Discussion of article "Extract profit down to the last pip" - page 25

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

And if I put $10,000 into the account, will the strategy work just as well? Or will there be slippages?

There will be no negative slippages. Partial execution is more common.

Accordingly, if trading resumes on this account, it will be on a more advanced variant. The question is only in the settings.

Launched. I would like to believe that the article was useful.

Do you teach the fundamental patterns of the model? It seems to me that it is the technique of movement that should be taught.

I gave the example of a black swan in the currency market. There were also enough black chickens....

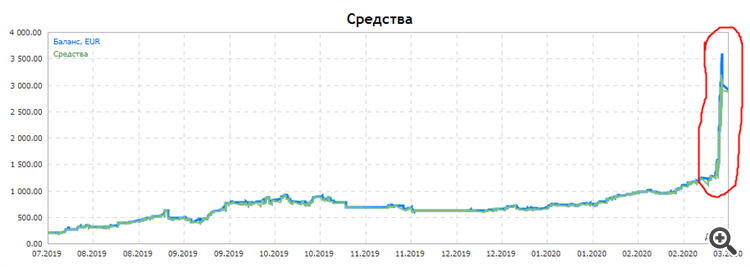

There are positive examples of systematic trading during the Storm.

This is a high-turnover almost round-the-clock continuous trading during the current week on a real account.

Why this happened is below.

Frankly about algo trading.

Forum on trading, automated trading systems and testing trading strategies

Some signs of correct TS

fxsaber, 2020.02.29 10:23 AM

It is very difficult to realise the reason for the robustness of your TS. This makes it impossible to predict that on such and such symbol it will work or not. Only dumb optimisation answers this question. And again, there is an understanding that it works. But why it doesn't.

What are the reasons why statistically TC is profitable? This is a very difficult question. But it is possible to divide TS into two categories, when it is possible to impose fundamental reasoning to statistical analysis, and when it is not.

Fundamental.

Forum on trading, automated trading systems and testing trading strategies

Discussion of the article "Scratching out a profit to the last pip"

fxsaber, 2019.08.09 21:09

An example on the topic of patterns in price history. Take EURGBP.

Over the years of this pair's history, there has been a fundamental link between EUR and GBP based on EU treaties. This allowed sometimes to find long-lasting patterns, on which many people made money.

At the moment, the fundamental connection is broken. But it is not properly reflected in the price history.

Thus, you can get a cool result on the history. For example, you optimised for six months, and then on OOS for many years the result is the same.

But the bummer is that there is no preparation for Brexit in that history. So the collapse of the "pattern" found is highly likely. And this problem cannot be solved by any machine learning techniques. There is simply no data to train on. None at all.

I.e. there is a statistical analysis, and then we honestly answer the question whether there is something more behind this statistical analysis than just a cool result not only in history, but also in real trading. That something more is the foundation.

Storm.

What is the first thing to be destroyed in a storm? Of course, statistical analysis without fundamentals. Yes, scalpers made stable profits for years, but it was a cool statistical analysis of quiet time. The ninth shaft sank.

A prerequisite during force majeure is the presence of fundamentals to stat. analysis. Fundamental ratios between raging symbols are different in that their chart does not go anywhere.

Super Profitability.

During a storm, the market creates a huge number of small imbalances between fundamentally related symbols. These are the logical ones to trade. In fact, they are the only ones to trade.

That is, the task of an algo-trader is to create a safe harbour in the form of a symbol, which is quiet and smooth during the panic around. Now it can be analysed statistically. Preventively - statistical analysis + fundamental.

Guarantees.

There are none.

Launched. I would like to believe that the article was useful.

freaked out )))

and actually, what was this movement?

trading algorithm didn't change? or was it done by a completely different algorithm?

or just the volume of trades was increased?

and actually, what was this movement?

trading algorithm didn't change? or was it done by a completely different algorithm?

or just the volume of trades was increased?

Thehistory of trades is available.

Sergey Kovalev (if anyone knows him) thanks to this article finished his robot, which is now being monitored on the flywheel.

This week he increased his depo 16 times.

***

Sergey Kovalev (if anyone knows him) thanks to this article finalised his robot, which is now being monitored on a flyswatter.

***

Filigree micro-scalping! Congratulations. A money-making article, though.