Piyush Lalsingh Ratnu / Perfil

- Informações

|

3 anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Lalsingh Ratnu

20.10.2023 | As alerted by us on 13.10.2023, XAUUSD $1985 Achieved | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Piyush Lalsingh Ratnu

Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Piyush Lalsingh Ratnu

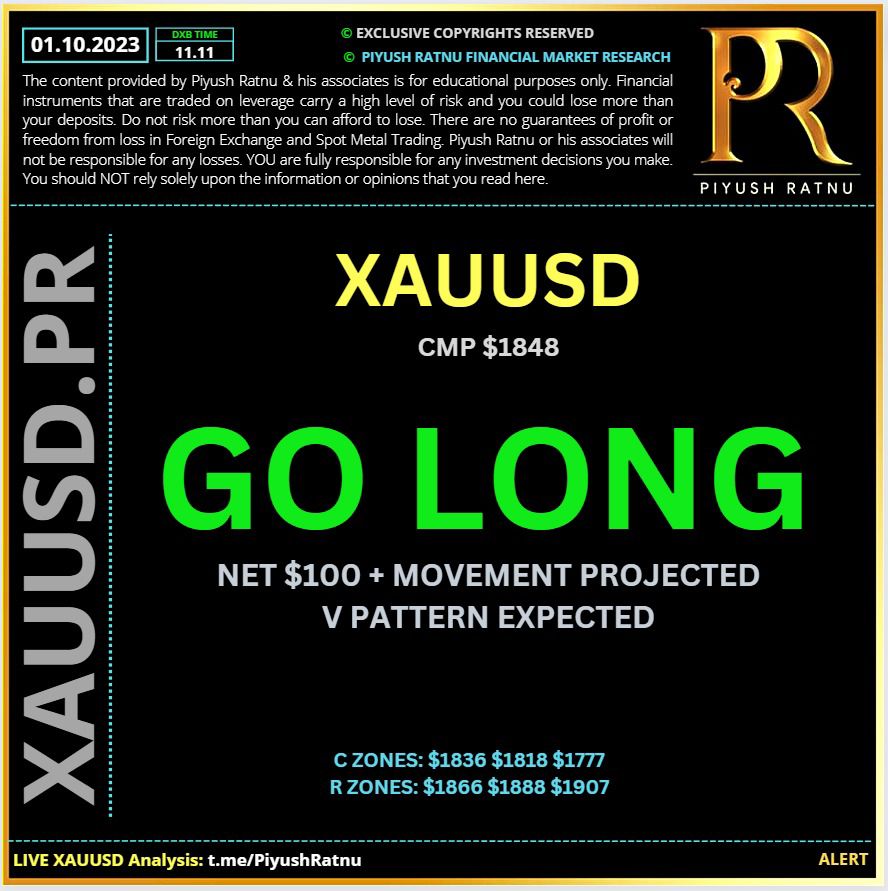

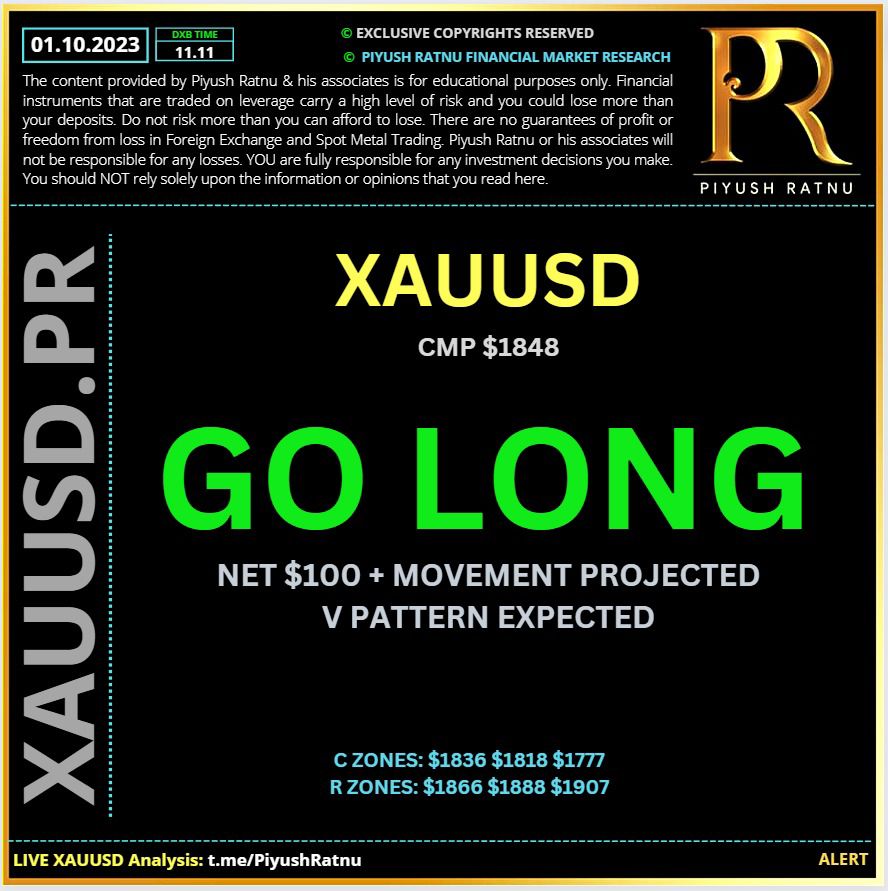

As published in my analysis dated 06.10.2023:

🍎"I expect V pattern on M30, H1 and H4 TF chart in sequence in next 7 trading days (short term target) and 18 trading days (long term target). XAUUSD CMP $1821. I will prefer to BUY lows near D1+W1 SR zone mentioned in the above analysis."

♾I had suggested buying lows near and below $1818 zone, on 06.10.2023, in addition I had projected Long target as $1888 for the buying positions to be achieved before 18.10.2023.

♾XAUUSD breached the mark of $1919 today, 5 days before 18.10.2023 | Geo - political tensions, crashing yields, struggling dollar and reversing futures are the key reasons for the sudden rise in GOLD prices, once again.

🍎"I expect V pattern on M30, H1 and H4 TF chart in sequence in next 7 trading days (short term target) and 18 trading days (long term target). XAUUSD CMP $1821. I will prefer to BUY lows near D1+W1 SR zone mentioned in the above analysis."

♾I had suggested buying lows near and below $1818 zone, on 06.10.2023, in addition I had projected Long target as $1888 for the buying positions to be achieved before 18.10.2023.

♾XAUUSD breached the mark of $1919 today, 5 days before 18.10.2023 | Geo - political tensions, crashing yields, struggling dollar and reversing futures are the key reasons for the sudden rise in GOLD prices, once again.

Piyush Lalsingh Ratnu

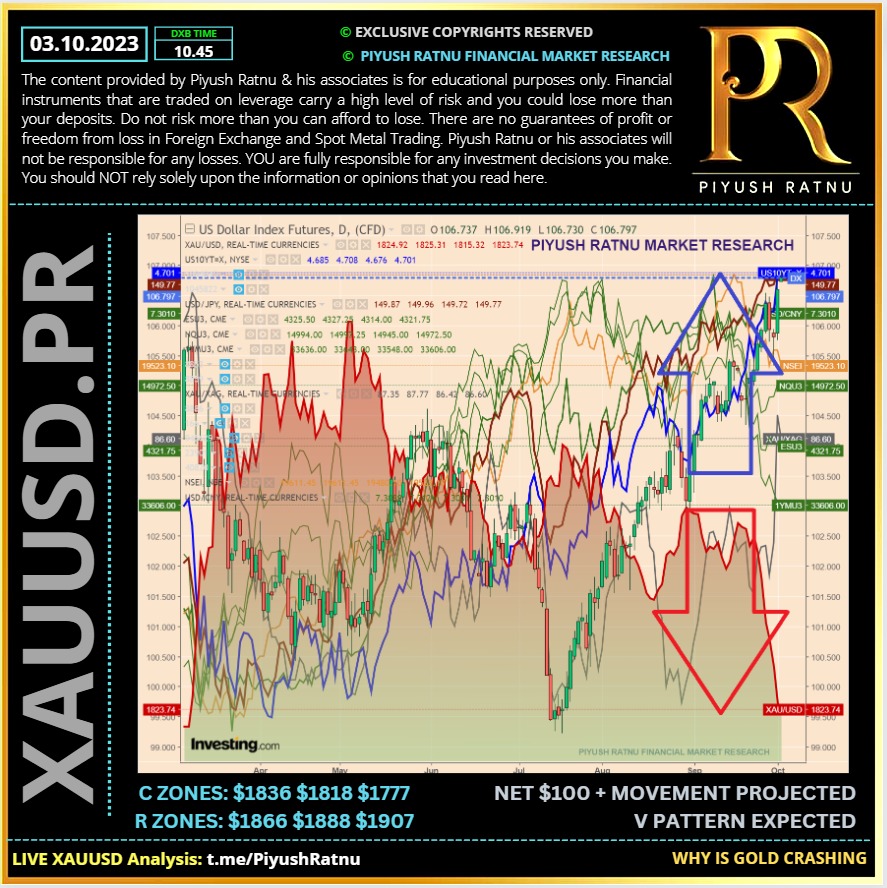

On 03.10.2023: I had projected $1866/1888 before 18.10.2023

Today’s high: $1885. We closed all our buy positions from $1818 zone in net profit today.

Those who believed in our analysis, am sure made handsome profits in the price rise: $1808 zone - $1888 zone.

Today’s high: $1885. We closed all our buy positions from $1818 zone in net profit today.

Those who believed in our analysis, am sure made handsome profits in the price rise: $1808 zone - $1888 zone.

Piyush Lalsingh Ratnu

I had projected V pattern post NFP:

XAUSD crashed from $1820 to $1810, and reversed back to $1820 before 60 minutes.

🟢CMP $1823 R1 above PPZ.

XAUSD crashed from $1820 to $1810, and reversed back to $1820 before 60 minutes.

🟢CMP $1823 R1 above PPZ.

Piyush Lalsingh Ratnu

05.10.2023 | XAUUSD - US NFP deviation correlations | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Piyush Lalsingh Ratnu

🆘Daily Digest Market Movers:

⏰Gold price juggles ahead of US Employment data

• Gold price falls back while attempting a break above the immediate resistance of $1,830.00 as the US Dollar rebounds after correcting to near 106.50. 10-year US Treasury yields improve to near 4.74%.

• The precious metal failed to capitalize on soft US Institute of Supply Management (ISM) Services PMI and a weak ADP Employment Change report for September.

• The US ADP reported that employers hired 89K fresh talent in September, almost half August’s reading of 180K and lower than expectations of 153K. This was the lowest labor growth since January 2021.

• Nela Richardson, chief economist at ADP said "We are seeing a steepening decline in jobs this month"." Additionally, we are seeing a steady decline in wages in the past 12 months."

• Loosening labor market conditions is expected to dent expectations for one more interest rate increase by the Federal Reserve in the remainder of 2023, which were propelled by hawkish interest rate guidance from Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman.

• The US Services PMI for September matched expectations at 53.6 but dropped from the 54.5 reading in August. Being a proxy for the US service sector, which accounts for two-thirds of the US economy, the economic data carries weight and importance.

• New Services PMI Orders dropped significantly to 51.8 against the former release of 57.5, indicating a poor demand outlook.

• On the US factory activity front, the Manufacturing PMI for September improved significantly. A revival in the US manufacturing sector is anticipated. New Factory Orders in August expanded by 1.2% vs. expectations of a 0.3% gain on a monthly basis. In July, orders for US-made goods contracted by 2.1%.

• The US Dollar Index (DXY) faced selling pressure after weak US data on Wednesday but has revived gradually as investors appear to have placed less significance on the September ADP Employment Change. The Fed is scheduled to announce its next monetary policy move in November. Policymakers are expected to give more preference to October’s private payrolls data.

• Meanwhile, investors await the NFP report for September, which will provide more clarity about labor market conditions.

• According to estimates, the US labor force is expected to have witnessed fresh additions of 170K employees – lower than the former release of 187K. The Unemployment Rate is seen declining to 3.7% vs. August’s reading of 3.8%.

• In addition to the jobs data, investors will watch out for the Average Hourly Earnings data. On a monthly basis, labor earnings are forecast to have expanded at a higher pace of 0.3% against a 0.2% jump recorded in August. The annual data is seen unchanged at 4.3%. Higher wages could elevate consumer inflation expectations ahead.

⏰Gold price juggles ahead of US Employment data

• Gold price falls back while attempting a break above the immediate resistance of $1,830.00 as the US Dollar rebounds after correcting to near 106.50. 10-year US Treasury yields improve to near 4.74%.

• The precious metal failed to capitalize on soft US Institute of Supply Management (ISM) Services PMI and a weak ADP Employment Change report for September.

• The US ADP reported that employers hired 89K fresh talent in September, almost half August’s reading of 180K and lower than expectations of 153K. This was the lowest labor growth since January 2021.

• Nela Richardson, chief economist at ADP said "We are seeing a steepening decline in jobs this month"." Additionally, we are seeing a steady decline in wages in the past 12 months."

• Loosening labor market conditions is expected to dent expectations for one more interest rate increase by the Federal Reserve in the remainder of 2023, which were propelled by hawkish interest rate guidance from Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman.

• The US Services PMI for September matched expectations at 53.6 but dropped from the 54.5 reading in August. Being a proxy for the US service sector, which accounts for two-thirds of the US economy, the economic data carries weight and importance.

• New Services PMI Orders dropped significantly to 51.8 against the former release of 57.5, indicating a poor demand outlook.

• On the US factory activity front, the Manufacturing PMI for September improved significantly. A revival in the US manufacturing sector is anticipated. New Factory Orders in August expanded by 1.2% vs. expectations of a 0.3% gain on a monthly basis. In July, orders for US-made goods contracted by 2.1%.

• The US Dollar Index (DXY) faced selling pressure after weak US data on Wednesday but has revived gradually as investors appear to have placed less significance on the September ADP Employment Change. The Fed is scheduled to announce its next monetary policy move in November. Policymakers are expected to give more preference to October’s private payrolls data.

• Meanwhile, investors await the NFP report for September, which will provide more clarity about labor market conditions.

• According to estimates, the US labor force is expected to have witnessed fresh additions of 170K employees – lower than the former release of 187K. The Unemployment Rate is seen declining to 3.7% vs. August’s reading of 3.8%.

• In addition to the jobs data, investors will watch out for the Average Hourly Earnings data. On a monthly basis, labor earnings are forecast to have expanded at a higher pace of 0.3% against a 0.2% jump recorded in August. The annual data is seen unchanged at 4.3%. Higher wages could elevate consumer inflation expectations ahead.

Piyush Lalsingh Ratnu

Buying at $1818 gave us good results: XAUUSD reversed from $1815 today morning back to $1827 (CMP)

Net pips achieved: 800+ in 8 hours.

Those who do not want to take higher risk can close their positions at CMP. Those who can add additional funds to increase the size of their account in case of a deeper crash: can hold their positions.

I expect V on M30 Hand H1 TF in sequence in next 10 days.⚠️

Kindly refer our algorithm: PRSDBS and PRFIBRTSQ to understand the V patterns, and retracement zones with current: ideal B/S zones.

🟢Scenario 1:

T parameters: $1836 a tough nut ahead:

Breach= $1866/1888

M15VS1

M30VS5

H1V236

🟢Scenario 2: Reversal: $1818/1800/1777

XAUUSD PRICE Current status: PRPZ:

M15V100 achieved

M30V50 achieved

H1V236 achieved

H4VE10 achieved

18.40 hours:

🆘XAUUSD back to $1828 third time, Exit BUY positions.

Buying at and below $1818: gave us neat exits since morning.

Net pips achieved: 800+ in 8 hours.

Those who do not want to take higher risk can close their positions at CMP. Those who can add additional funds to increase the size of their account in case of a deeper crash: can hold their positions.

I expect V on M30 Hand H1 TF in sequence in next 10 days.⚠️

Kindly refer our algorithm: PRSDBS and PRFIBRTSQ to understand the V patterns, and retracement zones with current: ideal B/S zones.

🟢Scenario 1:

T parameters: $1836 a tough nut ahead:

Breach= $1866/1888

M15VS1

M30VS5

H1V236

🟢Scenario 2: Reversal: $1818/1800/1777

XAUUSD PRICE Current status: PRPZ:

M15V100 achieved

M30V50 achieved

H1V236 achieved

H4VE10 achieved

18.40 hours:

🆘XAUUSD back to $1828 third time, Exit BUY positions.

Buying at and below $1818: gave us neat exits since morning.

Piyush Lalsingh Ratnu

♾Premium Portfolio Accounts: Open position status:

OP 18.18

@1820

.37 (1818 zone)

BL 18.18 @ 1800

BL 36.36 @ 1777

BL 36.36

@1735

BL 66.66 @ 1717

BL 66.66 @ 1700

TP 1896

OP 18.18

@1820

.37 (1818 zone)

BL 18.18 @ 1800

BL 36.36 @ 1777

BL 36.36

@1735

BL 66.66 @ 1717

BL 66.66 @ 1700

TP 1896

Piyush Lalsingh Ratnu

⏰USD Index looks at yields, data, Fed

The index advanced for the third consecutive session and adds to the positive start of the week, recording new yearly peaks in levels last seen in November 2022, north of 107.00 figure.

The equally sharp move higher in US yields across the curve also underpins the pronounced uptick in the dollar, which has been in place since mid-July and has entered its 12th consecutive week of gains so far.

The continuation of the upside bias in the greenback appears propped up by speculation of further tightening by the Federal Reserve (an extra rate hike is priced in before year-end), a view that has been reinforced by hawkish comments from FOMC M. Bowman on Monday.

In the US docket, the release of the JOLTs Job Openings will be in the limelight later in the NA session seconded by the speech by Atlanta Fed R. Bostic (2024 voter, hawk).

🆘What to look for around USD

The greenback trades in a firmer note and surpasses the 107.00 hurdle to print new YTD highs on Tuesday.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which at the same time appears underpinned by the renewed tighter-for-longer stance narrative from the Federal Reserve.

♾Key events in the US this week:

JOLTs Job Openings (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Final Services PMI, ISM Services PMI, Factory Orders (Wednesday) - Initial Jobless Claims, Balance of Trade (Thursday) – NFP, Unemployment Rate, Consumer Credit Change (Friday).

🆘Eminent issues on the back boiler:

Persevering debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

The index advanced for the third consecutive session and adds to the positive start of the week, recording new yearly peaks in levels last seen in November 2022, north of 107.00 figure.

The equally sharp move higher in US yields across the curve also underpins the pronounced uptick in the dollar, which has been in place since mid-July and has entered its 12th consecutive week of gains so far.

The continuation of the upside bias in the greenback appears propped up by speculation of further tightening by the Federal Reserve (an extra rate hike is priced in before year-end), a view that has been reinforced by hawkish comments from FOMC M. Bowman on Monday.

In the US docket, the release of the JOLTs Job Openings will be in the limelight later in the NA session seconded by the speech by Atlanta Fed R. Bostic (2024 voter, hawk).

🆘What to look for around USD

The greenback trades in a firmer note and surpasses the 107.00 hurdle to print new YTD highs on Tuesday.

In the meantime, support for the dollar keeps coming from the good health of the US economy, which at the same time appears underpinned by the renewed tighter-for-longer stance narrative from the Federal Reserve.

♾Key events in the US this week:

JOLTs Job Openings (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Final Services PMI, ISM Services PMI, Factory Orders (Wednesday) - Initial Jobless Claims, Balance of Trade (Thursday) – NFP, Unemployment Rate, Consumer Credit Change (Friday).

🆘Eminent issues on the back boiler:

Persevering debate over a soft or hard landing for the US economy. Incipient speculation of rate cuts in early 2024. Geopolitical effervescence vs. Russia and China.

Piyush Lalsingh Ratnu

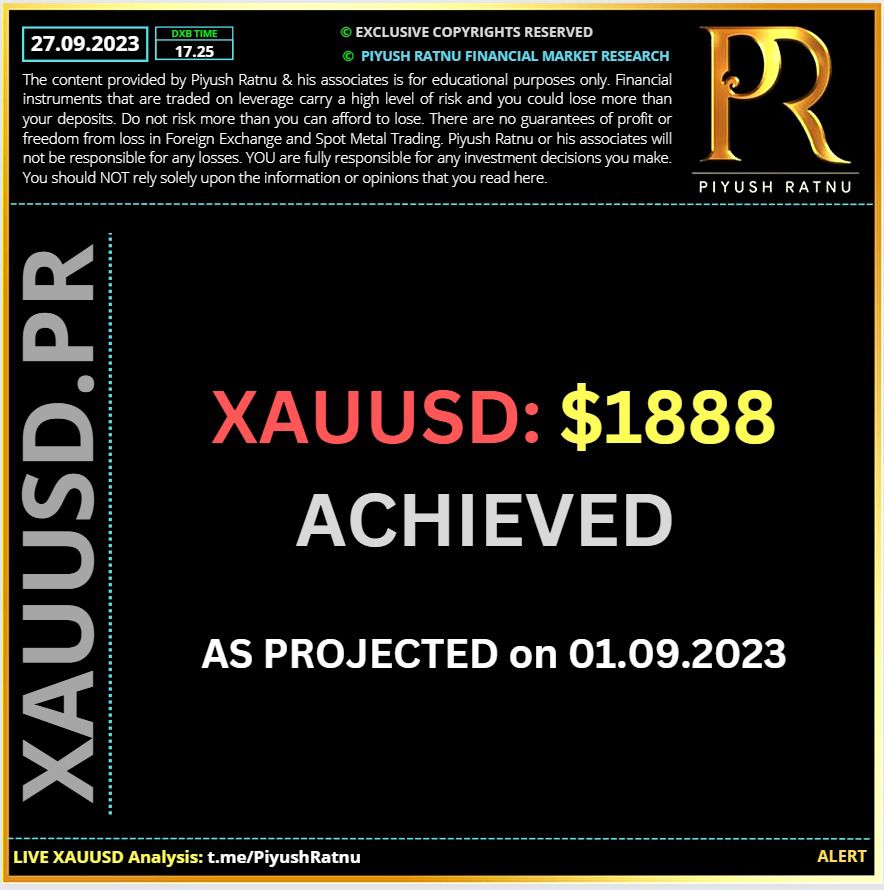

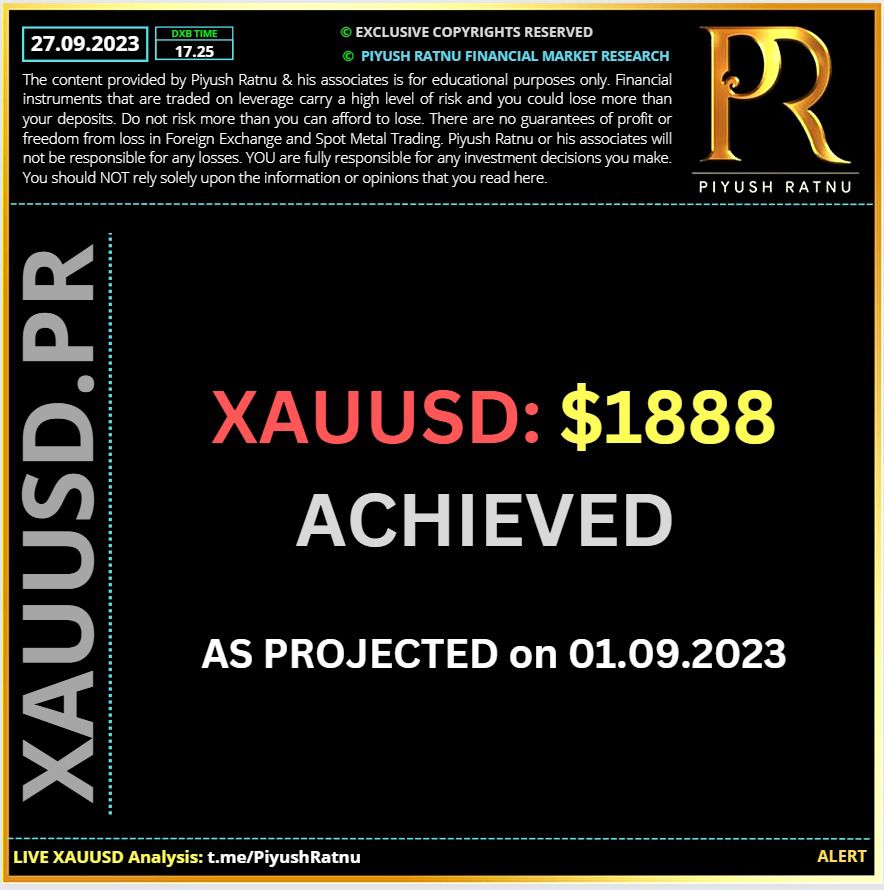

✔️As projected in my analysis: dated 01.09.2023:

I had projected crash in Gold price of Gold smashes $1907 support zone.

💎Buy limits at 1888, 1866, 1836 were suggested by me with exit of $5/NAP.

Those who implemented buy limits and made an exit with bigger lot sizes: am sure made a good profit and neat exit.

♾XAUUSD PRICE ACTION so far:

$1907-1901 RT $1909

$1888-1866 RT $1881

$1836-1832 RT $1840

$1818-1815 RT $1822

🟢In all the above price movements, price zones projected by me proved accurate and an ideal buying zone to exit in NAP.

Read my analysis at: https://t.me/PiyushRatnu/6229

I had projected crash in Gold price of Gold smashes $1907 support zone.

💎Buy limits at 1888, 1866, 1836 were suggested by me with exit of $5/NAP.

Those who implemented buy limits and made an exit with bigger lot sizes: am sure made a good profit and neat exit.

♾XAUUSD PRICE ACTION so far:

$1907-1901 RT $1909

$1888-1866 RT $1881

$1836-1832 RT $1840

$1818-1815 RT $1822

🟢In all the above price movements, price zones projected by me proved accurate and an ideal buying zone to exit in NAP.

Read my analysis at: https://t.me/PiyushRatnu/6229

Piyush Lalsingh Ratnu

🍎Spot GOLD Price Movers:

• Gold price continues a five-day losing spell to near $1,840.00 in the context of ‘higher for longer’ interest rates by the Federal Reserve to tame the so-called ‘last leg’ of inflation.

• The yellow metal is expected to extend downside as the US Manufacturing PMI outperformed expectations. The economic data landed at 49.0, much higher than estimates and the former release of 47.7 and 47.6 respectively. Also, the New Orders Index jumped to 49.2 from the August reading of 46.8.

• The precious metal also faces pressure from higher US Treasury yields, which have jumped to near 4.63% as Fed policymakers still favor more interest rates to ensure price stability.

• New York Fed Bank President John C. Williams said on the weekend that the Fed is at or near peak levels of interest rates. Williams sees signs of inflation pressures waning and labor market imbalance diminishing.

• The yellow metal failed to find bids on Friday despite a soft PCE report, which is majorly used by the Fed for policy decision-making.

• Monthly Core PCE grew at a nominal pace of 0.1%, slower than expectations and the former pace of 0.2%. The annual core PCE data decelerated to 3.9% as expected against July's reading of 4.3%. The headline PCE expanded at a higher pace of 0.4% against July's reading of 0.2% but slower than expectations of 0.5%. On an annual basis, PCE inflation accelerated to 3.5% as expected due to rising energy prices.

• A soft core PCE inflation report has decreased the chances of one more interest rate hike from the Fed before the year ends. As per the CME Group Fedwatch tool, investors price in that interest rates will remain steady at 5.25%-5.50% at the November monetary policy. Meanwhile, chances for interest rates remaining unchanged at 5.25%-5.50% until the end of 2023 dropped to 56%.

• A slowdown in consumer spending on core goods has eased consumer inflation expectations, making Fed policymakers comfortable in holding interest rates.

• On a broader note, the US economy is resilient due to a stable labor demand, upbeat wage growth, and robust retail demand, which would keep hopes for a rebound in inflation intact and Gold price on the back foot.

• The market mood improves as the US government manages to ditch a government shutdown in a last-minute deal. The agreement between the US House and Senate approved a funding bill until November 17.

• China’s new home prices rose slightly after declining for four months as home-builders ramped up property selling, capitalizing on supportive measures from China’s government and expansionary monetary policy by the People’s Bank of China (PBoC).

• Improved market sentiment is restricting recovery in the US Dollar index (DXY). The USD Index aims to stabilize above the 106.00 resistance as global slowdown fears persist.

• Gold price continues a five-day losing spell to near $1,840.00 in the context of ‘higher for longer’ interest rates by the Federal Reserve to tame the so-called ‘last leg’ of inflation.

• The yellow metal is expected to extend downside as the US Manufacturing PMI outperformed expectations. The economic data landed at 49.0, much higher than estimates and the former release of 47.7 and 47.6 respectively. Also, the New Orders Index jumped to 49.2 from the August reading of 46.8.

• The precious metal also faces pressure from higher US Treasury yields, which have jumped to near 4.63% as Fed policymakers still favor more interest rates to ensure price stability.

• New York Fed Bank President John C. Williams said on the weekend that the Fed is at or near peak levels of interest rates. Williams sees signs of inflation pressures waning and labor market imbalance diminishing.

• The yellow metal failed to find bids on Friday despite a soft PCE report, which is majorly used by the Fed for policy decision-making.

• Monthly Core PCE grew at a nominal pace of 0.1%, slower than expectations and the former pace of 0.2%. The annual core PCE data decelerated to 3.9% as expected against July's reading of 4.3%. The headline PCE expanded at a higher pace of 0.4% against July's reading of 0.2% but slower than expectations of 0.5%. On an annual basis, PCE inflation accelerated to 3.5% as expected due to rising energy prices.

• A soft core PCE inflation report has decreased the chances of one more interest rate hike from the Fed before the year ends. As per the CME Group Fedwatch tool, investors price in that interest rates will remain steady at 5.25%-5.50% at the November monetary policy. Meanwhile, chances for interest rates remaining unchanged at 5.25%-5.50% until the end of 2023 dropped to 56%.

• A slowdown in consumer spending on core goods has eased consumer inflation expectations, making Fed policymakers comfortable in holding interest rates.

• On a broader note, the US economy is resilient due to a stable labor demand, upbeat wage growth, and robust retail demand, which would keep hopes for a rebound in inflation intact and Gold price on the back foot.

• The market mood improves as the US government manages to ditch a government shutdown in a last-minute deal. The agreement between the US House and Senate approved a funding bill until November 17.

• China’s new home prices rose slightly after declining for four months as home-builders ramped up property selling, capitalizing on supportive measures from China’s government and expansionary monetary policy by the People’s Bank of China (PBoC).

• Improved market sentiment is restricting recovery in the US Dollar index (DXY). The USD Index aims to stabilize above the 106.00 resistance as global slowdown fears persist.

Piyush Lalsingh Ratnu

⚠️Is it wise to invest in gold during a recession?

It’s interesting that this phrase ‘safe haven’ gets thrown about when it comes to investing in gold. It doesn’t always make sense to hold gold, which doesn’t give a yield, While gold can work as a safe haven in a lower-interest-rate environment, it doesn’t work as well if investors hold gold against the US dollar, which does produce a yield.

To counter the effects of a recession, a central bank injects liquidity into the market, which leads to inflation that lowers the value of the currency. This lowers investor confidence in the strength of the currency and increases demand for gold, which usually holds its value in weak economic environments.

It’s interesting that this phrase ‘safe haven’ gets thrown about when it comes to investing in gold. It doesn’t always make sense to hold gold, which doesn’t give a yield, While gold can work as a safe haven in a lower-interest-rate environment, it doesn’t work as well if investors hold gold against the US dollar, which does produce a yield.

To counter the effects of a recession, a central bank injects liquidity into the market, which leads to inflation that lowers the value of the currency. This lowers investor confidence in the strength of the currency and increases demand for gold, which usually holds its value in weak economic environments.

Piyush Lalsingh Ratnu

🆘XAUUSD current status:

MNAS5

W1 A50 u/1845

D1 A100 u/1803

SR D1: R2 1875 R3 1896 R4 1909 | S2 1821 S3 1800 S4 1787

SRW1: R2 1913 R3 1963 R4 1994 | S2 1782 S3 1732

SRMN: R2 1901 R3 1942 R4 1966 | S2 1795 S3 1754 S4 1729

Co-relations:

USDJPY back to 23.10.2022 range: $150.000 zone

XAUUSD on 23.10.2022: $1645

Tomorrow is Chinese holiday: I expect a major drop in volumes and sudden spike in GOLD price. Stay Alert. Avoid pile up.

Major correction on the way. I project V pattern.

MNAS5

W1 A50 u/1845

D1 A100 u/1803

SR D1: R2 1875 R3 1896 R4 1909 | S2 1821 S3 1800 S4 1787

SRW1: R2 1913 R3 1963 R4 1994 | S2 1782 S3 1732

SRMN: R2 1901 R3 1942 R4 1966 | S2 1795 S3 1754 S4 1729

Co-relations:

USDJPY back to 23.10.2022 range: $150.000 zone

XAUUSD on 23.10.2022: $1645

Tomorrow is Chinese holiday: I expect a major drop in volumes and sudden spike in GOLD price. Stay Alert. Avoid pile up.

Major correction on the way. I project V pattern.

Piyush Lalsingh Ratnu

XAUUSD @ H4A100 | $1888 zone achieved

🟢S2 ZONE 1888 | DOWN TREND (Below $1907): 1900/1888/1866/1836 | BUY LIMITS

✔️As projected in my analysis dated 01.09.2023

Read more at:

https://bit.ly/PRTrackRecordXAUUSD

🟢S2 ZONE 1888 | DOWN TREND (Below $1907): 1900/1888/1866/1836 | BUY LIMITS

✔️As projected in my analysis dated 01.09.2023

Read more at:

https://bit.ly/PRTrackRecordXAUUSD

: