Everyone knows the facts - the top x% of the most wealthiest individuals own the absolute majority of the worlds wealth. Oxfam claims that 99% of the wealth is in the hands of the 1% or the wealthiest 62 individuals are as rich as 50% of the poorest. Even if these claims have been challenged it points on a big problem of our society that must be addressed by worlds governments. But this misbalance of the distribution of wealth is not a side effect of our modern lifestyle or the financial crises, nor of capitalism. This problem is not new but exists and has existed in almost any known civilization, even thousands of years ago. Communism is no exception! The gap grows and shrinks and these cycles are triggered by crises, wars, and revolutions. Currently (2007 on), the gap is becoming bigger and more obvious, as numerous recent studies show.

The reasons for the existence of this gap are not necessarily the same reasons for the shrinking and/or growing of the gap. We see the impact, rich vs poor but its hard to see the reasons as this impact results from interactions of many different interests. It’s a rather easy game for populists to use such facts in order to campaign against established governments or banks as often seen since the debt crises of 2007/2008. The real truth for this gap and the best solution to an alternative more fair system however keeps hiding in the dark. Maybe saving banks at risk of bankruptcy with taxpayers money is unfair, because those who took the high risks are not all paying the bills at the end but loosing one credit institute after the other would have most probably cost us all a lot more money and jobs. These bailout packages perhaps increased the gap but are certainly not the reason for the existence of the gap between rich and poor.

Many articles have been written about potential reasons and there is more than one opinion on possible solution. In this article I would like to discuss the very nature of money and moreover interest in regards to the above described problem. The following simplified example, inspired by real life experience, outlines my thoughts.

John, 25 earns 50k€ p.a. in his first job. Because he is paid on a regular basis and is confident to continue working and earning, he borrows money (over 5 years, 3% interests) for a new car. Cost 30k€ for the car + 2.700 interests = -32,7k€

John’s Balance Sheet

Income after tax: 35.000

Expenses: (25.000)

Loan redemption: (6.900)

Liability: (25.800)

Assets: 30.000

(Assuming that John had no money before working, his net worth is 7.3k€)

Johns Balance Sheet (5 years later)

Total Income after tax: 5*35.000=175.000

Expenses: 5*25.000=(125.000)

Loan redemption: (32.700)

Liability: 0

Assets: 15K€ (car’s rest worth)

(After 5 years John is worth 32.3k. By the way, a car is a pretty bad asset in terms of return on investment!)

Jane, 25 earns 50k€ p.a. in her first job. Jane wants to mitigate the risk of income and one day she wants to be independent from employers. Jane decides to create multiple sources of income and starts by investing whatever she doesn’t need in liquid securities portfolio and received 3%.

Jane’s Balance Sheet

Income after tax: 35.000

Expenses: (25.000)

Investing: (10.000)

Assets: 10.300

(Assuming that Jane had no money before working, her net worth is 10,3k€)

Jane’s Balance Sheet (5 years later)

Total Income after tax: 5*35.000=175.000

Expenses: 5*25.000=(125.000)

Investing: 5*10.000=(50.000)

Assets: 54.6k€

(After 5 years Jane is worth 54.6k She liquidates her portfolio and buys an apartment, using loan financing of 200.000€)

Yes, John has his own fancy car and Jane must use public transportation! But not only is Jane’s financial situation 70% higher than John’s after only 5 years, she now receives 10.000 p.a. of additional net income from renting out an apartment.

This example, even if it is extremely simplified, certainly is representative for a modern way that many citizen of developed countries are living. It highlights pretty clear how such a gap may start. And the gap keeps growing year after year. When its time for John to get a loan in because he wants to by an apartment for himself, Jane buys a second apartment and increased her income already by more than 50%. At the age of 45, John will continue to pay back his debt for another decade and will continue to work for another 2 decades and Jane has created enough additional income to retire and focus on other, more pleasant aspects of life.

The above example also shows the difference between „good“ and „bad“ debt as described by Robert Kyosaki in his book Rich Dad Poopr Dad.

N.B.: taxes on investments are typically much lower than salary income taxes. Good for Jane!

Why is it that so many of us opt a lifestyle and pay for stuff that clever marketers make us want, instead of investing in ourselves? Everyone may has its own reasons, loss of trust in banks and financial products, psychology of direct certain belohnung instead of potential future bigger belohnung or lack of financial education. Perhaps future civilizations, living in times where materiel besitztümer are avaialable at no cost to anybody. Working will be no obligation but its normal for everybody to do something for all of us. This sounds very far away! Or maybe we will never overcome this gap because that’s how our very nature is and that’s what to many of us want, maybe the system is just as it is?

I believe that we can choose which side of the gap we want to be or stay. And from that believe comes hope, comes motivation, comes action, comes change. If you change your actions and your habits your life will unavoidably change.

If there is one important take away from this article than its the following: Investing money is not a guarantee for return on invest it must be done right but not investing time and effort in improving your income will almost certainly not improve your income.

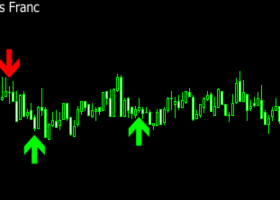

About the Autor - Laurent Scherer is a trader and account manager and founder of Lorbeer Investment, a company offering mirror trading services to individual investors. To learn more about Lorbeer Investment please visit: www.lorbeerinvestment.com

Sources Oxfam - http://www.bbc.com/news/business-35339475