You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast = good for currency (for EUR in our case)

==========

French Private Sector Expands For First Time In 5 MonthsThe French private sector returned to growth in March for the first time since last October, flash survey data from Markit Economics showed Monday.

The flash composite output index rose to 51.6 from 47.9 in February. A score above 50 indicates expansion and the latest reading signals the fastest growth in 31 months.

Expansion was broad-based across the service and manufacturing sectors. The services activity index climbed to 51.4, a 26-month high, from 47.2 in February. The reading was expected to rise to 47.8. Similarly, the manufacturing PMI improved more than expected to 51.9, a 33-month high, from 49.7 in the prior month. The score was forecast to rise to 49.8.

if actual > forecast = good for currency (for EUR in our case)

==========

Expansion In German Private Sector Slows In March

Germany's private sector growth slowed in March from a 33-month high but the pace of expansion remained marked, preliminary survey data from Markit Economics showed Monday.

The flash composite output index dropped to 55.0 from February's 33-month high of 56.4. Nonetheless, a reading above 50 indicates expansion.

The easing in the rate of activity growth was broad-based, with both manufacturers and service providers indicating weaker expansions than seen in February.

The flash services activity index slipped more-than-expected to 54.0 from 55.9 in February. The score was forecast to fall to 55.5.

Likewise, the flash manufacturing PMI came in at 53.8, down from 54.8 in February and below the expected reading of 54.5.

"Although the rate of expansion in activity eased to a three-month low, growth in the three months to March was the joint-strongest since mid-2011," Oliver Kolodseike, economist at Markit said.

Fundamental indicators explained (based on dailyfx article)

United Kingdom Consumer Price Index (YoY) (FEB)Inflation figures out of the U.K. remain key for price action in GBP crosses moving forward as the Bank of England continues to remain quiet as prices rise towards the 2.5% YoY level floated by Carney as possible ‘threshold’ for any rate increases. The savvy leader of the BoE (and former head of the Bank of Canada) has likely remained silent as to not further fuel speculations of rate increases sooner rather than later. Any further official speculation would add even more fundamental fuel to the GBP’s rise. Higher inflation figures reported on Tuesday would likely support the Sterling while those that meet or beat expectations may leave GBP crosses relatively unchanged as we have seen before.

JPY National Consumer Price Index (YoY) (FEB)Japanese data and even developments out of the Bank of Japan have failed to move Yen crosses over the last few weeks as some of the equity/yen correlations have broken down. Nevertheless, inflation data out of Japan gives key insight into whether the BoJ is on target with its goal of achieving 2% CPI by expanding its monetary base dramatically. If inflation expectations miss expectations, we will have to see comments from the BoJ eventually, even as the central bank remains relatively silent as the fiscal house attempts to get the sales tax and corporate tax changes in order. A failure to do so could lead to instability in Japanese confidence, but of course price action as of late continues to remain market sentiment in equity and bond markets.

EUR German Consumer Price Index (YoY) (MAR P)These preliminary figures for German inflation data will be closely watched by market participants, especially in the context of EUR/USD just below 1.40 and as Draghi of the European Central Bank remains almost overconfident in his assessments of EU prospects. If we see a miss here, it will add to fundamental pressure on the Euro and pressure as well on the ECB to eventually take some sort of action. On the other hand, if we do see developments out of Russia that include any hint of natural gas supply disruptions, disinflation worries would likely be something of the past as higher prices would help boost CPI levels. Nevertheless, this is the sort of inflation not welcomed by consumers or the ECB. Although equity markets continue to brush off worries of geopolitical tensions, those trading Euro and Yen crosses should not be complacent, especially as forex markets have proved to respond most logically to macro developments.

Fundamental indicators explained (based on dailyfx article)

- News events can help us decipher an economy’s strength

- GDP, CPI and Employment figures can change the demand of a currency

- Fundamental traders look to pair currencies from a strong economy to a weaker one

There are a variety of news events fundamental traders may monitor to determine the strength or weakness of an economy. Ultimately, these factors will influence money flows causing currency pairs to fluctuate. Today we will continue our look at market fundamentals by examining three of the most important events and how they can affect currency prices.GDP

First we have the Gross Domestic Product (GDP). The GDP growth rate looks specifically at changes in growth patterns of an economy by tabulating household consumption, government spending, domestic investment’s, and net exports for a country. As growth increases it means an economy is expanding and can cause a high demand for a nation’s currency as that currency is needed to make new purchases. As well, a contraction or slowdown in growth can have the opposite effect.

Ultimately this growth (or lack of it) causes inflationary pressures in the market place. With central banks looking to potentially change monetary policy due to these results GDP announcements can become volatile events.

CPI

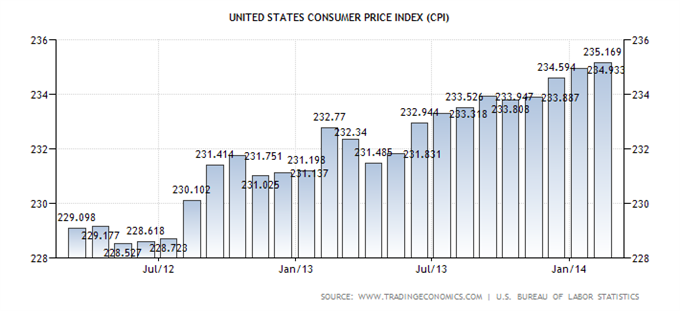

Next, we will look at the Consumer Price Index (CPI). CPI is another economic indicator that is released on a monthly basis by most major economies. It is designed to give a timely glimpse into current inflation levels in an economy. Inflation tracked through CPI looks specifically at purchasing power and the rise of prices of goods and services. If prices are rising drastically this can be signs of growth as well as rising inflation.

In most scenarios, if CPI is released lower than expected, normally this would influence Reserve Banksto consider stimulating the economy by opting for lower interest rates or commit to new open market operations to increase the money supply. Conversely a higher CPI reading suggests an inflating economy. This would give cause for increasing current interest rates and thus affect demand for a currency.

Employment Figures

Lastly fundamental traders should monitor employment figures to get a bearing on the strength or weakness of an underlying economy. A booming economy will offer many employment opportunities and drive down unemployment figures. As business contracts, the opposite is true. As unemployment rises, it can have a devastating effect on an underlying economy.

While there are a variety of employment statistics that can be tracked one of the most watched is the Non Farm Payroll (NFP) figure released in the United States. This event shows new jobs added to the workforce outside of the agricultural sector and shows the strength of the US economy. As this number is released fundamental traders will watch for opportunities to buy or sell currencies coupled with the dollar.

A further slowdown in U.K. inflation may generate a further decline in the GBP/USD as it limits the Bank of England’s (BoE) scope to normalize monetary policy sooner rather than later.

Why Is This Event Important:

Indeed, the upcoming shuffle in the Monetary Policy Committee (MPC) may spark a material shift in the policy outlook as the central bank continues to assess the underlying slack in the real economy, but it seems as though Governor Mark Carney will do little to halt the appreciation in the British Pound as it helps to balance the risks surrounding the region.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Narrows to 1.7% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade.

- If market reaction favors selling sterling, short GBP/USD with two separate positions.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: Headline Inflation Tops Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in opposite direction.

Potential Price Targets For The ReleaseGBP/USD Daily

U.K. Consumer Prices grew an annualized 1.9% in January to mark the slowest pace of growth since November 2009, with the core rate of inflation narrowing to 1.6% from 1.7% the month prior. The initial reaction to the weaker-than-expected print was short-lived as the GBP/USD climbed back above the 1.6700 handle, but the sterling struggled to hold its ground during the North American trade as the pair closed at 1.6680.

Google Partners with Luxottica to Bring Glass Technology to Ray-Ban and Oakley

Two major proprietary brands of Luxottica, Ray-Ban and Oakley will be a part of the collaboration with Glass; however details about these new products will be disclosed at a later stage. The first collection generated by this partnership is said to combine high-end technology with avant-garde design offering the best in style, quality and performance.

if actual > forecast = good for currency (for GBP in our case)

==========

if actual > forecast = good for currency (for EUR in our case)

==========

German Business Sentiment Falls More Than Forecast

Germany's business confidence declined more than expected in March, reports said citing a monthly survey from Ifo institute on Tuesday.

The business sentiment index dropped to 110.7 from 111.3 in February, when the score was expected to fall to 110.9.

Meanwhile, assessment of current conditions improved to 115.2 from 114.4 in the prior month. Economists had forecast the index to rise marginally to 114.5.

The expectations index fell to 106.4 in March from 108.3 a month ago. The score was seen at 107.7.

Mixed Markets Look To Draghi, US Data For Clarity (based on forexminute article)

European markets look strong on Tuesday despite mixed economic data, and US index futures are up pre-trade ahead of a raft of key fundamental data releases.

Starting in Europe, the FTSE is currently trading at 6,596.13, a 1.16% (75.75-point) premium to the day's open. The gain sees the index break through Thursday/Friday highs, and despite a Monday afternoon selloff that broke Friday lows. Leading the charge is home improvement retailer Kingfisher plc (KGF.L), up 7.06% at 435.20 on a positive earnings surprise.

The gains in the UK come as the ONS reports better than expected retail price index data, with the core headline figure coming in at 0.7% versus a forecast 0.5%. Consumer price index (CPI) came in as expected, with the YoY figure at 1.7% and the MoM figure at 0.5%. Producer price index (PPI) data missed expectations, the headline input MoM figure reported at -0.4% versus a forecasted 0.3%.

In Germany, the DAX 30 is up 1.66% at 9,340.36. Heading into European lunch, the day's biggest gainer is kidney dialysis company Fresenius Medical Care AG & Co. KGAA (FME.DE), currently up 3.51% at 50.26. As with its UK counterpart, the DAX's gains follow mixed data. German business expectations missed expectations, reported at 106.4 versus a forecast of 107.6; current assessment beat expectations of 114.6, reported at 115.2; and IFO business climate index disappointed, reported at 110.7 versus a forecast of 111.0.

In the US, S&P 500 futures are up 0.33% at 1,855.65, while NQ100 futures are up 0.31% at 3,622.30, approximately one hour before the US markets open.

The gains likely come in anticipation of better than expected fundamental US data releases, with the day's headliners being CB consumer confidence, forecast at 78.6, and new home sales, forecast at 445K, a 4.9% decline on previous data.

Traders and investors will also look to ECB President Mario Draghi for insight into Eurozone monetary policy, with his bimonthly speech scheduled for 16:00 GMT on Tuesday.

2013-03-25 14:00 GMT (or 15:00 MQ MT5 time) | [USD - Consumer Confidence]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Improves Much More Than Expected In March

Consumer confidence in the U.S. has improved by much more than expected in the month of March, according to a report released by the Conference Board on Tuesday.

The Conference Board said its consumer confidence index jumped to 82.3 in March from a revised 78.3 in February. Economists had been expecting the index to edge up to 78.4 from the 78.1 originally reported for the previous month.

The bigger than expected increase by the consumer confidence index reflected a rebound in expectations for the short-term outlook. The report showed that the expectations index surged up to 83.5 in March after tumbling to 76.5 in February.