AUD/NZD: the Pair is in the Range of 1.1260 and 1.1090 for the Second Month

AUD/NZD: the Pair is in the Range of 1.1260 and 1.1090 for the Second Month

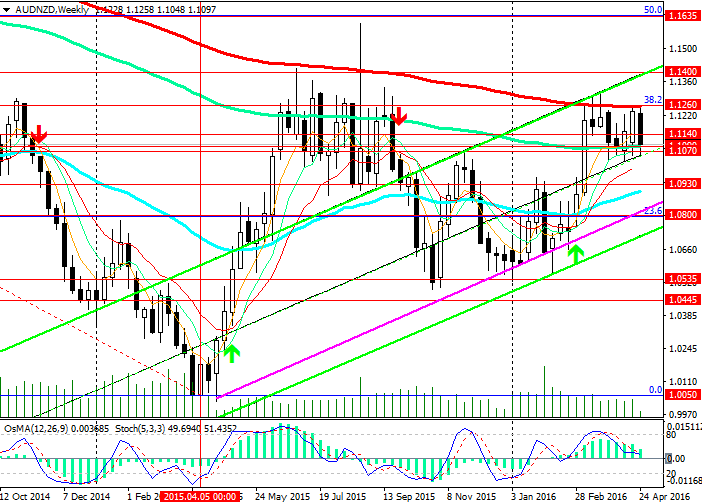

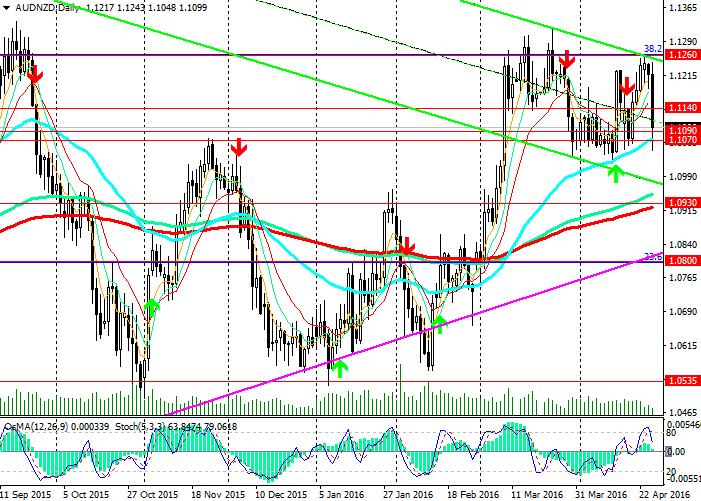

At the beginning of this week the pair AUD/NZD has again rebounded from resistance level of 1.1260 (ЕМА200 on the weekly chart and Fibonacci 38.2% to the last wave of decline since November 2011). Since the beginning of March the pair AUD/NZD has traded in the range of 1.1260 - 1.1090 (ЕМА144 on the daily chart).

Following the release of the Australian inflation data today, the pair sharply went down. The pair fell by over 160 points. However, later the price corrected rebounding from support level of 1.1070 (ЕМА50 on the daily chart).

The situation is very interesting. On the one hand, weak inflation Australian data puts pressure on the price of the Australian dollar. On the other hand, expectations of the decline in the interest rates in New Zealand today put pressure on the New Zealand’s currency. The pair AUD/NZD is stuck between two fundamental factors. The pair needs to break through the channel between the levels of 1.1260 and 1.1090. The direction of the breakout will depend more on the fundamental background than on the technical analysis.

Break out above resistance level of 1.1260 may cause the rise in the pair in the ascending channel on the weekly chart with the upper limit at the level of 1.1400 up to 1.1635 (Fibonacci 50%).

Consolidation of the price below support level of 1.1070 may trigger further decline to the level of 1.0930 (ЕМА200, ЕМА144 on the daily chart) and to 1.0800 (Fibonacci 23.6%), 1.0535 (lows of 2013, 2014 and 2016) and 1.0445 or further down to 1.0000.

On 4-hour, daily and weekly charts the indicators OsMA and Stochastic are in favour of the sellers.

Further movement direction in the pair will depend on macro-economic statistics of New Zealand and Australia and on the monetary policies of the Central Banks of both countries.

Support levels: 1.1090, 1.1070, 1.0930, 1.0800, 1.0535 and 1.0445.

Resistance levels: 1.1260, 1.1400 and 1.1635.

Trading tips

Sell Stop: 1.1040. Stop-Loss: 1.1090. Take-Profit: 1.1000, 1.0930 and 1.0800.

Buy Stop: 1.1140. Stop-Loss: 1.1080. Take-Profit: 1.1260, 1.1300, 1.1400, 1.1500 and 1.1635.