Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.29 12:08

Forex Weekly Outlook Mar 31-Apr 4The US dollar gained against the euro and the yen, but lost ground against the other currencies. the ECB rate decision, Janet Yellen’s speech, US ISM Manufacturing PMI, important employment data culminating in the all-important Non-Farm Payrolls and rate decision in the Eurozone are the highlights of this week. Here is an outlook on the main events awaiting us this week.

Final US GDP growth for the final quarter of 2013 was slightly revised to the upside, reaching 2.6%. In the meantime, weekly jobless claims surprised with a 10,000 drop to 311,000, beating forecast for a 326,000 reading, indicating the US job market continues to improve. Will this trend continue? In the euro-zone, dovish comments by the ECB pushed the euro down, while UK retail sales gave a boost to the pound. NZD/USD reached the highest levels since 2011 and also the Aussie and the loonie enjoyed significant gains.

- Eurozone inflation data: Monday, 9:00. Inflation in the Eurozone eventually increased by only 0.7%. The initial reading was 0.8%, better than the 0.7% increase predicted by analysts, but this changed in the final read. The core CPI figure, excluding energy, food, alcohol & tobacco, edged up 1% in February, following 0.8% posted in the previous month. Markets had expected the pace of price acceleration to remain steady for the month. Eurozone inflation is expected to reach 0.6%. The low expectations are due to the weak German inflation numbers.

- Canadian GDP: Monday, 12:30. Gross domestic product in December fell more than expected, dropping 0.5% after a 0.2% gain in the previous month. Analysts expected a smaller decline of 0.2%. This was the biggest monthly decline since March 2009. Weakness was visible across the board however; Bank of Canada Governor Stephen Poloz said this could be a temporary relapse due to weather related factors. Nonetheless real gross domestic product grew by 2.0% in 2013 compared to 2012. Gross domestic product is expected to expand 0.4%.

- Janet Yellen speaks: Monday, 13:55. Federal Reserve Chair Janet Yellen is scheduled to speak in Chicago. Yellen may explain the Fed’s latest decision to continue tapering, cutting another $10bn from its economic stimulus. The Federal Reserve Chair may also elaborate on the rate hike intentions for 2015. Volatility is expected.

- Australian rate decision: Thursday, 3:30. Australia’s central bank maintained its cash rate at a record low of 2.5% in March, in line with market consensus. The weakening of the Australian dollar will help boost growth. The RBA kept an accommodative monetary policy with credit growth rising gradually. Domestic demand showed signs of improvement and the labor market is expected to grow in the coming months. Rates are expected to remain unchanged.

- US ISM Manufacturing PMI: Tuesday, 14:00. Manufacturing activity expanded more rapidly than expected in February, emerging from the harsh winter weather rising to 53.2 from 51.3 in January. The manufacturing expansion could have been stronger, if it had not been for a shortage of parts. However, orders have improved, ensuring larger growth in the coming months. Another improvement to 54.2 is anticipated now.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. U.S. private sector added 139,000 jobs in February, lower than market forecast of 159,000 gain. The weak result was blamed on difficult winter conditions. Economists believe employment will pick-up in spring. The ADP figures give an early estimate for the government’s much more comprehensive labor market report on Friday, which includes both public and private sector employment. U.S. private sector is expected to gain 192,000 jobs.

- Eurozone rate decision: Wednesday, 12:15. The European Central Bank kept interest rates on hold leaving monetary policy unchanged to help boost the euro zone recovery. ECB President Mario Draghi said the ECB will take bold policy action if the outlook deteriorates, but assured the euro area is on a recovery track. However one of the biggest downside risks is low inflation, below 1%. ECB policymaker Ewald Nowotny said that he and his colleagues were nearing unanimity on the option to end the so-called sterilization operations. The ECB is expected to keep rates unchanged at 0.25%.

- US Trade Balance: Thursday, 12:30. The U.S. trade deficit changed slightly in January, reaching a $39.1 billion gap from December’s revised shortfall of $39.0 billion. The release was in line with market consensus. Exports rose 0.6% to $192.5 billion and imports edged up 0.6% to $231.6 billion in January. Domestic demand weakened mildly, increasing businesses’ inventories which will in turn constrain import growth in the first quarter. US Trade Balance is expected to reach 0.2 billion.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for jobless benefits declined last week by 10,000 to a seasonally adjusted 311,000, indicating the US job market is continuing its recovery process. Analysts expected claims to rise to 326,000. The four-week moving average fell to 317,750 last week, the lowest level since last September. US jobless claims are expected to rise to 319,000.

- US ISM Non-Manufacturing PMI: Thursday, 14:00. US service sector activity fell to 51.6 in February from in 54.0 January mainly due to contraction in the survey’s employment section. The Non-Manufacturing Business Activity Index dropped to 54.6% from 56.3 posted in January. The New Orders Index climbed to 51.3, from 50.9 registered in January. The Employment Index fell to 47.5 from 56.4 indicating in employment for the first time after 25 consecutive months of growth. A rise to 53.5 is anticipated this time.

- Canadian employment data: Friday, 12:30. Canadian job market lost 7,000 jobs in February after gaining 29,400 in the previous month; however, the unemployment rate remained unchanged at 7%. This unexpected decline was contrary to analysts’ expectations of a 16,900 job growth. The public sector shed nearly 51,000 jobs, offset by gains of 35,000 and 8,000 in the private sector. However, the majority of the jobs lost were part time, while full-time positions increased, which is a good sign for the Canadian employment market. Canadian job market is expected to gain 23,500 jobs, and unemployment rate is expected to remain at 7%.

- US Non-Farm Payrolls and Unemployment rate: Friday, 12:30. The US economy added more jobs than expected in February adding 175,000 positions, while economists expected a job gain of 151,000. However, the unemployment rate increased slightly to 6.7% from 6.6% in January. The labor force participation rate was unchanged at 63%. The job addition in February came after weeks of slowdown due to unusually tough weather conditions, indicating the US job market returns to recovery. US job market is expected to add 196,000 jobs, and unemployment rate is expected to decline to 6.6%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.30 15:06

USDCAD Fundamentals - weekly outlook: March 31 - April 4The U.S. dollar moved higher against the Canadian dollar on Friday, paring some of its weekly loss after data showed that U.S. consumer spending increased in February.

USD/CAD was last up 0.25% to 1.1059 after falling to lows of 1.0999 earlier in the session, the weakest since March 7. For the week, the pair ended down 1.23%.

The pair is likely to find support at 1.0999 and resistance at 1.1105, Thursday’s high.

Data on Friday showing that U.S. consumer spending rose 0.3% last month after a downwardly revised gain of 0.2% in January helped the greenback off lows against Canada’s dollar.

A separate report showed that the University of Michigan’s consumer sentiment index slipped to 80 in March, down from 81.6 the month before. It was higher than the preliminary March reading of 79.9 but below forecasts of 80.5.

The loonie, as the Canadian dollar is also known, strengthened against the greenback earlier in the week as the loonie tracked strong gains in the commodity linked Australian and New Zealand dollars.

The currency lacked strong drivers in any direction, with no major economic data releases in Canada on Thursday or Friday.

In the week ahead, investors will be looking to Friday’s U.S. nonfarm payrolls report for March for further indications on the strength of the labor market, while Monday’s Canadian GDP report will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, March 31

- Canada is to publish the monthly report on gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- The Institute of Supply Management is to publish a report on U.S. manufacturing growth.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on factory orders.

- Both the U.S. and Canada are to publish data on the trade balance, and the U.S. is also to publish the weekly report on initial jobless claims. Meanwhile, the ISM is to publish a report service sector activity.

- Canada is to publish data on the change in the number of people employed and the unemployment rate. The nation is also to publish its Ivey PMI

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.31 14:31

2014-03-31 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - GDP]

- past data is -0.5%

- forecast data is 0.4%

- actual data is 0.5% according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

USDCAD M5 : 29 pips price movement by CAD - GDP news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.30 15:02

Forex Fundamentals - Weekly outlook: March 31 - April 4The dollar rose to two-week highs against the yen on Friday, as indications that China’s government is prepared to do more to shore up the cooling economy bolstered risk appetite.

Market sentiment was boosted after China's premier Li Keqiang said the country has policies in place to counter economic volatility. The remarks eased concerns over recent signs of a slowdown in the world’s second-largest economy.

Data on Friday showing that U.S. consumer spending rose 0.3% last month after a downwardly revised gain of 0.2% in January also lifted the dollar higher against the yen.

USD/JPY rose 0.64% to end Friday’s session at 102.83, the highest since March 12. For the week, the pair gained 0.57%.

The euro edged up from one-month lows against the dollar following the comments, with EUR/USD inching up 0.07% to settle at 1.3752, recovering from lows of 1.3702. The pair ended the week down 0.61%.

The euro remained under pressure after European Central Bank officials indicated earlier in the week that they are considering fresh policy options to stave off the risk of deflation in the region.

ECB governing council member and Bundesbank head Jens Weidmann said Tuesday that a negative deposit rate could be an appropriate way to address the impact of strong gains in the euro.

The same day ECB President Mario Draghi that the central bank stood ready to act if inflation slipped lower than the ECB expected.

Data on Friday showing that the annual rate of inflation in Spain slipped 0.2% in March fuelled concerns that deflation could threaten the economic recovery in the euro area. A separate report showed that the annual rate of inflation in Germany slowed in March.

The dollar was lower against the pound on Friday, with GBP/USD up 0.185 to 1.6640 at the close of trade.

Sterling remained supported after a report on Friday showed that U.K. fourth quarter growth was left unrevised at 0.7% for the final three months of 2013. Another report showed that the U.K. current account deficit came in at a larger-than-expected 22.4 billion pounds in the fourth quarter.

Elsewhere, the Australian dollar rose to a four-month high of 0.9295 against the greenback on Friday, before trimming back gains slightly to settle at 0.9247. AUD/USD ended the week with gains of 1.33%.

The Aussie was boosted as recent reports indicated that the economy is picking up, while hopes for fresh stimulus measures from China also supported the Australian’s dollar’s gains. Meanwhile, NZD/USD edged down 0.18% to 0.8654 at the close on Friday, after hitting two-and-a-half year highs of 0.8696 earlier in the session. The pair ended the week with gains of 1.31%.

In the week ahead, investors will be looking to Friday’s U.S. nonfarm payrolls report for March for further indications on the strength of the labor market, while Monday’s euro zone inflation report will also be in focus, ahead of the ECB policy meeting and press conference on Thursday.

Monday, March 31

- Japan is to release preliminary data on industrial production.

- New Zealand is to produce private sector data on business confidence, while Australia is to publish data on private sector credit.

- Switzerland is to publish its KOF economic barometer.

- The U.K. is to release data on net lending to individuals.

- The euro zone is to produce preliminary data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to publish the monthly report on gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- Japan is to publish its Tankan manufacturing and non-manufacturing index, as well as data on average cash earnings.

- China is to release data on manufacturing activity.

- The Reserve Bank of Australia is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- The euro zone is to release data on the unemployment rate. Germany is release data on the change in the number of people unemployed, while Spain and Italy are to release reports on manufacturing activity.

- Switzerland is to release its SVME manufacturing index.

- The U.K. is to release data on manufacturing activity.

- Later Tuesday, the Institute of Supply Management is to publish a report on U.S. manufacturing growth.

- Australia is to produce data on building approvals, a leading indicator of future construction activity.

- The U.K. is to produce private sector data on house price inflation, as well as official data on construction activity.

- In the euro zone, Spain is release data on the change in the number of people unemployed.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on factory orders.

- Australia is to release data on retail sales and the trade balance, the difference in value between imports and exports.

- China is to produce data on service sector activity.

- The euro zone is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. Spain and Italy are to publish data on service sector activity.

- The U.K. is also to release data on service sector growth, while the Bank of England is to announce its benchmark interest rate.

- Later in the day, the European Central Bank is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- Both the U.S. and Canada are to publish data on the trade balance, and the U.S. is also to publish the weekly report on initial jobless claims. Meanwhile, the ISM is to publish a report service sector activity.

- Germany is to publish data on factory orders.

- Canada is to publish data on the change in the number of people employed and the unemployment rate. The nation is also to publish its Ivey PMI

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.03 09:13

2014-04-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Service PMI]

- past data is 51.0

- forecast data is n/a

- actual data is 51.9 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China Services PMI Rises To 51.9 In March

The service sector in China expanded at a faster pace in March, the latest PMI from HSBC and Markit Economics revealed on Thursday, coming in with a four-month high score of 51.9.

That's up from 51.0 in February, and it moves farther above the boom-or-bust line of 50 that separates expansion from contraction.

The employment sub-index moved higher for the first time in five months, the data showed, while input costs declined at manufacturers but gained at service providers. Manufacturers' new orders fell at the strongest rate in 28 months.

Outstanding business fell for the second month in a row at manufacturers, albeit marginally. Backlogs of work also decreased slightly at service sector firms. Input costs faced by Chinese manufacturers fell at the sharpest rate since August 2012.

"The HSBC China Services PMI suggests a modest improvement of business activities in March, with employment expanding at a faster pace. However, combined with the weaker manufacturing PMI reading, the underlying strength of the economy is softening, which should ultimately weigh on the labor market," said Hongbin Qu, HSBC Chief Economist, China & Co-Head of Asian Economic Research.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 10 pips price movement by CNY - HSBC Service PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.04 14:45

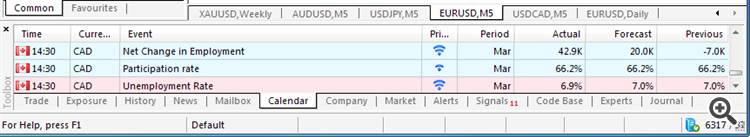

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

- past data is -7.0K

- forecast data is 20.0K

- actual data is 42.9K according to the latest press release

if actual > forecast = good for currency (for CAD in our case)

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 59 pips price movement by CAD - Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

It was seconday correction within primary bullish for the 10th day till Friday on D1 timeframe : price was trying to break Sinkou Span A line (which is the border of Ichimoku cloud/kumo) to be fully reversed from bullish to bearish market condition. Chinkou Span line of Ichimoku indicator crossed historical price from above to below for good breakdown but on open bar only.

W1 timeframe. Price is ranging between 1.0910 support and 1.1278 resistance with primary bullish (price is above Sinkou Span A line of Ichimoku indicator which is "virtual border" between bearish and bullish on the chart).

If D1 price will break 1.1013 support level on close bar from above to below so D1 price will be fully reversed to bearish with good breakdown together with ranging market condition.If not so bullish trend will be continuing with ranging market as well.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDCAD price movement for this coming week)

2014-03-31 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - GDP]2014-03-31 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-03-31 13:55 GMT (or 15:55 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-04-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-04-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-04-02 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-04-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-04-03 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Trade Balance]

2014-04-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]2014-04-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Employment Change]

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDCAD price movement

SUMMARY : possible reversal

TREND : ranging

Intraday Chart