Ravi Gurung / Profil

- Information

|

nein

Erfahrung

|

6

Produkte

|

11

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

Hi, I’m Ravi — a Quantitative Developer and Algorithmic Trader focused on building high-performance, transparent trading systems for the MQL5 community.

Why My EAs Are Different

My work is grounded in 16+ years of total market experience. I spent 12 years mastering manual trading psychology and market structure, followed by 4 years specializing in Quantitative Development.

I do not build or sell “black box” systems. I design, develop, and refine advanced trading strategies, transforming them into transparent, rules-based Expert Advisors, & Indicators for MetaTrader 5/4.

The objective is simple: automated systems that operate with the precision of a machine while respecting the logic of professional discretionary trading.

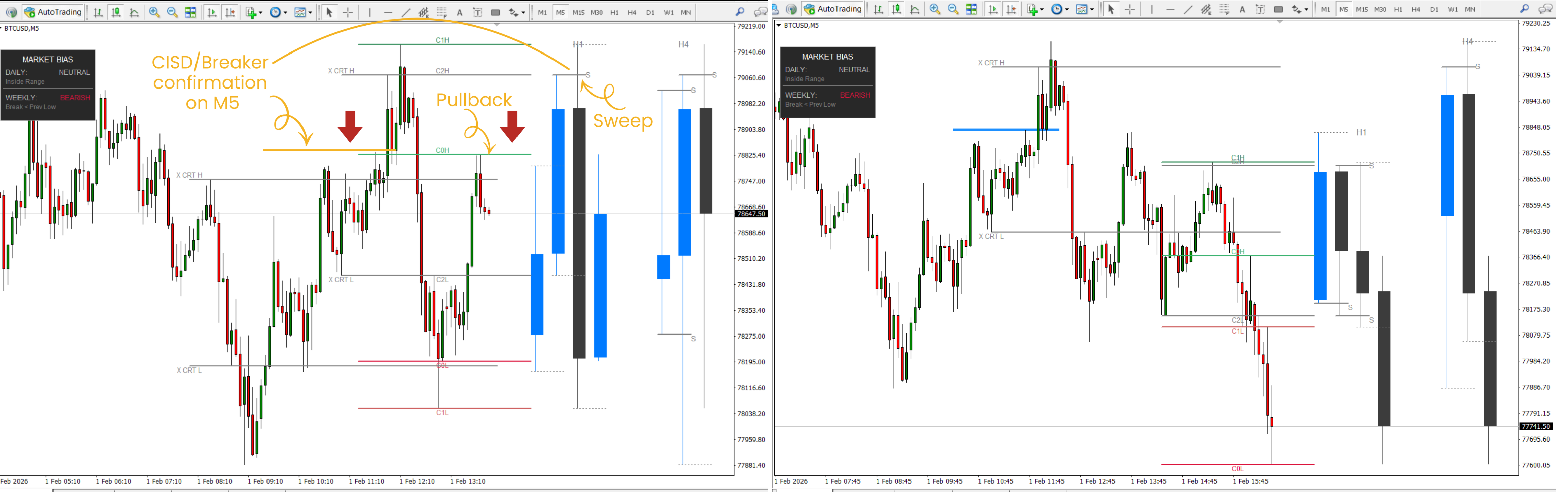

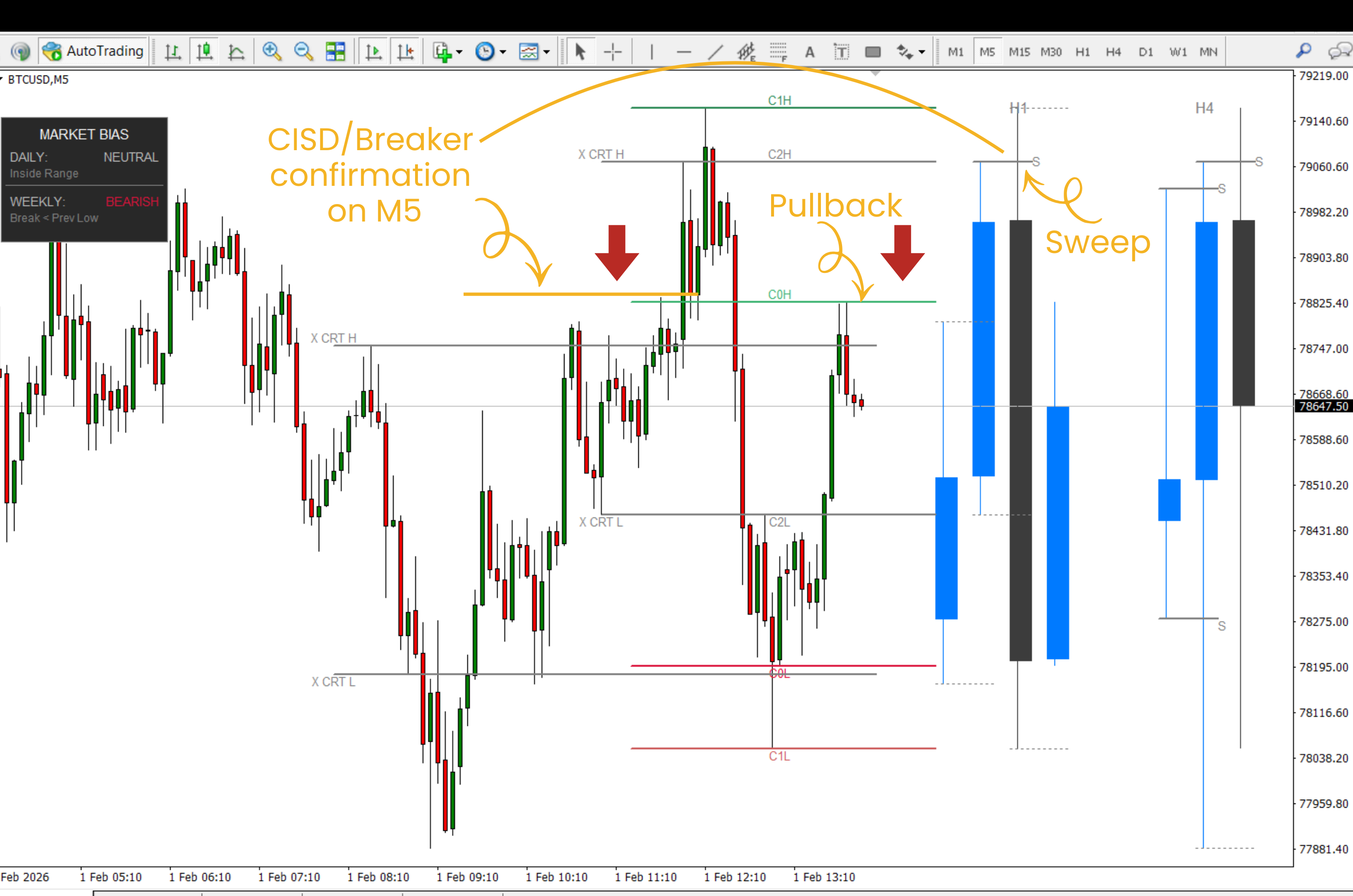

Image 1 shows the BTC chart from 3 hours ago.

Image 2 shows the current BTC chart.

Structure didn’t change — only price progressed.

BTCUSD on M5 is already mapped by higher-timeframe logic.

The grey CRT with the right check-mark indicates a completed CRT.

COH / COL represent the current H1 candle high and low, with C1H/C1L and C2H/C2L marking prior HTF ranges.

Once H1 liquidity is swept, the lower timeframe becomes relevant.

After the sweep, M5 confirms intent through a break of CISD / Breaker structure.

Execution is then either on the break of CISD / Breaker or on a pullback into the CISD / Breaker zone.

This is not prediction.

It is alignment between HTF intent and LTF execution.

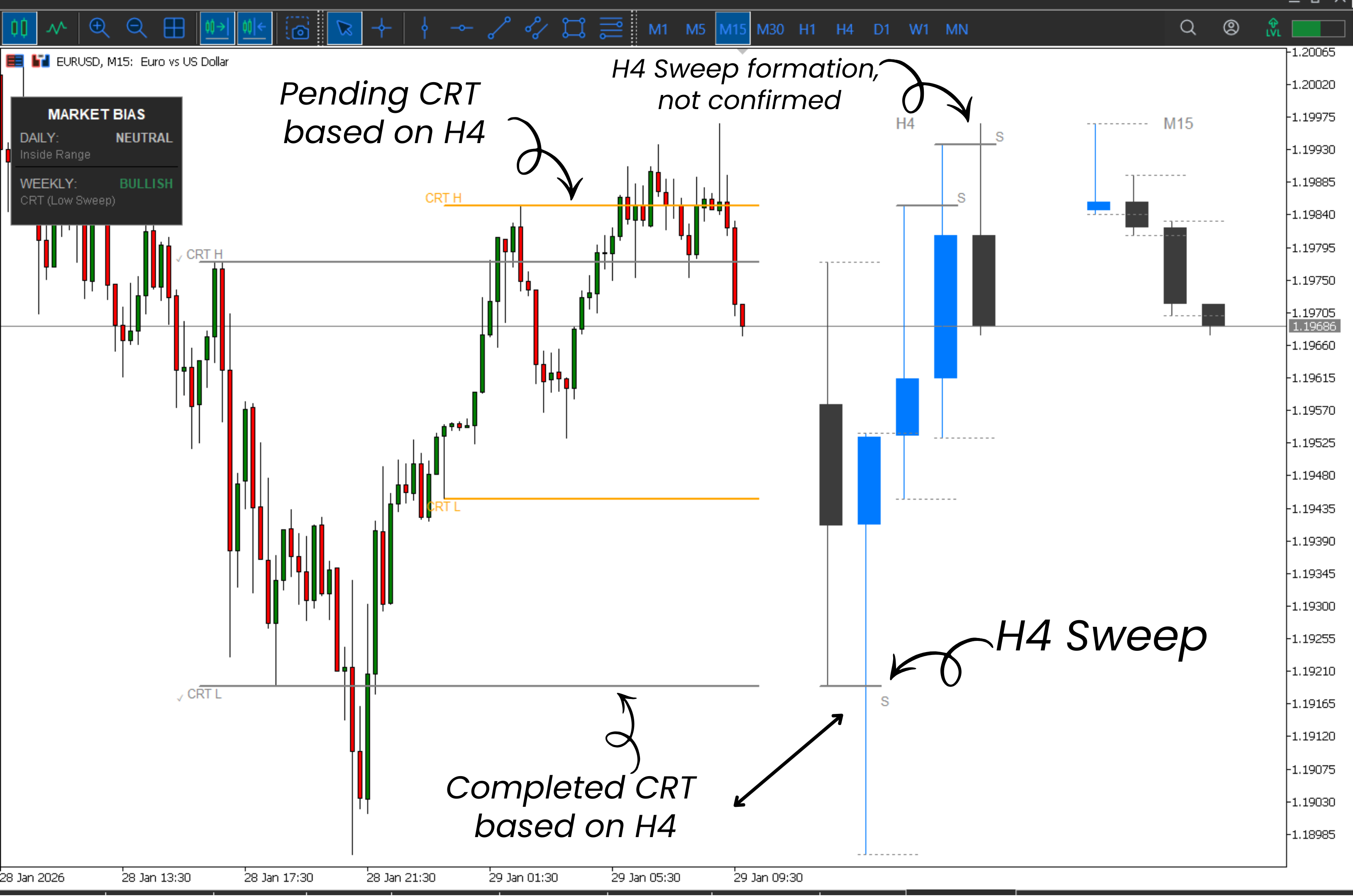

How CRT and Higher-Timeframe Fractals Work Together in Live Markets

This update demonstrates:

• Difference between pending and completed CRT levels

• Higher-timeframe sweep formation versus confirmed sweeps

• Alignment of completed CRT with validated HTF liquidity events

The indicator updates only on candle close and is designed to support context-based discretionary analysis rather than signal generation.

This example demonstrates how the indicator visualizes:

• CRT High and CRT Low ranges

• Higher-timeframe context via ghost candles

• Confirmed vs pending liquidity sweeps

• Daily and Weekly bias alignment

The indicator provides structural context only and does not generate trade signals.

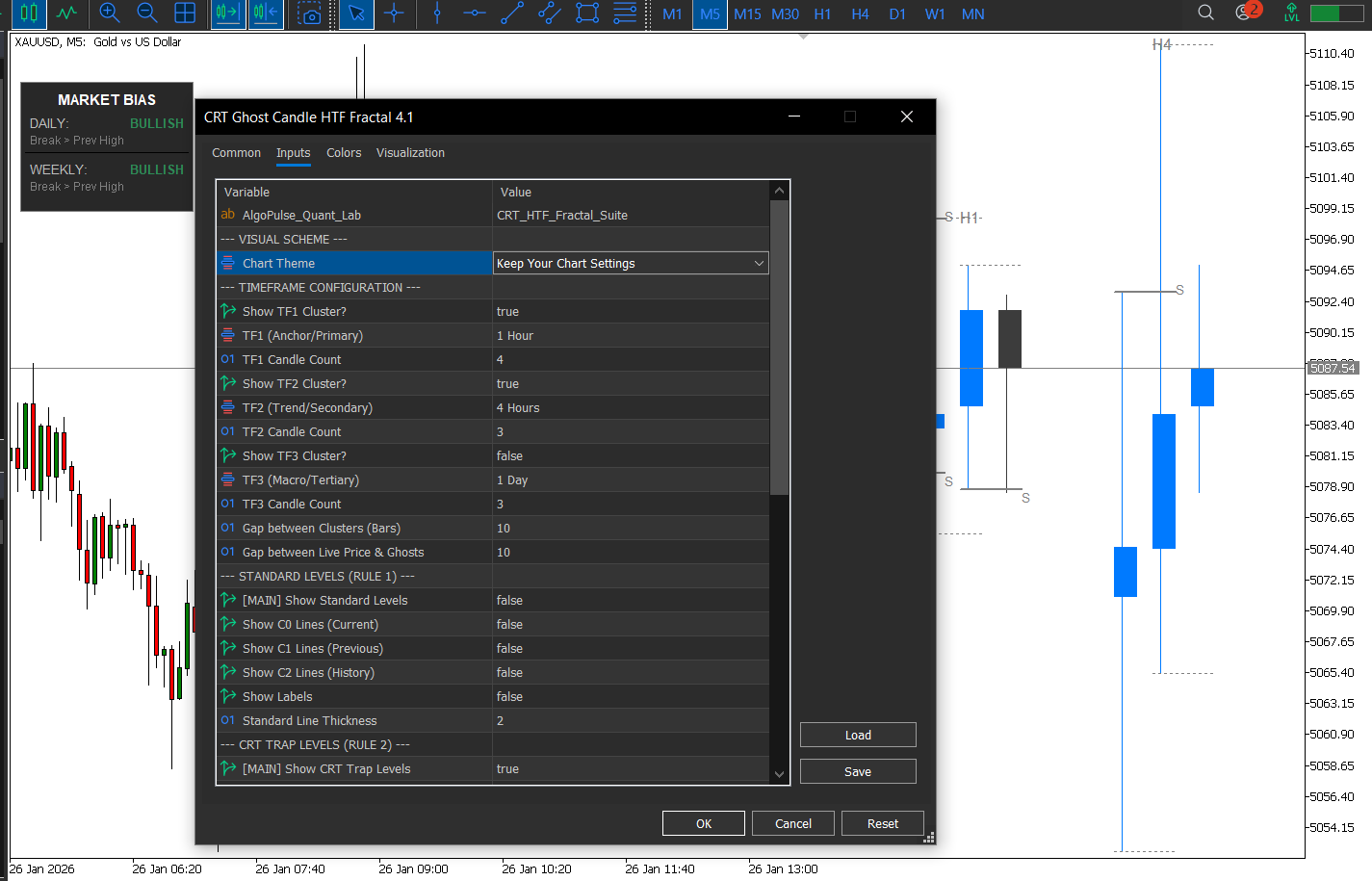

A new version (v4.1) of CRT Ghost Candle HTF Fractal is now available.

This update introduces user-controlled chart behavior and flexible timeframe visualization:

• Option to keep your existing chart settings (background, colors) when switching symbols or timeframes

• Optional enable/disable of TF1, TF2, and TF3 ghost candle clusters

• Improved adaptability across different trading styles and chart themes

The default behavior remains unchanged (clean, standard chart), while advanced users now have full visual control through Inputs.

The update is available from the Purchases section.

In reality, CRT is not an entry model.

It is a range validation framework.

Fractals do not predict price movement.

They confirm where liquidity has already been engineered.

When the focus shifts from chasing entries to understanding intent,

CRT becomes a tool for structure and context — not prediction.

Institutionelles CRT Ghost Candle & HTF Fractal-Framework, das die Struktur höherer Zeitrahmen, Liquiditätsschwankungen und direktionale Tendenzen direkt auf niedrigere Zeitrahmen projiziert - entwickelt für ernsthafte diskretionäre Trader. MT5 Version : Hier klicken Produkt Übersicht CRT Ghost Candle HTF Fractal ist ein fortschrittlicher Marktstruktur- und Liquiditätsvisualisierungsindikator für MetaTrader 4, der die Logik höherer Timeframes direkt auf Ihren Arbeitschart projiziert, ohne

CRT Multi-Timeframe Marktstruktur- & Liquiditäts-Sweep-Indikator CRT Ghost Candle HTF Fractal ist ein professioneller Forex- und Multi-Asset-Indikator für MT5, der Marktstrukturen, Liquiditätsschwünge und Kerzenbereiche in höheren Zeitrahmen direkt auf Charts mit niedrigerem Zeitrahmen anzeigt. Er ermöglicht es Händlern, auf niedrigeren Zeitrahmen präzise zu handeln, ohne den Kontext des höheren Zeitrahmens zu verlieren, so dass sie nicht ständig zwischen den Charts wechseln müssen. Welches

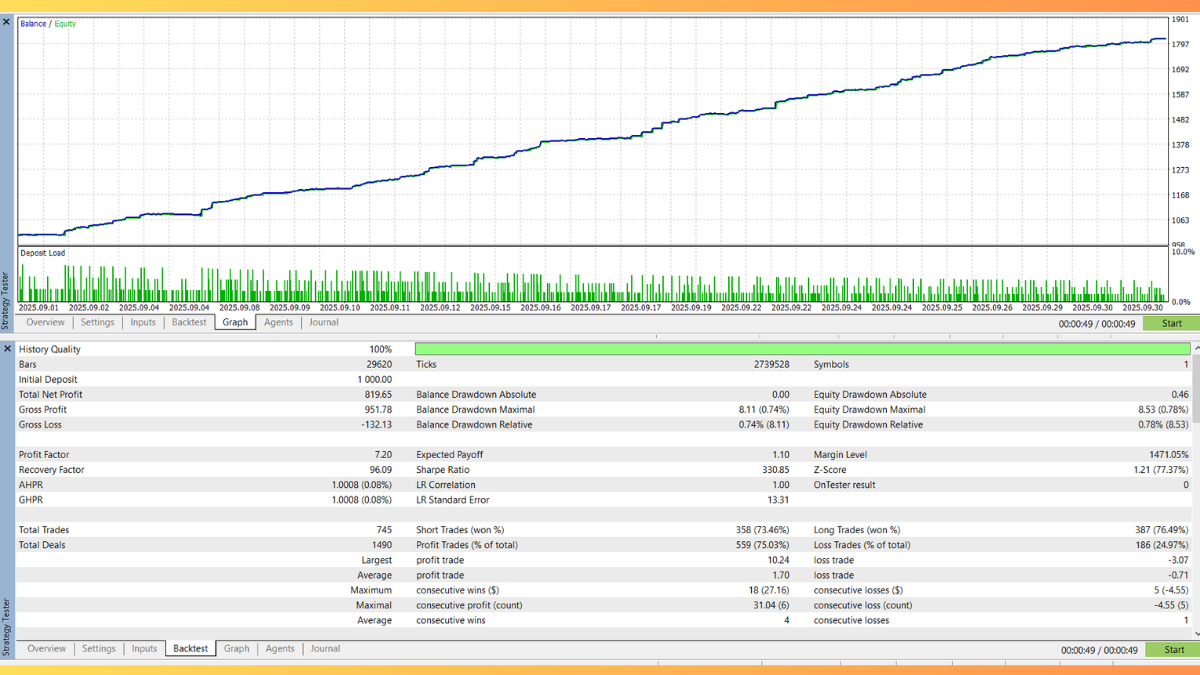

I’ve run 100,000+ backtests since 2020. Most traders blame their strategy when they fail, but the real culprit is often the execution environment.

I am not an affiliate nor promoting, and I gain nothing from this. However, I want to share technical findings on why I use a specific True ECN environment as my “Control Group” for Algo development (as seen in the screenshots).

1. The “100% Quality Data” Standard Most brokers provide 90% or “N/A” modelling quality. This creates “phantom” profits that vanish in live trading. My tests on this setup consistently hit 100% History Quality with real ticks. If your backtest isn't using 100% quality, the results are often unreliable.

2. Why the Execution Environment Matters Beyond data quality, my live testing found these critical factors:

True ECN: Positive slippage on limit orders.

Data Fidelity: Real ticks matching live execution.

Standardization: Correct Tick Values & GMT alignment.

Liquidity: Spreads hold up better during volatility.

The Lesson: Don't optimize your EA to fix a bad feed. Fix your execution environment, then optimize your EA.

Does your current setup provide 100% real tick historical data? Check your strategy tester report.

Universal Broker Support: Improved logic for automatic Tick Size and Tick Value detection.

GMT Alignment: Enhanced stability for brokers with varying server times (GMT+2/GMT+3).

Optimized Execution: Ensures consistent calculations across different liquidity providers (e.g., IC Markets, Pepperstone, Vantage, etc.).

Recommended for all users to update immediately.

https://www.mql5.com/en/market/product/160456

Index Vector Pro: Dual-Engine Volatilitätssystem Professional Index Trading (DE40 & US30) | Engineered for Consistency Index Vector Pro ist ein spezialisiertes algorithmisches Handelssystem, das für den DAX40 (DE40) und US30 (Dow Jones) entwickelt wurde. Im Gegensatz zu Standard-Bots, die Konten einem unbegrenzten Risiko aussetzen, nutzt dieses System eine strikte zeitbasierte Struktur, um nur mit hochwahrscheinlichen Marktbedingungen zu handeln. Es wurde für Händler entwickelt, die der

A new Yearly Candle just opened. 🕯️

May this year bring you strong trends, zero noise, and plenty of green candles.

Wishing you perfect execution, wealth, and health in the year ahead. Let’s make this one count. 🚀

EINFÜHRUNGSANGEBOT: $35 (zeitlich begrenzt) Normaler Preis: $69 Aktueller Preis: $35 (50% sparen) Wir bieten diesen Breakout Vector MTF-Indikator zu einem Einstiegspreis an, um unsere erste Benutzerbasis aufzubauen. Der Preis wird bald wieder auf $69 ansteigen. Holen Sie sich das volle professionelle MTF Levels System zum Preis eines Standard Indikators. Breakout Vector MTF-Indikator mit Mobile- und Desktop-Alarm Der institutionelle Fahrplan für MetaTrader 5 Die meisten Trader haben Probleme

Just finished stressing-testing the new 0.9/1.25 institutional settings on Gold (XAUUSD) for 2025. The data speaks for itself:

🔹 Net Profit: +226% ($1k ➔ $3.2k) 🔹 Recovery Factor: 6.47 (Institutional Grade)

🔹 Drawdown: Low and controlled 🔹 Logic: Pure vector breakout, NO Grid, NO Martingale.

This is what happens when you trade volatility vectors instead of guessing. The EA is live on the Market now.

See the full strategy here: https://www.mql5.com/en/market/product/158065

Want to AUTOMATE this strategy? We have released the fully automated Expert Advisor based on this logic. Check out Range Vector Fibo Logic EA here: https://www.mql5.com/en/market/product/158065 UPGRADE VERFÜGBAR: Haben Sie genug vom manuellen Handel? Ich habe gerade die automatisierte MTF-Version mit mobilen Alarmen und Auto-Targets veröffentlicht. Holen Sie sich die Pro Version hier: https: // www.mql5.com/en/market/product/159350 Range Vector Fibo Logic (Indikator) Ein-Kerzen-Strategie

<br/ translate="no"> LAUNCH SPECIAL: Nur die ersten 15 Exemplare Wir bieten die ersten 15 Lizenzen zu einem ermäßigten Preis von $149 für die lebenslange Nutzung an (regulärer Preis $299), um unsere erste Benutzerbasis aufzubauen. Aktueller Preis: $149 Nächster Preis: $199 Endgültiger Preis: $299 Greifen Sie jetzt zu, bevor der Preis steigt. Bereich Vektor Fibo Logic (RVFL) Range Vector Fibo Logic (RVFL) ist ein hochentwickeltes algorithmisches Handelssystem, das entwickelt wurde, um