You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

0ne of those nights

my sister just got here i will have to work on this later.

one insight about exit

when we have a handful of opened transaction in our portfolio

then we will watch out for profit / loss in each transaction -- we will turn out head away from pattern prediction

we should really, treated these opened transaction as

different weight in a lever-scale (the old type weighted "machine")

to decide which transaction to take off from the scale (exit which ones)

in nature and instinct, we would take the profit ones away first, then pray for the losing ones

but if it is a balance-scale, should we take the heavy losing ones away first

-- unless we have design a winning formulate to fit the market condition, we should bear in mind the balance scale system

one insight about exit

when we have a handful of opened transaction in our portfolio

then we will watch out for profit / loss in each transaction -- we will turn out head away from pattern prediction

we should really, treated these opened transaction as

different weight in a lever-scale (the old type weighted "machine")

to decide which transaction to take off from the scale (exit which ones)

in nature and instinct, we would take the profit ones away first, then pray for the losing ones

but if it is a balance-scale, should we take the heavy losing ones away first

-- unless we have design a winning formulate to fit the market condition, we should bear in mind the balance scale system

[lang=it]Well, real insight should tell you to close your losses before they get big and never pray or hope, that is the same thing.

We have a proverb: who lives hoping dies shitting (sorry for the bad word).[/lang]

[langtitle=it]insight[/langtitle]

[lang=it]"one insight about exit

when we have a handful of opened transaction in our portfolio

then we will watch out for profit / loss in each transaction -- we will turn out head away from pattern prediction

we should really, treated these opened transaction as

different weight in a lever-scale (the old type weighted "machine")

to decide which transaction to take off from the scale (exit which ones)

in nature and instinct, we would take the profit ones away first, then pray for the losing ones

but if it is a balance-scale, should we take the heavy losing ones away first

-- unless we have design a winning formulate to fit the market condition, we should bear in mind the balance scale system"

Well, a good insight should tell you to cut your losses before they get big and never pray or hope, that is the same.

We have a proverb: who lives hoping dies shitting (sorry for the bad word).[/lang]

ok sorry

some times life steps in and you have to drop what you are doing. sorry about that.

every thing is relative.

every thing depends on the individual. what their tolerance for target are!

#1 . how much of a counter trend am i willing to take against me to hold the trade.

#2. what is that range going to be on the chart, and when will it be here.

# a reversal is relative the same way.

what time frame defines my reversal? a reversal in trend to a 15 minute trader in monthly trend is just a monthly

counter trend. so this part is left up to individual.

how can any trader on gods green earth know where the market is going with constant accuracy ?

i am not perfect at this! it is very difficult. but i put a system in place to take most of the guess work

out of this subject.

why is this so much harder then the entry side of the market? i will show you why.

what can we do to be more consistent? i will show you.

this will take me some time to draw so be back after awhile. also have to eat.

the thing we are going to do is :

#1. track the markets strength side. with consistent market habits.

#2. we are going to look at strength and weakness using the other side also.

#3. we are going to understand channel shift.

#4. we will talk about cone formations, and what that is.

we are going to this with common seance approach. as simple as i can!!

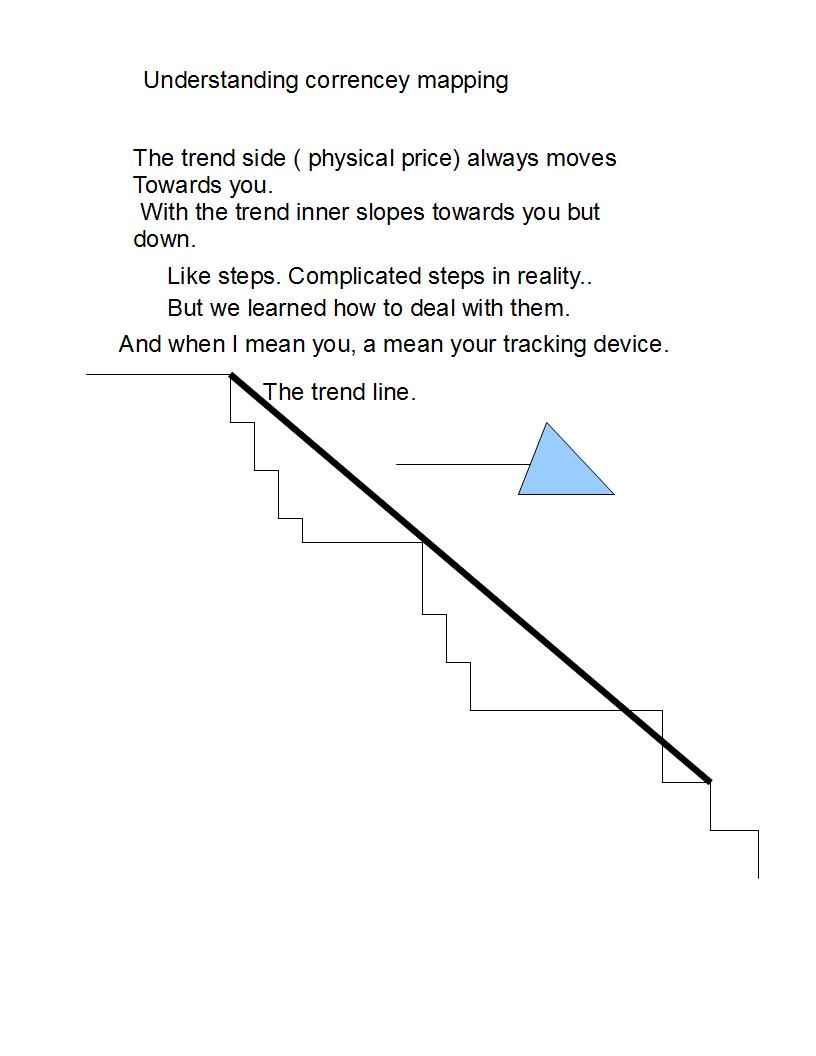

trend side

the market always moves towards your tracking device. or resistance device the TREND LINE.

device the TREND LINE.

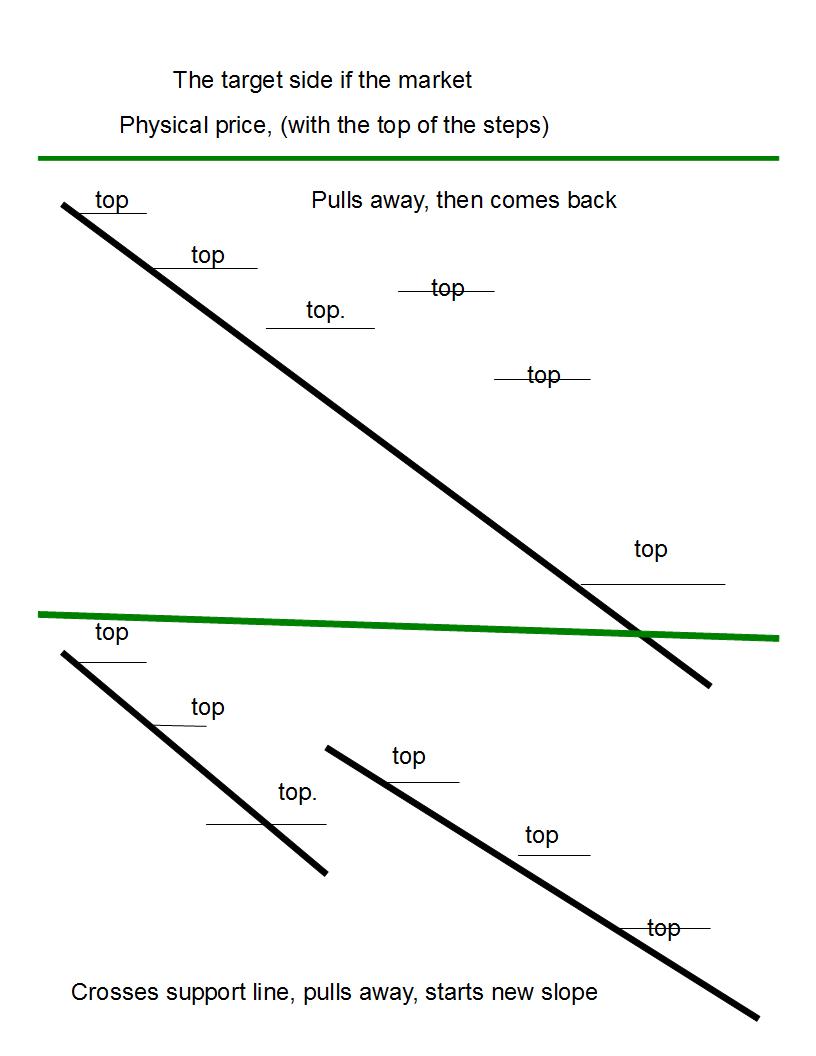

when tracking the target side

now we know this! crossing a trend line on the trend side of a trend line is trap in a trend.

what about the target side of a trend?

the target side is know different. the target side is even more challenging then the entry side of a trend.

the market wants you to be confused. contently.. changing angles... by the time traders get a channel

defined the channel becomes worthless 90% of the time.

knowing what to expect is the first step, to non emotional decision making when it comes to targets.

if we are going to cross a trend line for a trap on the trending side of the market....THEN THAT MEANS

THE MARKET WILL MOVE AWAY FROM THE TARGET SIDE OF THE MARKET TO DO SO.

THIS MOVEMENT CAN CHANGE THE CHANCEL AS A CHANNEL SHIFT! OR WE COULD ONLY SLIGHTLY

CROSS THE CHANNEL AND THE RE-ENTER IT.

SO YOU CAN SEE TWO THINGS HERE!

#1. USING TREND LINES FOR TARGETS IS CHAOS.

#2. LOOKING AT PRICE THAT PULLS AWAY FROM THE TARGET SIDE, IF THAT IS THE BASIS FOR EXIT

THAT IS LOST OPPORTUNITY FOR A LARGER RUN.

SO WHAT IS THE ANSWER? IF ANY?

A MARKET PULLING AWAY FROM THE TARGET SIDE, SHOWS WEAKNESS THAT WILL ONLY LEAD TO STRENGTH

BY THE TIME YOU RECOGNIZE THE WEAKNESS( LOST OPPORTUNITY )

)

Thank you for this great thread. It gives really good insights how to observe changes in market and not get lost between different tendencies on different timeframes. It is so true that indicators have tendency to give us false signals in periods of consolidation, but your ideas allows to get view from above and with more confidence. Keep it up!

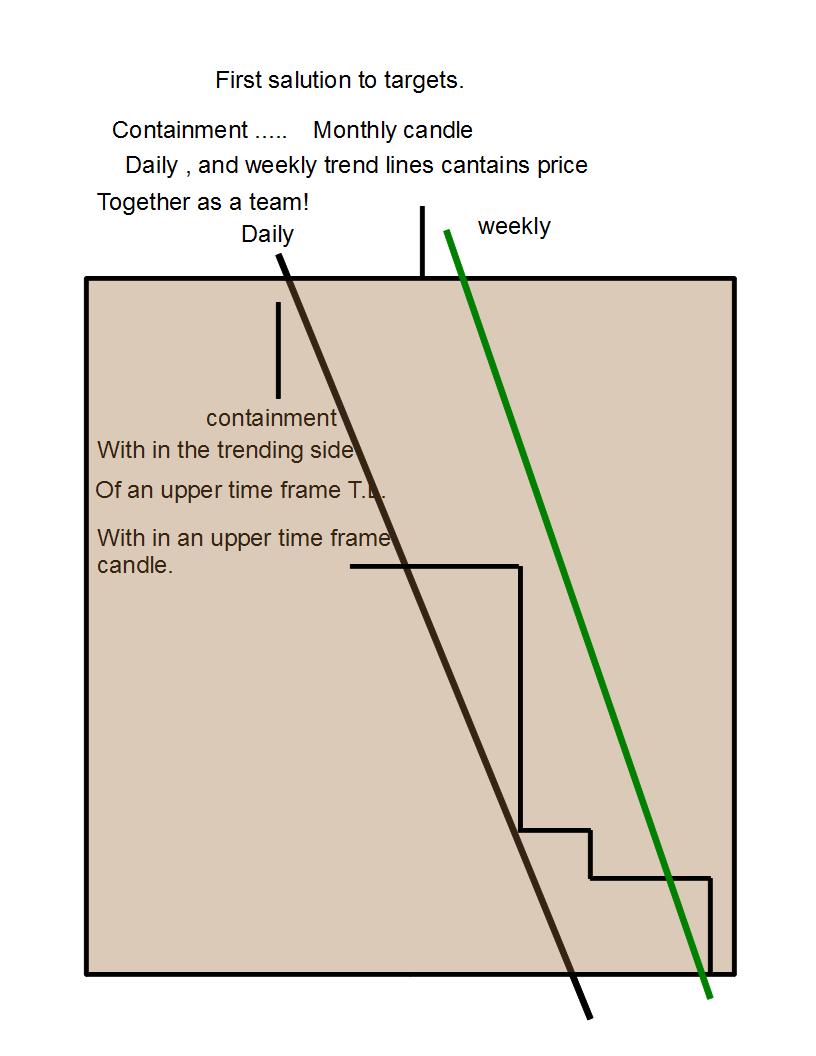

filtering noise in degres

we all have herd of filtering noise in the market. traders do not really have a plan for this concept.

what is that really?

what that is this: well what i do is use noise to expect a filtered out candle!!! the opposite !!

!!

i expect the daily trend line cross in a monthly candle but not a weekly cross.not till the end of it.