Piyush Lalsingh Ratnu / Perfil

- Informações

|

3 anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Lalsingh Ratnu

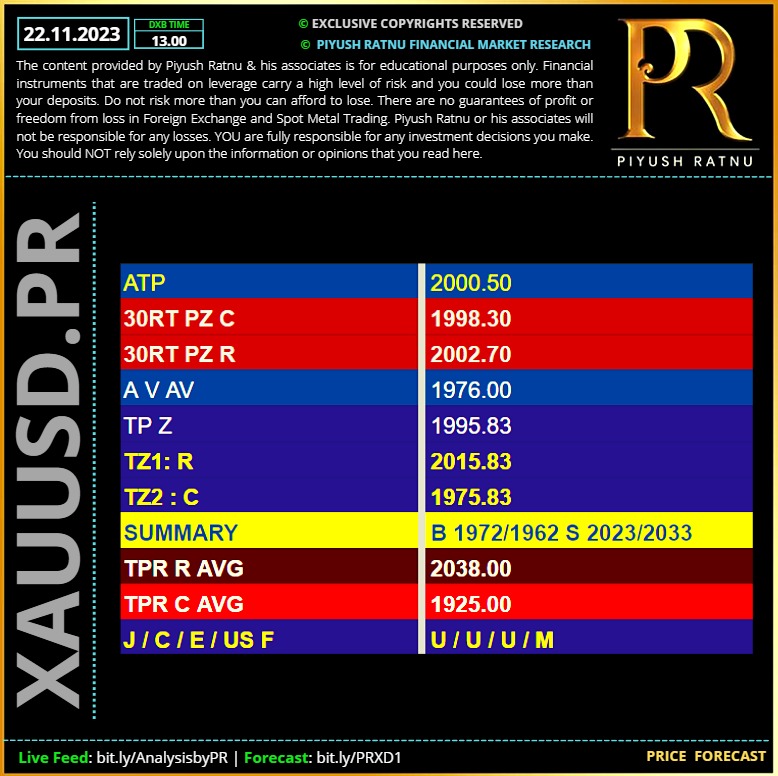

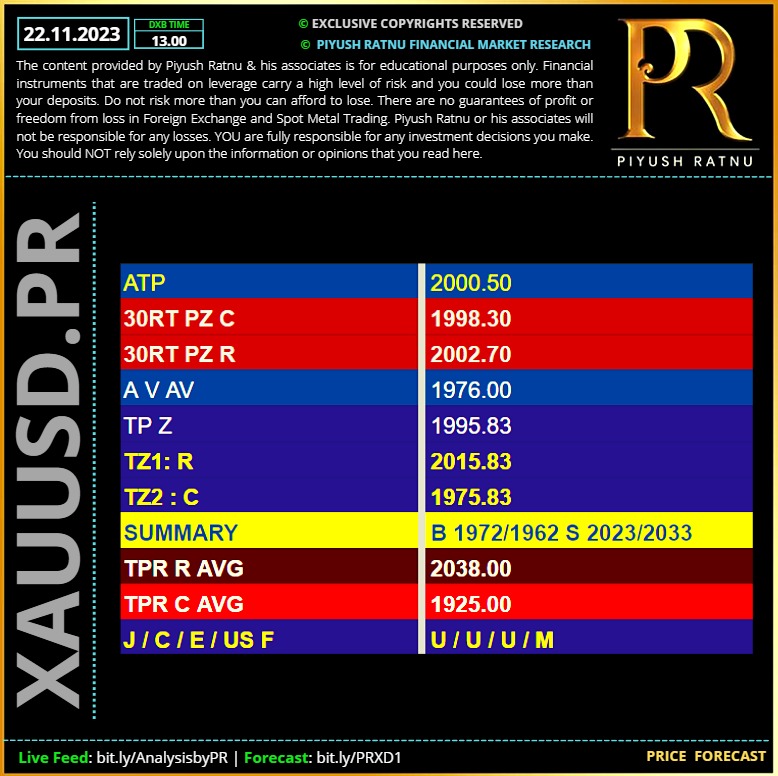

22.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🟢 18.30 hours today: Market Mover

18:30 JPY CPI, n.s.a (MoM) (Oct) 0.3%

18:30 JPY National Core CPI (YoY) (Oct) 3.0% 2.8%

18:30 JPY National CPI (YoY) (Oct) 3.0%

18:50 JPY Foreign Bonds Buying -68.2B

18:50 JPY Foreign Investments in Japanese Stocks 388.4B

🟢 Thursday, November 23, 2023: HOLIDAY

All Day Holiday United States - Thanksgiving Day

All Day Holiday Japan - Workers Day

Price trap as a result of Low volumes might be faced.

Avoid big lots, pile ups.

18:30 JPY CPI, n.s.a (MoM) (Oct) 0.3%

18:30 JPY National Core CPI (YoY) (Oct) 3.0% 2.8%

18:30 JPY National CPI (YoY) (Oct) 3.0%

18:50 JPY Foreign Bonds Buying -68.2B

18:50 JPY Foreign Investments in Japanese Stocks 388.4B

🟢 Thursday, November 23, 2023: HOLIDAY

All Day Holiday United States - Thanksgiving Day

All Day Holiday Japan - Workers Day

Price trap as a result of Low volumes might be faced.

Avoid big lots, pile ups.

Piyush Lalsingh Ratnu

🟢 Strong Support H1AS5 ahead | rising USDJPY indicates -XAUUSD (1990/1985 zone) in next 30 minutes, reversal/retracement might result in $2009/2019 zone: Strong resistance zone.

Piyush Lalsingh Ratnu

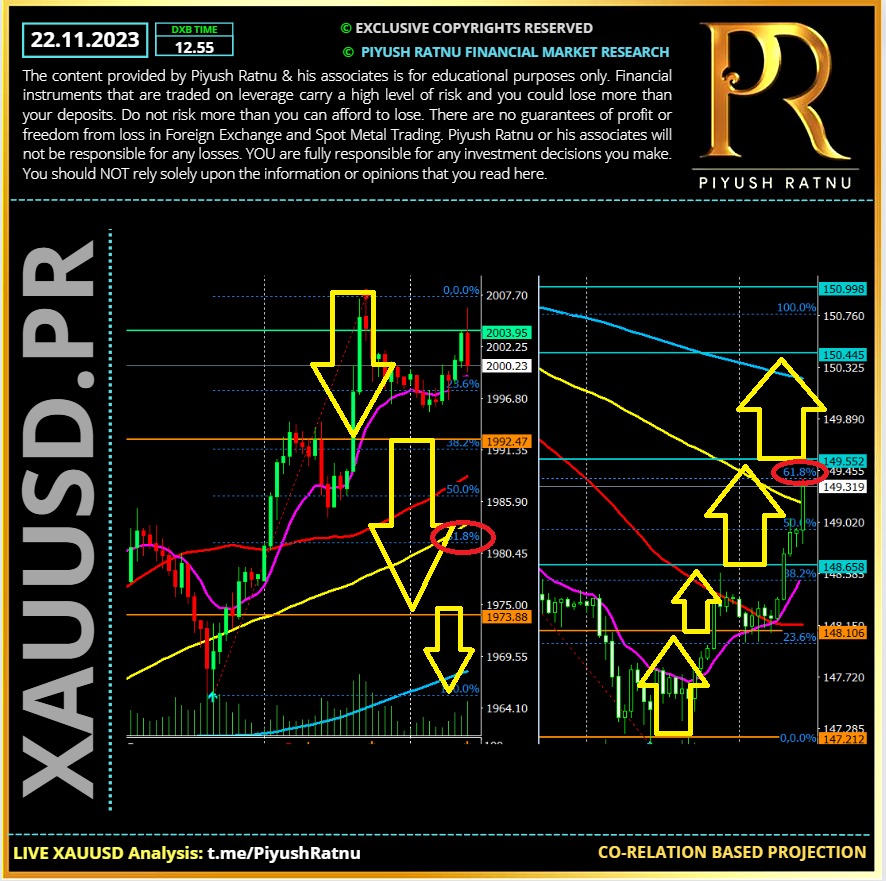

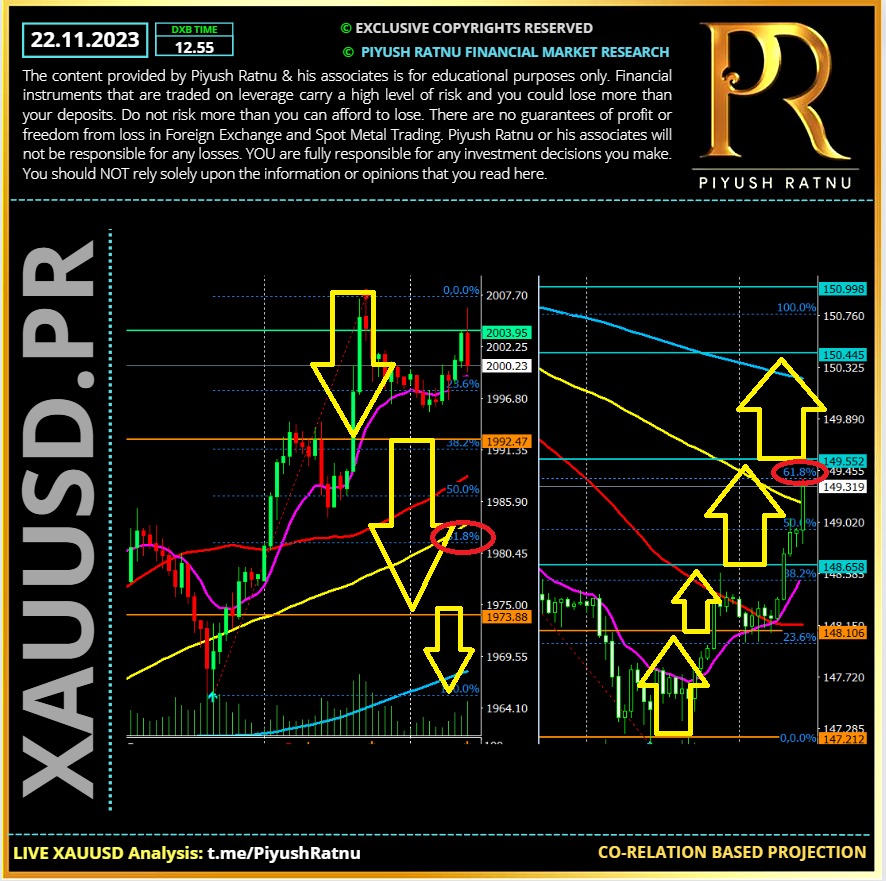

22.11.2023 | XAUUSD : Correlation based projections | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

ALERT: Market reversal in process:

🍎 USDJPY + 2000 pips

🟢 Pending impact on XAUUSD: - $60

🟢 Target: expect price zone: $1985/1966/1947

H1A100 H4A100 on radar | I will HOLD SHORT Trades 🆘

💠Expected Date Frame: 12.12.2023

🍎 USDJPY + 2000 pips

🟢 Pending impact on XAUUSD: - $60

🟢 Target: expect price zone: $1985/1966/1947

H1A100 H4A100 on radar | I will HOLD SHORT Trades 🆘

💠Expected Date Frame: 12.12.2023

Piyush Lalsingh Ratnu

🟢Daily XAUUSD Market Price Movers:

✔️ The minutes from the Federal Reserve's latest meeting revealed officials backing higher for longer interest rates for some time to tame inflation and underpin the US Dollar.

✔️ Market participants, however, seem convinced that the US central bank will keep rates steady rather than hiking and are pricing in the possibility of rate cuts by spring 2024.

✔️ The benchmark 10-year US Treasury bond yield languishes near a two-month low and turns out to be a key factor driving some flows towards the non-yielding yellow metal.

✔️ The National Association of Realtors reported that US Existing Home Sales fell in October to a seasonally adjusted annual rate of 3.79 million units or the lowest level in more than 13 years.

✔️ Israel and Hamas have agreed to a deal for the staggered release of 50 civilians held hostage in Gaza in exchange for Palestinian prisoners and a four-day halt to hostilities.

✔️ The US military conducted discrete, precision strikes against two Iran-backed facilities in Iraq in response to the attacks against US and Coalition forces by Iran and Iran-backed groups.

✔️ The markets reacted little to the latest development as there hasn't been any major escalation in the Middle East tensions, doing little to influence the safe-haven precious metal.

✔️ Traders now look to the US macro data – Initial Weekly Jobless Claims, Durable Goods Orders and revised Michigan Consumer Sentiment Index – for short-term impetus.

✔️ The minutes from the Federal Reserve's latest meeting revealed officials backing higher for longer interest rates for some time to tame inflation and underpin the US Dollar.

✔️ Market participants, however, seem convinced that the US central bank will keep rates steady rather than hiking and are pricing in the possibility of rate cuts by spring 2024.

✔️ The benchmark 10-year US Treasury bond yield languishes near a two-month low and turns out to be a key factor driving some flows towards the non-yielding yellow metal.

✔️ The National Association of Realtors reported that US Existing Home Sales fell in October to a seasonally adjusted annual rate of 3.79 million units or the lowest level in more than 13 years.

✔️ Israel and Hamas have agreed to a deal for the staggered release of 50 civilians held hostage in Gaza in exchange for Palestinian prisoners and a four-day halt to hostilities.

✔️ The US military conducted discrete, precision strikes against two Iran-backed facilities in Iraq in response to the attacks against US and Coalition forces by Iran and Iran-backed groups.

✔️ The markets reacted little to the latest development as there hasn't been any major escalation in the Middle East tensions, doing little to influence the safe-haven precious metal.

✔️ Traders now look to the US macro data – Initial Weekly Jobless Claims, Durable Goods Orders and revised Michigan Consumer Sentiment Index – for short-term impetus.

Piyush Lalsingh Ratnu

Stocks are still rocking and rolling in what’s been a strong month so far. The Dow closed about 200 points higher Monday, while the S&P 500 and the Nasdaq are on five-day winning streaks.

Treasury yields have come down a bit, with hopes that the Federal Reserve is easing off its inflation-fighting rate-hiking initiative.

We’ll hear more about what the Fed’s thinking about inflation and the state of the economy with the central bank set to release the minutes from its last policy-setting meeting. 23.00 hours | Today ♾

Treasury yields have come down a bit, with hopes that the Federal Reserve is easing off its inflation-fighting rate-hiking initiative.

We’ll hear more about what the Fed’s thinking about inflation and the state of the economy with the central bank set to release the minutes from its last policy-setting meeting. 23.00 hours | Today ♾

Piyush Lalsingh Ratnu

XAUUSD marching towards $2005 due to co-relation based pending price movement (1965+40), as alerted in morning at 08.50 hours.

🟢 I will implement SHORT positions from 1999 in GR:

1 PG $6

1 PG $6

2 PG $6

2 PG $6

3 PG $6

3 PG $6

5 PG $6

5 PG $6

Net Price Mapping: $48: 2048 | NAP EXIT

🟢 I will implement SHORT positions from 1999 in GR:

1 PG $6

1 PG $6

2 PG $6

2 PG $6

3 PG $6

3 PG $6

5 PG $6

5 PG $6

Net Price Mapping: $48: 2048 | NAP EXIT

Piyush Lalsingh Ratnu

🟢Co - relation alert:

USDJPY approaching 30.10.2023 Price zone

$149.000 on radar

In proportion

XAUUSD approaching 30.10.2023 Price Zone

$2009 on radar

USDJPY approaching 30.10.2023 Price zone

$149.000 on radar

In proportion

XAUUSD approaching 30.10.2023 Price Zone

$2009 on radar

Piyush Lalsingh Ratnu

🟢JPY Update:

Bank of Japan (BoJ) Governor Kazuo Ueda, adding to his earlier comments, said that the central bank does not have any specific plan yet on how it will sell ETFs and that a weaker Japanese Yen (JPY) pushes up domestic inflation via a rise in import costs

🟢Quotes:

If the achievement of our price target approaches, we can discuss strategy and guidelines on exiting ultra-loose policy including the fate of our ETF buying.

When we sell ETFs we will do it in a way that avoids as much as possible causing market disruption, and huge losses on the BOJ's balance sheet.

Cannot say decisively that a weak JPY is negative for Japan's economy.

Weak JPY is positive for exports, and profits of globally operating Japanese firms.

Bank of Japan (BoJ) Governor Kazuo Ueda, adding to his earlier comments, said that the central bank does not have any specific plan yet on how it will sell ETFs and that a weaker Japanese Yen (JPY) pushes up domestic inflation via a rise in import costs

🟢Quotes:

If the achievement of our price target approaches, we can discuss strategy and guidelines on exiting ultra-loose policy including the fate of our ETF buying.

When we sell ETFs we will do it in a way that avoids as much as possible causing market disruption, and huge losses on the BOJ's balance sheet.

Cannot say decisively that a weak JPY is negative for Japan's economy.

Weak JPY is positive for exports, and profits of globally operating Japanese firms.

Piyush Lalsingh Ratnu

Gold price is consolidating the weekly gains above $1,980 early Friday, set to snap a two-week losing streak. Falling US Treasury bond yields aid the Gold price uptrend, but the resurgent United States Dollar (USD) could check the bright metal’s bullish momentum.

Cautious optimism prevails, as Asian stock markets ended mixed while the European markets are likely to see a positive open. Resurfacing US-China trade worries and uncertainty around the US Federal Reserve’s (Fed) interest rate outlook are keeping investors on the edge.

Amidst jittery markets, the safe-haven US Dollar is finding a floor, limiting the upside attempts in Gold price. However, Gold price continues to cheer the recent sell-off in the US Treasury bond yields, as the demand for the US government bonds increased on hopes that the US Fed is done with its hiking cycle, with markets pricing in interest rate cuts by May next year.

The latest run of soft US economic data releases cemented Fed pause expectations, justifying the upsurge in the non-interest-bearing Gold price. Earlier this week, the US Producer Price Index (PPI) fell the most in three-and-a-half years in October after the US Consumer Price Index (CPI) inflation fell to 3.2% YoY in October. Further, Retail sales, which are adjusted for seasonality but not inflation, fell 0.1% in October from the prior month. On Thursday, the US Initial claims rose 13,000 to a seasonally adjusted 231,000 for the week ended Nov. 11.

Against this backdrop, Gold price is likely to maintain its uptrend but the end-of-the-week profit-taking could emerge as a headwind alongside a potential extension in the US Dollar recovery. Meanwhile, the US Housing Starts and Building Permits data are unlikely to have a significant impact on the US Dollar trades.

🟢Crucial Price Zones:

C: 1966/1947

R: 2009/2023

Cautious optimism prevails, as Asian stock markets ended mixed while the European markets are likely to see a positive open. Resurfacing US-China trade worries and uncertainty around the US Federal Reserve’s (Fed) interest rate outlook are keeping investors on the edge.

Amidst jittery markets, the safe-haven US Dollar is finding a floor, limiting the upside attempts in Gold price. However, Gold price continues to cheer the recent sell-off in the US Treasury bond yields, as the demand for the US government bonds increased on hopes that the US Fed is done with its hiking cycle, with markets pricing in interest rate cuts by May next year.

The latest run of soft US economic data releases cemented Fed pause expectations, justifying the upsurge in the non-interest-bearing Gold price. Earlier this week, the US Producer Price Index (PPI) fell the most in three-and-a-half years in October after the US Consumer Price Index (CPI) inflation fell to 3.2% YoY in October. Further, Retail sales, which are adjusted for seasonality but not inflation, fell 0.1% in October from the prior month. On Thursday, the US Initial claims rose 13,000 to a seasonally adjusted 231,000 for the week ended Nov. 11.

Against this backdrop, Gold price is likely to maintain its uptrend but the end-of-the-week profit-taking could emerge as a headwind alongside a potential extension in the US Dollar recovery. Meanwhile, the US Housing Starts and Building Permits data are unlikely to have a significant impact on the US Dollar trades.

🟢Crucial Price Zones:

C: 1966/1947

R: 2009/2023

Piyush Lalsingh Ratnu

🆘ALERT:

1000 pips crash observed in USDJPY

Expected impact on GOLD:

$30+ from $1980 zone

Target price Zone: $2009

CMP $1990

I will SELL HIGH with NAP EXIT.

1000 pips crash observed in USDJPY

Expected impact on GOLD:

$30+ from $1980 zone

Target price Zone: $2009

CMP $1990

I will SELL HIGH with NAP EXIT.

Piyush Lalsingh Ratnu

🟢XAUUSD CMP @ R1

R2 and S2 crucial zones

I would prefer:

Sell positions above R2 +3/6/9

Buy positions below S1 -6/9/12 S2

🆘$1985/1955 crucial Price zones

R2 and S2 crucial zones

I would prefer:

Sell positions above R2 +3/6/9

Buy positions below S1 -6/9/12 S2

🆘$1985/1955 crucial Price zones

Piyush Lalsingh Ratnu

US 10YT crashed -1.01%

USD S 49

USDJPY 151.410

XAUXAG 86.22

DXY 105.670

🟢Impact:

XAUUSD should form a V formation, hence I will BUY lows.

USD S 49

USDJPY 151.410

XAUXAG 86.22

DXY 105.670

🟢Impact:

XAUUSD should form a V formation, hence I will BUY lows.

Piyush Lalsingh Ratnu

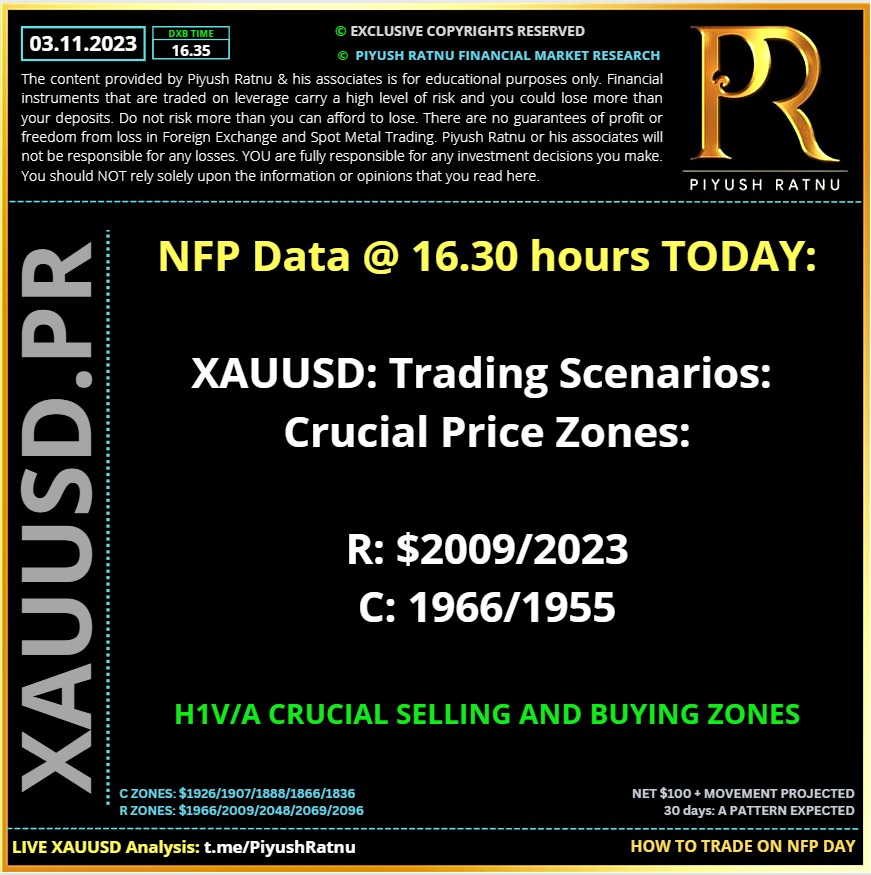

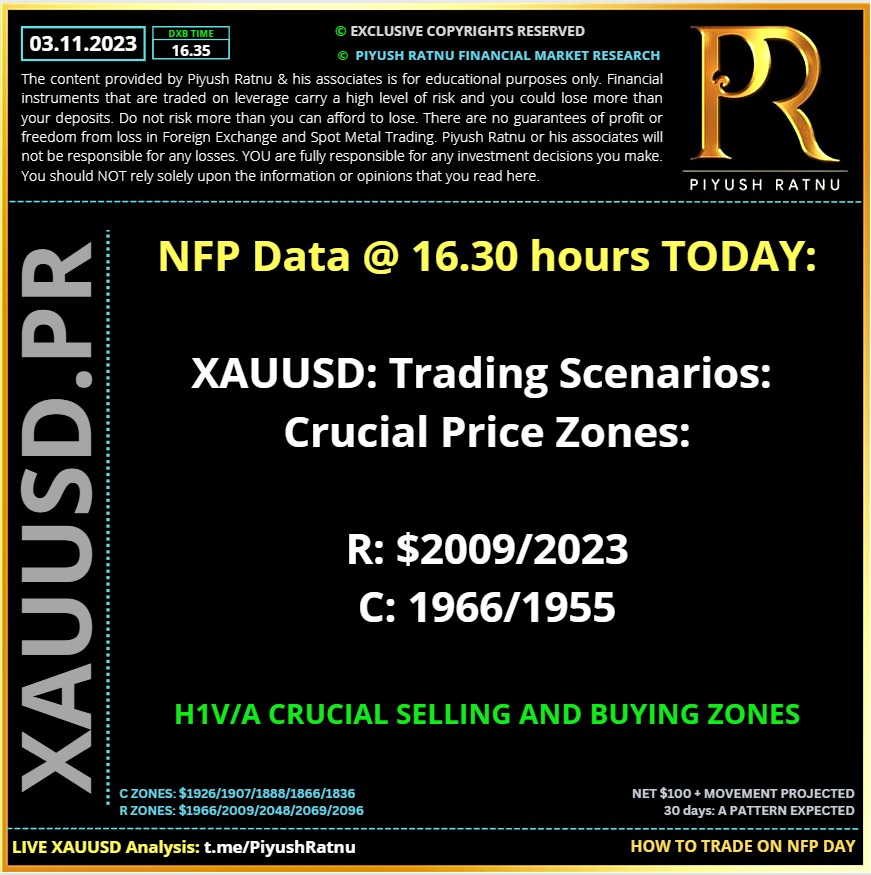

NFP DAY: HOW TO TRADE XAUUSD TODAY?

FACTS:

🟢Gold price treads water below $2,000, awaits US Nonfarm Payrolls for a fresh impetus.

🟢US Dollar stalls sell-off with US Treasury bond yields as risk tone turns cautious.

🟢Gold price is poised for a fresh advance amid a bullish daily technical setup.

Gold price is finding support from a subdued performance in the US Dollar and the US Treasury bond yields, as they struggle to stabilize, following the steep losses incurred in the aftermath of a non-committal US Federal Reserve (Fed) policy outlook.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates. Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates.

Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

🆘XAUUSD: Trading Scenarios: Crucial Price Zones:

R: $2009/2023 SZ

C: 1966/1955 BZ

🔘 EXIT NAP

FACTS:

🟢Gold price treads water below $2,000, awaits US Nonfarm Payrolls for a fresh impetus.

🟢US Dollar stalls sell-off with US Treasury bond yields as risk tone turns cautious.

🟢Gold price is poised for a fresh advance amid a bullish daily technical setup.

Gold price is finding support from a subdued performance in the US Dollar and the US Treasury bond yields, as they struggle to stabilize, following the steep losses incurred in the aftermath of a non-committal US Federal Reserve (Fed) policy outlook.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates. Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

The sell-off in the US Dollar extended on Thursday, as the benchmark 10-year US Treasury bond yields breached the 4.70% key level on increased expectations that the Federal Reserve is done with hiking rates.

Further, a hawkish pause from the Bank of England (BoE) boosted the GBP/USD pair, weighing down on the US Dollar. The BoE kept the policy rate steady at 5.25%, as widely expected but three policymakers voted in favor of a hike, suggesting that the door remains open for future rate hikes.

🆘XAUUSD: Trading Scenarios: Crucial Price Zones:

R: $2009/2023 SZ

C: 1966/1955 BZ

🔘 EXIT NAP

Piyush Lalsingh Ratnu

03.11.2023 | How to trade on NFP and Crucial Price Zones | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

🟢 Daily Digest XAUUSD Price Movers:

• Gold price trades directionless below the psychological resistance of $2,000 as investors await further development on the Israel-Palestine war and the Fed’s monetary policy decision.

• The precious metal struggles to come out of the woods but a volatile action is widely anticipated after the announcement of the interest rate decision by the Fed on Wednesday.

• Investors hope that easing price pressures and higher US long-term bond yields would allow Fed policymakers to advocate a steady monetary policy decision.

• Fed Chair Jerome Powell and his colleagues are expected to keep doors open for further policy tightening as robust consumer spending and tight labor market conditions could make consumer inflation stubborn.

• 10-year US Treasury yields have eased to 4.84% ahead of the Fed policy announcement but are extremely high and significantly impacting financial conditions in the US economy.

• Cleveland Fed Bank President Loretta Mester said ahead of November's monetary policy that higher bond yields are equivalent to one interest rate hike of 25 basis points (bps). The Fed could use higher Treasury yields as a substitute for further policy tightening.

• The majority of Fed policymakers hope for a ‘soft landing’ from the Fed as price pressures are consistently easing and the US economy is resilient.

• The US Dollar Index (DXY) retreats from 106.40 (supporting Gold) ahead of the Fed’s monetary policy and crucial economic indicators such as private payrolls and the ISM Manufacturing PMI data for October.

• As per the estimates, 150K fresh private jobs were added against 89K added in September. The Manufacturing PMI is seen steady at 49.0, below the 50.0 threshold for the 12th month in a row.

• Investors should note that the survey done by S&P Global on private factories for October showed that private Manufacturing PMI met the 50.0 threshold. US firms remain optimistic that the Fed is done with hiking interest rates.

• The US manufacturing and service sector is recovering faster due to a strong growth outlook amid robust spending by households. Meanwhile, Goldman Sachs hiked their GDP growth projections for the fourth quarter of 2023 and the first quarter of 2024 to 1.6% and 1.7% respectively.

• The near-term appeal for the Gold price remains upbeat as Israeli defense forces (IDF) prepare for a ground assault in Gaza to dismantle Palestine military troops in retaliation for airstrikes from Hamas.

• The IDR moves gradually in Gaza to keep hopes of the release of more than 200 hostages alive.

• Meanwhile, the World Gold Council (WGC) reported that gold demand by Indian jewelers fell annually due to higher prices. The WGC said that global gold demand excluding over-the-counter (OTC) trading slipped 6% in the third quarter, Reuters reported.

⚠️The WGC hopes that the Gold buying from central banks could reach a new record in 2023.

• Gold price trades directionless below the psychological resistance of $2,000 as investors await further development on the Israel-Palestine war and the Fed’s monetary policy decision.

• The precious metal struggles to come out of the woods but a volatile action is widely anticipated after the announcement of the interest rate decision by the Fed on Wednesday.

• Investors hope that easing price pressures and higher US long-term bond yields would allow Fed policymakers to advocate a steady monetary policy decision.

• Fed Chair Jerome Powell and his colleagues are expected to keep doors open for further policy tightening as robust consumer spending and tight labor market conditions could make consumer inflation stubborn.

• 10-year US Treasury yields have eased to 4.84% ahead of the Fed policy announcement but are extremely high and significantly impacting financial conditions in the US economy.

• Cleveland Fed Bank President Loretta Mester said ahead of November's monetary policy that higher bond yields are equivalent to one interest rate hike of 25 basis points (bps). The Fed could use higher Treasury yields as a substitute for further policy tightening.

• The majority of Fed policymakers hope for a ‘soft landing’ from the Fed as price pressures are consistently easing and the US economy is resilient.

• The US Dollar Index (DXY) retreats from 106.40 (supporting Gold) ahead of the Fed’s monetary policy and crucial economic indicators such as private payrolls and the ISM Manufacturing PMI data for October.

• As per the estimates, 150K fresh private jobs were added against 89K added in September. The Manufacturing PMI is seen steady at 49.0, below the 50.0 threshold for the 12th month in a row.

• Investors should note that the survey done by S&P Global on private factories for October showed that private Manufacturing PMI met the 50.0 threshold. US firms remain optimistic that the Fed is done with hiking interest rates.

• The US manufacturing and service sector is recovering faster due to a strong growth outlook amid robust spending by households. Meanwhile, Goldman Sachs hiked their GDP growth projections for the fourth quarter of 2023 and the first quarter of 2024 to 1.6% and 1.7% respectively.

• The near-term appeal for the Gold price remains upbeat as Israeli defense forces (IDF) prepare for a ground assault in Gaza to dismantle Palestine military troops in retaliation for airstrikes from Hamas.

• The IDR moves gradually in Gaza to keep hopes of the release of more than 200 hostages alive.

• Meanwhile, the World Gold Council (WGC) reported that gold demand by Indian jewelers fell annually due to higher prices. The WGC said that global gold demand excluding over-the-counter (OTC) trading slipped 6% in the third quarter, Reuters reported.

⚠️The WGC hopes that the Gold buying from central banks could reach a new record in 2023.

Piyush Lalsingh Ratnu

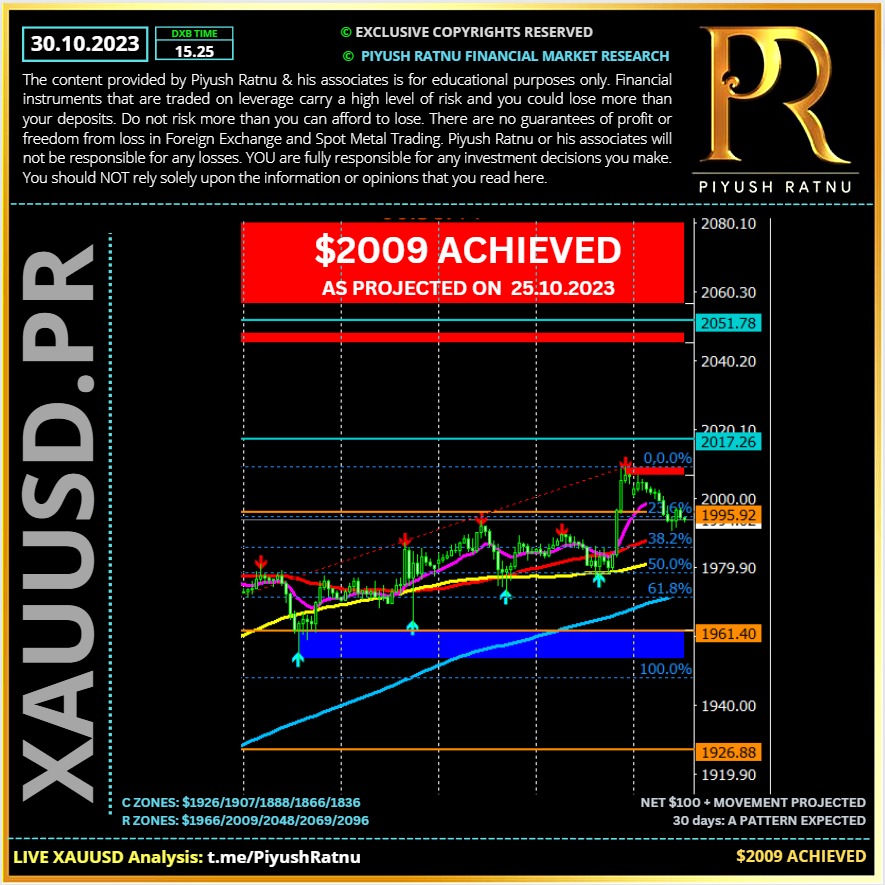

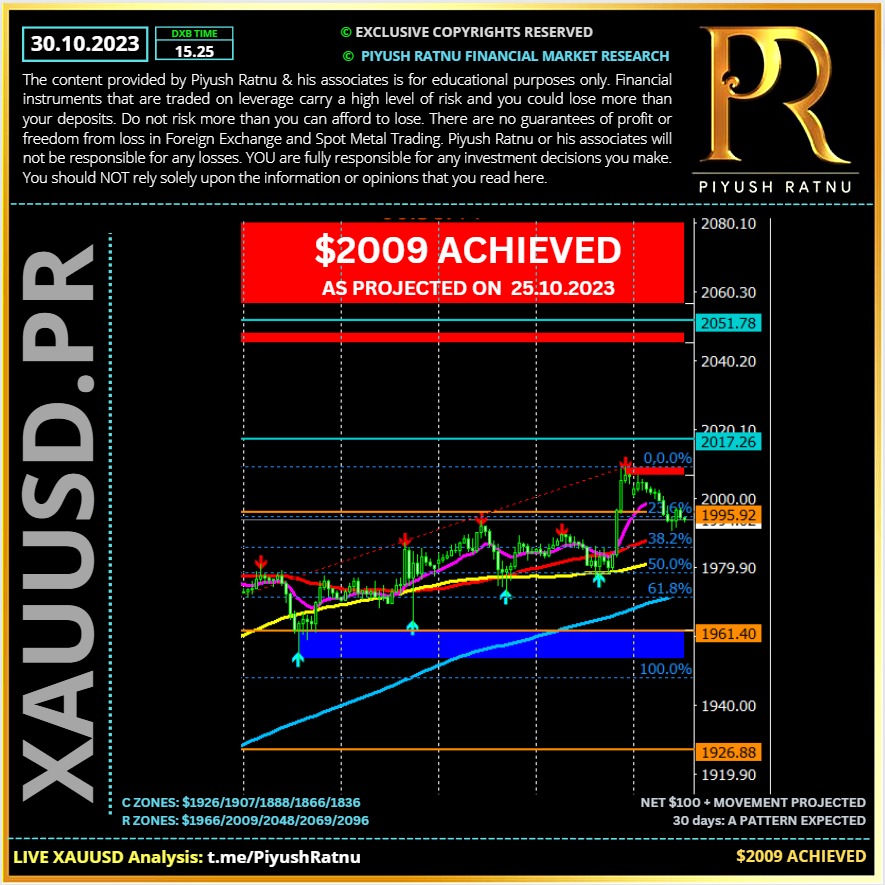

30.10.2023 | As projected by us, XAUUSD touched $2009 | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

⏰XAUUSD current status:

1. below S1 M30AS5 M15AF50 M30AF50

2. @ H1AF382 approaching H1AS5

3. Approaching $1985 zone, today's low $1991

Status of trades: we will HOLD SHORT Positions: SET 3

🟢Set 1 and SET 2 NAP Exit at: $2002 and $1998

1. below S1 M30AS5 M15AF50 M30AF50

2. @ H1AF382 approaching H1AS5

3. Approaching $1985 zone, today's low $1991

Status of trades: we will HOLD SHORT Positions: SET 3

🟢Set 1 and SET 2 NAP Exit at: $2002 and $1998

: