Daily Technical Outlook: EURUSD

EURUSD: The 1.2442 Level Set To Reverse Roles As Support.EURUSD: Though vulnerable to the downside, as long as it holds above the 1.2442 level, it faces the risk of a return to the 1.2588 level. A breach will aim at the 1.2692 level followed by the 1.2748 level. The alternative scenario will be for the pair to return to the 1.2442 level. A reversal of roles as support is likely here but if that fails to occur the pair could weaken further towards the 1.2239 level. A clearance of here will set the stage for a move lower towards the 1.2132/17 levels. Further down, support stands at the 1.2040 level. All in all, EUR continues to face upside recovery threat though vulnerable.

USDJPY: Recapture Of Key Support Envisaged.

USDJPY: We continue to hold our broader downside bias and look for USDJPY to eventually return to the 77.88/66 levels. A violation of here will aim at the 77.00 level, its psycho level. Below here will call for more declines towards the 77.35 level and then the 76.49 level. Its daily RSI is bearish and pointing lower suggesting further declines. On the upside, the pair must break and hold above the 79.64 level to annul its present bearishness. This could push the pair further towards the 80.59 level where a breach will turn attention to the 81.77 level. All in all, USDJPY remains biased to the downside with risk towards its key support.

USDCAD: Focus Turn Lower With Trend Resumption Looming.

USDCAD: With USDCAD continuing its weakness and testing the 0.9841 level to close lower on Tuesday, the threat is for an eventual break and hold below the 0.9841 level, its Aug’2012 low. If this occurs, the pair will resume its medium term weakness towards the 0.9800 level. A violation of there will allow for a move lower towards the 0.9700 level, its psycho level and possibly towards the 0.9600 level. Conversely, the only way to prevent these bear threat is for it to decisively break and hold above the 0.9945 level. This if seen could propel it further towards the 1.0000/83 levels. A breach will aim at the 1.0105 level and then the 1.0165 level. All in all, the pair remains biased to the downside in the medium term.

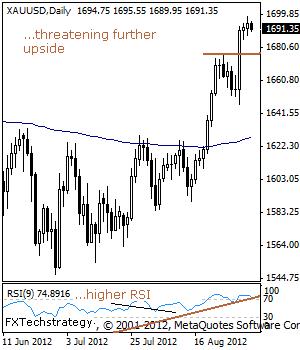

GOLD: Risk Remains Higher Short Term

GOLD: With consolidation now occurring above the 1,676 level following its last week rally, GOLD faces the risk of further upside. In such a case, the 1,700.00 level will be targeted. Price hesitation is expected at this level but if taken out, expect the commodity to strengthen further towards the 1,714 level and next the 1,750 level. Its weekly RSI is bullish and pointing higher suggesting further upside. The alternative scenario will be for the commodity to return to the 1,640.45 level where a reversal of roles as support is expected to occur. However, if this fails, further declines will shape up towards the 1,584 level and then the 1,544.35. Below here will call for a move lower towards the 1,527.05 level. All in all, GOLD continues to hold on to its bullish tone.

EURUSD: Maintains Its Bullish Tone.

EURUSD: With EUR holding above its broken resistance zone at the 1.2692/1.2748 levels, further upside gain is likely. It now faces the risk of moving higher towards the 1.2839 level where its daily 200 ema is located. A breather may occur and turn the pair back lower at this level but if this fails to occur, expect the pair to strengthen further towards the 1.2900 level. Its daily RSI is bullish and pointing higher supporting this view. The alternative scenario will be for the pair to return to the 1.2692/1.2748 levels where a reversal of roles could occur. Further down, support lies at the 1.2442 level where a violation will expose the 1.2239 level. A clearance of here will set the stage for a move lower towards the 1.2132/17 levels. All in all, EUR continues to face upside recovery threats.

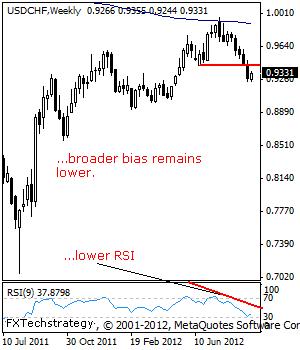

USDCHF – Sees Further Bearish Momentum, Eyes The 0.9193 Level.

USDCHF: The pair continues to weaken turning lower below the 0.9421 level, its July 2012 low to close the week at 0.9271 level. This leaves the pair aiming at the 0.9193 level, its May 07’2012 low on further declines where a violation could force more declines towards the 0.9100 level. A breach of here will aim at its major psycho level at the 0.9000 level. Its weekly RSI is bearish and pointing lower supporting this view. The alternative scenario will be for the pair to initially return above the 0.9421 level and then the 0.9655 level. This if seen should open up further upside towards the 0.9808 level. Further out, resistance resides at the 0.9970 level. On the whole, the pair remains biased to the downside in the short term.

US Dollar Index Technical Outlook

Dollar Index: Recovering But Vulnerable Short Term

US Dollar Index: While the Index may be attempting to recover higher, it continues to hold on to its broader short term downside bias triggered from the 84.10 level. As long as it trades and holds below the 80.96 level, a retarget of the 78.53 level is likely to occur. A violation of this level will call for a run at its psycho level at 76.00 level. Alternatively, on continued corrective recovery, the Index will target the 79.82 level where a breach will call for a move lower towards the 80.49 level. Further out, resistance resides at the 81.18 level with a break below here allowing for more upside towards the 82.72 level. All in all, the Index continues to look vulnerable short term though facing a recovery threat

USDCAD: Shooting Star Candle Surfaces.

USDCAD: The pair may have closed higher on Thursday but left a lot to be desired after it printed a shooting star candle pattern. This candle pattern is both negative and upside reversal signal suggesting the pair may have ended its correction. This will leave USDCAD targeting the 0.9692 level where a violation will call for more declines towards the 0.9631/00 levels. A break will aim at the 0.9500 level and possibly the 0.9450 level. Alternatively, the pair will have to return above 0.9815 level to resume its correction. Further resistance lies at the 0.9945 level. This if seen could propel it further towards the 1.0000/83 levels. All in all, the pair remains biased to the downside in the medium term though facing recovery risks.

Special Focus On USDCHF

USDCHF – Halts Declines, Looks To Correct Higher.

USDCHF: While the pair may have halted its declines and triggered a mild correction, it continues to hold on to its broader short term downside bias. As long as it holds and trades below the 0.9421 level, its July 2012 low, its short term downtrend remains valid. Support lies at the 92.38 level where a violation will aim at the 0.9193 level, its May 07’2012 low with a breach targeting the 0.9100 level. A breach of here will aim at its major psycho level at the 0.9000 level. Its weekly RSI is bearish and pointing lower supporting this view. The alternative scenario will be for the pair to follow through on its recovery threats and then target the 0.9421 level. Above here if seen will call for a run at the 0.9655 level followed by the 0.9808 level. On the whole, the pair remains biased to the downside in the short term though attempting a recovery.

EURUSD: Bears Extend Hold On The Downside.

EURUSD: A second consecutive week of declines saw the EUR even more vulnerable to the downside with eyes on the 1.2753 level. A clearance of here will open the door for a run at the 1.2692/1.2748 levels where a reversal of roles could occur. This could see the pair back off lower prices and target the upside. However, if this fails to happen Further declines will aim at the 1.2442 level. Its weekly RSI has turned lower supporting this view. On the other hand, the pair will have to return above the 1.3171 level to annul its present weakness and turn upside risk towards the 1.3282 level. Above here will call for a move higher towards its weekly ema at 1.3415 level. All in all, EUR continues to face bear threats.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

EURGBP- Although the cross closed higher for a second week in a row the past week, it will have to break and hold above the 0.7961 level to resume its corrective recovery triggered from the 0.7761 level. This if seen will open the door for a run at the 0.8039/93 levels. We expect a back off lower at these levels but if broken, further upside pressure should build up towards the 0.8154 level. Its daily RSI is bullish and pointing higher supporting this view. On the downside, a failure to return above the 0.7961 level could see the cross face downside pressure towards the 0.7761 level. Below here will trigger the resumption of its broader medium term weakness towards the 0.7700 level. Further down, support lies at the 0.7691 level, its Oct 2008 low and next the 0.7594 level. All in all, the cross remains biased to the downside in the medium term though recovering.