You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

off to work again

yes there is data transfer on the back side as well as the front they can be found in the center of channel

also. like a dance.

8 out of ten times drawing a channel with over lays is way more accurate then drawing channel with just physical price.

what's more is angle of physical price is one clue, and the other is physical price back side support or in a up trend back side

resistance on physical price in conjunction with the overlay candles is the other.

i have to go now i will be back later. great observations guys assume.

ok first of all

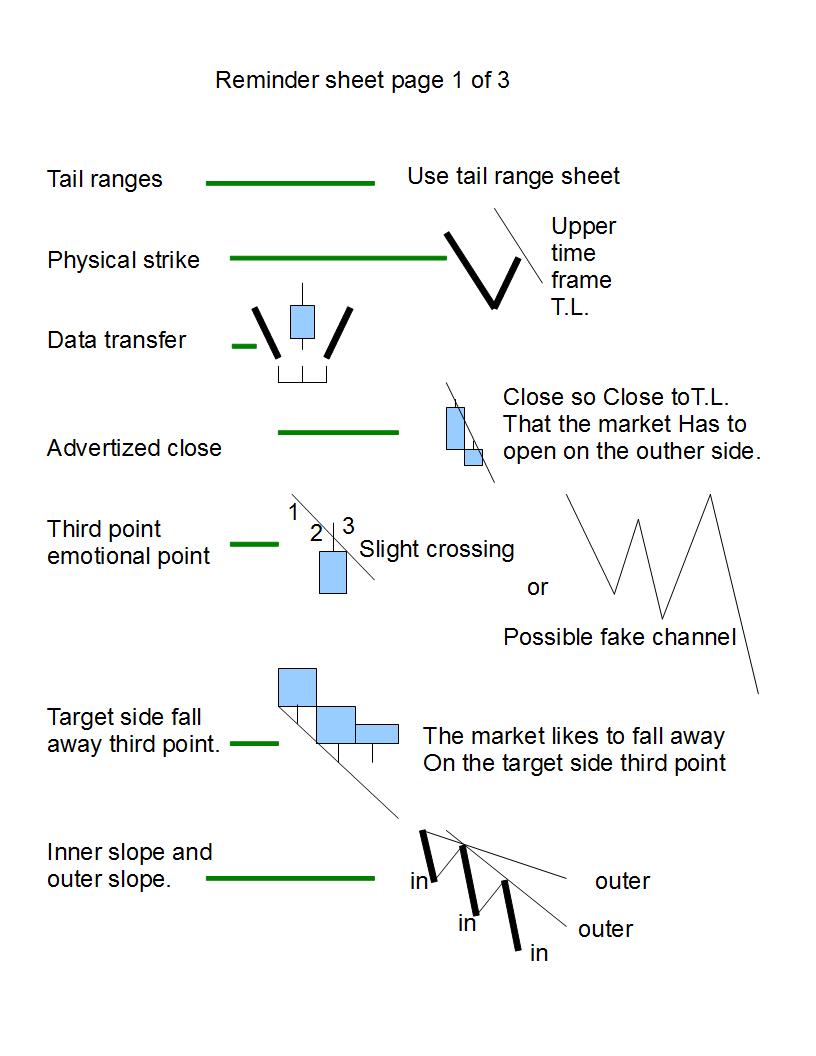

the first thing is i wanted to make a three reminder sheets.

here is page no. 1

page two cumming soon.

this sheets

the sheets are designed to go up on the wall near your computer. like a reminder to what we learned here.

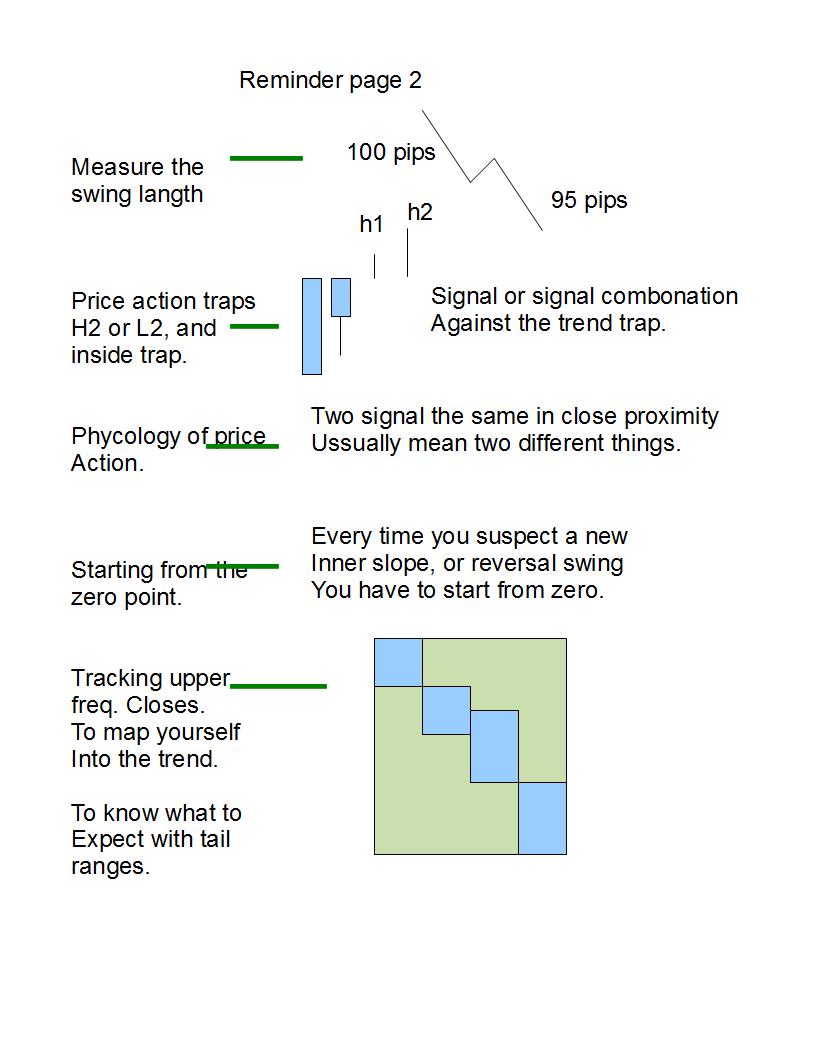

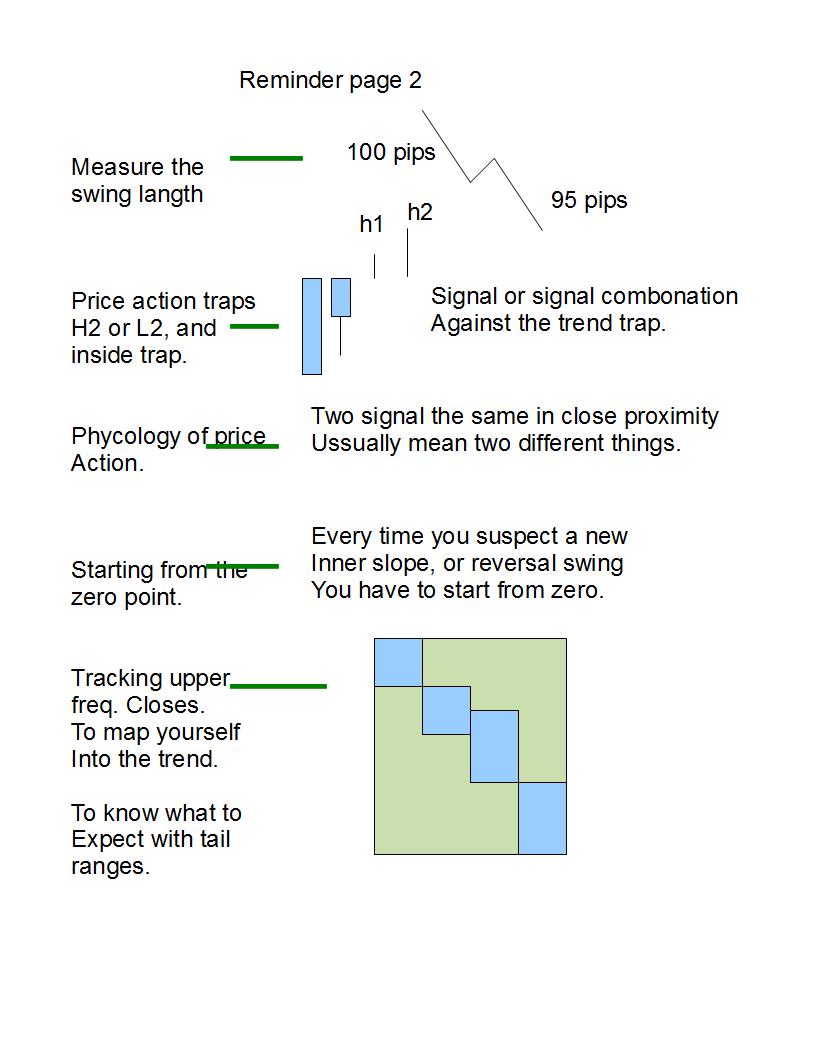

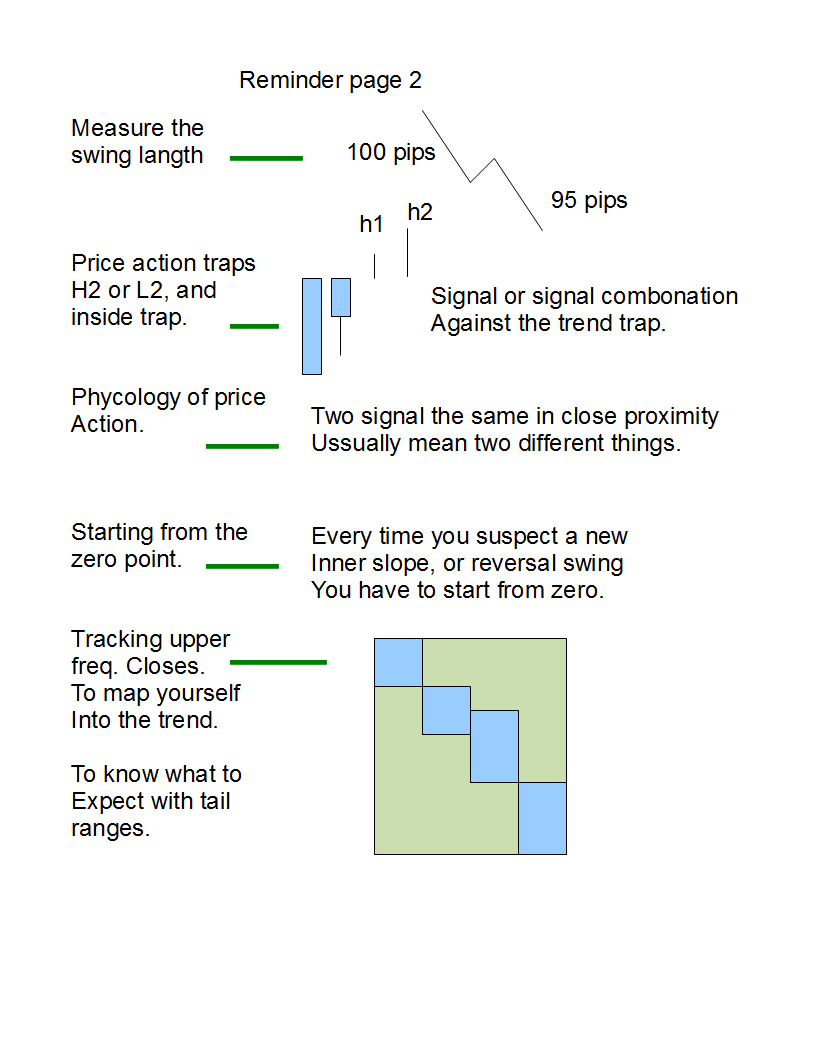

reminder page 2

reminder page 2, again this is page two, all these sheets do is remind you of the things you learned here.

sheets do is remind you of the things you learned here.

correction

cleared up the arrows hope this fixed it.

hope this fixed it.

lets try again

lets try this again

i got a mail from xx

i got a mail from xx asking me a question that i knew someone would ask me eventually.

what trend line are valid and which ones are not valid. this reminds of the same question my trading partner asked me

almost 4 years ago.

the answer is still the same. they are all invalid and they are valid. lol

remember i said this about physical price compared to over lay's i said " physical price and overlays have a relationship"

"like a dance" that's trend lines the ones you think are no longer valid are the valid ones, and the ones you think are valid

are the worthless ones.

what you find out is this: traders keep adjusting the trend line with every single new candle close. new close adjust the trend

line.

the reality of this is: a long term outside trend line marks containment.... and they do come into play

eventually ... and eventually could mean they only give you test info on a counter trend or maybe info on a reversal.

they can be useful with a ,with-trend-move late into an extended trend they often do. in extended trends.

most traders through those outside trend lines away after awhile because they become so irrelevant.

then later they become relevant.

but the most useful ones i seem to use all the time is the ones traders throw away almost immediately after

a new close makes them obsolete.

the best data transfer trades come from the old lines traders have long given up on.

and the best target and counter trend trade possibilities come from lines that traders gave up on (

on the back side)

on the back side)

To be honest all I can see is going over the same charts time and time again. Looking back over a few months, even longer to see where there is a fit and you could do that with almost anything. What about the charts of now, this week into next week to get some idea about a trade...apart Simbas one demo trade and to be honest he was just trying to be clever and not much else, there has been nothing else..

Hope you can see what I mean..

correct, it is not sticking to the latest curriculum but the essence of this thread subject

say , there is advance level of a course that is only been told from trader father to trader son -- advanced trading lesson(S), but this advanced course is for those who successfully completed forex candle course 101

just like , when we see half or 3/4 of a day

we hold 1 losing position or prepare to enter 1 new position

we always ask ourselves, why shouldn't the market repeat the PATTERN (chart pattern) in our mind

or

politician - those which are witty smart

say something sound like JOBS will be everywhere, tax won't get higher, more govt touch on the imminent issue --

then the smart one with a sense of economic will ask

--- oke, take the smart politician way of thinking, but resources is limited, however, our desire is a falling 8 -- infinity sign

---

same thing applies to forex -- every index fund manager will say

-- this is a GROWTH FUND, we have money in CASH, cash mean forex to you (as the contributor)

however, you also trade forex as retail participants -- retail forex trader or home-maker trader

then you will ask -- if resource is NO net gain and no net loss (like osmosis) NO INFLUX of new capital into the forex money systems of the whole world (zero sum game), then let's say you are winning, WHO or WHICH resources will Give you free-money --- give you a hint, answer is probably a 4 letter word -- started with B

with the same token (coin, flip it)

when you are losing, you will ask , is the commissioner taking away from your balance, or like UK, forex is govt-classified as an e-casino , therefore allowing whatever whoever take your money away

the topic is very advance forex lesson -- we are here (not to steer you) but help you learn how to driive or how much money that is on the patrol -- thanks for pointing it out -- this early morning-- many hours earlier, I just have under 30 minute to type that blue whale thing and send 1 email to boe, then I have to JET -- call it jet-lag disorientated ~ooops ~

page 13, 22 and 34 of this powerpoint did interest me as advanced lessons too

[PPT]

Chaos Theory and the Markets --

transcripts.fxstreet.com/files/Chaos-Theory-and-the-Markets.ppt

or same thing

you can try to type in this as URL in your web browser

http : // tiny - cc // dotthisdotthat

oooh, I was not home school during kindergarten

this is 101 forex class syllabus

http://www.autochartist.com/hpatterns.htm

I knew all these and within candle movement 5 years ago and experience those roller coaster way of seeing single trans or overall trans in few years ago market condition

e.g. in 1 year christmas -- 2008 , I guess, the market candle within of EUR/GBP go while , I call in EG

in the following year post-thanksgiving, prechristmas -- 2009, I guess, the market for most currentcy within-candle are extra slow or extra calm , like south africa world cup days, that calm

2012 vampire british olympics, I just hope there is no competitive contestants for the brits, and let them win all they olympic "suppose to be fair athelet game" medals but world wide city is picking their leaders -- local athletes could earn more to be political campaign supporters, they just a bit big brain for muscle-memory , never figure that simple logic of marketing out

this is my 10 cents of "advanced course" in forex

I did went to few university campus organised phD / prof grade symposium on invenstment and read at least 10 research paper, 1 forex book about MACD and did a double major , one subject is all about textbook case of simple interest rate height that may affect different country long term currency movement -- they do it in years rather than NANO-second though !!! heheh when gifted prodigy talk to me about investment, they use brownian motions in A-level physics == I am not a trader, so I do have reservation about the knowledge of this R/S diff TF line and the OPPOSITE-VOLATILE-or-not textbook cases, as I know only what I knew

PS, I better get my email check

rather than waiting to be PM-ed here

as my INBOX in forex-tsd still keeping my zig123 correspondences -- I think he could be a TRADER (unlike us)

this true

the biggest secret has not been discovered yet! but there one huge secret that i know that has not been talked about yet.

this is really no secret is more like a common sense directive. i draw!! i will draw what i think could happen, before a new week

starts, and before a new month starts.

then i decide what is most likely based on the chart analysis. lets say i want to trade next week. lets say i believe

next week will be a spinning to in likely hood.... now if i want to trade next week and be accurate and make money!!

and we are expecting a spinning top, what dose that mean? that means i have to lower my frequency and treat

the each leg of the spinning top as its own trend.

the real secret that has not been talked about in depth is when to change freq. we did talk about starting from zero.

but how about the expectations of starting from zero and going as small as we can 5 min with 30 min over lays.

or 1 minute with 15 minute over lays an add 30 then 1 hr trend line over lays as the one leg grows.

this is taking exception analysis and adjusting to what the market will most likely do. some times the information

is clear! some times the analysis information is not the ideal. but i work with what i have.

this is a shot of what i think will happen next week in probability.

this is distracting me though, i am suppose to make traders independent of me. not dependent on me!

i wanted to try and start the set up pages!

i am no "genie" i am a probability-ist . (made up word) so trading is about risk, this is not my style to trade in limited

information weeks, or where i think the risk reward is limited.

i can not hope for risk reward i have to wait till it comes to me. but if you study this thread and get a grasp of it, like

i said before you almost always know what the market will most likely do.

so if this is true and it is, then you can take risks with a 80% win loss ratio regardless of the trade potential.

i treat the current up swing as its own trend!!!!!!!!! a find the most mature time frame on that trend. this case

it is the daily time frame.

i then apply what i know ( we all know to be true market habits with the analysis.)

the trend lines on the shot are the physical channel line, and the monthly over lay line.