Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Renat Fatkhullin - MetaQuotes

Ну наконец-то 7 месяцев разработки нового MetaTrader 4 завершились релизом: https://www.mql5.com/ru/forum/149270

Пока показываем только лишь часть реализованного. В конце февраля выкатим сногсшибательные фичи для обоих платформ MetaTrader 4 и 5.

Пока показываем только лишь часть реализованного. В конце февраля выкатим сногсшибательные фичи для обоих платформ MetaTrader 4 и 5.

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: MFCS Currency Correlation Chart

Australian Dollar Strongly Correlated to Gold, Silver, Steel Prices (based on this article ) View forex correlations to the SPDR Gold ETF Trust (GLD), United States Oil Fund ETF (USO), SPDR Dow Jones

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: MFCS Currency Correlation Chart

Trade Gold Using Currency Correlations (based on dailyfx article ) Talking Points: Correlations are useful to find direction for a variety of markets, Gold and the AUDUSD have a positive correlation

Sergey Golubev

Самые популярные вопросы школьников сейчас - это следующие :

"у тебя чё по географии?"

"у тебя сколько четверок?"

"у папы ружье есть?"

============

С добрым утром

"у тебя чё по географии?"

"у тебя сколько четверок?"

"у папы ружье есть?"

============

С добрым утром

Sergey Golubev

MetaQuotes

MetaTrader 4 Now Features the Market of Trading Robots!

The release of MetaTrader 4 build 600 has considerably expanded the capabilities of traders - the platform now features the store of trading applications . MetaTrader Market already offers more than 200 trading robots, technical indicators and other

Sergey Golubev

Sergey Golubev

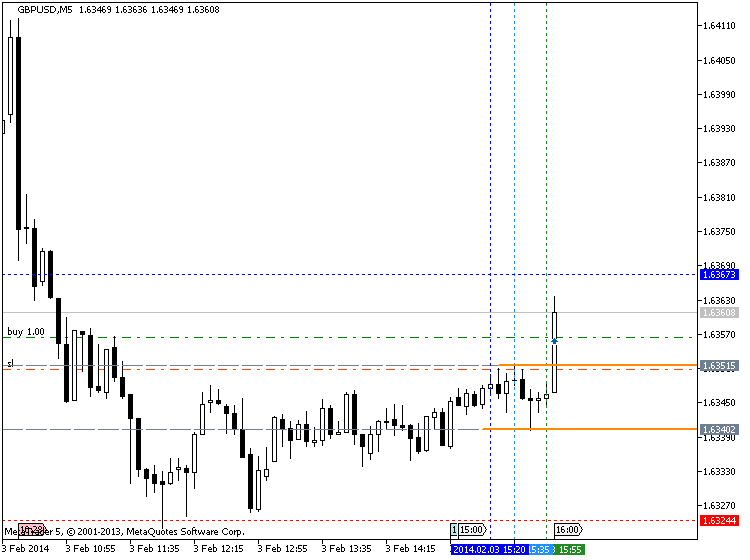

Comment to topic GBPUSD Technical Analysis 02.02 - 09.02: Correction to Finsih or Breakdown to Start?

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI ]

Sergey Golubev

Sergey Golubev

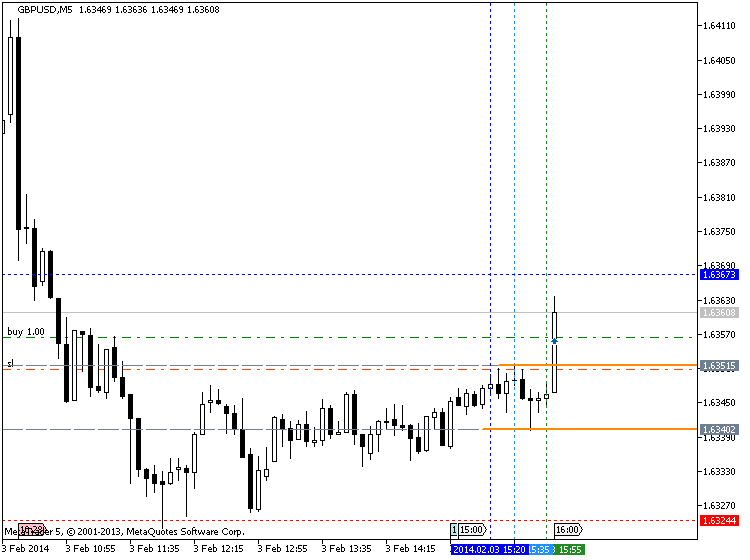

Comment to topic Market Condition Evaluation based on standard indicators in Metatrader 5

2013-02-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI ]

Sergey Golubev

现货金反弹至日内高点1248.83美元

Sergey Golubev

Comment to topic 报刊评论

现货金反弹至日内高点1248.83美元 摩根士丹利:下调2014年黄金预估价值1160美元/盎司

Sergey Golubev

Sergey Golubev

Comment to topic Press review

Gold price 'to average $1,220 in 2014' Some analysts expect price to fall below $1,000, while others are much more bullish The gold price will average $1,219 an ounce this year, according to a survey

Sergey Golubev

Paulo Oliveira

Comment to topic Informações e Dicas Relacionadas ao Terminal MetaTrader 5

Se você é totalmente novo para este site e você é programador e procurando algum trabalho, ou , você é comerciante e quer construir sua estratégia / system / indicador / EA Existem algumas páginas

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read February 2014

Guppy Trading, Essential Methods For Modern Trading : Daryl Guppy A compilation of the very best of Daryl Guppy Daryl Guppy has been one of Australia's foremost experts on share trading and charting

Sergey Golubev

Why The Fed Should Not Taper Alone (based on Forbes article)

The Fed’s decision to taper its large-scale asset purchases is causing turmoil in emerging markets. But neither the Fed nor the US Treasury seem remotely concerned. The FOMC’s latest decision to continue the taper at $10bn per month makes no mention of anything other than US domestic conditions. And Jack Lew, the Treasury Secretary, suggests that problems in emerging market are more down to bad policy on their part than anything the Fed is doing.

read more here http://www.forbes.com/sites/francescoppola/2014/01/31/why-the-fed-should-not-taper-alone/

The Fed’s decision to taper its large-scale asset purchases is causing turmoil in emerging markets. But neither the Fed nor the US Treasury seem remotely concerned. The FOMC’s latest decision to continue the taper at $10bn per month makes no mention of anything other than US domestic conditions. And Jack Lew, the Treasury Secretary, suggests that problems in emerging market are more down to bad policy on their part than anything the Fed is doing.

read more here http://www.forbes.com/sites/francescoppola/2014/01/31/why-the-fed-should-not-taper-alone/

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: PinBar

Getting That Reversal (based on dailyforex article ) Trading a trend reversal can be the source of the most profitable trades but it is often the most difficult area to enter for two reasons: firstly

Sergey Golubev

Рубашка, провисевшая ночь на стуле — автоматически считается выглаженной.

С добрым утром

С добрым утром

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read February 2014

High Profit Candlestick Patterns : Stephen Bigalow High profit trading patterns , revealed by utilizing time-honored Japanese candlestick signals. A straight-forward approach to understanding and

Sergey Golubev

Sergey Golubev

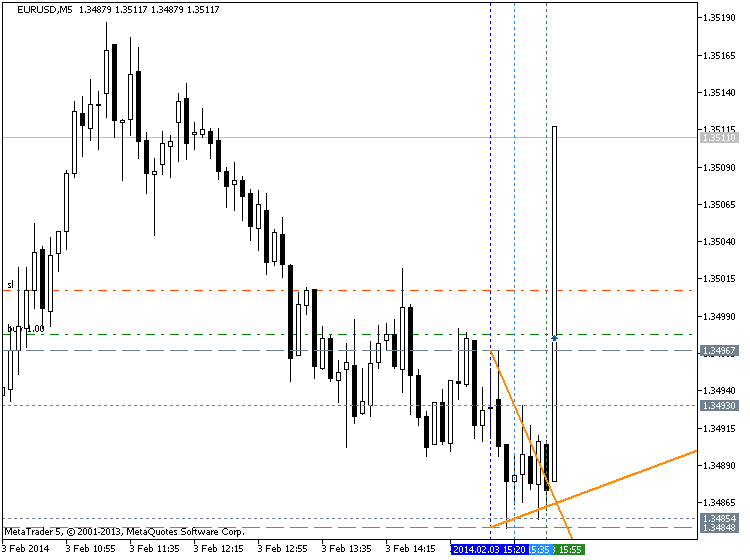

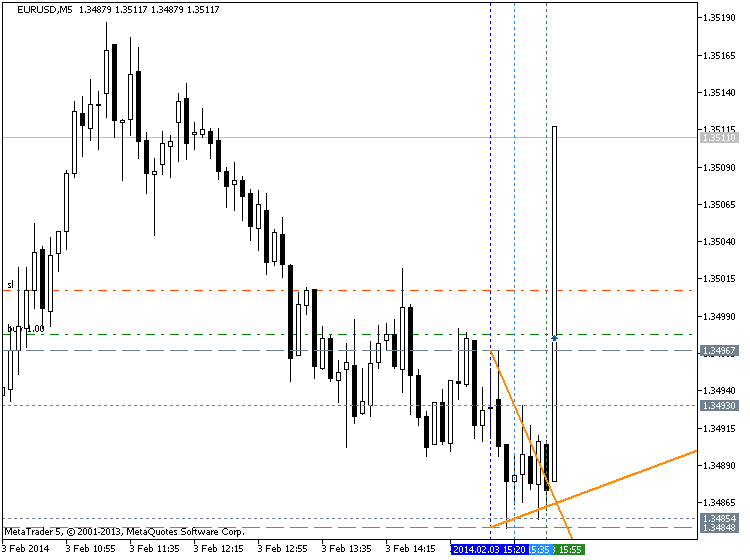

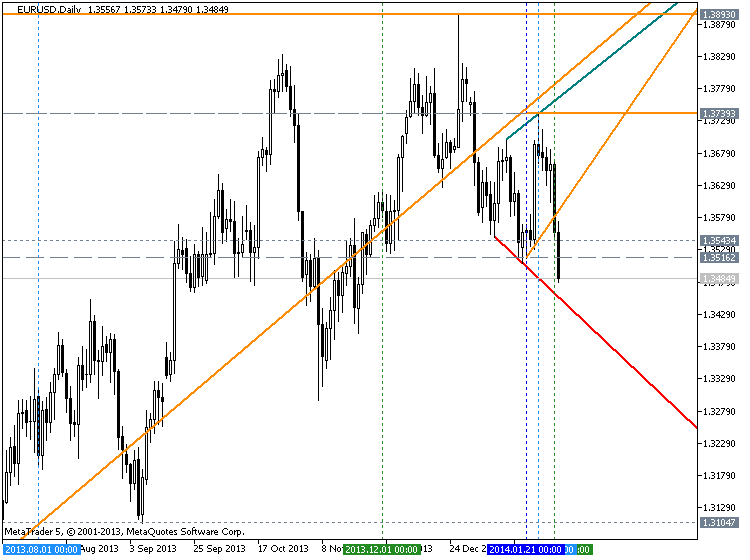

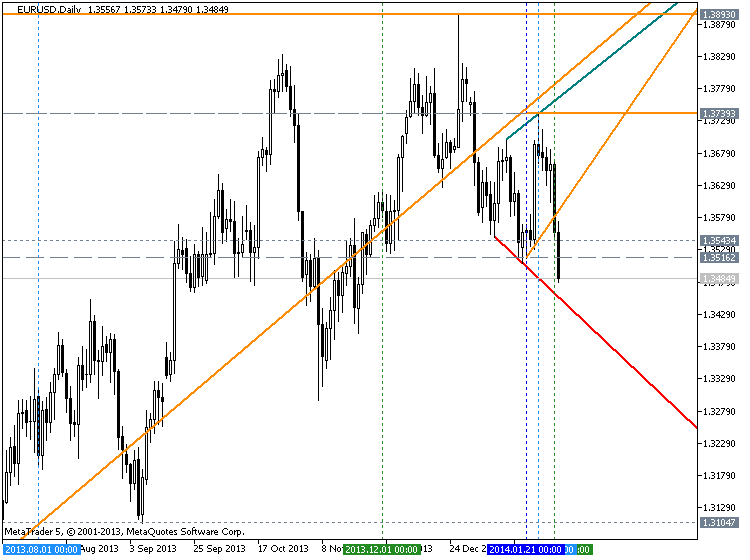

Comment to topic Press review

EURUSD breaks trendline support (based on dailyfx article ) EURUSD remains capped by the trendline that connects the 2008 and 2011 highs. The break below the trendline that extends off of the

Sergey Golubev

Выступление Даниила Гранина в бундестаге - полная видеозапись (27.01.2014) - http://www.dw.de/%D0%B2%D1%8B%D1%81%D1%82%D1%83%D0%BF%D0%BB%D0%B5%D0%BD%D0%B8%D0%B5-%D0%B4%D0%B0%D0%BD%D0%B8%D0%B8%D0%BB%D0%B0-%D0%B3%D1%80%D0%B0%D0%BD%D0%B8%D0%BD%D0%B0-%D0%B2-%D0%B1%D1%83%D0%BD%D0%B4%D0%B5%D1%81%D1%82%D0%B0%D0%B3%D0%B5-%D0%BF%D0%BE%D0%BB%D0%BD%D0%B0%D1%8F-%D0%B2%D0%B8%D0%B4%D0%B5%D0%BE%D0%B7%D0%B0%D0%BF%D0%B8%D1%81%D1%8C-27012014/av-17392834

: