Here: "... it turns out it closes the losing series in pairs: the first and the last order. That's the first!" is already incomprehensible.

How do you see what is written? Just curious.

well, interesting option with pairwise closing, by the way, mb with opposite positions... but you need reserch... But what if you learn mql and write your own bot? ) I think this is the main question that you have to ask yourself in order not to depend on clumsy programmers and do everything yourself )

Here: "... it turns out it closes the losing series in pairs: the first and the last order. That's the first one!" is already incomprehensible.

How do you see what is written? Just curious.

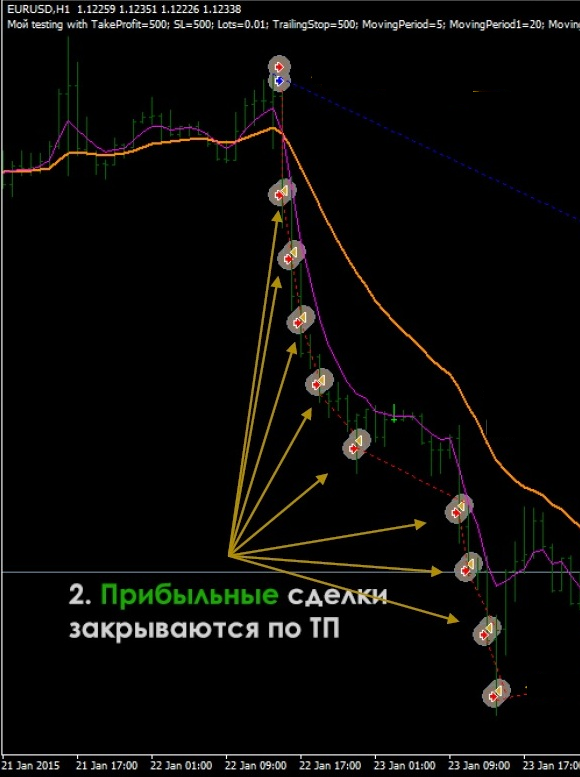

I have attached a picture! Look closely, pairwise closing of averaging positions, the first and last order in a series of open orders are closed. Words may be difficult, but visual is better. So I have attached pictures.

In words and by example. You don't see it, but I see several options at once :)/

Ah, yes. I forgot to add: the first and the last are closed when the total goes to the plus) That's probably what you mean

Again, you can't see the point. Oh, come on. Let's explain it now.

So we have a no-holds-barred move where, after a certain step, we open a pair of opposite positions: Buy and Sell:

As a result, we obtain 10 Buy positions and 10 Sell positions. In this case all the Buy positions will be in the loss. Right?

Again, you can't see the point. Oh, come on. Let's explain it now.

So we have a no-holds-barred move where, after a certain step, we open a pair of opposite positions: Buy and Sell:

As a result, we obtain 10 Buy positions and 10 Sell positions. In this case all the Buy positions will be in the loss. Right?

The funny thing is that if we open bai's as well, we're going to get busted. All the classic martins will go bust. And we are in a small minus. After all, the first trade opens with the minimum lot, 500 pips of megatrend for such a single minus trade is a small drawdown compared to the martin-like ones. And my task... our task is to reduce the chances of getting out of the market. I mean, we're mentally prepared, we're on a martin

What is the lot for opening orders?

10 sells interest

What is the lot for opening orders?

10 sells interest

I think the lot is 0.01 for the first knee. If drawdowns will be low in the process of testing, the initial lot may be raised. But the losing pattern - the ladder, when the pullback is horizontal, flat - in this case the arrows will cross and give a signal for the opening of the next knee. And so on and so on, and we will get the same ilan in the end. What am I talking about, it's a Martin, we are a priori ready to lose. The question is when it will happen. And the point is to make this period as far away as possible.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Nowhere can I find the kind of owl I had in mind myself. Nah, well, someone obviously wrote it!? The Ilan-like obscurantism is worn to a crisp.

Anyway, once I saw El Diablo advisor on one website. Nothing special! And it cost $200! Then I read about it and it turns out that it closes losing series in pairs: the first and the last order. This is the first!

Second!Isawanother EA called Argus... Regular Martin, pfft! And it cost $120! Later, I've read about it: it turns out that it never searches for moves with advantages, it does not enter using Sicilian, but simply opens deals one after another, thus reducing unprofitable ones to loss-making ones. But he is the most profitable, 5000 points a month, if I do not give up.

That's not all! Third!

I was wondering what would happen if you combine these two EAs? Why does the author of these two EAs have no such thing? But never mind...

Fourth, what if we run the martin along the chart and study the points where it is losing? What's there to learn? Those places are known - the no-return moves. Brexit-exits. In one of the January stretches so ancient the price fell in such an even slide that it drained any martin. The flat hill without the pullback or the sharp movements, but with a flat flat pullback - these are the killer patterns, that destroy the deposit of the low-liquid traders.

Fifth: what if we choose a filter, that would not allow opening many knees in such loss-making segments? What if we attach a pairwise closure to it? And what if we enter all the time without finding an entry with an advantage? All rolled into one! Is there such an owl in the world? What's it like? Works, doesn't it? Show me if there is, is it better than the usual ilan? Because my micro-theory makes everything look rosy. Throw it in if you've got one. And if there isn't and you happen to write such an owl, then please drop it in your personal email.

Come on, it's a lot of letters, I'll explain in pictures.

Parameters:

EMA 5 and 20.

Filter: divergence of waves. We do not open the next knee until it has crossed.

And if we do, we should experiment with the coefficient - whether it is a standard 1.6, or double or triple. After all, after a long rent the price will fall back, the first trade opens with 0.01 lot (let's say), and the second one opens with 0.13 lot. The second one should pass some points to cover the first one in profit. In this case an increased multiplier is also possible.

TP any, but I think 15-20 points will do (minimum daily range, which may be, that the scoop receives profitable trades every working day, do not sit idle)

Minimum threshold at which the next knee opens for a losing series (for example, if a flat starts immediately after opening a losing trade) - to experiment. I think we can start with 20. I.e. if the price goes against the open position, then the price reverses, the reverse crossover occurs, and at this time the price is at 10-19 points from the first position, then additional trade do not open, wait for the price to return back, to reduce the risk of getting into a sideways trend with two open trades (not ten! ie, reduce the risk of opening every 20 points).