You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Why Gold and Silver Are at an Important 'Make-or-Break' Point

Gold and silver have been some of the worst performing markets in the past few years. After experiencing a parabolic surge in 2011, precious metals, along with other commodities, have been in a steady downtrend as the Fed continues its march toward tighter monetary policy as the economy shows continued growth. The U.S. dollar’s sharp rally since the summer also contributed to gold and silver’s punishment, while lower oil prices have further weakened the case for inflation hedges.

fter experiencing a major technical breakdown one month ago when gold dropped below its long-held $1,200 support level, precious metals have been in a holding pattern as they wait for a catalyst to cause either a bearish follow-through move or a reversal of the breakdown signals. Gold is currently sitting right underneath its key $1,200 resistance level that it has attempted to break above several times in the past week to no avail.

Ed Moy: World entering era of greater gold transparency (based on mining.com article)

Edmund C Moy, former US Mint Director and senior aide to President George W Bush, recently joined gold-backed IRA provider Fortress Gold Group as chief strategist.

In this interview with MINING.com, Moy discusses growing demand from Asia, paper versus physical markets in gold, the changing central bank landscape and argues that the clamor from citizens for greater transparency about official gold holdings would only grow.

“India and China are asking why have we never headed up the IMF or the World Bank? Why is the price of gold fixed in London?

The long term trend with central banks becoming net purchasers is a push from Asian countries to take up their rightful place in the global financial system and reject Western dominance. Accumulating gold is a way of readying themselves for a post-dollar world.”

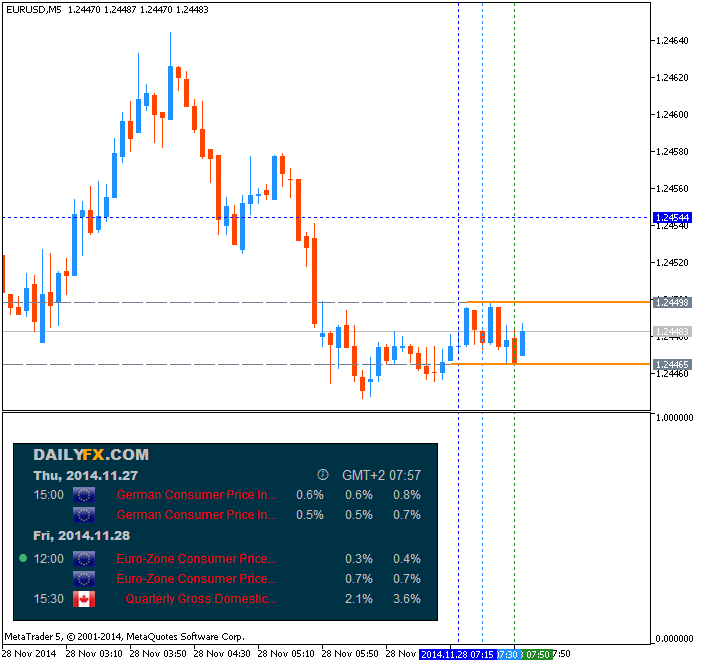

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may heighten the bearish sentiment surrounding the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to implement more non-standard measures.

What’s Expected:

Why Is This Event Important:

There’s growing bets that the Governing Council may have little choice but to implement quantitative easing across the monetary union amid the growing threat for deflation, and the single currency remains at risk of facing additional headwinds in 2015 as the economic recovery remains subdued.

However, the CPI report may show sticky price growth in Europe as the region returns the growth, and a stronger-than-expected inflation print may trigger a more meaningful correction in EUR/USD as it mitigates the risk for deflation.

How To Trade This Event Risk

Bearish EUR Trade: Euro-Zone CPI Slips to 0.3% or Lower

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish EUR Trade: Headline Reading for Inflation Tops Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will continue to look for lower highs & lows as the downward trending channel remains in play.

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the Euro-Zone CPI report has had on EUR during the last release(1 Hour post event )

(End of Day post event)

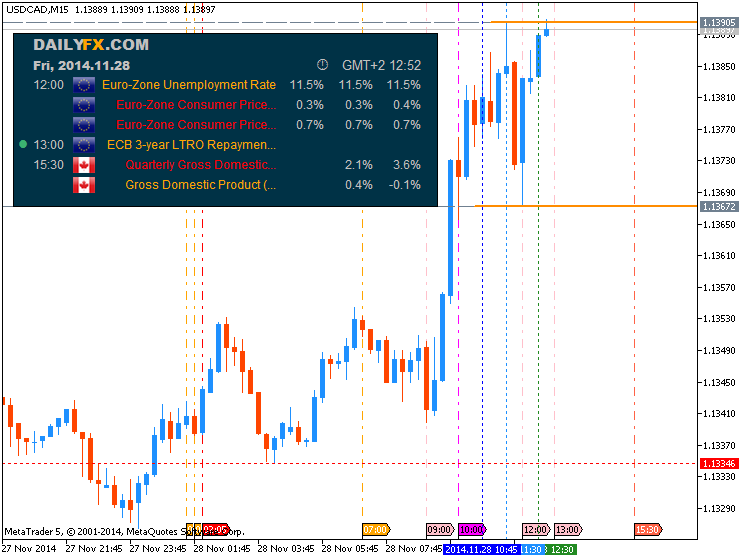

Trading the News: Canada Gross Domestic Product (GDP) (based on dailyfx article)

Canada’s 3Q Gross Domestic Product (GDP) report may generate a near-term bounce in USD/CAD as the growth rate is expected to increase an annualized 2.1% following the 3.1% expansion during the three-months through June.

What’s Expected:

Why Is This Event Important:

A marked slowdown in economic activity may undermine the appeal of the Canadian dollar as the Bank of Canada (BoC) remains reluctant to further normalize monetary policy, and the USD/CAD may continue to track higher in December as Governor Stephen Poloz continues to talk down interest rate expectations.

How To Trade This Event Risk

Bearish CAD Trade: 3Q GDP Slows to 2.1% or Lower

- Need green, five-minute candle following a dismal GDP report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long USD/CAD with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Canada Growth Rate Exceeds Market Forecast- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily Chart

- Need a break of the bearish trends in price & the

RSI to revert back to the approach of looking for opportunities to

buy-dips.

- Interim Resistance: 1.1370 (23.6% retracement) to 1.1380 (78.6% expansion)

- Interim Support: 1.1155 (78.6% retracement) to 1.1165 (23.6% expansion)

Impact that the Canada GDP report has had on CAD during the previous quarter(1 Hour post event )

(End of Day post event)

2014

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.11.28

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5: 58 pips price movement by CAD - GDP news event

US ISM Manufacturing PMI, Rate decision in Australia, the UK and the Eurozone, Important employment events in Canada and the US including the important NFP release. These are Forex Market Movers This Week. Check out these events on our weekly outlook.

Last week, US data showed mixed results. Durable goods orders advanced unexpectedly 0.4% but missed on the core, posting 0.9% decline. Jobless claims disappointed crossing the 300,000 line for the first time in nearly three months with a 21,000 jump to 313,000. New Home Sales rose for the third straight month to a seasonally adjusted annual rate of 458,000 units but missed forecast for a higher gain of 471,000 units. Nevertheless, the second GDP release came out better than the first estimate, showing a 3.9% growth rate in the third quarter reflecting upward revisions to business and consumer spending, as well as to inventories. Due to the flood of US economic data released at once before Thanksgiving, volatility tends to be higher. Will the US data continue to show resilience?

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: BullishThe markets continue to seem relatively sanguine in their outlook on Japanese domestic developments with the December 14 snap election drawing closer (as we discussed last week). That is likely to keep external factors at the forefront in the near term, with seasonal considerations becoming ever more important as the looming end of the calendar year alters capital flows. While risk appetite flourished in 2014, investors are almost certainly questioning that trend’s continuity in the year ahead as consensus forecasts calling for some degree of Fed stimulus withdrawal become increasingly entrenched. That may fuel a desire to book profits on risk-sensitive exposure as the year-end holiday cycle gets underway, securing yearly performance numbers ahead of what might be tougher times ahead. In the FX space such, this translates into liquidation of carry trades, many of which are financed in terms of the perennially low-yielding Japanese unit. A broad unwinding this exposure would translate into a wave of short-covering on anti-Yen positions, putting substantial upward pressure on the currency. Thin inter-holiday liquidity conditions may amplify volatility, making for particularly sharp moves against prevalent trends and vaulting JPY swiftly higher from recently-established six-year lows.

US economic news-flow may likewise encourage this dynamic. A slew of high-profile releases are due to cross the wires including manufacturing- and service-sector ISM figures, the Fed’s Beige Book survey of regional economic conditions, and the always intensely followed US Employment report. Outcome expectations point to improvements in most areas (albeit with some soft spots). If these prove robust, this may fuel speculation that Janet Yellen and company will move faster to lift rates than is currently priced in, encouraging the push toward liquidation and accelerating Yen gains.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: NeutralThe British Pound finished lower for the sixth-consecutive trading week versus the US Dollar, and a busy week of economic event risk ahead points to GBP volatility and potential losses.

GBP traders will turn attention to the upcoming Bank of England Interest Rate Decision for any surprises, while broader market volatility seems likely on a European Central Bank meeting as well as the monthly US Nonfarm Payrolls labor data release.

The BoE seems unlikely to announce any policy changes at their upcoming meeting, and indeed this is a major reason why the British Pound continues to underperform versus major counterparts. It was in the late summer that a strong wave of UK economic data boosted forecasts for the future of domestic interest rates; the Bank of England seemed likely to raise rates before most G10 counterparts. Yet it was only this week that analysts pushed BoE interest rate forecasts to the third quarter of 2015—lagging behind the US Federal Reserve and other major central banks. Given that the Bank of England does not release a detailed statement on unchaged policy, GBP traders will likely look to the ECB rate decision and US Nonfarm Payrolls to drive moves across Sterling pairs.

The European Central Bank meeting could spark important moves in EUR pairs, and the British currency could move in kind via the EUR/GBP. Risks arguably remain to the topside for the EUR ahead of the event as ECB President Mario Draghi is unlikely to announce fresh easing at the coming meeting. Even downgraded BoE policy forecasts leave the Sterling at an advantage, however. The EUR/GBP will likely remain under pressure as the ECB is likely to keep interest rates lower for longer.

Interest rate differentials will remain in focus on Friday’s US NFPs release as the future of US Federal Reserve monetary policy remains in the balance. Any especially strong labor market data prints could send the US Dollar to fresh highs versus the Sterling and other majors. And yet we would argue that risks remain to the downside as the Greenback surges to fresh peaks across the board.

Long-term seasonality studies suggest that currencies will often set monthly lows/highs at the beginning and end of the month, and the first week of December could see important currency moves ahead of year-end. We will keep a close eye on key data to judge the likelihood of a lasting GBP reversal.

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: BearishThe Australian Dollar plunged to a fresh 2014 low against its US counterpart during the week as volatility levels rose and its yield advantage detiorated. A light local economic docket left the Aussie with little guidance, yet the RBA’s Lowe delivered the currency a blow when he suggested the door was open to further rate cuts. Additional pressure was potentially put on the pair by a significant slump for some of Australia’s key export commodities.

Looking ahead; the first week of December is littered with top-tier domestic data as well as the last RBA decision for the year. On balance local data has softened and this trend may prevail with upcoming trade balance, retail sales and building approvals data. However economists’ expectations point to a relatively robust third quarter growth reading of 3.1 percent year-on-year for the Australian economy.

At this stage it would likely take a more material deterioration in local economic data over an extended period to catalyze a change in the RBA’s rhetoric within their policy statement. This suggests that for the time-being another status-quo Statement could prevail at the final meeting for the year. This in turn could leave the AUD to take its cues from elsewhere.

Heightened implied volatility levels in the FX market remain a significant threat to the AUD. The CVIX measure jumped to a 2014 high over the past week – indicating traders are pricing in some significant movements amongst the major currencies over the near-term. As noted in recent reports such expectations bode ill for the high-yielding currencies like the Aussie. This threat has been amplified by a deterioration in the AUD’s relative yield advantage against its major counterparts. This includes a slide in the Aussie 10 year bond yield spread to Treasuries to its lowest since 2006.

S&P 500 forecast for the week of December 1, 2014, Technical Analysis

The S&P 500 did very little during the Thanksgiving week, as we failed to hang onto the gains. By doing so, we ended up forming a shooting star, which tells us that the market is ready to pull back a little bit. That being the case, the market looks as if it is running out of steam a little bit, and that’s okay because we realize that it’s only a matter time before the market pulls back and looks for buyers. We believe those moves will be buying opportunities as the S&P should go to the 2100 level.

The silver markets initially tried to rally during the course of the week, but ended up falling rather precipitously. However, there are plenty of buyers just below so we need to see a couple of hammers from previous weeks get broken down below. In other words, we need to see a move below the $15 level, and as a result we would be sellers at that point in time. We have no interest in buying, because this market is so negative and the US dollar is so strong at the moment.