You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2013-01-31 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - GDP]

if actual > forecast = good for currency (for CAD in our case)

==========

Canada grows 0.2% in November – USD/CAD breaks 1.12 – new 4 year record

Canada reported a growth rate of November as expected, following a solid 0.3% growth rate in October. GDP growth is reported once per month, contrary to most countries that publish these figures on a quarterly basis.

USD/CAD was trading on high ground towards the publication, at around 1.1190. The 1.12 level looms. USD/CAD now edges higher.

EURUSD breaks trendline support (based on dailyfx article)

GBPUSD Technical Analysis (based on dailyfx article)

AUDUSD Technical Analysis (based on dailyfx article)

The next major target in AUDUSD is .7937. This target is determined by the .8847-.9757 range (.8847 – (.9757-.8847). Interestingly, the 50% retracement of the decline from the 2001 low registers at .7927. ‘Chartwise’, the 2010 low is at .8067. Significant demand may not exist until this zone.

The market has followed through on the recent outside week. The implications are that the outside week serves as the ‘kick-off’ for the next leg of the bear.

NZDUSD Technical Analysis (based on dailyfx article)

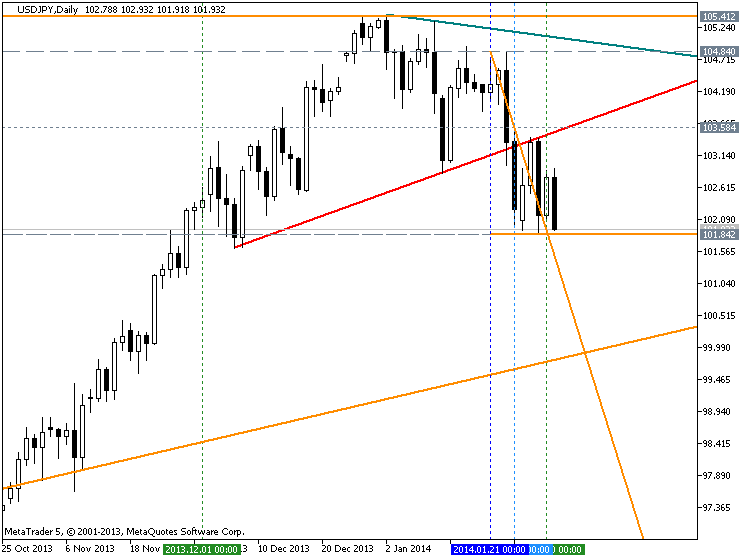

USDJPY Technical Analysis (based on dailyfx article)

USDCAD Technical Analysis (based on dailyfx article)

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Bearish

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral

GOLD Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Bearish