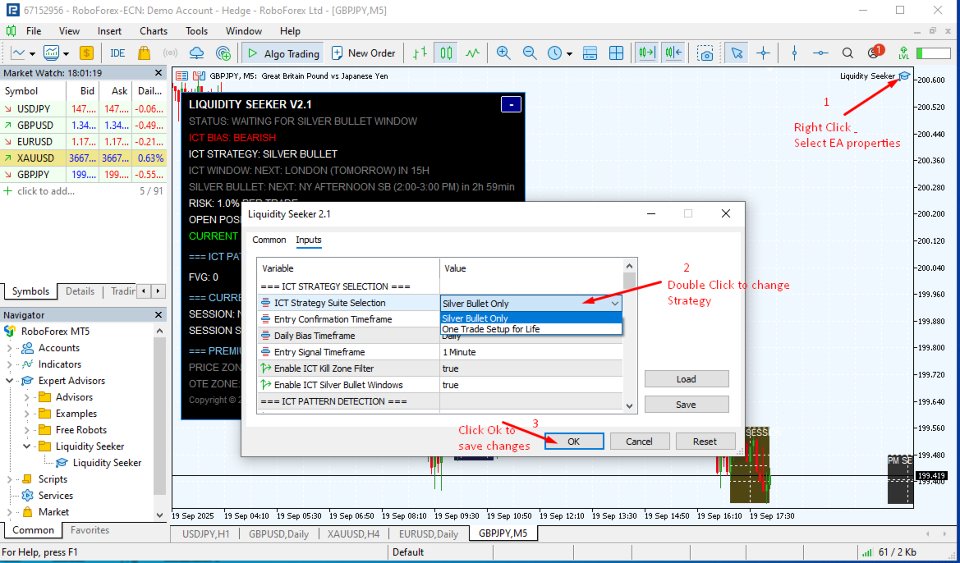

Strategy Selection

-

SelectedStrategy: Choose between Silver Bullet, One Trade Setup, or Full ICT Suite

-

EntryConfirmation: 5-minute or 15-minute timeframe confirmation options

-

BiasTimeframe: Higher timeframe for daily bias determination (Daily recommended)

-

EntryTimeframe: Primary analysis timeframe (1-minute for precision entries)

ICT Pattern Detection

-

EnableBreakOfStructure: Activate BOS detection and trading signals

-

EnableFairValueGap: Enable FVG identification and mitigation trading

-

EnableOrderBlock: Activate Order Block detection with quality filtering

-

EnablePDArray: Premium/Discount array analysis for institutional zones

-

EnableOTE: Optimal Trade Entry (70.5% Fibonacci) zone detection

-

OTEFibLevel: Customizable OTE level (default 0.705 per ICT methodology)

-

MSSLookbackBars: Market Structure Shift analysis period (default 20)

-

BOSLookbackBars: Break of Structure detection range (default 50)

-

MinimumFVGSize: Minimum Fair Value Gap size in points (default 10)

Risk Management

-

RiskPercent: Account risk percentage per trade (default 1.0%)

-

MaxSpread: Maximum allowed spread in points (default 50)

-

MaxSpreadGold: Gold-specific maximum spread (default 80 points)

-

TakeProfit1Percent: First partial close percentage (default 30%)

-

TakeProfit2Percent: Second partial close percentage (default 70%)

-

TakeProfit3Percent: Final position close percentage (default 100%)

-

UsePartialClose: Enable/disable institutional-style position scaling

-

PartialClosePercent: Size of partial close at TP1 (default 50%)

-

EnableTrailingStop: Activate dynamic trailing stop system

-

TrailingStopPercent: Trailing stop activation threshold (default 50%)

ICT Kill Zones

-

EnableLondonKillZone: London session trading (2:00-5:00 AM NY)

-

EnableNYAMKillZone: New York morning session (8:30-11:00 AM NY)

-

EnableNYPMKillZone: New York afternoon session (1:00-4:00 PM NY)

-

EnableCustomKillZone: User-defined trading session

-

CustomKillZoneStartHour: Custom session start time (NY timezone)

-

CustomKillZoneEndHour: Custom session end time (NY timezone)

Safety Features

-

NewsImpactFilter: Filter trades during news (None/Medium/High impact)

-

MinutesBeforeNews: Stop trading X minutes before news events

-

MinutesAfterNews: Resume trading X minutes after news events

-

RecoverFromDisconnect: Automatic trade recovery after connection loss

-

MaxConcurrentTrades: Maximum simultaneous positions (default 1)

-

WeekendProtection: Prevent trading near weekend market close

-

FridayEndHour: Stop trading after specified hour on Friday

Display & Logging

-

MagicNumber: Unique EA identifier for trade management

-

TradeComment: Custom comment for all trades

-

EnableLogFile: Detailed logging for analysis and debugging

-

DisplayDashboard: Show/hide real-time information dashboard

-

BuyColor: Color for bullish signals and objects (default Green)

-

SellColor: Color for bearish signals and objects (default Red)

-

ICTObjectColor: Color for ICT pattern objects (default Dodge Blue)

-

FVGColor: Fair Value Gap visualization color (default Light Cyan)

-

OBColor: Order Block visualization color (default Light Salmon)

Advanced Capabilities

Multi-Strategy Approach

The EA seamlessly switches between different ICT methodologies based on market conditions and user selection, ensuring optimal performance across various market phases.

Institutional Flow Detection

Advanced algorithms identify when institutional money is entering or exiting positions, providing early signals for high-probability trades.

Session-Based Analysis

Comprehensive tracking of all major trading sessions with automatic calculation of key levels that institutions use for liquidity provision and extraction.

Smart Money Confirmation

Multiple confirmation layers ensure trades align with institutional order flow, significantly improving win rates and risk-adjusted returns.

Why Choose Liquidity Seeker EA?

✅ Authentic ICT Implementation - Built by traders who understand true institutional mechanics

✅ Proven Methodology - Based on concepts used by professional institutional traders

✅ Advanced Automation - Eliminates emotional trading while maintaining strategic precision

✅ Comprehensive Safety - Multiple protection layers for capital preservation

✅ Real-Time Analysis - Instant detection and execution of high-probability setups

✅ Professional Grade - Suitable for both retail and institutional trading environments

Transform your trading with the power of institutional knowledge. Liquidity Seeker EA doesn't just follow the market - it anticipates institutional moves and positions you ahead of the crowd.

Stop trading against the smart money. START trading WITH them.