You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

systems traders

xx we have been friends, not close but friends on this site for a long time.in fact i think you

were my first friend here!

as your friend, i want to help you. some traders will only take bits and parts of what i am showing

them. but xx i want you to let me take you the distance here! i really do not think you will need a

system any more, just 2-4 lines on a chart, and some well know guide line sheets in your hand.

so my friend. my mission here is to take traders like your self to a place where trading is so graceful and deliberate,

that you will look back and say man i am good. not kind of good, not secretively good , but very very very good.

math system is ok. in the end here, if you can fallow some of my mistakes and difficulties teaching in a non face to face manner. in the end we will put this all together!!

i will set you free my friend.

trading continued

bollinger bands, and all indicators are effected in a manipulative way.

when the market slows down, loosing tick speed, and ranges narrow.

or combination of the two.

THEN THAT RESETS ALL INDICATORS TO ZERO, OR CLOSE TO IT.

indicators are effected in a dramatic way with any new increase in movement! after being reset!!

this is the trap! they are usually pushed into the counter trends direction in an unfair proportion.

that also works with a rest or slowing down, then a signal with trend trapping trend followers.

this dramatic change from resting to waking up, then back to resting, then waking up... is a trap.

the perception has to be, that traders are looking at a reversal. and trend traders lost trust.

inside stop out

inside signal trap!!!!!!!! inside inside.

this is the sequence:

#1 decreased volatility, small ranges. setting all indicators to zero.

#2 new increased volatility. traps: let the traps happen on both sides of the market.

#3 let the market go back inside the range!! usually slowing down when it gets there!!

#4 new inside signal with trend.

#5 place trade one to 10 pips above new signal or signals with trend .

this is how you take advantage of the inside new decreased volatility on the real swing.

lets look at a few shots.

this is easy to recognize, we are looking at an inside triangle formation. after increased volatility traps.

trust is lost when with trend traders get trapped twice or more!! lots of times the second time with trend traders get kicked

out with this inside move stop. out.

a lot of times you will not see this inside trap decrease in volatility on the chart you are on!! the market only slows down

in tick speed here. sometimes both tick speed and candle volatility, but usually just the speed.

why because the market movers want to give traders time to set up their with trend trade, and they want to collect more traders.

then they stop them out on the inside signals highs.

the inside move stop out is very common.. when the real swing begins.

ok i will do time frame

the pair on all shots is the eur/usd . i am very encouraged to have long time

experienced trader like my self, that says thing like, "this applicable to what i do"!!

i welcome any input that you may have sometimes when your an army of one. you

skip over details, even though it's stuck in my brain, i have a habit of assuming others

get certain things automatically, and that is not always the case!!

and it fun to have this type of discussions with traders who know exactly what i am

talking about, because of years of hard work and experience.

i am always striving for perfection, it may never happen, but the only way to get there is to

learn from other experienced traders opinions with an open mind!!

one thing traders must know if you are not willing to learn even when you successful then most likely

that person was never successful.

keeping an open mind and learning is how i got where i am. thanks my friend for the post.

Any system based on the high low open close, is a sound system.

All traps are based on crossing the highs lows, opens and closes.

And the gann , murray math trend momentum compass, those experienced

in those systems have foundation to work from that is within what the market

behavior really is. So it can be very beneficial!!

Xx my friend you may find interesting how a change freq. When and why.

Towards the end of this thread.

Thanks good point well taken!!my own above dig, I did not know that GA will rebound to come down

but BEST PRICE to enter -- is something i.e. we suppose to enter when there is next wave movement and progressive to that direction, rather than bouncing little bit

I could upload my picture in IMGUR-- I will try to upload some EUR/AUD into this thread

-- forex is not really zero sum, but more like zero balance -- have to be very skillful and don't bet too many and withstand substantial loss to finally come up with a winning formulae

and there are always uncertainty there (xx %)

m-candle look like this -- just a merely multi-time-frame candle consolidator

color of candle does not mean much

one of my template look like this, it seem to have more prediction power

the pink thin line provide a guide -- if your intended direction is down, we could place limit order pricing along that line (only if it continue to go down)

today -- new year day, the whole world FOREX is OFF day today

traps continue. hey xx how's things going?

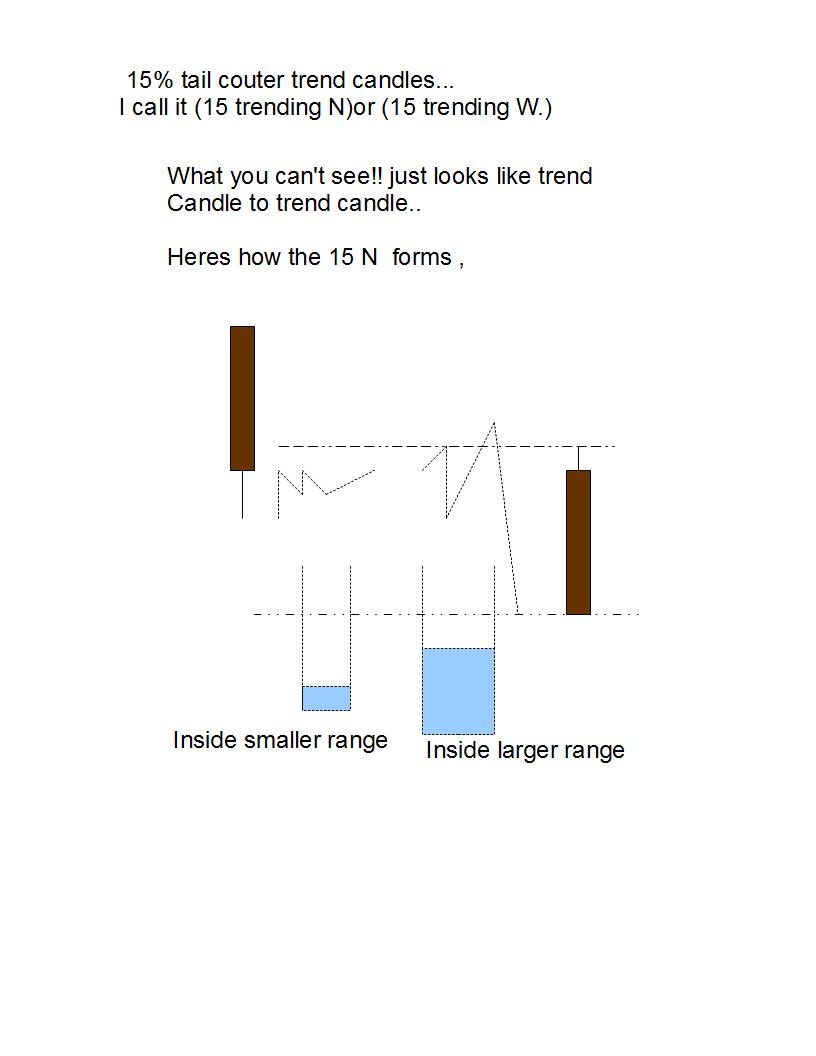

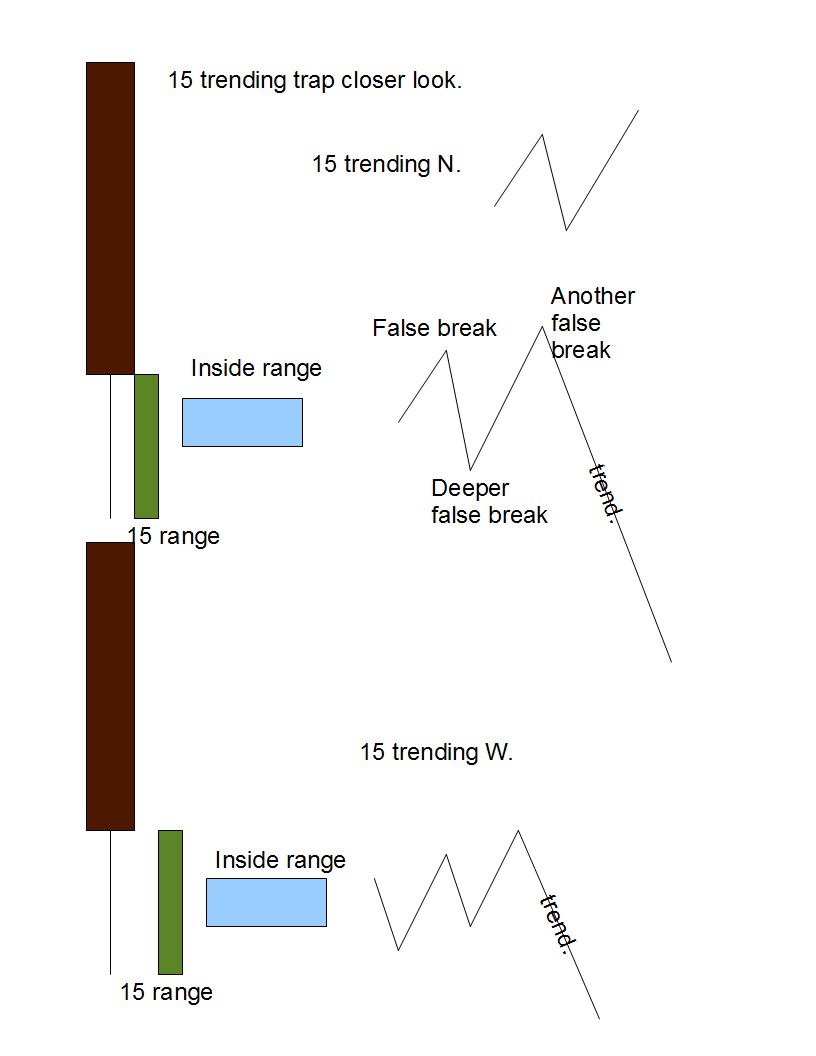

15 - trending N, trap.

15 -trending W, trap.

15 -

trending V. trap.

trending V. trap.

here is the chart example

this is the 15-W.

oops

i almost forgot. this is the one hour time frame.

with weekly over lays.on that last shot.

example chart

here is an example of the 15- N.

the differences

the difference is that the 15 -N, moves to the counter trend first.

the 15-W, moves against the trend traders first.

the eur/ usd, one hr. with weekly over lays.