Piyush Lalsingh Ratnu / Perfil

- Informações

|

3 anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Lalsingh Ratnu

XAUUSD at PPZ S1

S2 2023

R2 2048

R1 2039

USD S 65

JPY S 35

US10YT 4.103

DXY 104.005

XAUXAG 91.45

US F Stable

S2 2023

R2 2048

R1 2039

USD S 65

JPY S 35

US10YT 4.103

DXY 104.005

XAUXAG 91.45

US F Stable

Piyush Lalsingh Ratnu

Purchase one of the most accurate trading algorithm for SPOT GOLD XAUUSD and USD Majors by Piyush Ratnu.

For more details, kindly email at info@piyushratnu.com | t.me/PiyushRatnuOfficial

For more details, kindly email at info@piyushratnu.com | t.me/PiyushRatnuOfficial

Piyush Lalsingh Ratnu

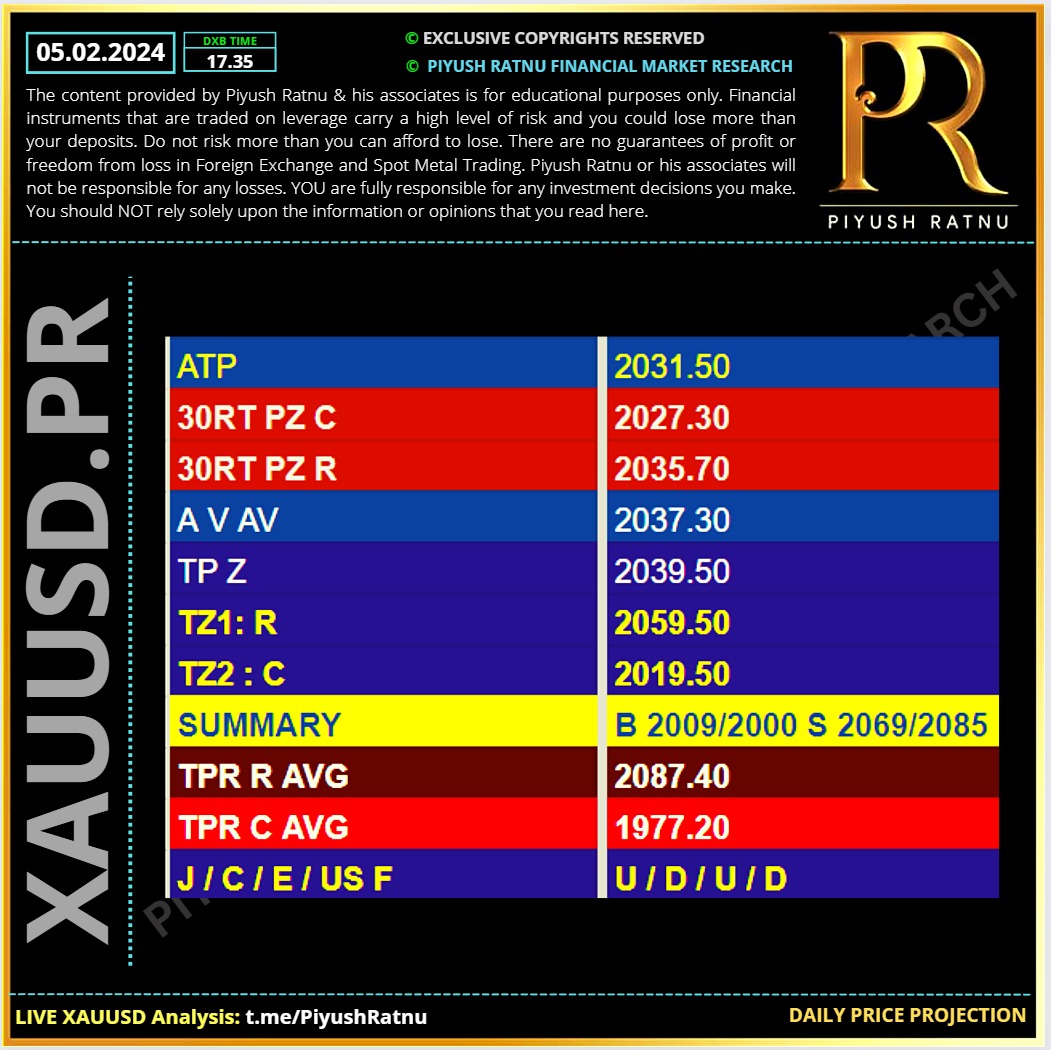

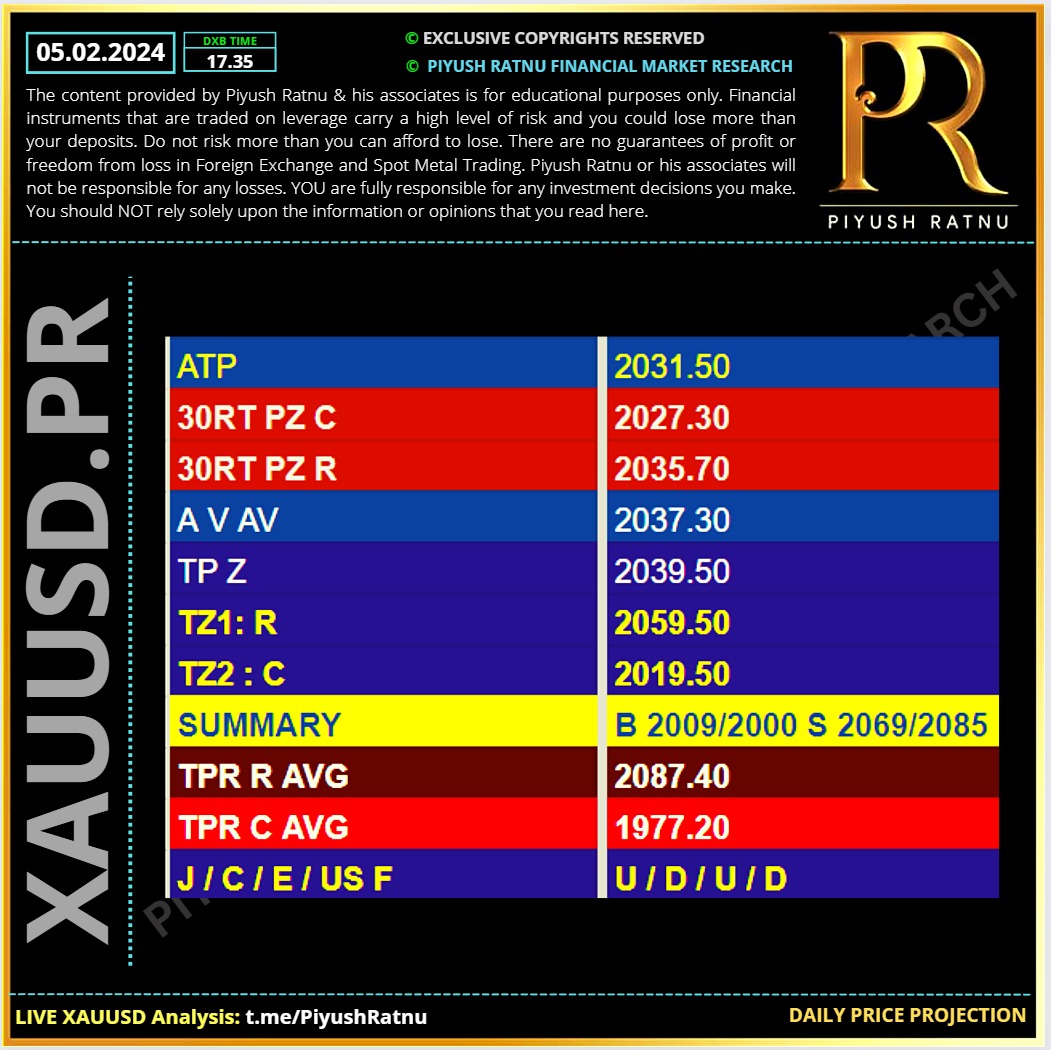

05.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

S2 z achieved

Buying at S2 gave us neat results: CMP $2018

🆘 All trades closed in NAP

Buying at S2 gave us neat results: CMP $2018

🆘 All trades closed in NAP

Piyush Lalsingh Ratnu

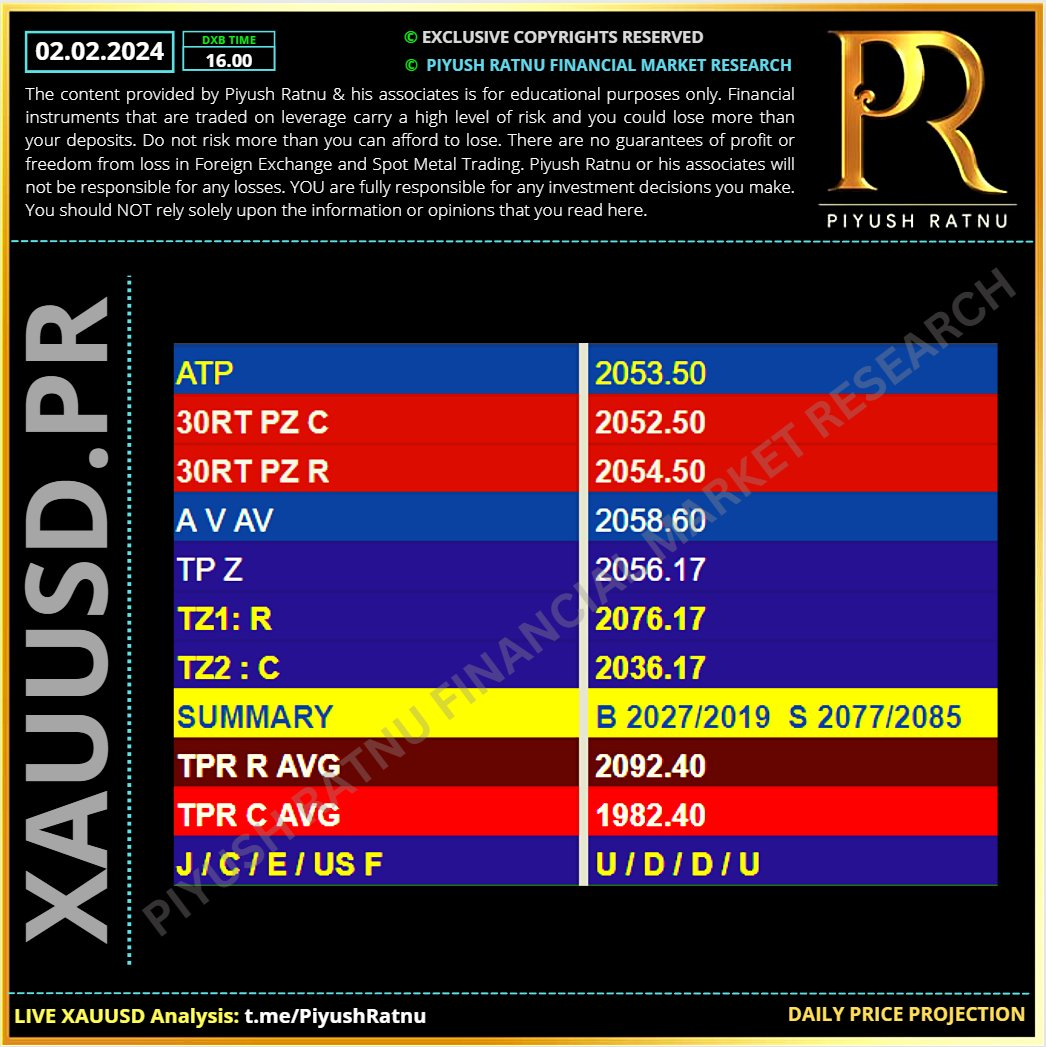

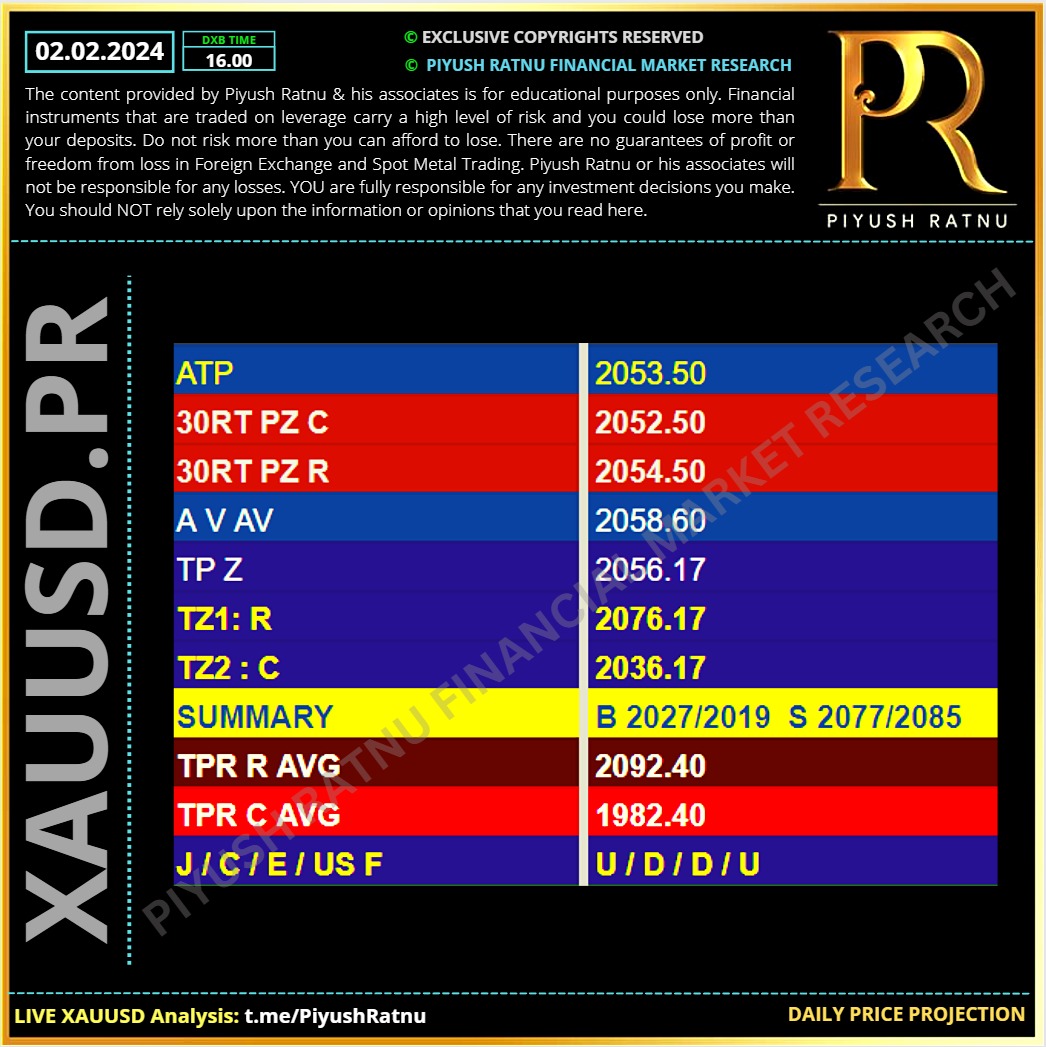

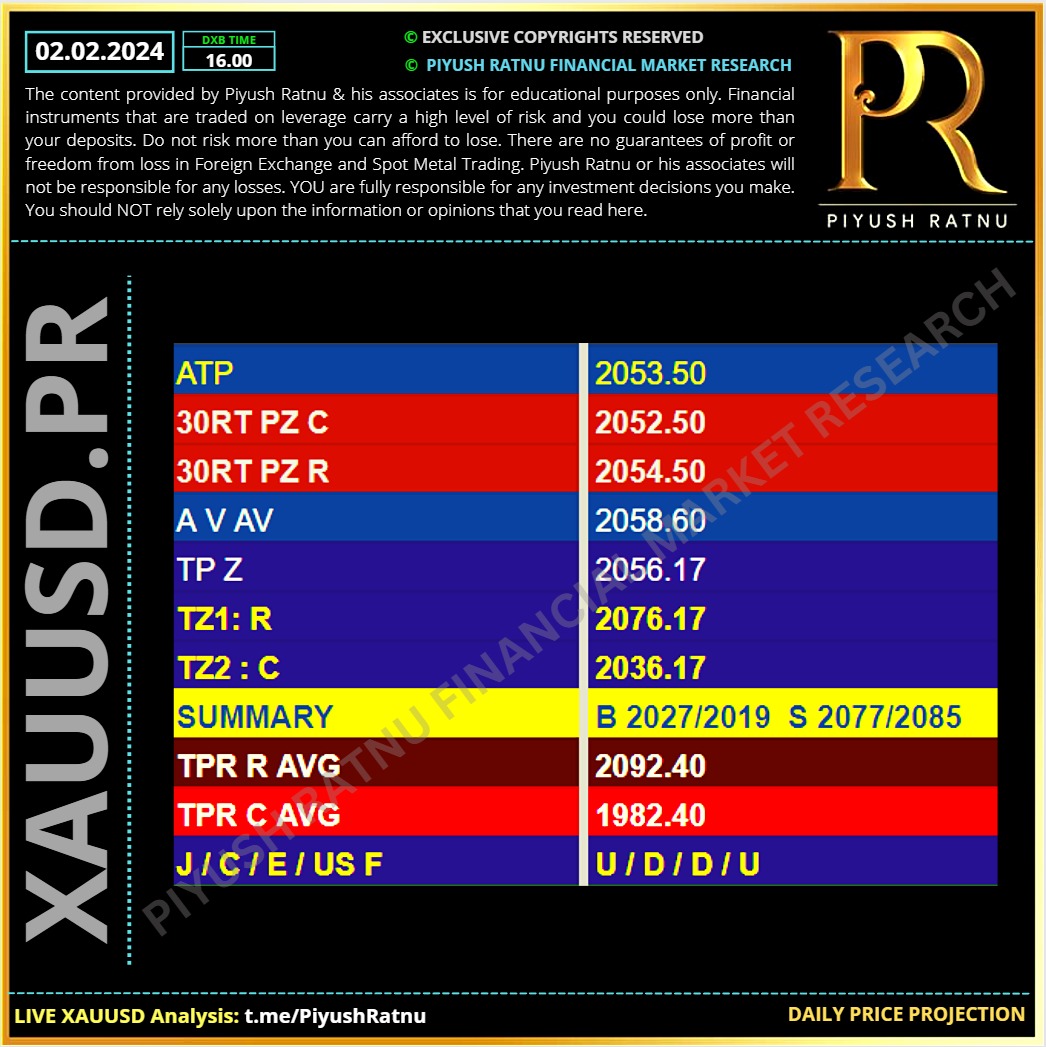

02.02.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 XAUUSD @ H1A0.0

Next: H4A100.0 $2009 zone

S2: 2015

S3: 1997

S4: 1985

Alternate Scenario:

R1: 2045

R2: 2063

R3: 2085

Next: H4A100.0 $2009 zone

S2: 2015

S3: 1997

S4: 1985

Alternate Scenario:

R1: 2045

R2: 2063

R3: 2085

Piyush Lalsingh Ratnu

🆘US UK strikes on Iran:

No reaction observed on charts!

Surprising, still I will wait to BUY lows, I will avoid short positions, as per my experience and knowledge, it is just a web of manipulation, in a blink of an eye they might announce escalation resulting in $50-80 movement.

It will be wise to BUY lows at S2 S3 (PRSR D1) and exit in NAP.

No reaction observed on charts!

Surprising, still I will wait to BUY lows, I will avoid short positions, as per my experience and knowledge, it is just a web of manipulation, in a blink of an eye they might announce escalation resulting in $50-80 movement.

It will be wise to BUY lows at S2 S3 (PRSR D1) and exit in NAP.

Piyush Lalsingh Ratnu

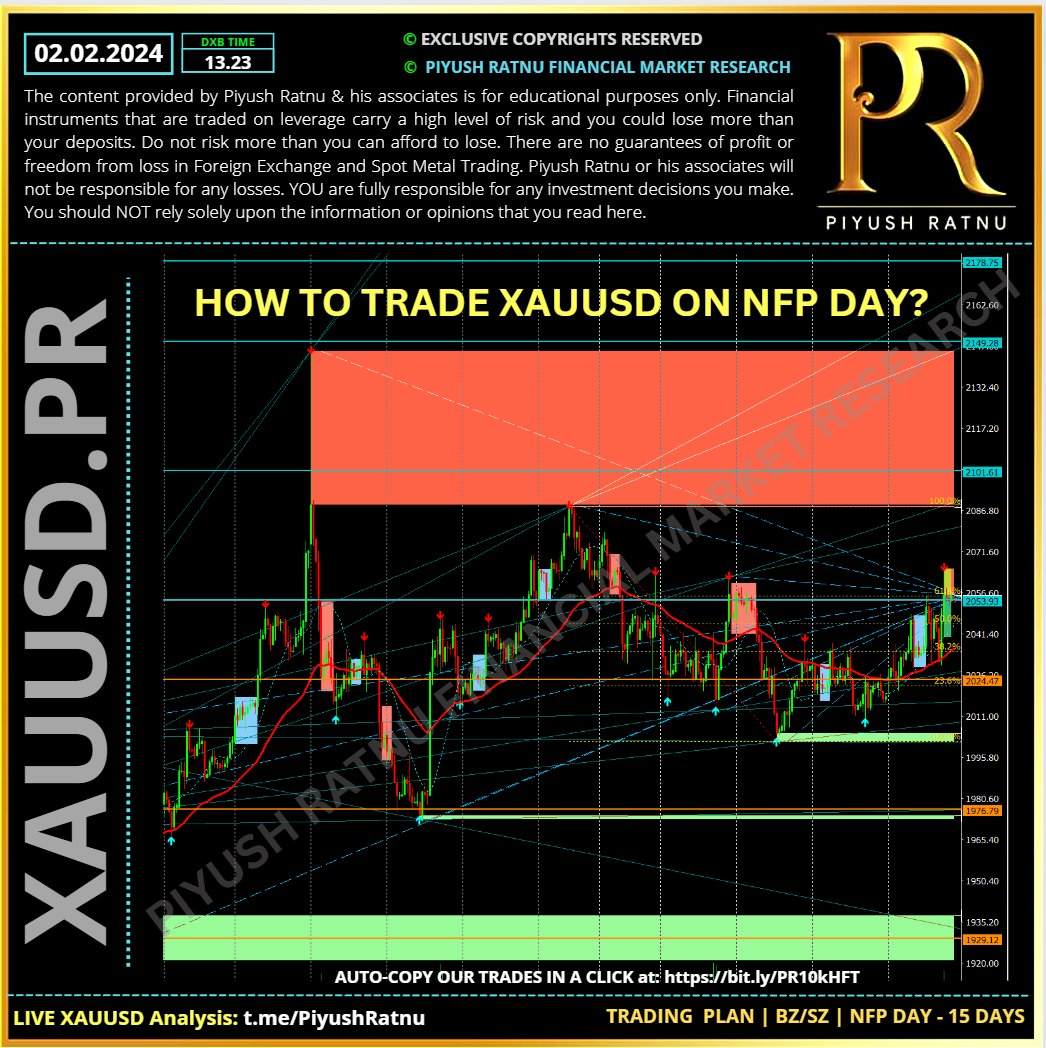

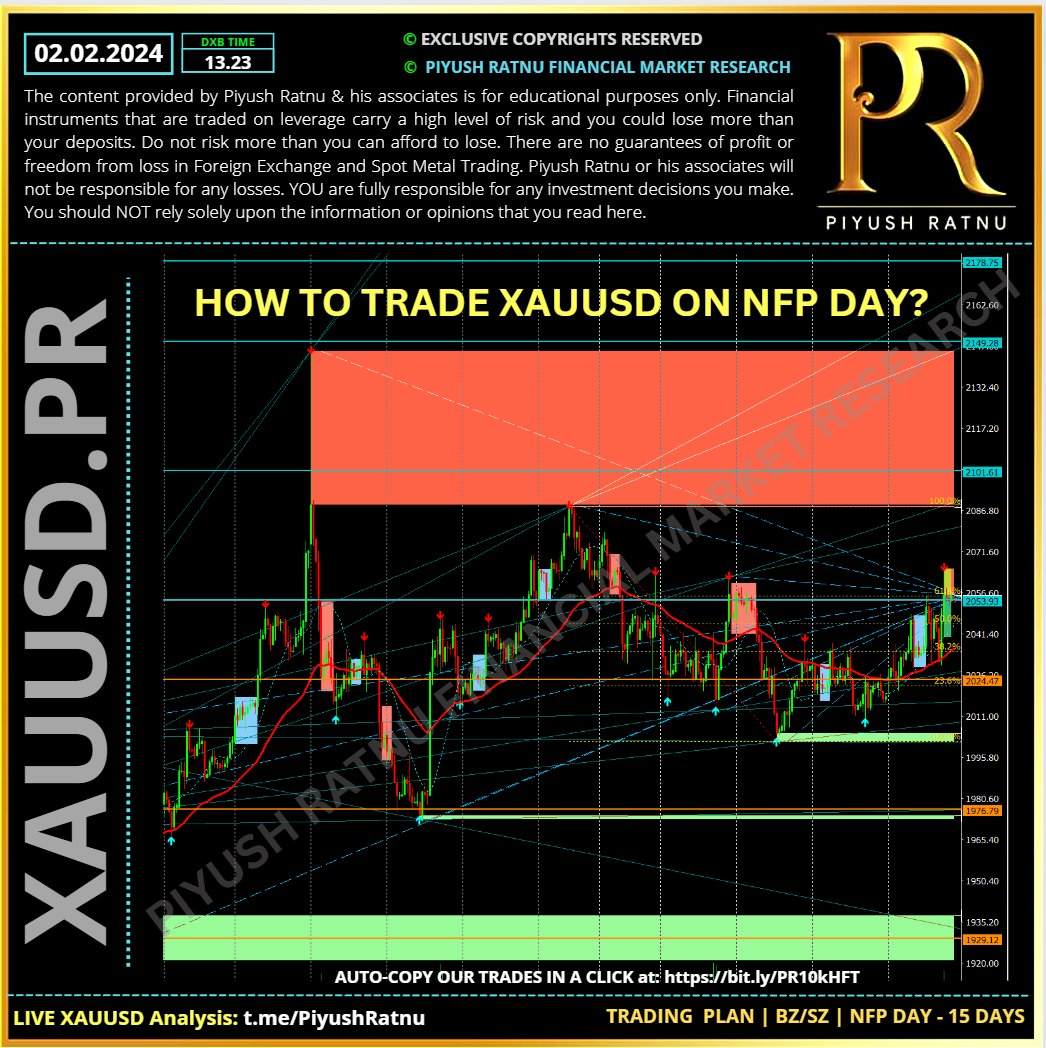

⚠️XAUUSD CMP $2035

M1V382

M5V236

⚠️ USDJPY CMP $147.777

M1A382

M5A236

Achieved | All trades closed in NAP

📌Ongoing trades: 0

M30A 2030 achieved RT 2035 achieved (CMP)

Analysis proved accurate once again on NFP DAY.

M1V382

M5V236

⚠️ USDJPY CMP $147.777

M1A382

M5A236

Achieved | All trades closed in NAP

📌Ongoing trades: 0

M30A 2030 achieved RT 2035 achieved (CMP)

Analysis proved accurate once again on NFP DAY.

Piyush Lalsingh Ratnu

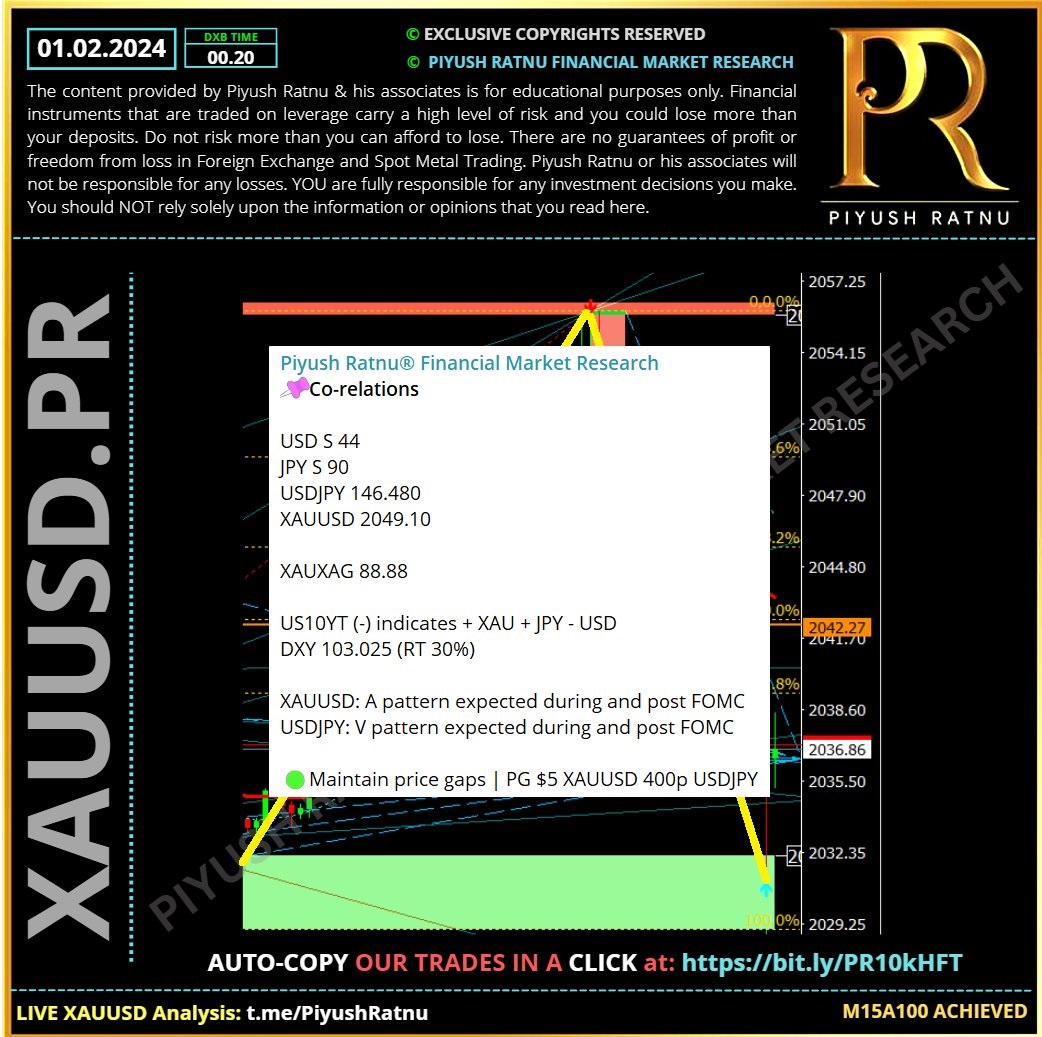

USDJPY 1000 pips + completed

Impact pending on XAUUSD: -$30 | $13 witnessed

CMP $2038

Impact pending on XAUUSD: -$30 | $13 witnessed

CMP $2038

Piyush Lalsingh Ratnu

How to trade XAUUSD Spot Gold with accuracy on Non Farm Payrolls Day?

Trading Scenario and Price Analysis by Piyush Ratnu

Trading Scenario and Price Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

Key factors impacting XAUUSD Price:

• Gold price rebounds strongly from the day’s low near $2,030 despite the Federal Reserve not being interested in reducing interest rates in March.

• In his monetary policy statement on Wednesday, Fed Chair Jerome Powell turned down speculation for reducing interest rates until policymakers get greater confidence that underlying inflation will sustainably return to the 2% target.

• A strict denial for rate cuts in March has shifted expectations to the May policy meeting.

• As per the CME Fedwatch tool, traders see a 61% chance of a rate cut by 25 basis points (bps) to 5.00%-5.25% for May.

• The Fed’s decision to keep interest rates unchanged in the range of 5.25%-5.50% for the fourth straight time was widely anticipated.

• Also, Jerome Powell said, “risks to achieving full employment and 2% inflation are better balanced.”

• The US Dollar Index (DXY) faces pressure near 103.80 as investors know that rate cuts by the Fed are imminent. Meanwhile, various economic data are lined up that will guide further action in the safe-haven assets.

• In today’s session, market participants will focus on the ISM Manufacturing PMI for January and the Initial Jobless Claims (IJC) for the week ending January 26.

• According to the estimates, the Manufacturing PMI fell to 47.0 from December’s reading of 47.4. The reasoning behind lower factory output would be higher furloughs due to the festive mood.

• The Manufacturing PMI data will be followed by the official Employment data for January, which will be published on Friday.

• The private Employment Change data, reported by the ADP on Wednesday, showed that private employers recruited 107K workers in December, which was significantly lower than expectations of 145K and the former reading of 158K.

• This has set a negative undertone for the NFP data ahead. Investors anticipate that overall payroll additions slowed to 180K against 216K in December. The Unemployment Rate is expected to increase to 3.8% from 3.7%.

• Apart from employment numbers, wage growth data will in be the focus as it will guide inflation, being a major contributor to high price pressures.

• The annual Average Hourly Earnings is seen steady at 4.1%. The month-on-month wage growth may have grown at a slower pace of 0.3% against a 0.4% increase in December. A slowdown in the wage growth data would soften the inflation outlook.

• Gold price rebounds strongly from the day’s low near $2,030 despite the Federal Reserve not being interested in reducing interest rates in March.

• In his monetary policy statement on Wednesday, Fed Chair Jerome Powell turned down speculation for reducing interest rates until policymakers get greater confidence that underlying inflation will sustainably return to the 2% target.

• A strict denial for rate cuts in March has shifted expectations to the May policy meeting.

• As per the CME Fedwatch tool, traders see a 61% chance of a rate cut by 25 basis points (bps) to 5.00%-5.25% for May.

• The Fed’s decision to keep interest rates unchanged in the range of 5.25%-5.50% for the fourth straight time was widely anticipated.

• Also, Jerome Powell said, “risks to achieving full employment and 2% inflation are better balanced.”

• The US Dollar Index (DXY) faces pressure near 103.80 as investors know that rate cuts by the Fed are imminent. Meanwhile, various economic data are lined up that will guide further action in the safe-haven assets.

• In today’s session, market participants will focus on the ISM Manufacturing PMI for January and the Initial Jobless Claims (IJC) for the week ending January 26.

• According to the estimates, the Manufacturing PMI fell to 47.0 from December’s reading of 47.4. The reasoning behind lower factory output would be higher furloughs due to the festive mood.

• The Manufacturing PMI data will be followed by the official Employment data for January, which will be published on Friday.

• The private Employment Change data, reported by the ADP on Wednesday, showed that private employers recruited 107K workers in December, which was significantly lower than expectations of 145K and the former reading of 158K.

• This has set a negative undertone for the NFP data ahead. Investors anticipate that overall payroll additions slowed to 180K against 216K in December. The Unemployment Rate is expected to increase to 3.8% from 3.7%.

• Apart from employment numbers, wage growth data will in be the focus as it will guide inflation, being a major contributor to high price pressures.

• The annual Average Hourly Earnings is seen steady at 4.1%. The month-on-month wage growth may have grown at a slower pace of 0.3% against a 0.4% increase in December. A slowdown in the wage growth data would soften the inflation outlook.

Piyush Lalsingh Ratnu

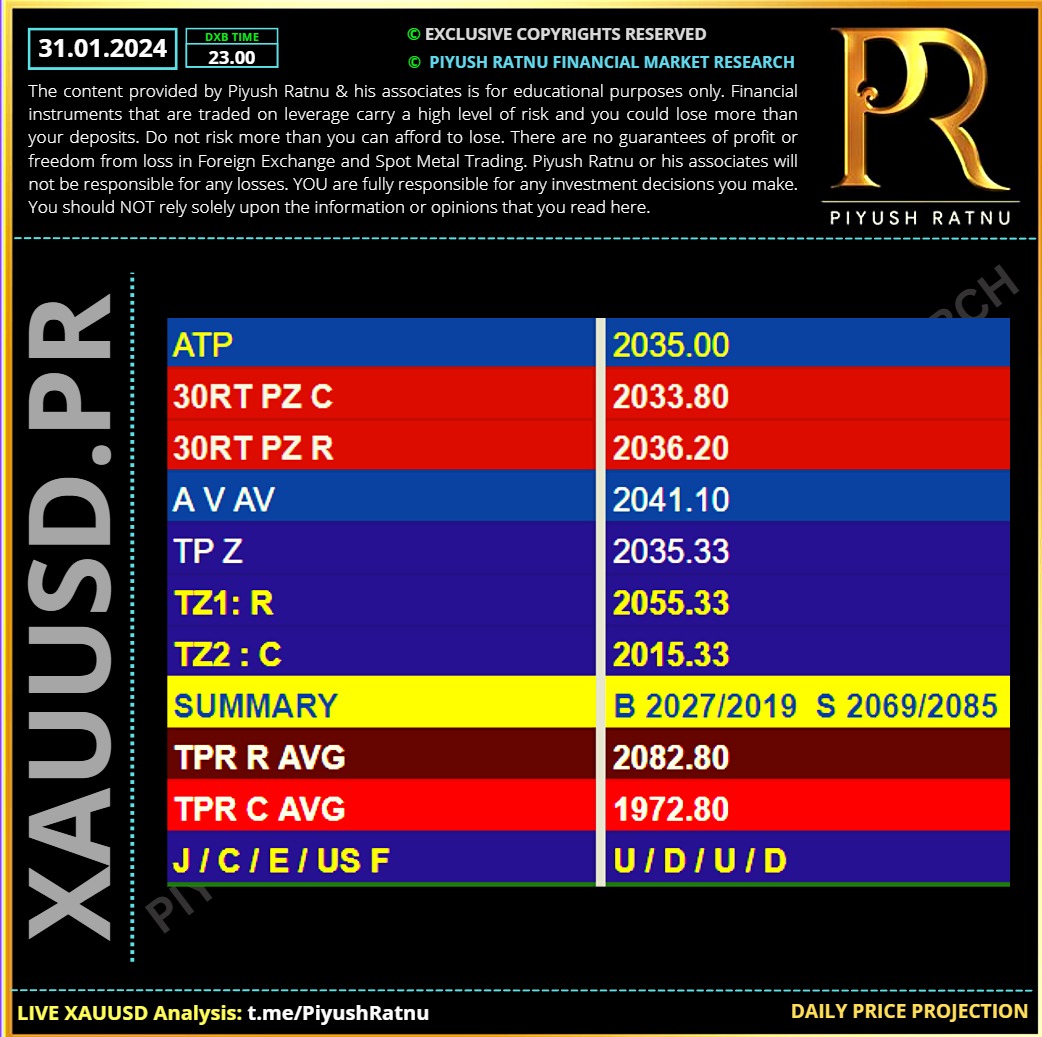

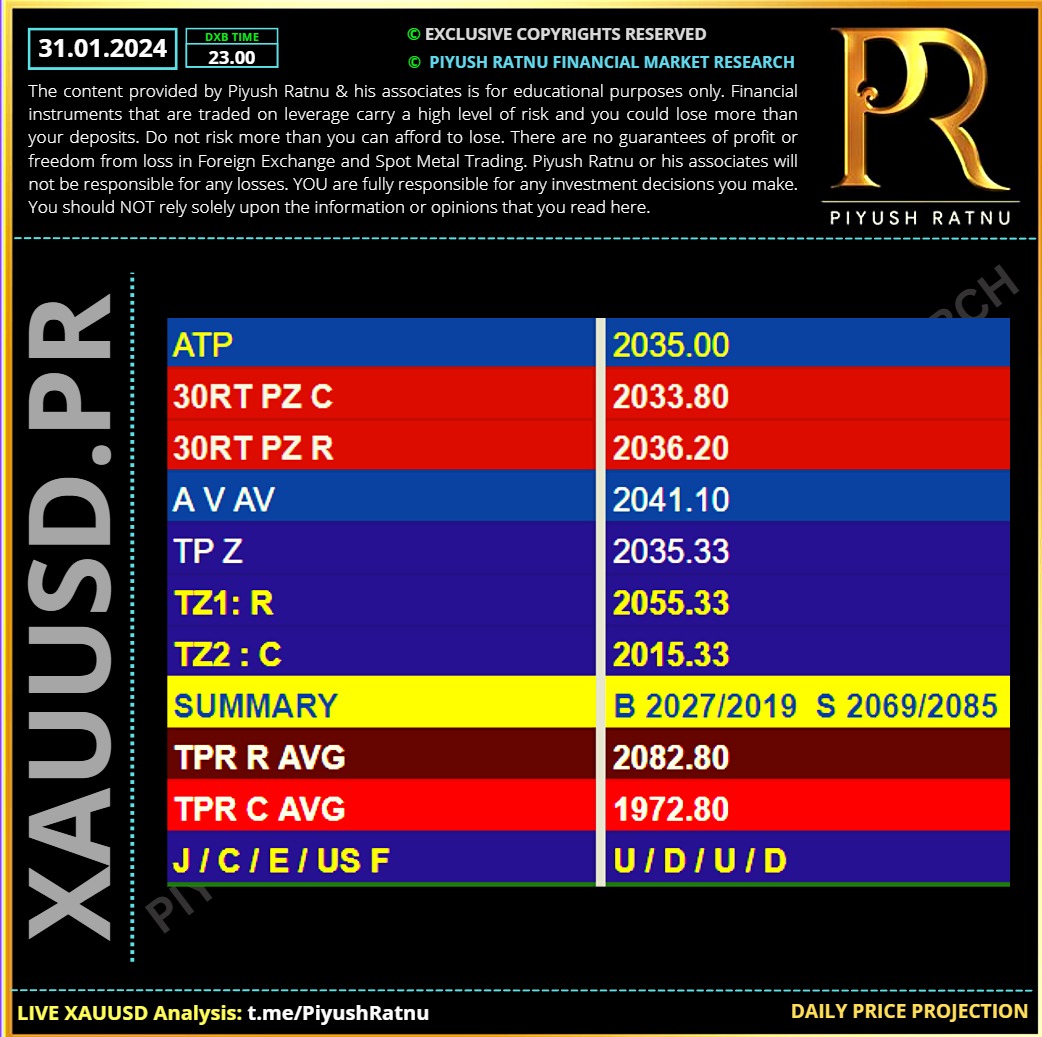

31.01.2024 | XAUUSD : Daily Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Piyush Lalsingh Ratnu

🟢 M5A50 M15A382 M30A382 H1A23.6 achieved

XAUUSD CMP $2046

Selling at and above $2048 gave us neat exit

NEXT: $2025/2019 or $2060/2069 crucial

FUP $2009 / $2085 in Next 4 trading days.

XAUUSD CMP $2046

Selling at and above $2048 gave us neat exit

NEXT: $2025/2019 or $2060/2069 crucial

FUP $2009 / $2085 in Next 4 trading days.

: