Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

在 MetaTrader 5 中使用自组织特征映射 (Kohonen 映射) 自组织特征映射 (SOM) 是一种人工神经网络,使用无监督学习方法来进行训练,从而形成训练样本输入空间的二维离散表示内容,称为映射。 这些映射类似于多维标度,适合用于实现高维数据低维表示的分类和可视化。该模型首先由芬兰教授 Teuvo Kohonen 作为人工神经网络提出,因此有时也被称为 Kohonen 映射。

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

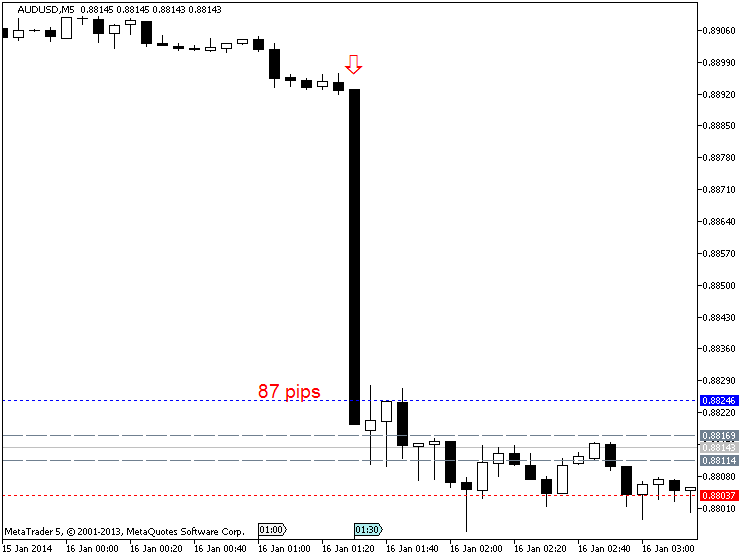

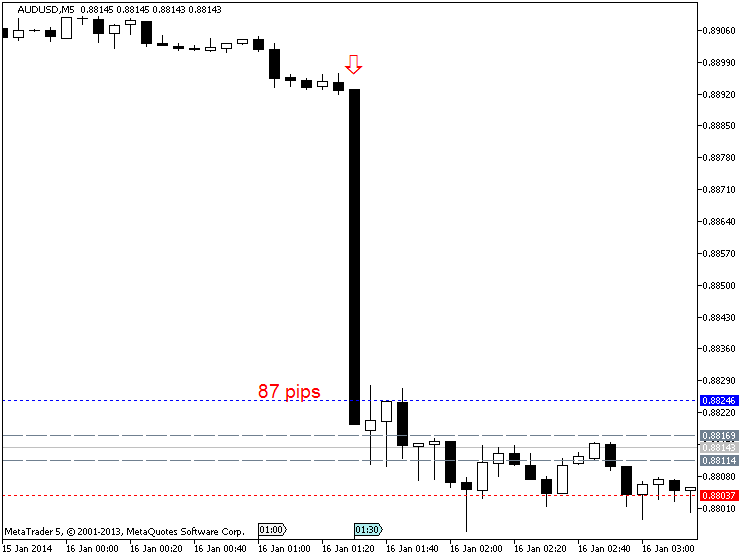

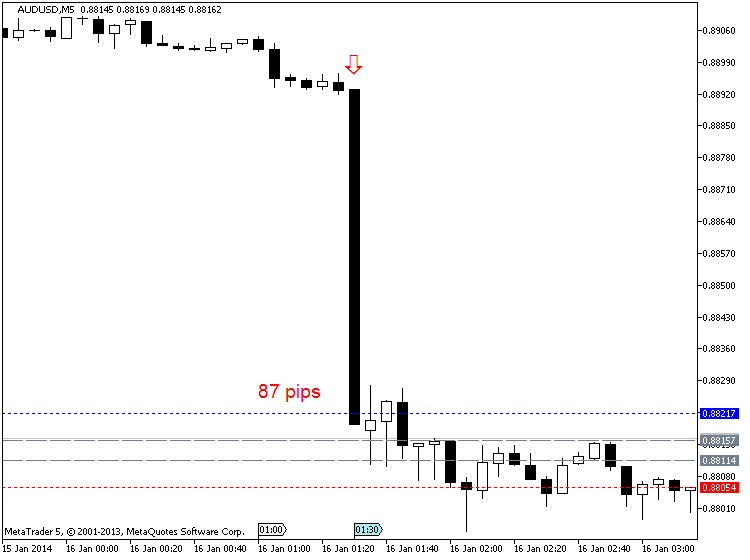

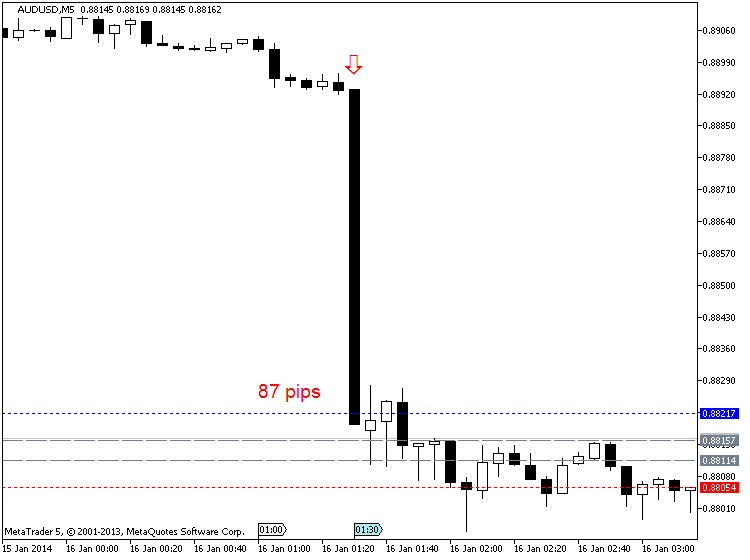

澳大利亚就业数据糟糕 澳元创新低跌至0.8795 星期四, 一月 16 2014, 05:23 GMT 昨日数据显示美国12月生产者物价指数年率从0.7%上调至1.2%,好于预期的1.1%。今日数据显示澳大利亚澳大利亚12月失业率保持在5.8%,与预期相同。澳大利亚12月就业人数变化从2.1万下调至-2.26万,预期为1.0万。 美元:美元指数报80.98点

Sergey Golubev

Sergey Golubev

Comment to topic Notícias econômicas e financeiras

2013-01-16 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Índice de Desemprego ] dados passado é de 5,8%, dados de previsão é de 5,8%, dados reais é de 5,8%, de acordo com o comunicado de imprensa mais

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

使用带 ENCOG 机器学习框架的 MetaTrader 5 指标进行时间序列预测 本文将介绍如何将 MetaTrader 5 连接到 Heaton Research 开发的 ENCOG - 高级神经网络和机器学习框架。我知道有一些以前讲述过的方法让 MetaTrader 能够使用机器学习技术:FANN、NeuroSolutions、Matlab 和 NeuroShell。我希望 ENCOG

Sergey Golubev

Sergey Golubev

Comment to topic Press review

Better Day for Asian Trading, European Stocks Up (based on forexminute article ) Continuing the earlier day’s positive trade, European stocks were up today. On the other hand, Asian stocks are moving

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

用于预测市场价格的通用回归模型 市场价格是由于需求和供应之间缺乏稳定平衡而形成的,反之,又取决于各种各样的经济、政治和心理因素,由于性质以及影响原因的差异,直接考虑这些因素非常困难。 然而,必须能够预见并以一定程度地精确性来预测将来的市场价格行为,以便对当前情形下的货物的买卖(包括货币或股票),做出正确的决策。可以使用来自各种来源的、以一种或另一种方式处理的、不同性质的大量信息来解决这个问题。

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

High Probability Trading Strategies - Robert Miners Trading today's markets—including stocks, futures, or Forex—can be a challenging and difficult endeavor. But it is possible to achieve consistent

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

2014交易机会──欧美央行鸽鹰分化,做空欧元/美元 星期三, 一月 15 2014, 05:00 GMT 自从2013年9月以来,市场对於美联储缩减QE时间表的猜测就从未停止过。这个因素将在2014年继续对市场波动性产生影响。不过,整体而言,预期美联储将在2014年某个时点继续缩减QE规模是比较靠谱的。换言之,美联储在货币政策上将较向鹰派倾斜。

Sergey Golubev

Методы влияния на людей

1. Заинтересуйте

Каждый человек ищет личную выгоду. Поэтому объясняя вашу позицию, не забудьте рассказать слушателю, какой прок в ней он может найти для себя.

2. Ищите компромисс

Человека нельзя просто зазомбировать. Если вы хотите повлиять на кого-то, вы должны уметь вести переговоры и идти на компромиссы.

3. Общайтесь

Общение – вот основной ключ к влиянию. Чем более вы коммуникабельны, тем большее количество людей будет поддерживать вашу точку зрения.

4. Будьте вдохновителем

Для того, чтобы убедить в чем-то других, вы сами должны излучать энтузиазм.

5. Загипнотизируйте

Загипнотизируйте собеседника. Конечно, не в буквальном смысле. Сделайте это с помощью вашего обаяния. Помните, что люди обычно охотнее соглашаются с теми, кого любят и уважают.

6. Заплатите

Деньги – это отличный мотиватор, не так ли? Возможно, это один из самых простых и быстрых способов получить то, что вы хотите. Единственный минус – этот способ может дорого вам обойтись.

7. Будьте последовательны

Если ваше мнение меняется так же быстро, как направление ветра, вы вряд ли вы сможете кого-то в нем убедить. Будьте верны своей точке зрения.

8. Будьте экспертом

Не будьте голословны. Подтверждайте ваше мнение фактами. Для этого вам нужны определенные знания. Люди охотнее прислушиваются к тому, кто разбирается в том, что говорит.

9. Слушайте

Учитесь слушать и слышать. Это является важной составляющей эффективного общения, которое очень важно в умение влиять на окружающих.

10. Будьте уверены

Если от вас исходит чувство уверенности в себе и своих словах, люди обязательно прислушаются к вам. Если вы хотите убедить кого-то пойти вашим путем, поверьте для начала сами в то, что он верен.

11. Уважайте других

Чем больше вы сами уважаете мнения других людей, тем больше у вас шансов быть услышанными.

12. Создайте репутацию

Если вы зарекомендуете себя умным, надежным и обстоятельным человеком, люди будут больше доверять вам и начнут прислушиваться к вашему мнению.

13. Будьте терпеливы

Попытки убедить других в своей точки зрения могут занять много времени, поэтому вы должны быть очень терпеливы.

14. Признавайте свои ошибки

Если вы неправы, признайте это. Люди будут воспринимать вас как справедливого и честного человека.

15. Знайте, чего вы хотите

Зачем вам необходимо повлиять на другого человека? Какова ваша цель? Для того, чтобы кого-то убедить, вы сами должны четко понимать для чего вам это нужно. Иначе ваша речь будет неясной и размытой.

16. Практикуйтесь

Не упускайте шанса применить вашу технику убеждения на практике. Практика помогает отточить любое мастерство до совершенства.

17. Исследуйте

Исследуйте факты, подтверждающие вашу точку зрения, если хотите втолковать ее другим.

18. Будьте позитивны

Будьте жизнерадостны и вселяйте в других надежду на лучшее. Люди всегда с радостью прислушиваются к тем, кто позитивен и оптимистичен.

19. Заручитесь рекомендациями

Люди прислушиваются к мнению друг-друга. Попросите кого-нибудь замолвить за вас словечко и вы увидите, что уровень доверия к вам возрастет.

20. Попросите

Иногда для того, чтобы заставить кого-то что-то сделать для вас, достаточно просто об этом попросить. Будьте вежливы, не ленитесь сказать “пожалуйста” и “спасибо” и люди пойдут к вам навстречу.

1. Заинтересуйте

Каждый человек ищет личную выгоду. Поэтому объясняя вашу позицию, не забудьте рассказать слушателю, какой прок в ней он может найти для себя.

2. Ищите компромисс

Человека нельзя просто зазомбировать. Если вы хотите повлиять на кого-то, вы должны уметь вести переговоры и идти на компромиссы.

3. Общайтесь

Общение – вот основной ключ к влиянию. Чем более вы коммуникабельны, тем большее количество людей будет поддерживать вашу точку зрения.

4. Будьте вдохновителем

Для того, чтобы убедить в чем-то других, вы сами должны излучать энтузиазм.

5. Загипнотизируйте

Загипнотизируйте собеседника. Конечно, не в буквальном смысле. Сделайте это с помощью вашего обаяния. Помните, что люди обычно охотнее соглашаются с теми, кого любят и уважают.

6. Заплатите

Деньги – это отличный мотиватор, не так ли? Возможно, это один из самых простых и быстрых способов получить то, что вы хотите. Единственный минус – этот способ может дорого вам обойтись.

7. Будьте последовательны

Если ваше мнение меняется так же быстро, как направление ветра, вы вряд ли вы сможете кого-то в нем убедить. Будьте верны своей точке зрения.

8. Будьте экспертом

Не будьте голословны. Подтверждайте ваше мнение фактами. Для этого вам нужны определенные знания. Люди охотнее прислушиваются к тому, кто разбирается в том, что говорит.

9. Слушайте

Учитесь слушать и слышать. Это является важной составляющей эффективного общения, которое очень важно в умение влиять на окружающих.

10. Будьте уверены

Если от вас исходит чувство уверенности в себе и своих словах, люди обязательно прислушаются к вам. Если вы хотите убедить кого-то пойти вашим путем, поверьте для начала сами в то, что он верен.

11. Уважайте других

Чем больше вы сами уважаете мнения других людей, тем больше у вас шансов быть услышанными.

12. Создайте репутацию

Если вы зарекомендуете себя умным, надежным и обстоятельным человеком, люди будут больше доверять вам и начнут прислушиваться к вашему мнению.

13. Будьте терпеливы

Попытки убедить других в своей точки зрения могут занять много времени, поэтому вы должны быть очень терпеливы.

14. Признавайте свои ошибки

Если вы неправы, признайте это. Люди будут воспринимать вас как справедливого и честного человека.

15. Знайте, чего вы хотите

Зачем вам необходимо повлиять на другого человека? Какова ваша цель? Для того, чтобы кого-то убедить, вы сами должны четко понимать для чего вам это нужно. Иначе ваша речь будет неясной и размытой.

16. Практикуйтесь

Не упускайте шанса применить вашу технику убеждения на практике. Практика помогает отточить любое мастерство до совершенства.

17. Исследуйте

Исследуйте факты, подтверждающие вашу точку зрения, если хотите втолковать ее другим.

18. Будьте позитивны

Будьте жизнерадостны и вселяйте в других надежду на лучшее. Люди всегда с радостью прислушиваются к тем, кто позитивен и оптимистичен.

19. Заручитесь рекомендациями

Люди прислушиваются к мнению друг-друга. Попросите кого-нибудь замолвить за вас словечко и вы увидите, что уровень доверия к вам возрастет.

20. Попросите

Иногда для того, чтобы заставить кого-то что-то сделать для вас, достаточно просто об этом попросить. Будьте вежливы, не ленитесь сказать “пожалуйста” и “спасибо” и люди пойдут к вам навстречу.

Sergey Golubev

Rogerio Figurelli

Quando a tecnologia abre portas para novas escolas de investimento

Acredito que existem várias lacunas entre a escola de análise técnica e a escola fundamentalista de investimento. Isso se deve ao fato de a escola técnica focar principalmente nos efeitos e a escola fundamentalista nas causas e valor intrínseco dos

Sergey Golubev

Sergey Golubev

Comment to topic How to Start with Metatrader 5

Limitless Opportunities with MetaTrader 5 and MQL5 Introduction 1. Trading System Conditions 2. External Parameters 3. Parameter Optimization 3.1. First Set-Up Variant 3.1.1

Sergey Golubev

Sergey Golubev

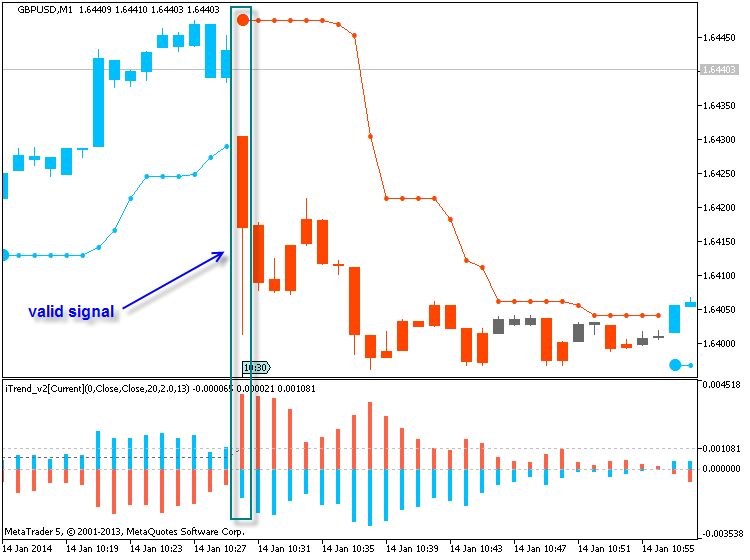

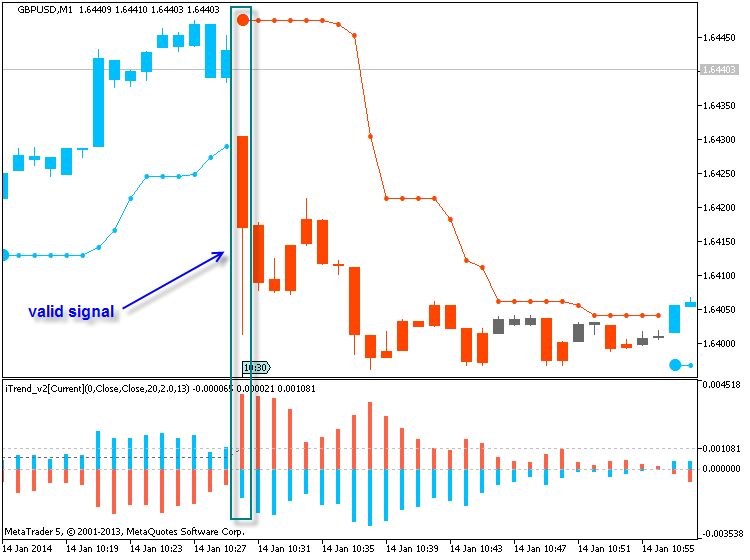

Comment to topic Brainwashing System / Asctrend System

Forum on trading, automated trading systems and testing trading strategies Press review newdigital , 2014.01.14 14:00 2013-01-14 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - CPI] past data is 2.1%

Sergey Golubev

Sergey Golubev

Comment to topic Una lectura interesante.

Como Gane $2,000,000 En La Bolsa ( Nicolas Darvas) Como hizo este famoso bailarín, sin ningún conocimiento del mercado bursátil, o finanzas en general, para ganar 2 millones de dolares en la Bolsa en

Sergey Golubev

MetaQuotes

Preguntas y Respuestas Frecuentes sobre el servicio Señales

Las preguntas más frecuentes sobre el servicio Señales serán recogidas y procesadas en este tema. La lista de preguntas se actualizará de vez en cuando. Pronto vamos a tratar de dar respuestas a todas las preguntas entrantes. Por favor, no dude en

Sergey Golubev

Sergey Golubev

Comment to topic 报刊评论

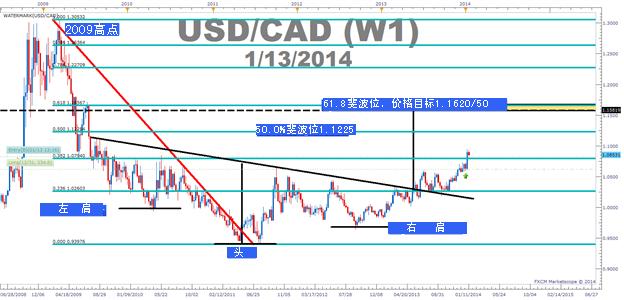

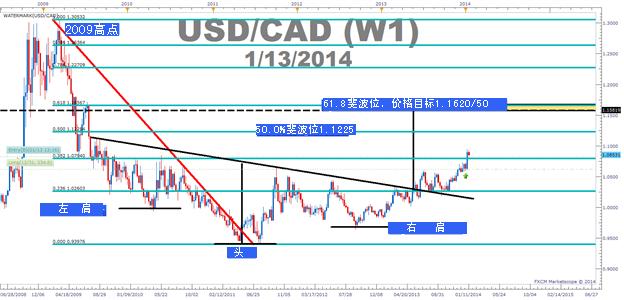

外汇进阶学习∶一目均衡收起锚链,美元/加元即将远航 2014年1月14日 13:41 美元/加元有孕育2014年最炙手可热交易的潜力。看看走势图,美元/加元已经很激进地产生了突破。目前逢高做多,不明智,一目均衡图却可帮你找到随势入场,风险收获比又低的机会。 支持是相对的

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

Technical Analysis Of The Financial Markets-John J Murphy John J. Murphy has now updated his landmark bestseller Technical Analysis of the Futures Markets, to include all of the financial markets

Sergey Golubev

Sergey Golubev

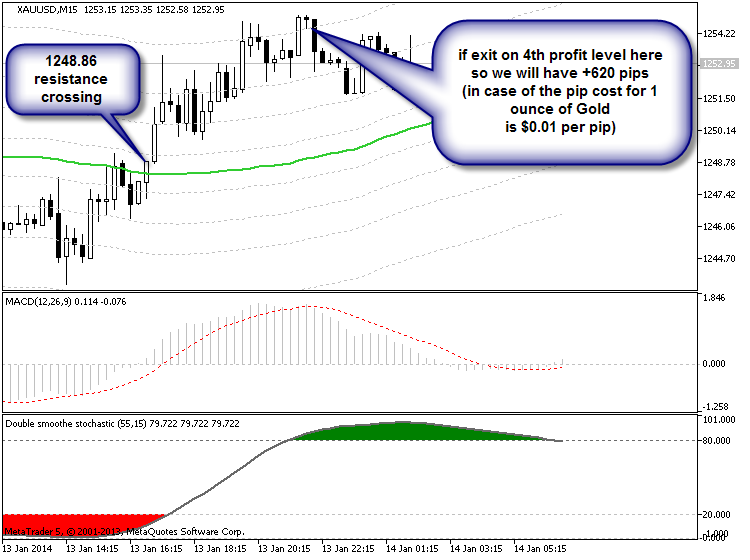

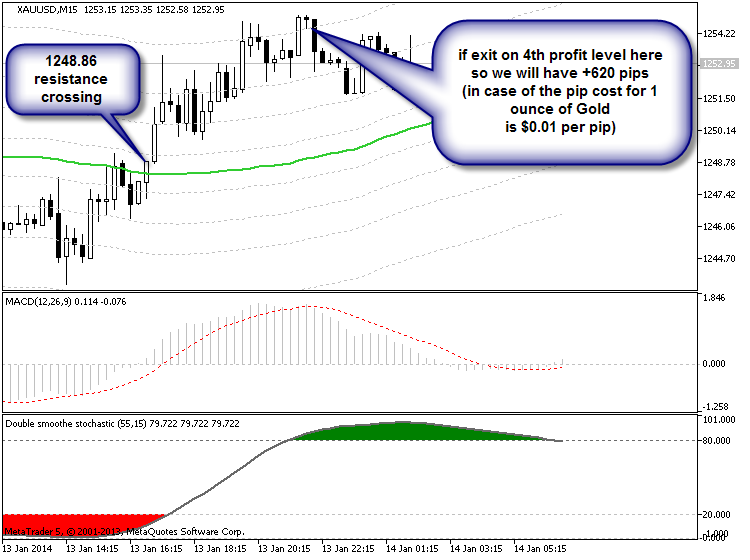

Comment to topic XAUUSD Technical Analysis 12.01 - 19.01: Rally

I told about 1248.86 level during the weekend : If the price will cross 1248.86 resistance so the rally may be started (good to open buy trade). If not so we will have the ranging market condition

: