Piyush Lalsingh Ratnu / Perfil

- Informações

|

3 anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Lalsingh Ratnu

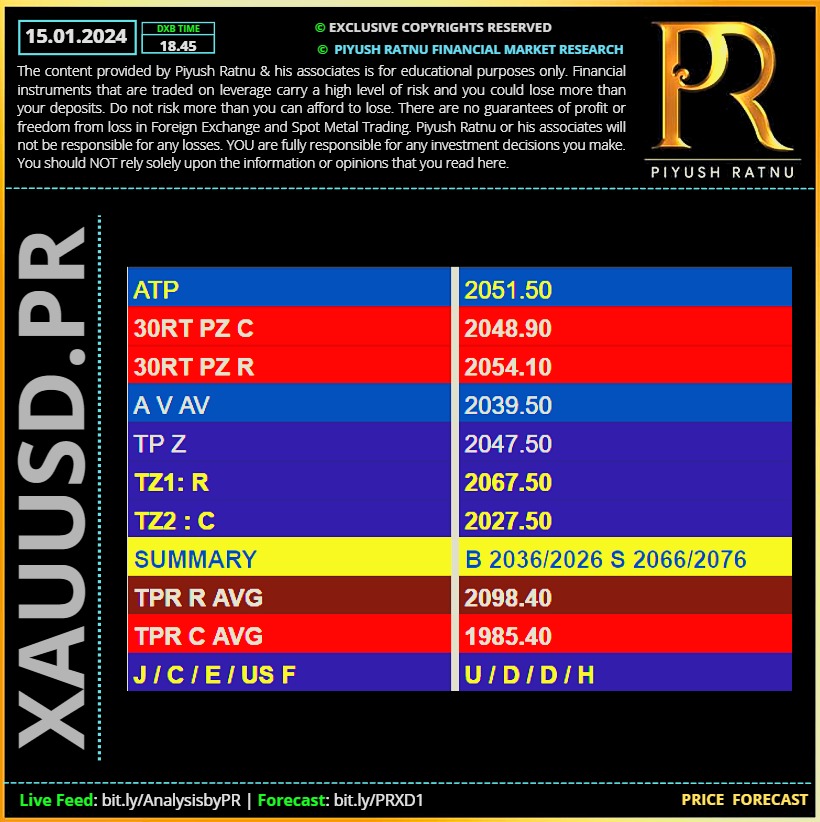

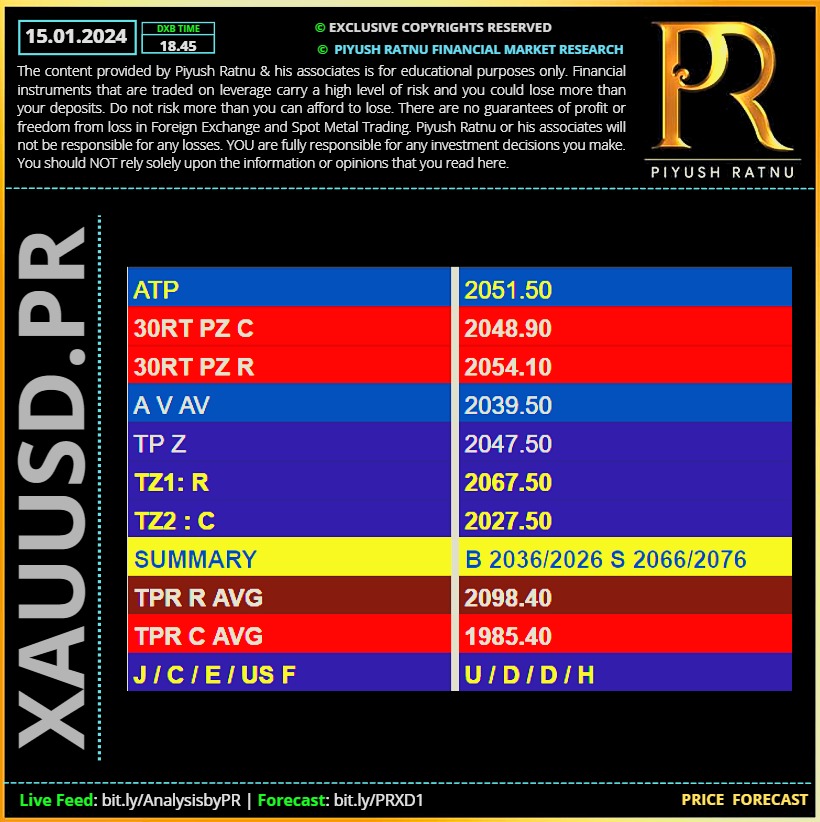

15.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

12.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Due to geo-political tensions:

SZ $2069/2096/2121/2145 on radar (XAUUSD)

avoid BIG LOTS | avoid SM/RM/BL

Maintain Money Management | Risk Management

SZ $2069/2096/2121/2145 on radar (XAUUSD)

avoid BIG LOTS | avoid SM/RM/BL

Maintain Money Management | Risk Management

Piyush Lalsingh Ratnu

As alerted and projected yesterday:

If USDJPY hits the price zone 144.800, XAUUSD might breach $2048 zone, XAUUSD CMP $2047

Analysis proved correct once again!

If USDJPY hits the price zone 144.800, XAUUSD might breach $2048 zone, XAUUSD CMP $2047

Analysis proved correct once again!

Piyush Lalsingh Ratnu

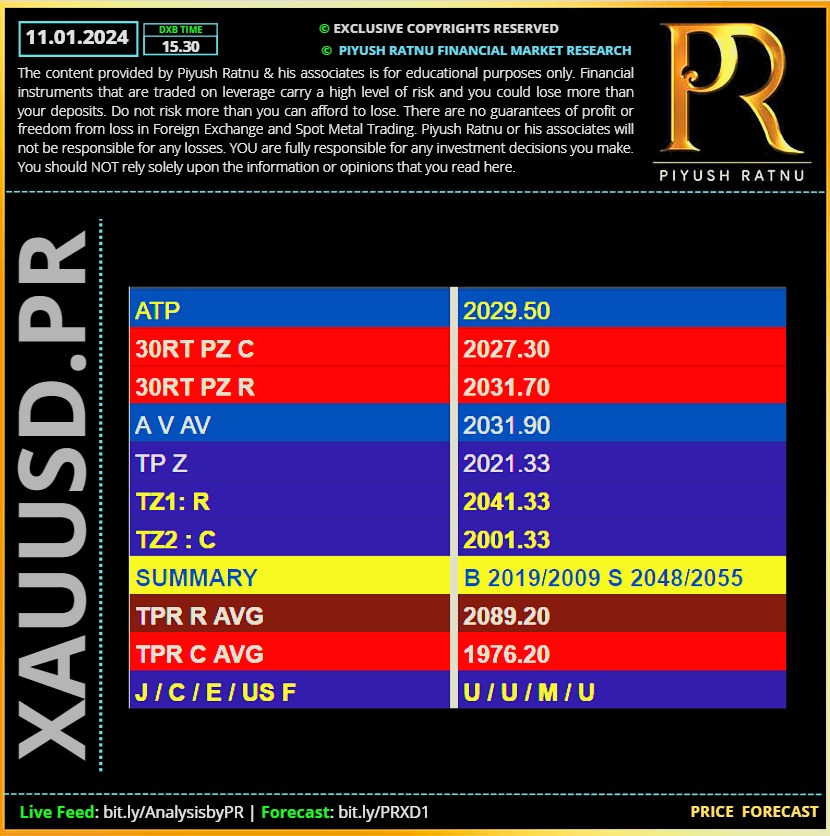

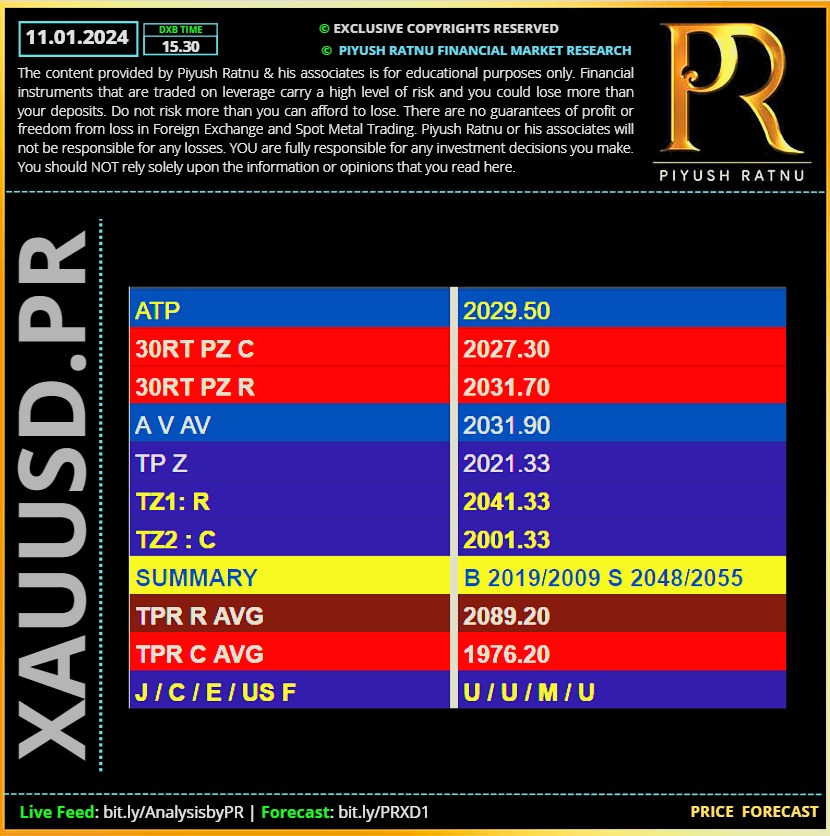

11.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Humble reminder: Kindly close trades in US F 1 2 3

A crash of 100+ points witnessed as projected in advance.

A crash of 100+ points witnessed as projected in advance.

Piyush Lalsingh Ratnu

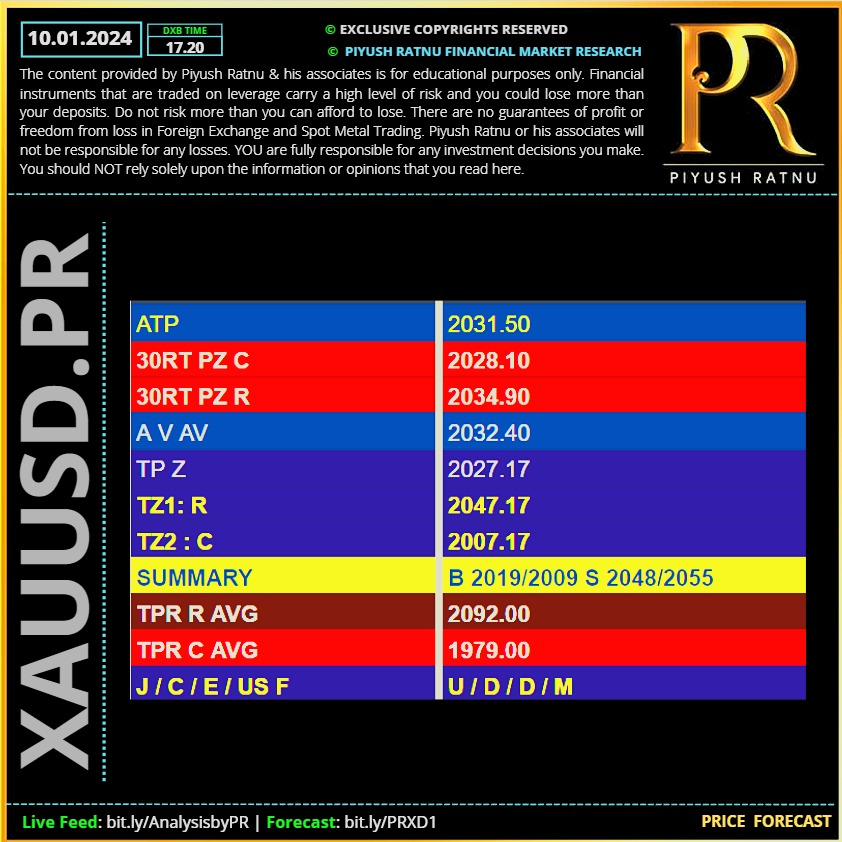

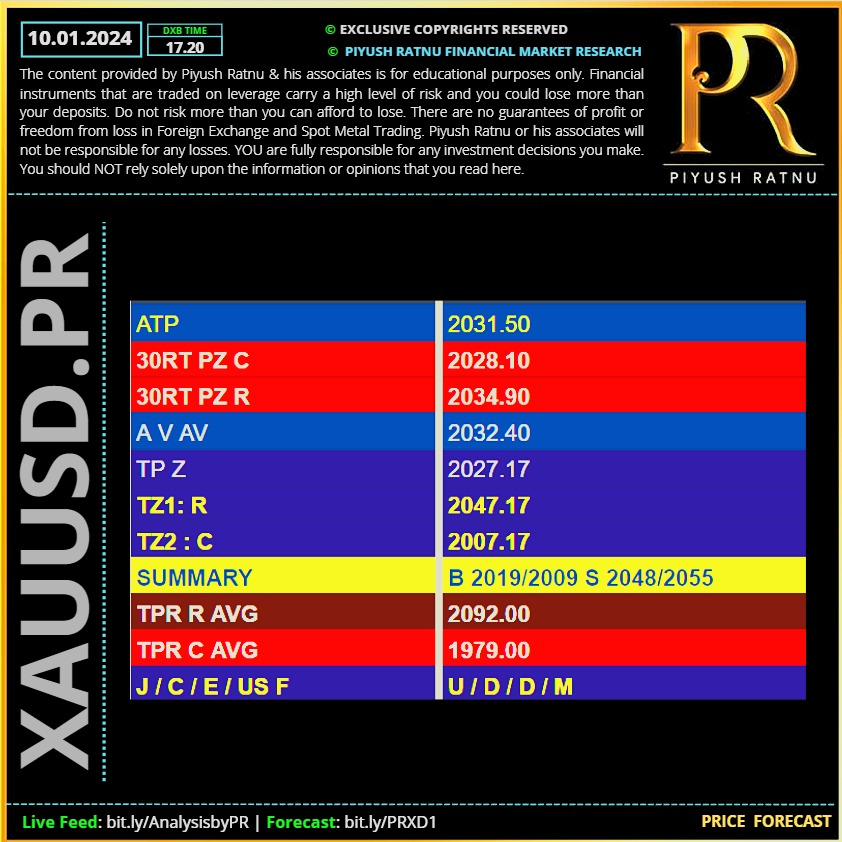

10.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

✔️ Reversal observed in 30 minutes, as alerted in advance.

USDJPY: 146.300-145.800 (CMP)

Impact: XAUUSD: $2025-2034 (CMP)

USDJPY: 146.300-145.800 (CMP)

Impact: XAUUSD: $2025-2034 (CMP)

Piyush Lalsingh Ratnu

XAUUSD approaching M15A0.0 M30A0.0

🆘 BZ $2019 on radar | CMP $2025

🆘 BZ $2019 on radar | CMP $2025

Piyush Lalsingh Ratnu

2024.01.11

✔️ Reversal observed in 30 minutes, as alerted in advance. USDJPY: 146.300-145.800 (CMP) Impact: XAUUSD: $2025-2034 (CMP)

Piyush Lalsingh Ratnu

🆘 Impact of USDJPY + might be observed in 30 min.

RT / Reversal: as USDJPY -, XAUUSD+ might be observed in 30 min.

Market Reversal in action, avoid entries for next 30 min.

RT / Reversal: as USDJPY -, XAUUSD+ might be observed in 30 min.

Market Reversal in action, avoid entries for next 30 min.

Piyush Lalsingh Ratnu

Co-relations as projected in advance before US Core CPI | CMP $2030 | + US CPI= + USD - XAUUSD

Piyush Lalsingh Ratnu

🆘Alert: XAUUSD currently at R1-R2 price trap

Breach of PPZ: $2019/2015

Breach of R2: $2048/2052

Breach of PPZ: $2019/2015

Breach of R2: $2048/2052

Piyush Lalsingh Ratnu

Trading Scenario: XAUUSD:

BZ M15A0.0 / SZ M15V100 crucial

BZ M30A0.0 / SZ M30V100 crucial

CMP $2033.00

BZ M15A0.0 / SZ M15V100 crucial

BZ M30A0.0 / SZ M30V100 crucial

CMP $2033.00

Piyush Lalsingh Ratnu

🆘 Key factors impacting Spot GOLD XAUUSD Price:

• Gold price climbs swiftly to near $2,030 as safe-haven assets have come under pressure ahead of the United States inflation data for December.

• The correction in the US Dollar Index (DXY) has extended to near 102.20, and the 10-year US Treasury yields have stabilized below 4.0%.

• The release of the US inflation data will provide cues about the likely monetary policy action for January’s meeting.

• Investors see headline inflation rising 3.2% annually, up from 3.1% in November. Core inflation, which excludes volatile food and energy prices, is forecasted to decline tof 3.8% against the former reading of 4.0%.

• Economists are anticipating that monthly headline and core inflation grew by 0.2% and 0.3%, respectively.

• The Federal Reserve (Fed) is highly expected to keep interest rates unchanged in the range of 5.25%-5.50% in January’s monetary policy meeting for the fourth time in a row. Guidance about upcoming interest rate cuts will be of utmost importance.

• In the latest projections, Fed policymakers said interest rates could come down by 75 basis points (bps) this year.

• As per the CME Fedwatch tool, chances in favour of a 25 bp rate cut in March have rebounded to 67%.

• Bets supporting an interest rate cut by the Fed in March could decline sharply if the US inflation report comes in hotter than projected. Also, projections for the first cut in interest rates could shift to May’s monetary policy meeting.

• A sticky or higher inflation data will offer an argument to Fed policymakers to keep interest rates high for the entire first half of this year.

• After the release of the US Inflation data, investors will shift focus towards the Producer Price Index (PPI) data for December, which will be published on Friday.

• On US-China relations, US Treasury Secretary Janet Yellen said former Republican President Donald Trump’s plan to levy universal 10% tariffs on all imports would escalate costs for consumers. She added that a review of tariffs on Chinese imports is highly needed.

• Gold price climbs swiftly to near $2,030 as safe-haven assets have come under pressure ahead of the United States inflation data for December.

• The correction in the US Dollar Index (DXY) has extended to near 102.20, and the 10-year US Treasury yields have stabilized below 4.0%.

• The release of the US inflation data will provide cues about the likely monetary policy action for January’s meeting.

• Investors see headline inflation rising 3.2% annually, up from 3.1% in November. Core inflation, which excludes volatile food and energy prices, is forecasted to decline tof 3.8% against the former reading of 4.0%.

• Economists are anticipating that monthly headline and core inflation grew by 0.2% and 0.3%, respectively.

• The Federal Reserve (Fed) is highly expected to keep interest rates unchanged in the range of 5.25%-5.50% in January’s monetary policy meeting for the fourth time in a row. Guidance about upcoming interest rate cuts will be of utmost importance.

• In the latest projections, Fed policymakers said interest rates could come down by 75 basis points (bps) this year.

• As per the CME Fedwatch tool, chances in favour of a 25 bp rate cut in March have rebounded to 67%.

• Bets supporting an interest rate cut by the Fed in March could decline sharply if the US inflation report comes in hotter than projected. Also, projections for the first cut in interest rates could shift to May’s monetary policy meeting.

• A sticky or higher inflation data will offer an argument to Fed policymakers to keep interest rates high for the entire first half of this year.

• After the release of the US Inflation data, investors will shift focus towards the Producer Price Index (PPI) data for December, which will be published on Friday.

• On US-China relations, US Treasury Secretary Janet Yellen said former Republican President Donald Trump’s plan to levy universal 10% tariffs on all imports would escalate costs for consumers. She added that a review of tariffs on Chinese imports is highly needed.

Piyush Lalsingh Ratnu

Monitor our Trading Performance at MyFxBook:

Fundamentals + Technical based Manual Trading | 90+ parameters mapping.

More Frequent trading during US Session.

XAUUSD Spread: 18 | High Frequency Trading

Tools used for Analysis: PRSDBS | PPZ | PRSR by Piyush Ratnu

Do not risk more than you can afford to lose.

We do not guarantee or warranty profits.

The risk of loss in foreign exchange trading can be substantial.

There are high chances you might lose entire capital.

Fundamentals + Technical based Manual Trading | 90+ parameters mapping.

More Frequent trading during US Session.

XAUUSD Spread: 18 | High Frequency Trading

Tools used for Analysis: PRSDBS | PPZ | PRSR by Piyush Ratnu

Do not risk more than you can afford to lose.

We do not guarantee or warranty profits.

The risk of loss in foreign exchange trading can be substantial.

There are high chances you might lose entire capital.

Piyush Lalsingh Ratnu

🟢 December Outflows: compounds 2023 losses

Highlights

Outflows from global gold ETFs continued in December as European losses overshadowed inflows into North America and other regions

While the gold price performance and a dovish Fed supported North American inflows, stronger currencies and hawkish local central bank stances deterred European gold investors

December widened 2023’s global gold ETF losses to US$15bn, the third consecutive annual outflow, mainly from European and North American funds, while Asia was the only region that captured inflows in 2023

Collective holdings fell by 7% in 2023 but total assets under management (AUM) rose 6% thanks to a 15% gold price gain.

♾ https://www.gold.org/goldhub/research/gold-etfs-holdings-and-flows/2024/01

Highlights

Outflows from global gold ETFs continued in December as European losses overshadowed inflows into North America and other regions

While the gold price performance and a dovish Fed supported North American inflows, stronger currencies and hawkish local central bank stances deterred European gold investors

December widened 2023’s global gold ETF losses to US$15bn, the third consecutive annual outflow, mainly from European and North American funds, while Asia was the only region that captured inflows in 2023

Collective holdings fell by 7% in 2023 but total assets under management (AUM) rose 6% thanks to a 15% gold price gain.

♾ https://www.gold.org/goldhub/research/gold-etfs-holdings-and-flows/2024/01

Piyush Lalsingh Ratnu

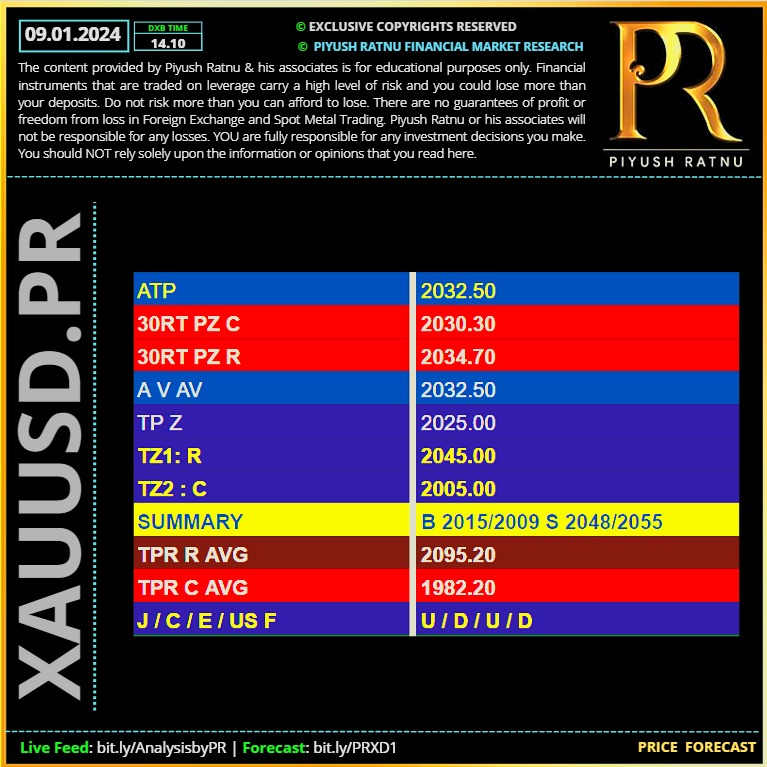

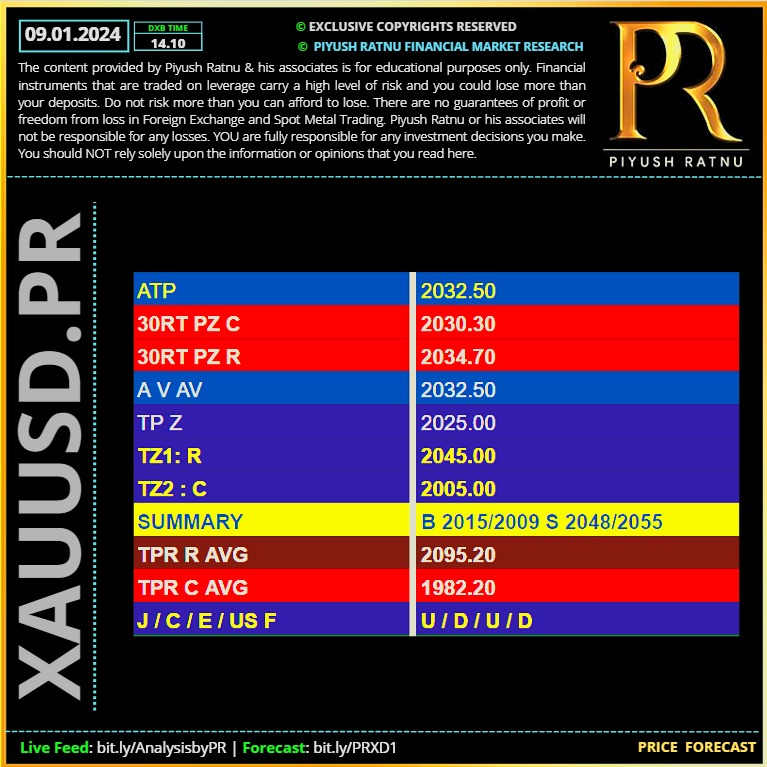

09.01.2024 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

: