Ravi Gurung / Profil

- Informations

|

Aucun

expérience

|

6

produits

|

7

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Hi, I’m Ravi — a Quantitative Developer and Algorithmic Trader focused on building high-performance, transparent trading systems for the MQL5 community.

Why My EAs Are Different

My work is grounded in 16+ years of total market experience. I spent 12 years mastering manual trading psychology and market structure, followed by 4 years specializing in Quantitative Development.

I do not build or sell “black box” systems. I design, develop, and refine advanced trading strategies, transforming them into transparent, rules-based Expert Advisors, & Indicators for MetaTrader 5/4.

The objective is simple: automated systems that operate with the precision of a machine while respecting the logic of professional discretionary trading.

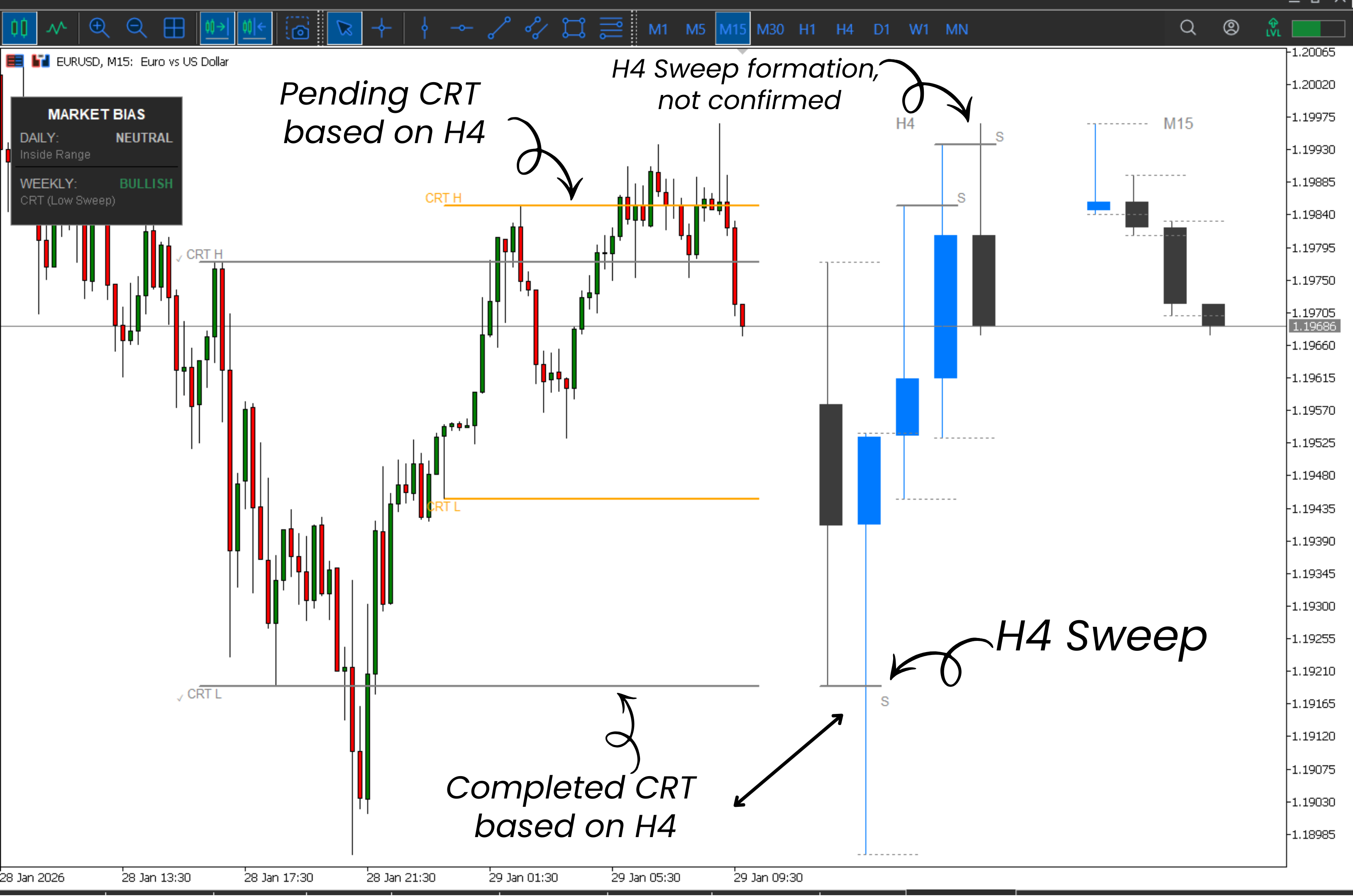

How CRT and Higher-Timeframe Fractals Work Together in Live Markets

This update demonstrates:

• Difference between pending and completed CRT levels

• Higher-timeframe sweep formation versus confirmed sweeps

• Alignment of completed CRT with validated HTF liquidity events

The indicator updates only on candle close and is designed to support context-based discretionary analysis rather than signal generation.

This example demonstrates how the indicator visualizes:

• CRT High and CRT Low ranges

• Higher-timeframe context via ghost candles

• Confirmed vs pending liquidity sweeps

• Daily and Weekly bias alignment

The indicator provides structural context only and does not generate trade signals.

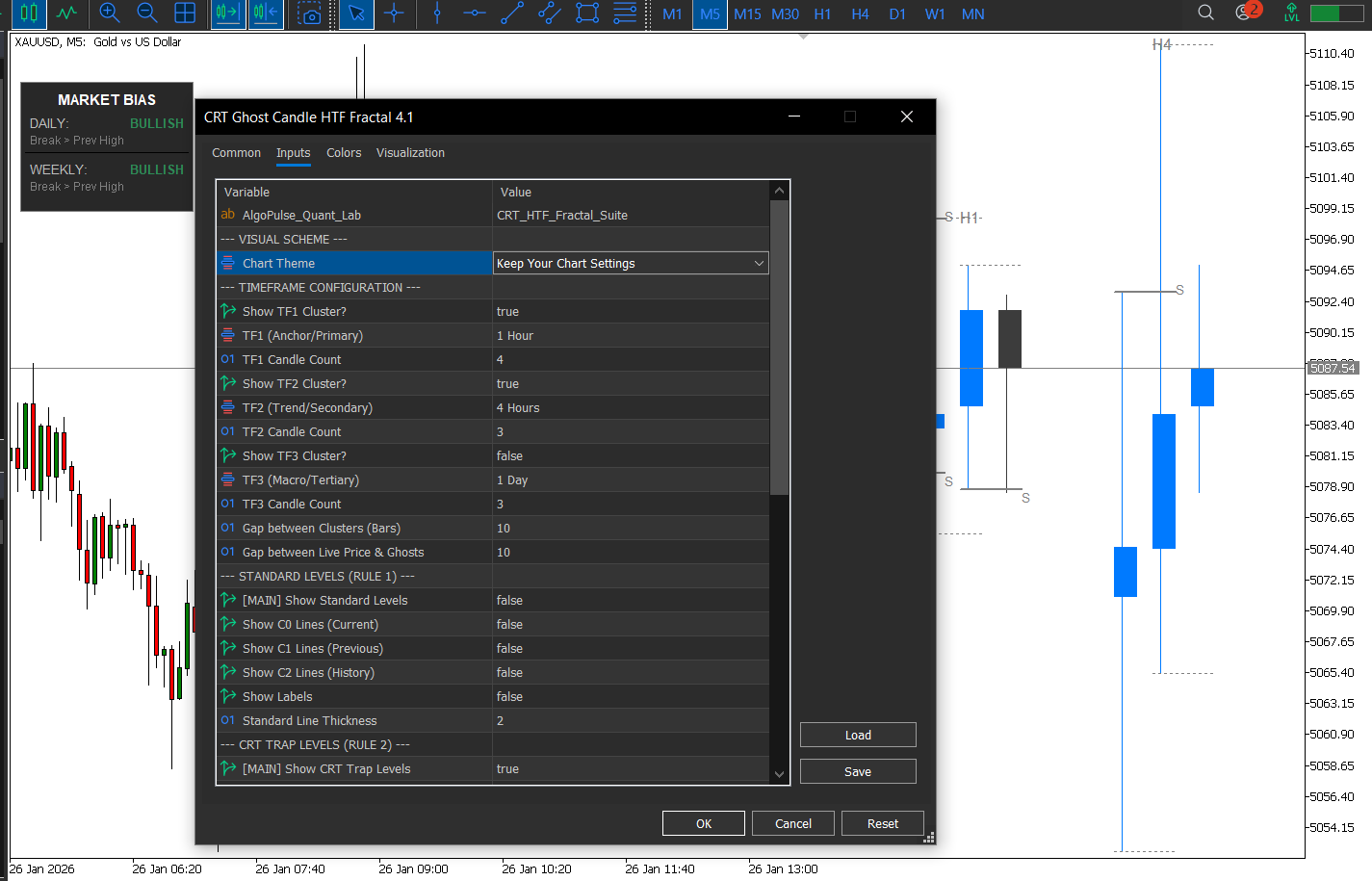

A new version (v4.1) of CRT Ghost Candle HTF Fractal is now available.

This update introduces user-controlled chart behavior and flexible timeframe visualization:

• Option to keep your existing chart settings (background, colors) when switching symbols or timeframes

• Optional enable/disable of TF1, TF2, and TF3 ghost candle clusters

• Improved adaptability across different trading styles and chart themes

The default behavior remains unchanged (clean, standard chart), while advanced users now have full visual control through Inputs.

The update is available from the Purchases section.

In reality, CRT is not an entry model.

It is a range validation framework.

Fractals do not predict price movement.

They confirm where liquidity has already been engineered.

When the focus shifts from chasing entries to understanding intent,

CRT becomes a tool for structure and context — not prediction.

Institutional-grade CRT Ghost Candle & HTF Fractal framework that projects higher-timeframe structure, liquidity sweeps, and directional bias directly onto lower timeframes — built for serious discretionary traders. MT5 Version : Click Here Product Overview CRT Ghost Candle HTF Fractal is an advanced institutional-grade market structure and liquidity visualization indicator designed for MetaTrader 4, built to compress higher-timeframe logic directly onto your working chart—without switching

Institutional-grade CRT Ghost Candle & HTF Fractal framework that projects higher-timeframe structure, liquidity sweeps, and directional bias directly onto lower timeframes — built for serious discretionary traders. Product Overview CRT Ghost Candle HTF Fractal is an advanced market structure and liquidity visualization indicator designed to compress higher timeframe logic directly onto your working chart—without switching timeframes. This indicator fuses Candle Range Theory (CRT), Higher

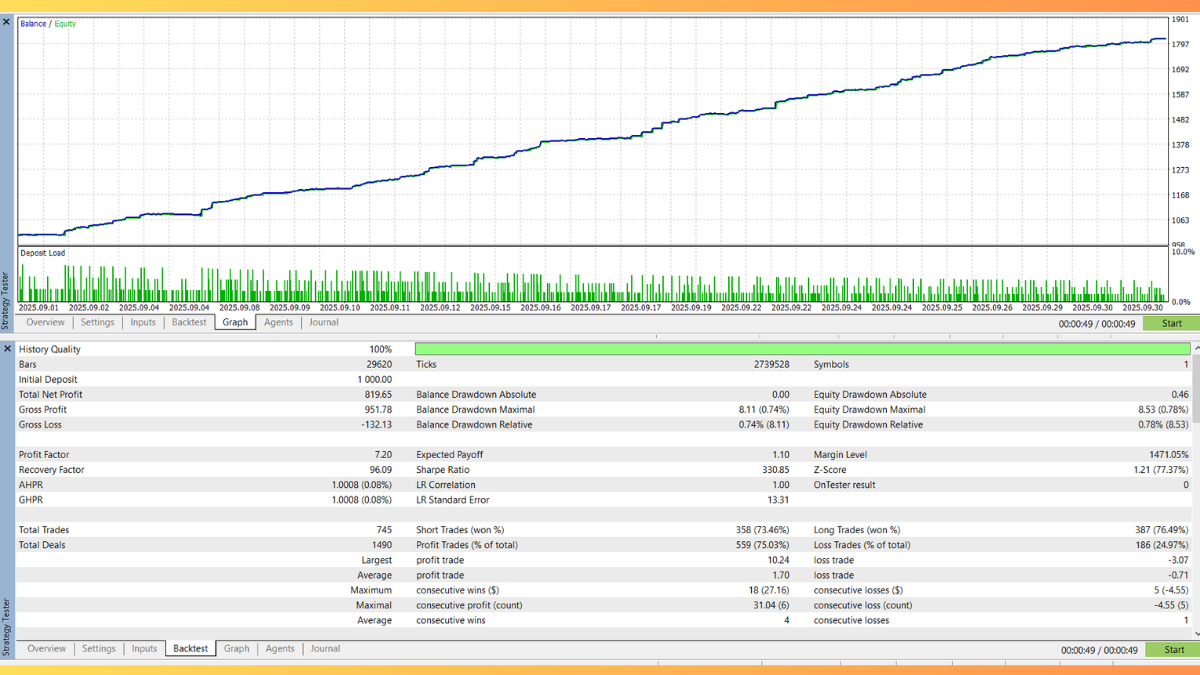

I’ve run 100,000+ backtests since 2020. Most traders blame their strategy when they fail, but the real culprit is often the execution environment.

I am not an affiliate nor promoting, and I gain nothing from this. However, I want to share technical findings on why I use a specific True ECN environment as my “Control Group” for Algo development (as seen in the screenshots).

1. The “100% Quality Data” Standard Most brokers provide 90% or “N/A” modelling quality. This creates “phantom” profits that vanish in live trading. My tests on this setup consistently hit 100% History Quality with real ticks. If your backtest isn't using 100% quality, the results are often unreliable.

2. Why the Execution Environment Matters Beyond data quality, my live testing found these critical factors:

True ECN: Positive slippage on limit orders.

Data Fidelity: Real ticks matching live execution.

Standardization: Correct Tick Values & GMT alignment.

Liquidity: Spreads hold up better during volatility.

The Lesson: Don't optimize your EA to fix a bad feed. Fix your execution environment, then optimize your EA.

Does your current setup provide 100% real tick historical data? Check your strategy tester report.

Universal Broker Support: Improved logic for automatic Tick Size and Tick Value detection.

GMT Alignment: Enhanced stability for brokers with varying server times (GMT+2/GMT+3).

Optimized Execution: Ensures consistent calculations across different liquidity providers (e.g., IC Markets, Pepperstone, Vantage, etc.).

Recommended for all users to update immediately.

https://www.mql5.com/en/market/product/160456

Index Vector Pro: Dual-Engine Volatility System Professional Index Trading (DE40 & US30) | Engineered for Consistency Index Vector Pro is a specialized algorithmic trading system designed for the DAX40 (DE40) and US30 (Dow Jones) . Unlike standard bots that expose accounts to unlimited risk, this system utilizes a strict time-based structure to trade only high-probability market conditions. It is designed for traders who prioritize drawdown control, stability, and long-term consistency over

A new Yearly Candle just opened. 🕯️

May this year bring you strong trends, zero noise, and plenty of green candles.

Wishing you perfect execution, wealth, and health in the year ahead. Let’s make this one count. 🚀

LAUNCH OFFER: $35 (Limited Time) Standard Price: $69 Current Price: $35 (Save 50%) We are offering this Breakout Vector MTF Indicator at an entry-level price to build our initial user base. The price will increase back to $69 soon. Grab the full Professional MTF Levels System for the price of a standard indicator. Breakout Vector MTF Indicator with Mobile and Desktop Alert The Institutional Roadmap for MetaTrader 5 Most traders struggle because they focus too closely on lower

Just finished stressing-testing the new 0.9/1.25 institutional settings on Gold (XAUUSD) for 2025. The data speaks for itself:

🔹 Net Profit: +226% ($1k ➔ $3.2k) 🔹 Recovery Factor: 6.47 (Institutional Grade)

🔹 Drawdown: Low and controlled 🔹 Logic: Pure vector breakout, NO Grid, NO Martingale.

This is what happens when you trade volatility vectors instead of guessing. The EA is live on the Market now.

See the full strategy here: https://www.mql5.com/en/market/product/158065

Want to AUTOMATE this strategy? We have released the fully automated Expert Advisor based on this logic. Check out Range Vector Fibo Logic EA here: https://www.mql5.com/en/market/product/158065 UPGRADE AVAILABLE: Tired of manual trading? I just released the Automated MTF Version with Mobile Alerts and Auto-Targets. Get the Pro Version here: https://www.mql5.com/en/market/product/159350 Range Vector Fibo Logic (Indicator) One Candle Strategy Stop waking up at 3 AM to draw lines manually

LAUNCH SPECIAL: First 15 Copies Only We are offering the first 15 licences at a discounted price of $149 for lifetime use (Regular Price $299) to build our initial user base. Current Price: $149 Next Price: $199 Final Price: $299 Grab it now before the price hike. Range Vector Fibo Logic (RVFL) Range Vector Fibo Logic (RVFL) is a sophisticated algorithmic trading system designed to capture Institutional Momentum Bursts in the forex and crypto markets. While most EAs rely on dangerous Martingale