Sergey Golubev / Profile

Newdigital

Friends

3916

Requests

Outgoing

Sergey Golubev

Sergey Golubev

Comment to topic Indicators: Fibonacci retracement

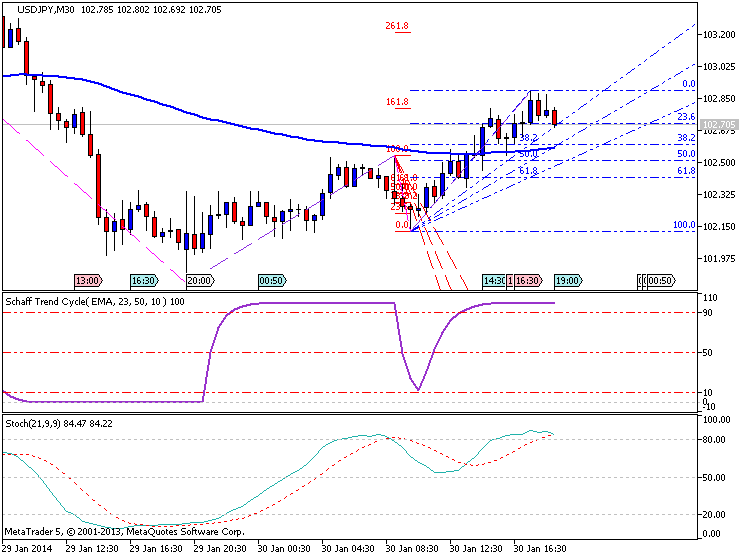

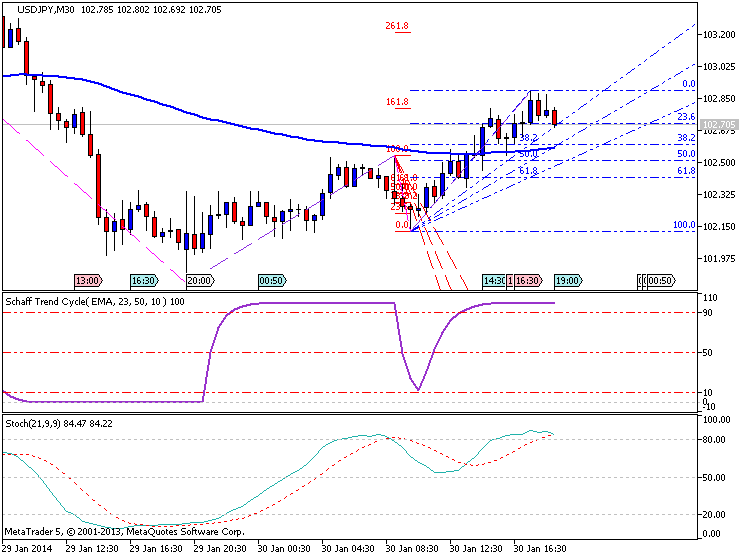

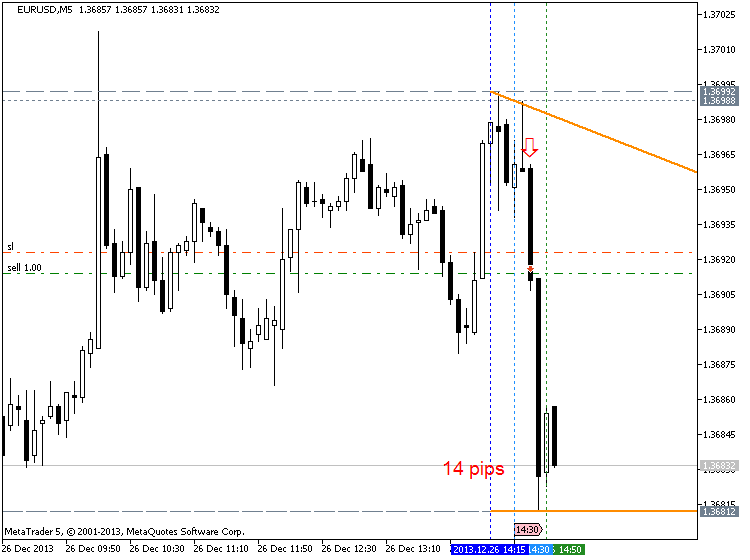

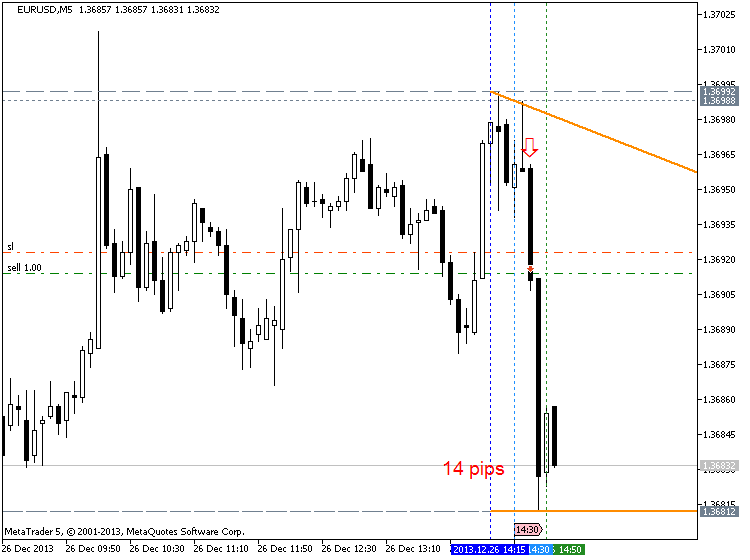

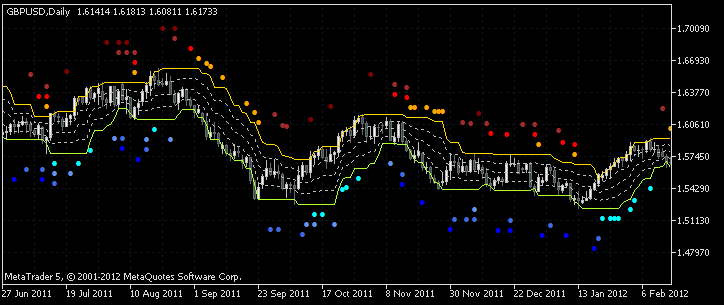

The 3 Step Retracement Strategy (adapted from dailyfx article ) Retracements are pullbacks within a trend, Find the trend and resistance using trendlines, Entries can be planned using a Fibonacci

Sergey Golubev

Muhammad Syamil Bin Abdullah

Comment to topic Something Interesting to Read February 2014

Advanced Swing Trading : John Crane The essential ingredients required for swing trading have been around for decades. The fact is that as long as human behavior remains the same, market behavior will

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read February 2014

Getting Started Patterns : Thomas Bulkowski An accessible guide to understanding and using technical chart patterns Chart pattern analysis is not only one of the most important investing tools, but

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting in Financial Video February 2014

Every trader needs one. Do you know what it is? Every trader needs one. Do you know what it is. Many times it's the difference between success and failure in the market. Watch the fifth episode of the

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

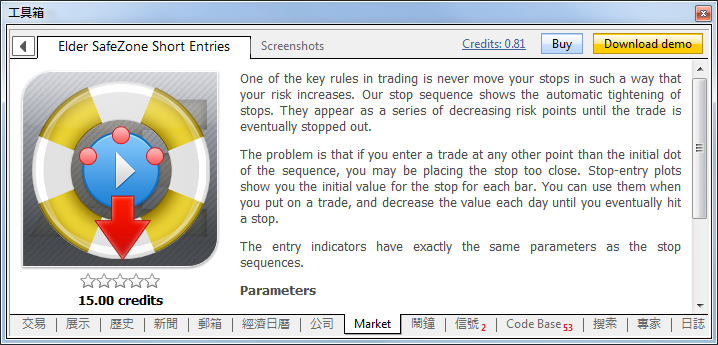

为什么说 MQL5 应用商店是销售交易策略与技术指标的最佳去处 我们创建 MQL5 应用商店 的主旨,就是帮助 EA 交易与指标开发人员销售其产品。此服务为 EA 交易开发人员提供了一个由成千上万潜在客户构成的、已经成型的市场!

Sergey Golubev

Sergey Golubev

Comment to topic Notícias econômicas e financeiras

Dólar atinge altas da sessão frente ao iene após dados do PIB dos EUA O dólar norte-americano atingiu altas da sessão em relação ao iene nesta quinta-feira após dados terem mostrado que a economia

Sergey Golubev

Sergey Golubev

Comment to topic Press review

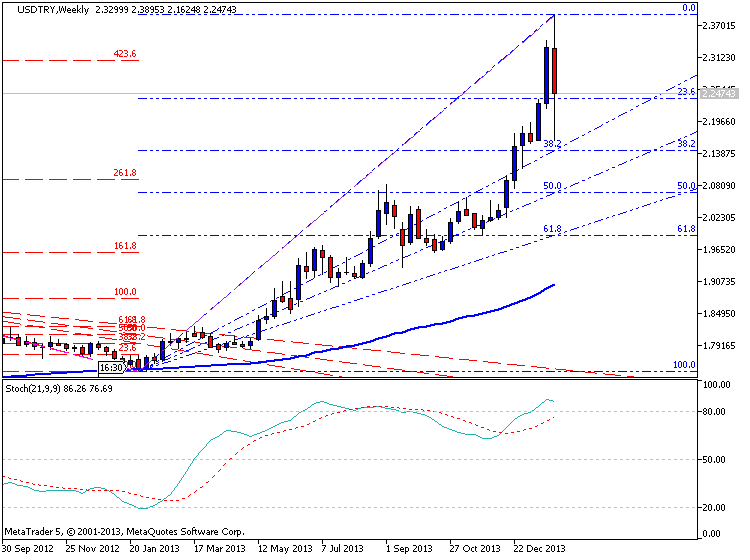

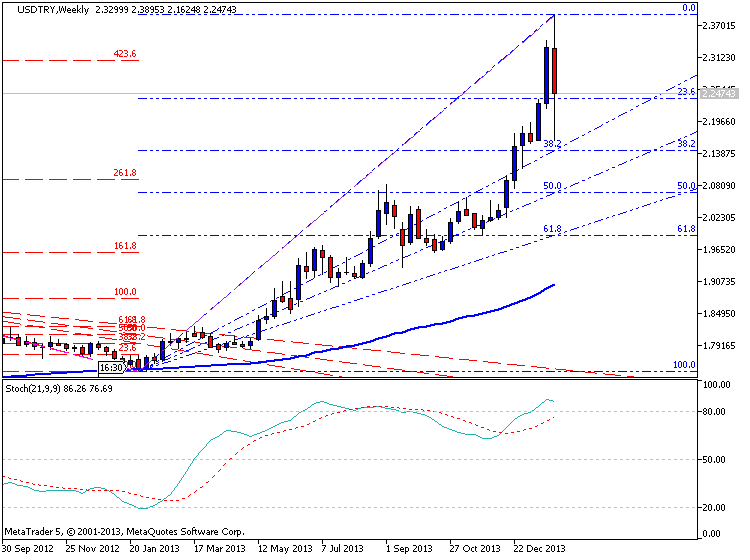

Turkey Shocks Forex Market As Fed Decision Looms (based on Forbes article ) his year was always going to be about the central banks and their interest rate decisions. So far, no asset class can be

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

The Disciplined Trader : Developing Winning Attitudes : Mark Douglas One of the first books to address the psychological nature of how successful traders think ~ The Disciplined Trader™ is now an

Sergey Golubev

Sergey Golubev

Comment to topic Press review

Gold and Silver Ready To Rumble Higher? (based on themarkettrendforecast article ) Aggressive investors can look at UGLD ETF, which is a 3x long Gold product that will give you upside leverage as Gold

Sergey Golubev

Sergey Golubev

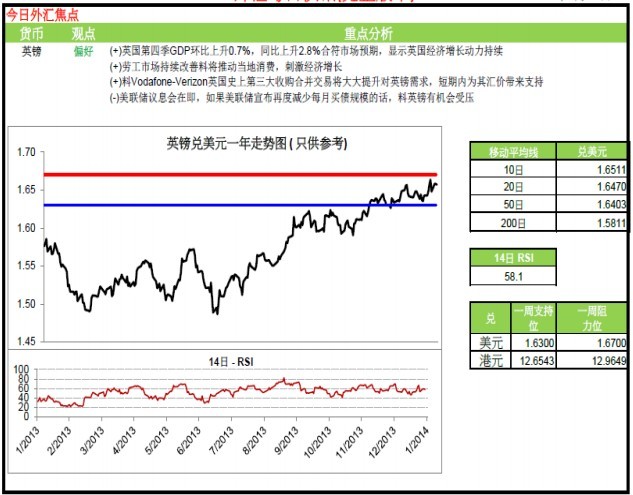

Comment to topic 报刊评论

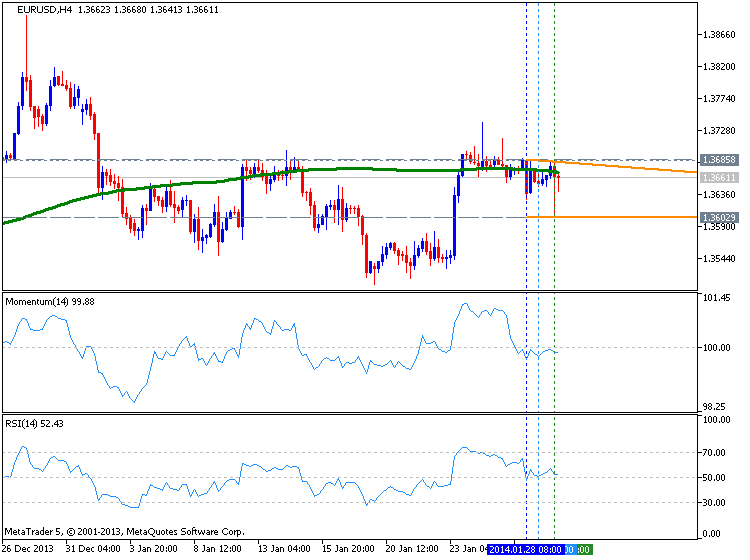

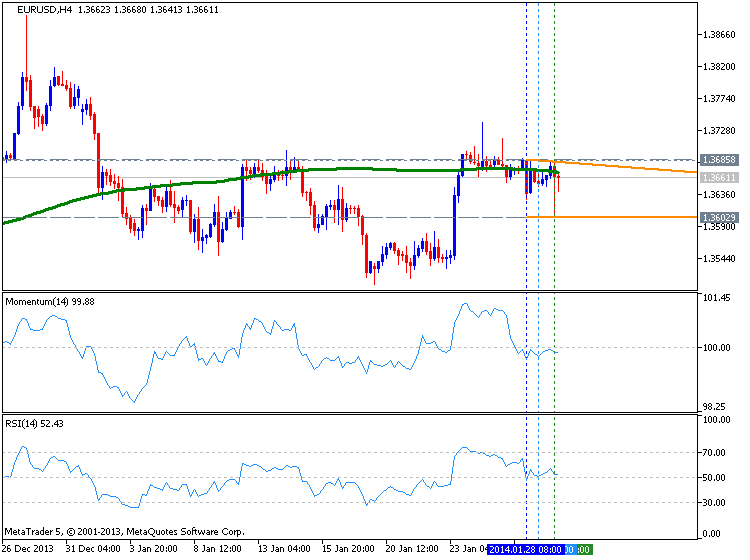

欧元/美元: 波幅有限,但倾向走高 星期三, 一月 29 2014, 13:22 GMT 欧元/美元仍受限于区间中,周三一度威胁近期高点区域1.3680.投资者等待日内稍晚的美联储利率决议,本地股市高开,而新兴市场货币再次大幅贬值。

Sergey Golubev

О провалах

Недавно зарегистрировала маму вконтакте. Она где-то наткнулась на аббревиатуру ТП, спросила, что это. Я начала объяснять ей, кто такая тупая п***да, а потом мама сказала мне, что по описанию это я.

Недавно зарегистрировала маму вконтакте. Она где-то наткнулась на аббревиатуру ТП, спросила, что это. Я начала объяснять ей, кто такая тупая п***да, а потом мама сказала мне, что по описанию это я.

Sergey Golubev

Про мечты и счастье

ыло бы забавно иметь возможность просматривать статистику свою. Например, сколько людей в метро подумало, что ты красивый, скольким ты разбил сердце, сколько тебе завидуют, сколько хотели бы с тобой подружиться, и так далее.

ыло бы забавно иметь возможность просматривать статистику свою. Например, сколько людей в метро подумало, что ты красивый, скольким ты разбил сердце, сколько тебе завидуют, сколько хотели бы с тобой подружиться, и так далее.

Iurii Starovoitov

2014.01.30

так развивай наблюдательность в людях и немного психологии и видно,а вообше незаморачиваться -работать и еще раз работать.)

Sergey Golubev

О жизни

У меня уроки с 8 утра. Каждый божий день я несусь в школу, перелезаю через забор, чтобы сэкономить время и не бежать через главный вход, и, взъерошенная, влетаю в кабинет со звонком. Я учитель.

У меня уроки с 8 утра. Каждый божий день я несусь в школу, перелезаю через забор, чтобы сэкономить время и не бежать через главный вход, и, взъерошенная, влетаю в кабинет со звонком. Я учитель.

Sergey Golubev

Про странности

Меня зовут Саша. Моего парня зовут Саша. Мой дед — Саша. Мою тетю зовут Саша, у тети сын, его зовут Саша, у сына есть сын, и его зовут Саша. Когда у меня будет ребенок, назову его Васей. Задолбало.

Меня зовут Саша. Моего парня зовут Саша. Мой дед — Саша. Мою тетю зовут Саша, у тети сын, его зовут Саша, у сына есть сын, и его зовут Саша. Когда у меня будет ребенок, назову его Васей. Задолбало.

Sergey Golubev

Про добро

Сегодня парень помог девушке зайти в автобус, подав руку, со словами: «Девушка, залазийте, пожалуйста, хуле».

Сегодня парень помог девушке зайти в автобус, подав руку, со словами: «Девушка, залазийте, пожалуйста, хуле».

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting in Financial Video January 2014

03: TWO MORE UNEMPLOYMENT REPORTS This is the 3nd video in a series on economic reports created for all markets, or for those who simply have an interest in economics. In this lesson we cover the ADP

Sergey Golubev

Sergey Golubev

Comment to topic Something Interesting to Read January 2014

Rocket Science Traders : John Ehlers Author John Ehlers sums up his book perfectly in saying, "Truth and science triumph over ignorance and superstition." Rocket Science for Traders adapts digital

Sergey Golubev

Sergey Golubev

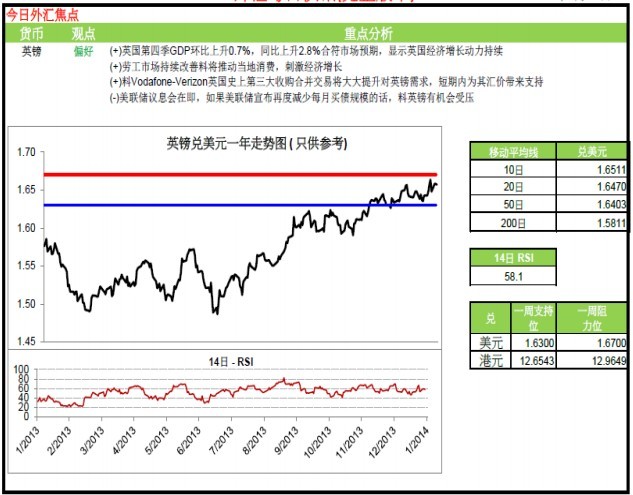

Comment to topic 报刊评论

每日外汇黄金策略 星期三, 一月 29 2014, 04:32 GMT 每日汇市及金市要闻: 英国第四季GDP初值环比增长0.7%,数值虽较第三季的0.8%增长略低,但仍是一个相当强劲的增长数值,显 示英经济未有放慢情况。而如以2013年全年计,英经济相较2012年更是大幅增长1.9%,是自2007年,即金融海啸后以来最强的经济增长。强劲的英 经济增长相信将会继续增强市场对英伦银行加息预期。

Sergey Golubev

Sergey Golubev

Comment to topic 如何开始学习MQL5

MetaTrader 5 与 MQL5 提供的无限机遇 简介 1. 交易系统条件 2. 外部参数 3. 参数优化 3.1.第一设置变量 3.1.1. 常规参数与规范 3.1.2. 测试程序设置 3.1.3. 获取结果的分析 3.1.4. 用于优化与测试结果分析的“读书报告”应用程序 3.1.5. 资金管理系统

: