Rejoignez notre page de fans

- Publié par:

- Vladimir

- Vues:

- 336

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Un modèle trigonométrique multi-harmonique (ou multi-tons) d'une série de prix x[i], i=1..n, est donné par :

x[i] = m + Sum( a[h]*Cos(w[h]*i) + b[h]*Sin(w[h]*i), h=1..H )

où :

- x[i] - prix passé à la i-ième barre, total n prix passés ;

- m - biais ;

- a[h] et b[h] - coefficients d'échelle des harmoniques ;

- w[h] - fréquence d'une harmonique ;

- h - nombre d'harmoniques ;

- H - nombre total d'harmoniques ajustées.

L'ajustement de ce modèle consiste à trouver m, a[h], b[h] et w[h] pour que les valeurs modélisées soient proches des valeurs réelles. La recherche des fréquences harmoniques w[h] est la partie la plus difficile de l'ajustement d'un modèle trigonométrique. Dans le cas d'une série de Fourier, ces fréquences sont fixées à 2*pi*h/n. Mais l'extrapolation de la série de Fourier consiste simplement à répéter les n prix passés dans le futur.

Cet indicateur utilise l'algorithme de Quinn-Fernandes pour trouver les fréquences harmoniques. Il ajuste les harmoniques de la série trigonométrique une par une jusqu'à ce que le nombre total d'harmoniques H spécifié soit atteint. Après avoir ajusté une nouvelle harmonique, l'algorithme codé calcule le résidu entre le modèle mis à jour et les valeurs réelles et ajuste une nouvelle harmonique au résidu.

L'indicateur a les paramètres d'entrée suivants :

- Npast - nombre de barres passées, auxquelles la série trigonométrique est ajustée ;

- Nfut - nombre de barres futures prédites ;

- Nharm - nombre total d'harmoniques dans le modèle ;

- FreqTOL - tolérance des calculs de fréquence.

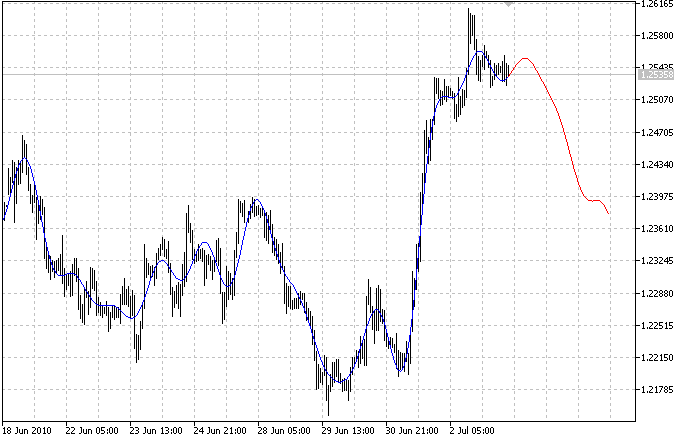

L'indicateur trace deux courbes : la courbe bleue indique les valeurs passées modélisées et la courbe rouge indique les valeurs futures modélisées.

Traduit de l’anglais par MetaQuotes Ltd.

Code original : https://www.mql5.com/en/code/130

AR extrapolation of price

AR extrapolation of price

Cet indicateur utilise un modèle autorégressif pour extrapoler les prix.

Linear regression slope

Linear regression slope

Pente de la régression linéaire normalisée par rapport à la SMA.