I am planning to study a strategy using algorithms such as neural networks, described as follows

- Step 1: Read the full historical data of 1 currency pair in the past for example XAUUSD

- Step 2: Process that data into a redefined data, which is intended as input data for step 3.

- Step 3: Build a logical algorithm that scans the data in the past and compares the data at the present time, then makes a buying and selling decision

1. I will describe each step in more detail below

In step 1:

Re-reading data from the past is simple because MT5 always provides data from the past for each tick

However, this data is large because it provides details about the price per tick, which in turn slows down the trading process.

So Step 2 will be needed to process this data so that it is simpler and lighter in size and faster to process

2. Process price history data processing

In step 2;

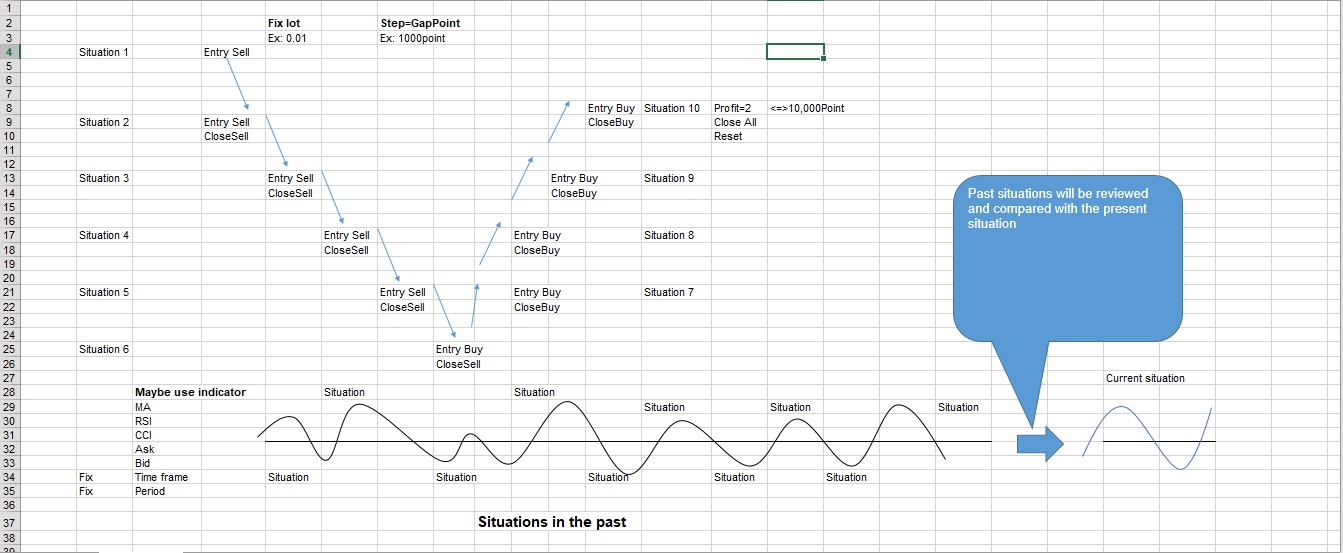

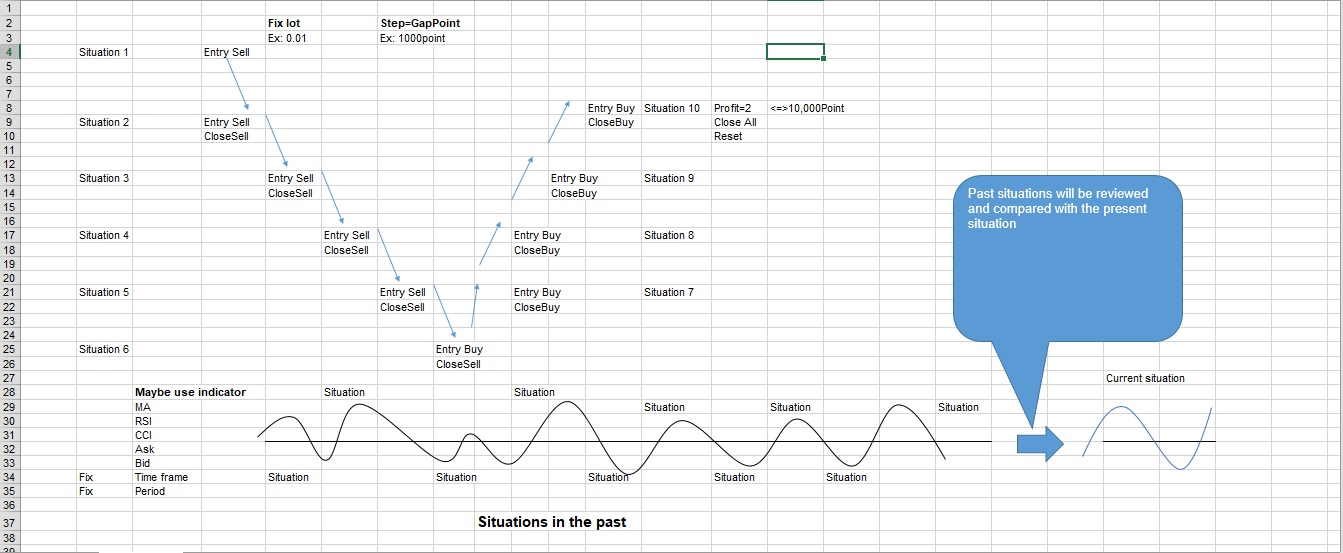

First we have to define what the ultimate purpose of the data is.

In this case: My purpose is to separate out which point to buy, which point to sell, take profit at which point, stop loss at which point, at that time, what is the RSI, MA, CCI, ATR Ask price, Bid price.

It's like you watch a movie again and you can completely know the segments in the movie from which you pick out the necessary points and save and create a more concise movie summary (like the Film Review clips).

The meaning of this treatment is: Construct how situations have happened in the past, these situations have clear answers.

- The scenarios here are: RSI, MA, CCI, ATR, Ask/Bid price

- The answers are: Entry Buy/Sell, Takeprofit/Stoploss

More optimized:

Determine the processing point.

For example a road 1 million meters long, we cannot process every millimeter. So let's cut it up every 1km and we'll take a situation there.

In my case: for every 1000Point will choose a situation

This data will be the model to use for step 3

3. Process data and make trading decisions

In step 3:

Determine the processing point. Similar: for every 1000Point will choose a situation

We will compare current situations with past situations, if it is the same then make the same decisions as the results had in the past.

Speak in more detail:

We compare the current indicators (RSI, MA, CCI, Ask/Bid price) through all the past situations created in step 2 i.e. RSI, MA, CCI, Ask/Bid price).

If similar to all indices with similarity, for example greater than 90%, then execute Buy/Sell, Takeprofit/Stoploss orders as in the past data.

Note how dynamic you can allow customization if you want.

In this step it will happen 2 cases

Case 1:

The current result is the same as the result in the past data, then we save the situation and the result again into the past data array.

Case 2:

Current result is not correct, unlike past data we correct this situation and save result in past data array

Optimization: For faster browsing

Choose to browse by category of historical data accuracy first.

Compare with the past situation with high accuracy first, if there is no case then go to medium level, continue to go to low level, if no situation add step 4

4. Refresh update new data

in step 4: We can handle as follows, every 100,000Point ie experiencing 100 situations, we can repeat step 1 and step 2.

The purpose is to refresh the data, get new data, and from there the data becomes more and more accurate

It's the algorithm described in words:

I will rely on these basic descriptions to build an automated strategy, during the construction process, there will certainly be many problems that need to be handled, maybe the completion time will be longer than expected.

Looking forward to your comments and support

Please follow to receive new notifications

My channel: https://www.mql5.com/en/channels/autocontroltrade

Warning !

After I tried to make an EA model using the Kink Neural Network as I described earlier, I noticed something completely wrong and I think you need to understand it well to avoid the risks when buying and using EAs of this type. EAs labeled GPT, AI, NeuralNetwork should learn carefully or ask the developer to clearly explain how it works.

I explain about the NeuralNetwork model that I plan to develop, having a problem like this:

When I use historical data as input, it means that during Backtest the results will always be correct. But in the present and in the future that may not be true.

So I realized that this approach can be used by many EA developers to produce highly profitable Backtest results.

So I decided to stop creating NeuralNetwork strategy and quickly warn everyone immediately.

My thoughts are exactly the same as that of some users on mql5 see details at :

https://www.mql5.com/en/forum/451283

For me, every strategy I create is algorithm-based and before and after completion I try to publish the results and how it works as clearly as possible. And let you test it for yourself by free experience on real account from March - 7/2023. Some newly created battles are even free with no time limit

As you can see the results of the strategies I create often have a similar DD rate of medium to high, and the parameters are open to allow customization.

Notes on identifying scam EAs:

1. The parameter entry does not have many options

2. Low DD %, unbelievably high profit

3. Backtest results increase steadily over the years

4. Selling at a high price, the purpose is to trick some uninformed people into making a big profit in a short time and disappear.

5. No feedback to customers when customers complain, respond in a general way, inconsistent with the answers

6. Always promise high profits, do not dare to face the truth, criticism and criticism

Hope you took a moment to read the article.

Wishing you good health and successful trading