Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

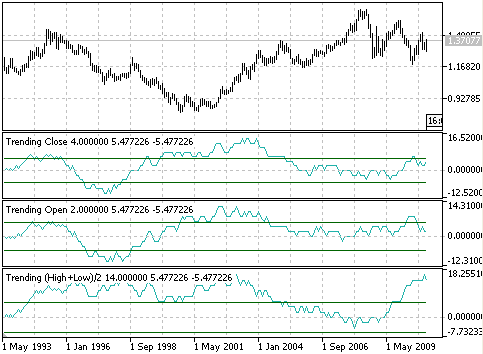

随机游走和趋势指标 掷硬币游戏很久以来就存在了。让我们来玩这个游戏,不过目的在于测试并理解 FOREX 市场中的技术交易机制。我们并不是第一个将硬币拿在手中的人。那些希望更加详细地学习概率论的人可以参考 William Feller 所写的 《An Introduction to Probability Theory and Its Applications》

Sergey Golubev

MetaQuotes

Perguntas Mais Frequentes sobre o serviço de Sinais

As perguntas mais frequentes sobre o serviço de Sinais serão coletadas e processadas neste tópico. A lista de perguntas será atualizada de tempos em tempos. Em breve iremos tentar dar respostas a todas as questões que chegam. Por favor, sinta-se a

Sergey Golubev

MetaQuotes

O que você deve saber sobre indicadores

Dezenas de artigos sobre indicadores estão disponíveis neste site. Você vai encontrar aqui exemplos de indicadores e artigos sobre como criar indicadores . No entanto, um iniciante pode ter algumas dificuldades ao escolher por onde começar quando for

Sergey Golubev

Paulo Oliveira

Comment to topic Estratégias/Trade Systems

Acho muito legal este tópico iniciado pelo Rafael, vou ajudar complementando o índice que Rafael iniciou: Página 1: Postagem inicial do Tópico - Rafael inaugura tópico e lança a idéia para sugestões

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

Fibonacci Trading: How to Master the Time and Price Advantage: Carolyn Boroden Product Description : Made famous by the Italian mathematician Leonardo De Pisa, the Fibonacci number series holds a

Sergey Golubev

MetaQuotes

Book: Algorithmic Trading and DMA: An introduction to direct access trading strategies

http://www.amazon.com/Algorithmic-Trading-DMA-introduction-strategies/dp/0956399207 Algorithmic trading and Direct Market Access (DMA) are important tools helping both buy and sell-side traders to achieve best execution. This book starts from the

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

The Gartley Trading Method : New Techniques To Profit from the Markets Most Powerful Formation (Wiley Trading): Ross L. Beck A detailed look at the technical pattern simply referred to today as the

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: spread_on_chart

What Does a Spread Tell Traders? Spreads are based off the Buy and Sell price of a currency pair, Costs are based off of spreads and lot size, Spreads are variable and should be referenced from your

Sergey Golubev

I just see one very good thread made by moderator of russian part of the forum (with the permission of MQ). This thread is here https://www.mql5.com/ru/forum/17387

I am recommending to the users to read it (or at least - read just the first page of this thread) with online translation.

Strongly recommended.

Just for information.

I am recommending to the users to read it (or at least - read just the first page of this thread) with online translation.

Strongly recommended.

Just for information.

Sergey Golubev

Sergey Golubev

Comment to topic 有趣,有趣的

杨幂 (1986年9月12日—),中国女演员、歌手、电视剧制片人。出生于北京。毕业于北京电影学院表演系2005级本科班。她曾获得第24届、第26届中国电视金鹰奖提名,第17届上海电视节白玉兰奖两项提名,并且获得一项白玉兰奖 。在2009年4月的“80后新生代娱乐大明星”评选活动中,成为内地新“四小花旦”(与黄圣依、王珞丹以及刘亦菲)之一。

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

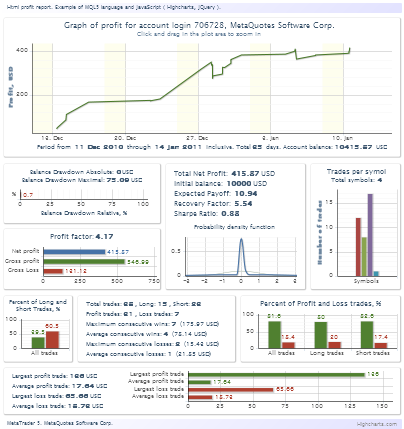

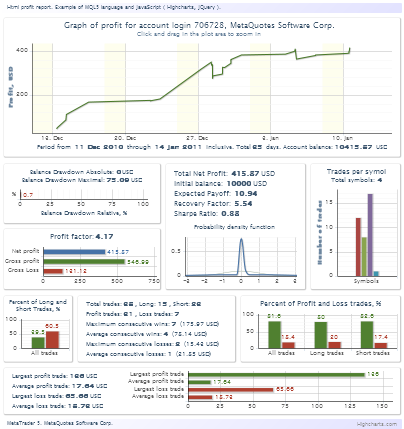

HTML 中的图表 MetaTrader 5 很有可能是一个完全自给自足的产品,并不需要额外的扩展。MetaTrader 5 提供与经纪人的连接,显示报价,允许我们使用各种各样的指标来进行市场分析,当然,还使交易者有机会进行 交易操作 。显然,因为 MetaTrader 5 主要专注于轻松交易,它不能——在技术上也不应该是一个专为数学方法的研究、分析以及多媒体内容的创建等而设计的绝对通用的工具。

Sergey Golubev

Sergey Golubev

Comment to topic Интересное Финансовое Видео Январь 2014

RSI. Индекс Относительной Силы (видео на 20 минут о том, как использовать индикатор RSI). ========== Создатель индикатора, Велес Вайлдер, исходил из того факта, что рано или поздно цена меняет свое

Sergey Golubev

Sergey Golubev

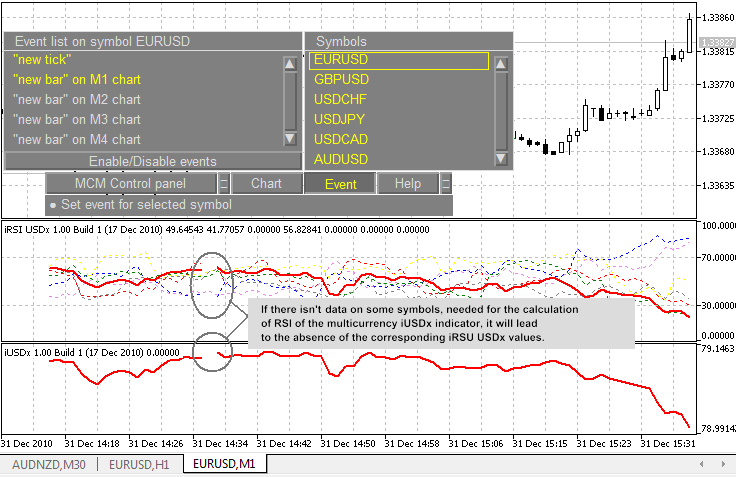

Comment to topic 如何开始学习MQL5

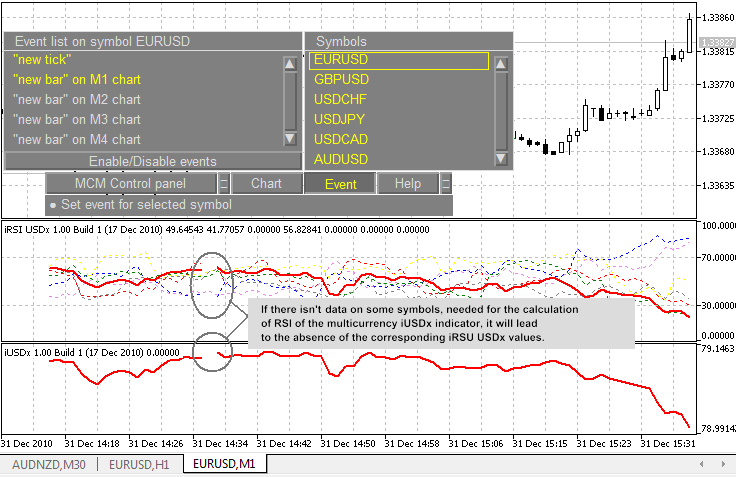

在 MetaTrader 5 中实施多货币模式 目前,市面上有大量成熟的多货币交易系统、指标和“EA 交易”。然而,开发人员仍然面临多货币系统开发的具体问题。 随着 MetaTrader 5 客户端和 MQL5 编程语言的发布,我们获得了实施完备多货币模式、以及随之而来的更高效的多货币机器人和指标的新的机会。这些新的机会正是本文探讨的主题。

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

Harmonic Trading, Volume One: Profiting from the Natural Order of the Financial Markets: Scott M. Carney: 9780137051502: Amazon.com: Books by Scott M. Carney Harmonic Trading creator Scott Carney

Sergey Golubev

Sergey Golubev

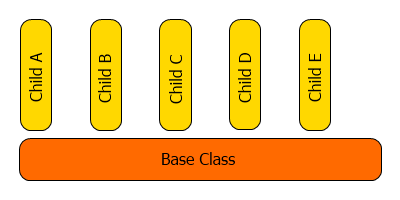

Comment to topic 如何开始学习MQL5

MQL5 中的电子表格 通常,电子表格指的是表格处理程序(存储和处理数据的应用程序),例如 EXCEL。尽管文中显示的代码不是那么强大,它可以用作表格处理程序的全功能实现的一个基类。我不是要使用 MQL5 创建 MS Excel,我希望实现一个类,以便在二维数组中操作不同类型的数据。

Sergey Golubev

Sergey Golubev

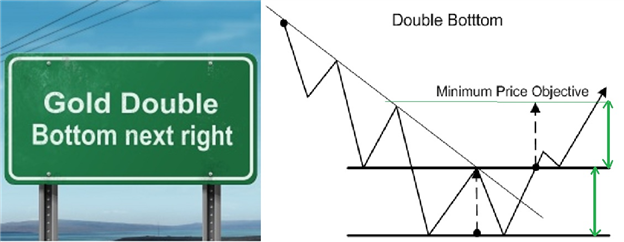

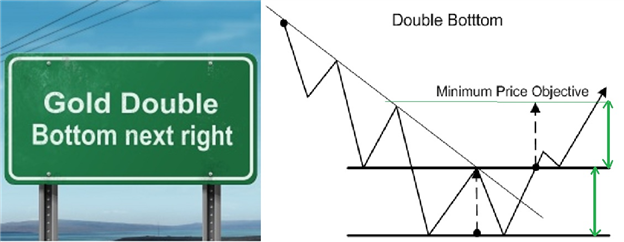

Comment to topic Press review

How to Trade the Double Bottom on Gold The Forex Double Bottom pattern is a bullish reversal pattern consisting a second test of a previous low followed by a rebound higher, Forex traders can

: