input int ExtremumOfBars=10; //Checking the condition of location of the pin bar at the extreme relative to the specified number of previous bars

sorry, i don't understand it ;

can you please explain it ?

thank you.

It checks if the pin bar is a high or a low for X previous bars.

thank you to reply.

a) " pinbar.mq5 indicator " on EURUSDM15-mt5: mt5 platform

b) " pinbar.mq4 indicator " on eurusdm15-mt4 : mt4 platform

*) do you know mt5 indicator as like for the mt4 ?

i mean ; a indicator for mt5 , show all the pin bar on chart . do you know such that ?

thank you.

You already have an mql5 version, you only have to find the good settings.

Forum on trading, automated trading systems and testing trading strategies

Reversal Candle (best body analysis for using in a code) - part 1 : Pinbar

TIMisthebest, 2013.10.15 10:49

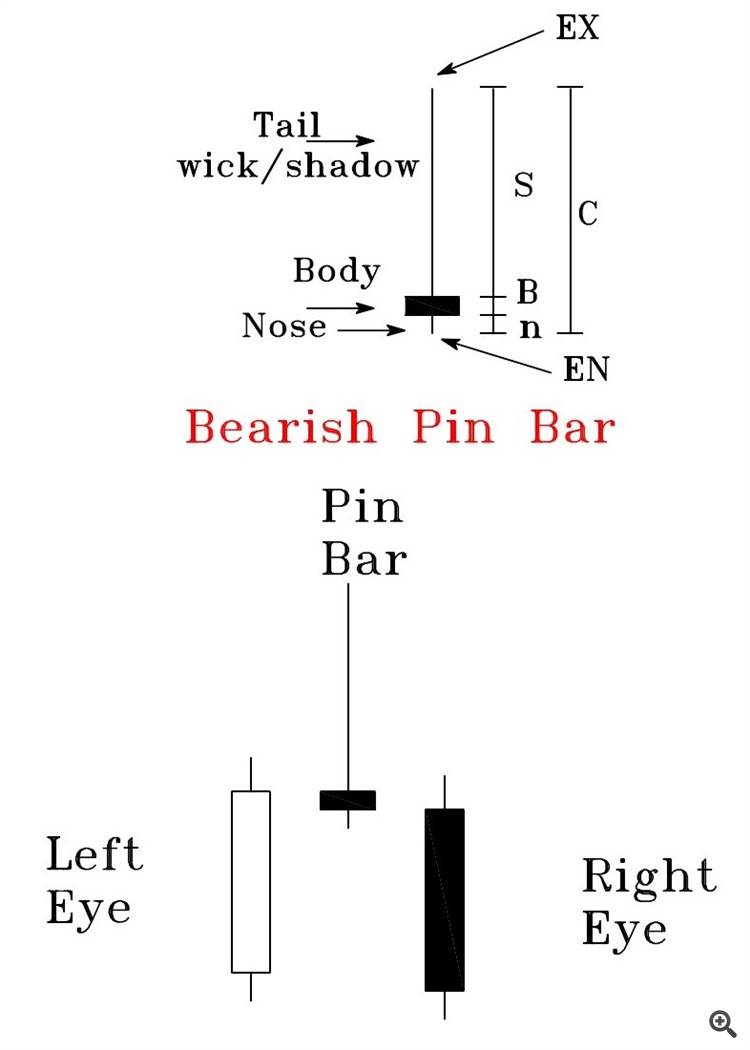

summary for parameter :

A) S >= 2B , S >= 3 B , S >= 0.33 C , S >= 0.67 C

B) B <= 0.33 C

C) Pin Bar Body Position : in the first 33 percent of candle , Nose Body Position <= 0.4 , Use Close Thirds=true

D) within previous bar : Open and close within previous bar , Pin Bars that form without a pullback in the market can be dangerous ,

Wait for the a retracement to begin (counter trend move) , it should close within previous bar body

Left Eye Opposite Direction = true , Nose Body Inside Left Eye Body = false

E) Pin Bar should be the same as of pattern (bullish/bearish) : Nose Same Direction = false , Use Body Direction=false

F) Entry : EN

G) Exit/Stop Loss : EX , EX+Spread+5 pips

H) Location : support/resistance

I) Left Eye Min Body Size = 0.1

J) Minmum protrusion : Min, Nose Protruding = 0.5 ( Minmum protrusion of Nose Bar compared to Nose Bar length )

K) it should be obvious from very far off distance. it should be bigger than

the previous bar ,

Long nose protruding from all other bars (must stick out from all other

candles) ,

Extremum Of Bars=10; //Bear(bull) pinbar must be higher(lower) then several previous. Can be zero to disable extremum check

L) Maximum relative size of the Nose Bar Body to Left Eye Bar Body : Max. Nose Body To Left Eye Body = 1

M) Minimum relative depth of the Left Eye to its length : Min. Left Eye Depth = 0.1 , ( depth is difference with Nose's back )

N) Minimum relative size of the Nose Bar Length to Left Eye Bar Length : Min. Nose Length To Left Eye Length = 0

CAN YOU PLEASE SHARE your opinion about this parameter and the suggestion value for them , or is there anotere important parameter must use it ?

please comment about it ,

thank's in advance.

Trading a trend reversal can be the source of the most profitable trades

but it is often the most difficult area to enter for two reasons:

firstly, the previous trend can simply continue; secondly, you may be

correct that there is an impending reversal, but if the entry is

mistimed you’ll get stopped-out. That said, this trade example shows

that with the correct criteria, you can enter safely in a reversal.

Prior to the Pin Bar marked on the chart, the price had been trending

down sharply. The Pin Bar marked the first sign the trend may be ending.

However, by itself, for me anyway, it did not produce a strong enough

confirmation of a trend reversal as the Pin Bar did not line up with a

previous support or Fib level. The trend could have simply been pulling

back a little before continuing down.

Then however, the next two candles produced a bullish Engulfing Setup.

To recap, an Engulfing Setup means that one candle’s body is engulfed in

the opposite direction by the next candle, and both candles have short

wicks relative to their bodies (precisely, the body must make up at

least two thirds of the entire length of the candle).

Now at this point, with a bullish Pin Bar followed immediately by a bullish Engulfing Setup, I was confident enough to enter at the open of the next candle to get at least a 1:1 risk/reward on the trade. The trade hit the profit-target within the next two candles (+125 pips).

In summary:

- Trend reversals, although tricky to trade, can be traded safely with the right entry criteria.

- The Pin Bar and Engulfing Setup can reinforce each other, especially when there’s no previous support or resistance to clarify the validity of the trade.

- You can exit too early on long-term charts because you’re not used to staying in a trade for a certain amount of time. Trading should be based on strategic rather than emotional decisions.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

PinBar:

An indicator of pin bars, to be used as a built-in indicator in Expert Advisors. Shows levels specified by the pattern for the open price and stop-loss.

Author: Andrew