Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.19 19:27

Forex Weekly Outlook December 22-26 (based on forexcrunch article)GDP data from Canada and the US, US Durable Goods Orders, New Home Sales, Unemployment claims, Haruhiko Kuroda’s speech are the major topics in Forex calendar. heck out these events on our weekly outlook.

Last week, Federal Reserve Chair Janet Yellen switched the phrase “considerable time” with the word “patience” in referral to rate hikes, at the FOMC press conference. The move was made to calm markets awaiting sharp policy shifts. Three Fed officials registered their dissent expressing discomfort with the Fed’s message. The Jobless claims came out better than expected with a drop to 289K, reaffirming US labor market’s strength. Philly Fed Manufacturing index came below expectations reaching 24.5 following the steep rise in November, still maintaining a positive score. New orders plunged from 35.7 to 15.7 and employment down from 22.4 to 7.2 points. Will the US economy continue to strengthen in 2015?

- Canadian GDP: Tuesday, 13:30. Canada’s economy expanded 0.4% in October after higher oil, gas and mining extraction, as well as manufacturing boosted growth. October’s reading was preceded by a 0.1% contraction in August. Since Canada is a major oil exporter, the Bank of Canada estimates that the slide in oil prices will reduce Canadian economic growth by 1/3 percentage points, somewhere between 2% and 2.5% in 2015. Poloz is also worried by household imbalances risking financial stability, leaving the door open for additional guidance in the future. Markets expect Canadian GDP to rise 0.1% in November.

- US Durable Goods Orders: Tuesday, 13:30. U.S. durable goods orders picked up in October beating expectations for a 0.4% fall. New orders rose by 0.4%, reaching $243.8 billion. Meanwhile, demand for manufactured goods, excluding transportation dropped 0.9% to $167.6 billion in October, after a 0.1% rise in the prior month. Analysts believe the decline suggests that business capital spending is weakening in Q4.The Fed expects GDP to slow to 2.5% in the fourth quarter. Long lasting product orders are expected to surge by 3%. While core orders are predicted to 3edge up 1.1%.

- US GDP: Tuesday, 13:30. On The second estimate of real gross domestic product for the third quarter of 2014 showed an annual rate increase of 3.9%, weaker than the 4.6% gain posted in the second quarter. However, this forecast was upwardly revised from the advance estimate of 3.5% released in October. Personal consumption expenditures and nonresidential fixed income investment increased more than expected, but export growth was slower than previously thought. The final GDP release for the third quarter is expected to reach 4.3%.

- New Home Sales: Tuesday, 15:00. Sales of new U.S. homes rose modestly in October, following a pickup in activity in the Midwest. New home sales increased 0.7% to a seasonally adjusted annual rate of 458,000. Economists expected a higher figure of 471,000. Sales of existing homes rose 1.5% in October to a seasonally adjusted annual rate of 5.26 million, adding another positive sign that the housing market is recovering. Analysts exdpect new home sales to reach 461,000 in November.

- US Unemployment Claims: Wednesday, 13:30. Fewer Americans filed claims for unemployment benefits last week, indicating increasing confidence among employers. The weekly unemployment claims dropped 6,000 to a seasonally adjusted 289,000, the lowest level since late October. The four-week average dropped 750 to 298,750. In the first 11 months of this year, employers have added 2.65 million jobs, posting the best hiring since 1999. The number of new claims is expected to reach 291,000 this week.

- Haruhiko Kuroda speaks: Thursday, 3:45. BOE Governor Haruhiko Kuroda speaks in Tokyo. Bank of Japan Governor Haruhiko Kuroda stated the bank will meet its 2% inflation target and continue to increasing base money, or cash and deposits at the bank, at an annual pace of 80 trillion yen ($674 billion). Kuroda said Japan’s economy continues to recover moderately after the tax hike effect subsides.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.22 18:27

EUR/USD Moves Down Again (based on finances article)

Last Friday the world’s financial markets closed mixed. In Europe, the FTSE 100 advanced 1.23 percent up to 6,545.27 points, the DAX 30 fell 0.25 percent closing at 9,778.90 points, and the CAC 40 shed 0.18 percent down to 4,241.65 points.

On the Russian equity market, the MICEX index dropped 1.9 percent down to 1,449.13 points whereas the RTS index grew 0.41 percent up to 768.06 points.

In the United States, the Dow Jones Industrial Average added 0.15 percent closing at 17,804.80 points, the Standard & Poor’s 500 grew 0.46 percent up to 2,070.65 points, and the NASDAQ Composite gained 0.36 percent going up to 4,765.38 points.

The MYMEX price of WTI oil futures for January rose by $2.41 and made $56.52 a barrel. On London’s ICE, the price of Brent oil futures for February went up by $2.11 and finished trading at $61.38 a barrel.

On the Forex market, EURUSD is going down. Now it’s at the bottom boundary of the weekly triangle. As the scale is quite large, it’s hard to pinpoint the level at which the pair may break out of the triangle or rebound from the support. Thus, it would make sense just to watch the pair’s movements for some time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.23 09:12

Technical Analysis for USDJPY, GBPUSD and EURUSD (based on dailyfx article)

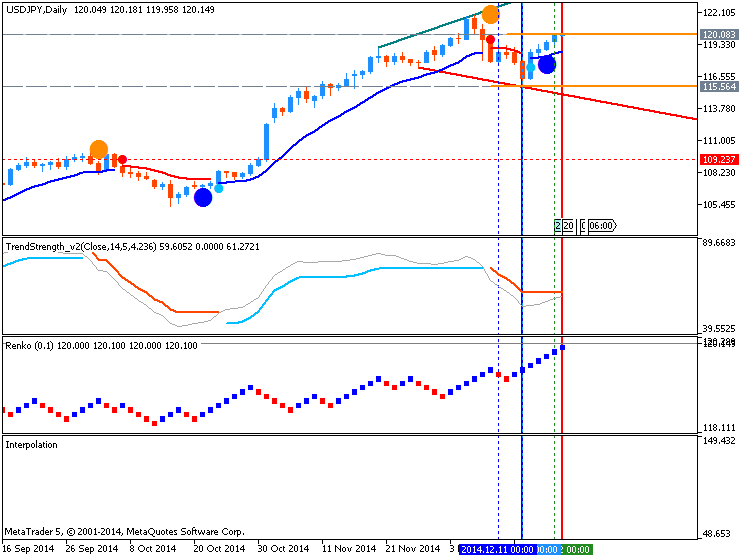

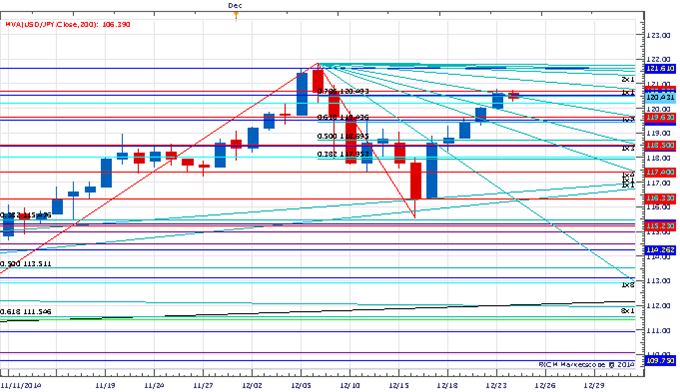

USDJPY

- USD/JPY has moved steadily higher over the past few days since finding support from just above the 38% retracement of the October low

- Our near-term trend bias is higher in USD/JPY while above 117.40

- A confluence of Gann and Fibonacci levels around 120.50 suggests this should be the next important action/reaction area

- A close back under 117.40 would turn us negative on the exchange rate

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 117.40 | 118.50 | 119.75 | 120.10 | 120.50 |

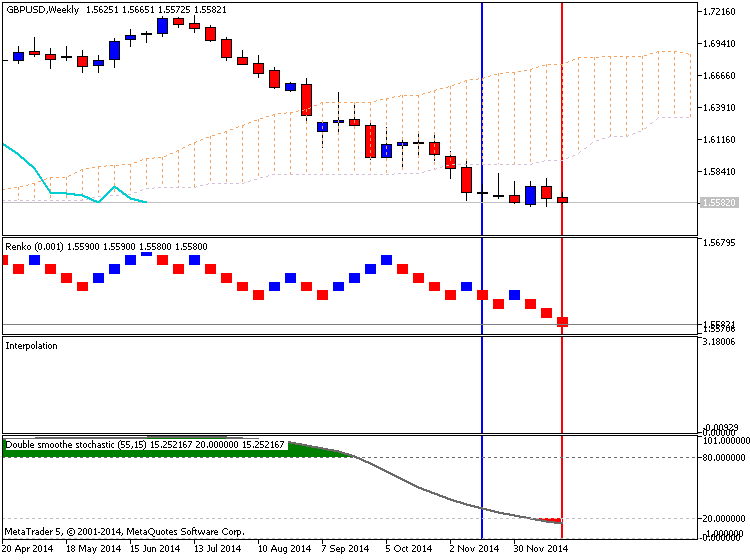

GBPUSD

- GBP/USD registered a new low for the year last week, but has since rallied back into the middle of the month-long range

- Our near-term trend bias is negative while below 1.5790

- A close under 1.5540 is needed to confirm the start of a more important leg lower

- A close over 1.5790 would turn us posiitve on Cable

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| GBP/USD | 1.5370 | 1.5540 | 1.5610 | 1.5675 | 1.5790 |

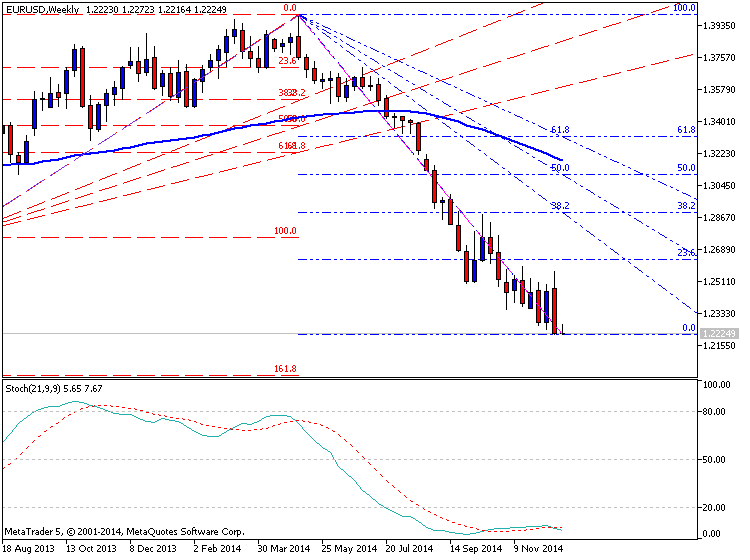

EURUSD

EUR/USD has managed to buck the historically positive seasonality of late December with aggressive weakness over the past few days taking the exchange rate to new lows for the year. The resumption of the broader trend has come earlier than we were expecting and has caught us a bit by surprise. We are now open to the possibility of a cyclical inversion early next year. Attention now turns to the next major downside pivot around 1.2135 as this marks the 50% retracement of the all-time low and the all-time high in the euro. Traction under this level in the weeks ahead would signal the start of a more important run lower in the exchange rate. A potential positive for the euro is the sentiment picture which saw the DSI fall to just 6% bulls on Friday. Extreme negative sentiment has accompanied every break to new lows over the past few months and warns too many traders are looking for the same thing. However, the next cyclical turn window of significance is not seen until closer to year-end.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.24 15:18

Strategy Video: A Lesson for 2015 from Past Financial Crises (based on dailyfx article)

- Before financial market crises unfolder there is a steady erosion of the system's structure

- In 2008, an appetite for leverage and need for return led to implosion triggered by Bear Stearns

- The 1998 failure of Long Term Capital Management offers a similar story to the conditions we face today

Financial crises often explode from periods of exceptional market

performance and their appearance is usually catches the investing

community off guard. Yet, as dramatic as the market reactions may be;

these disruptive periods of rebalancing are not so obscure when the

underlying structural circumstances of the financial system are

accounted for. Back in 2008, the Great Financial Crisis was built upon

an appetite for excessive return and leverage through high finance. It

was, however, subprime and Bear Stearns' collapse that receives the

blame. Further back, 1998 draws a strong corollary to today's market

with an Asian financial crisis and Russian default leading to the

dramatic failure of Long Term Capital Management. Heading into 2015, we

have: excessive leverage; exposure to exceptionally risky assets; low

returns; a dependency on low volatility; and growing investor doubt. We

discuss the importance of appreciating a big-picture structural risk

heading into 2015.

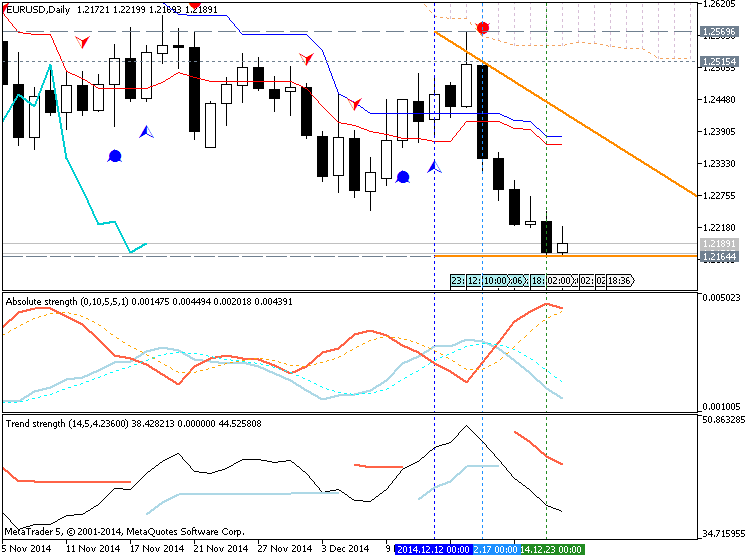

D1 price is on primary bearish market condition with trying to break 1.2265 support level:

- The price is located below Ichimoku cloud/kumo with Sinkou Span A line as the nearest kumo border

- Chinkou Span line broke the price for breakdown on D1 timeframe

- Nearest support level is 1.2265

- Nearest resistance level is 1.2569

If D1 price will break 1.2569 resistance level so the possible reversal to bullish condition may started

If not so we may see the ranging within bearish market condition.

- Recommendation for long: watch D1 price to break 1.2569 resistance for possible buy trade

- Recommendation to go short: watch D1 price to break 1.2265 support level for possible sell trade

- Trading Summary: bearish

1.2265 support level was broken on close D1 bar and we are having new support level for now: 1.2164

If someone used my advice and open sell stop order at 1.2265 so you should have 76 pips in profit for now:

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.26 06:31

Price & Time: EUR/USD Rebounds Ahead Of Key Pivot (based on dailyfx article)

Price & Time Analysis: EUR/USD

- EUR/USD fell to its lowest level since August of 2012 on Tuesday

- Our near-term trend bias is lower in EUR/USD while below 1.2360

- The 50% retracement of the all-time low and the all-time high around 1.2135 is the next important pivot for the exchange rate

- The next turn window of importance is seen around the end of the month

- A close above 1.2360 would turn us positive on the euro

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.2135 | 1.2165 | 1.2190 | 1.2260 | 1.2360 |

Price & Time Analysis: USD/JPY

- USD/JPY traded at its highest level in over two weeks on Tuesday before encountering resistance around the 1st square root relationship of the year’s high in the 120.70 area

- Our near-term trend bias is positive while over 119.50

- Traction over 120.70 is needed to prompt a push towards the yearly high

- An important turn window is seen this month

- A close under 119.50 would turn us negative on the exchange rate

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 119.65 | 120.25 | 120.40 | 120.70 | 121.85 |

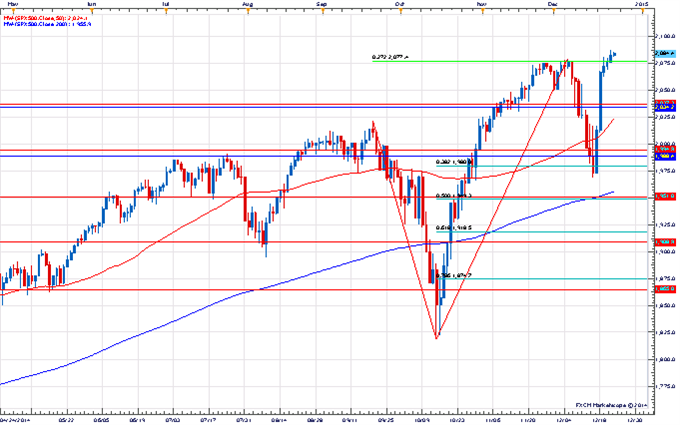

Focus Chart of the Day: S&P 500

The S&P 500 finally managed to break convincingly above the key

resistance at 2075/80 (127% extension of the September/October decline

& 6th square root relationship of the October low) on Tuesday. The

end of December is historically one of the strongest seasonal periods of

the year for the US equity market and it is very difficult seeing the

index letting up much before year-end. The first quarter of next year

could be a different story, however, as a slew of important cyclical

relationships during this time suggest the index will probably surprise

and come under a bit of pressure. The first important ‘turn window’ of

the year is seen around the 2nd week of January.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.26 19:33

Forex Weekly Outlook Dec 29- Jan 2 ( based on forexcrunch article)We end 2014 with US CB Consumer Confidence and Unemployment Claims

and open 2015 with US ISM Manufacturing PMI. Join our weekly outlook

with the main market movers to impact Forex trading. Happy 2015!

Last week, the final revision to US GDP in Q3 came out better than

expected, crossing the 4% growth rate for the second consecutive

quarter. US economy expanded 5% between July and September, beating the

preliminary estimate of 3.9% and the median forecast of 4.3%. The

strong expansion indicates the US economy will close 2014 on a strong

note. More positive data was released from the US labor market with a

continued decline in the number of initial unemployment claims, noting

the US job market continues to improve with increased hiring and fewer

dismissals. Will the US economy continue to expand in 2015?

- US CB Consumer Confidence: Tuesday, 15:00. U.S. consumer confidence declined in November to a five month low of 88.7 after posting 94.5 in October. Consumer’s confidence regarding current-business conditions and short-term outlook dropped considerably. Analysts expected confidence to rise to 95.9. Economists expect consumer sentiment will reach 94.6 in December.

- US Unemployment Claims: Wednesday, 13:30. The number of new applications for unemployment benefits declined last week to its lowest level since early November, indicating the job market continues to demonstrate strength. Initial jobless claims dropped by 9,000 to a seasonally adjusted 280,000. Economists expected claims to reach 290,000. The less volatile four-week moving average fell 8,500 to 290,250 indicating companies seek to hold on to their workers and hire new ones. The number of weekly claims is expected to reach 287,000 this week.

- US ISM Manufacturing PMI: Friday, 15:00. The U.S. manufacturing sector lost momentum in November, reaching 58.7 after a 59 points reading in the prior month. Economists expected a lower figure of 57.9. New Orders Index increased to 66, from October’s reading of 65.8; the Production Index reached 64.4%, down from the previous reading of 64.8; and the Employment Index declined to 54.9, compared to the precious reading of 55.5. Lower energy prices gave a boost to the manufacturing sector, increasing consumer’s demand and the continued strength of the Us labor market also contributes to growth. Manufacturing PMI is forested to reach 57.6 this time.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.27 20:05

Trading Video: Short Term Euro and Yen Setups the Order for Next Week (based on dailyfx article)

- Tepid liquidity this past week curbed trade opportunities and another lull is expected on New Year's Day

- Medium and long-term trade setups are unlikely to progress this week, but short-term options can do well

- There are plenty of short-term breakouts setting up for EURUSD, EURJPY, AUDUSD and others

There are more than a few great technical and fundamental setups tempting FX traders. Yet, many of these high-profile opportunities

call for dramatic breaks, reversals or trend upgrades which requires

deep market liquidity. Similar to this past week's Christmas drain, the

New Year's holiday in the week ahead will create another whirlpool. As

the big setups gestate, we should turn our focus to the many short-term

setups that have formed in the market. Many of the majors and crosses

present the proper technical patterns to trigger breakouts, but certain

pairs offer different circumstances. With a Greek Parliament election on

Monday; EURUSD, EURGBP and EURJPY, are fundamentally loaded. Conversely, pairs like GBPJPY, GBPNZD and GBPAUD are naturally more volatile. We discuss next week's trading landscape in the weekend Trading Video.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish market condition with trying to break 1.2265 support level:

W1 price is on primary bearish market condition with breaking 1.2247 support on open W1 bar for now.

MN price is on bearish breakdown by breaking 1.2357 support level with Chinkou Span line of Ichimoku indicator crossing the price from above to below.

If D1 price will break 1.2265 support level so the primary bearish breadown will be continuing

If D1 price will break 1.2569 resistance level so the possible reversal to bullish condition may started

If not so we may see the ranging within bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-12-22 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-12-23 13:30 GMT (or 15:30 MQ MT5 time) | [USD - GDP]

2014-12-23 15:00 GMT (or 17:00 MQ MT5 time) | [USD - New Home Sales]

2014-12-24 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Unemployment Claims]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : breakdown