Piyush Lalsingh Ratnu / Perfil

- Informações

|

3 anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Piyush Lalsingh Ratnu

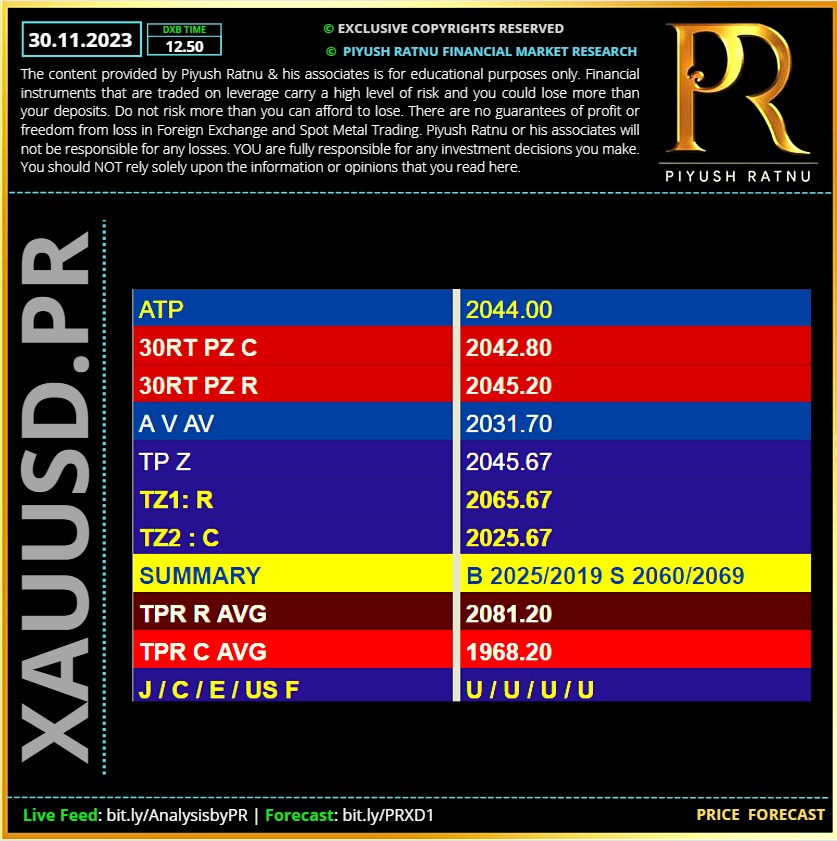

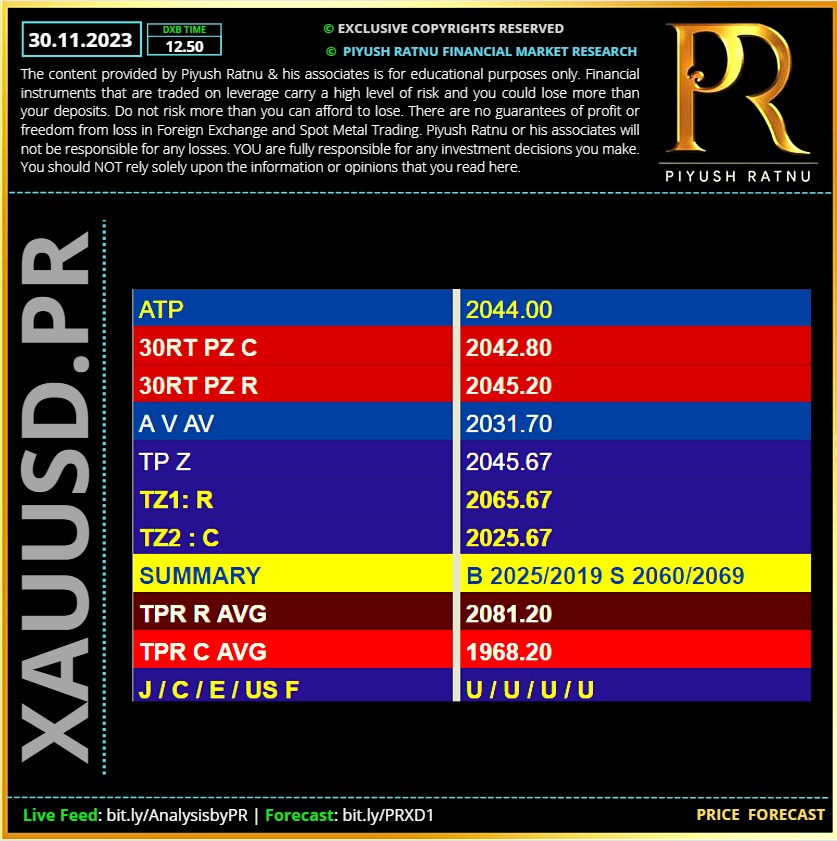

30.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

The Federal Reserve's preferred inflation measure rose at slower rate on an annual basis in October compared to the prior month, in the latest sign that the central bank's long-standing campaign of interest rate hikes may be working to corral price growth.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Last month's personal consumption expenditures (PCE) price index increased by 3.0% annually, decelerating from 3.4% in September. On a monthly basis, the measure was 0.0%, down from an uptick of 0.4% in the prior month. Economists expected readings of 3.0% year-on-year and 0.1% month-on-month.

The data could help determine how Fed officials will calibrate interest rates in the coming months. The central bank is widely tipped to leave rates at a range of 5.25% to 5.50% at its meeting next month, although some policymakers have hinted that a pivot away from this unprecedentedly tight stance may be coming soon.

Earlier this week, Fed Governor Christopher Waller, a typically hawkish voice, suggested that "we could start lowering the policy rate" if inflation continues to slow for "several more months." The comments bolstered expectations that the Fed may slash rates as soon as May next year.

Piyush Lalsingh Ratnu

XAU/USD: ADDITIONAL IMPORTANT LEVELS

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

Today last price 2043.22

Today Daily Change -1.45

Today Daily Change % -0.07

Today daily open 2044.67

🔘TRENDS

Daily SMA20 1983.09

Daily SMA50 1941.14

Daily SMA100 1936.29

Daily SMA200 1943.63

🔘LEVELS

Previous Daily High 2052.03

Previous Daily Low 2035.41

Previous Weekly High 2007.63

Previous Weekly Low 1965.51

Previous Monthly High 2009.49

Previous Monthly Low 1810.51

Daily Fibonacci 38.2% 2045.68

Daily Fibonacci 61.8% 2041.76

Daily Pivot Point S1 2036.04

Daily Pivot Point S2 2027.42

Daily Pivot Point S3 2019.42

Daily Pivot Point R1 2052.66

Daily Pivot Point R2 2060.66

Daily Pivot Point R3 2069.28

Piyush Lalsingh Ratnu

SHORTING XAUUSD @2040 and above gave us good results.

🟢 CMP $2036

We will HOLD short trades.

🟢 CMP $2036

We will HOLD short trades.

Piyush Lalsingh Ratnu

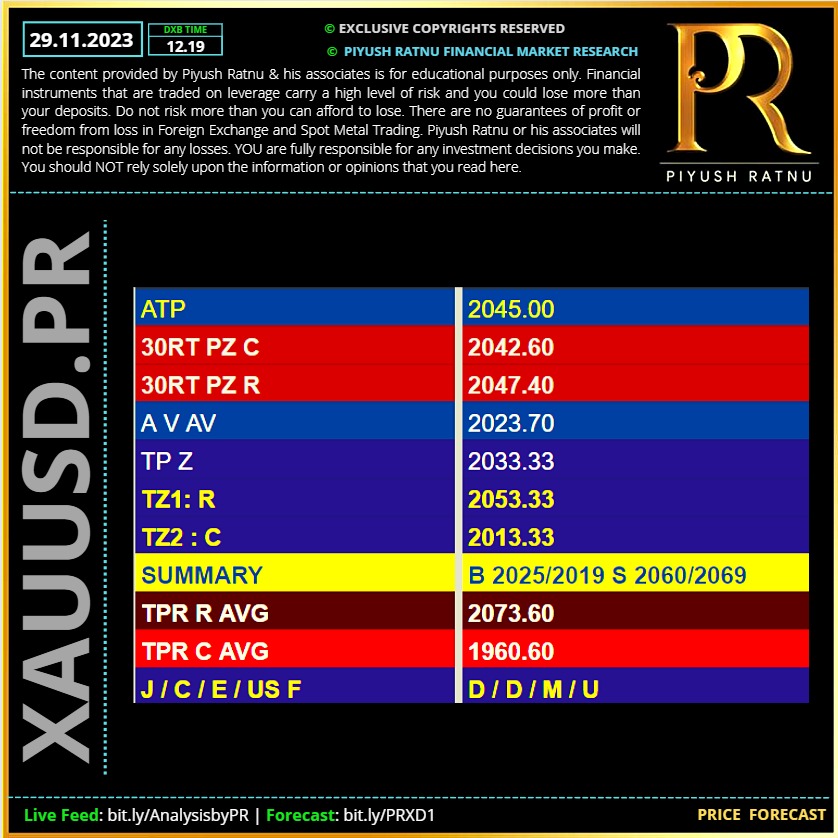

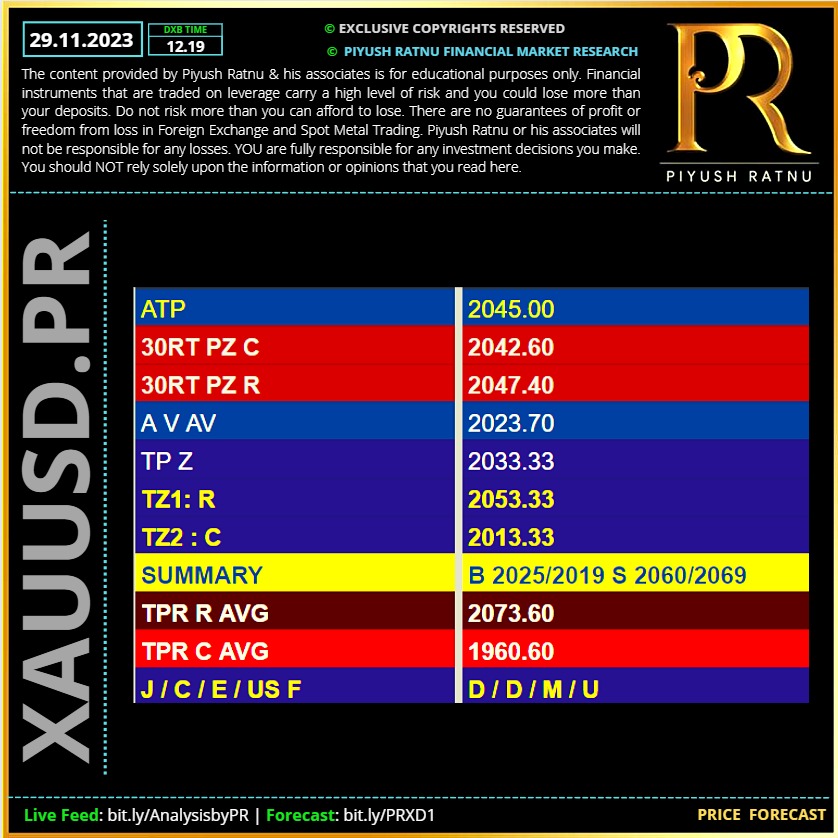

29.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

Co-relation ALERT:

A crash of 700 pips observed in USDJPY

As per co-relation: XAUUSD might + $14-16

CMP $2046

A crash of 700 pips observed in USDJPY

As per co-relation: XAUUSD might + $14-16

CMP $2046

Piyush Lalsingh Ratnu

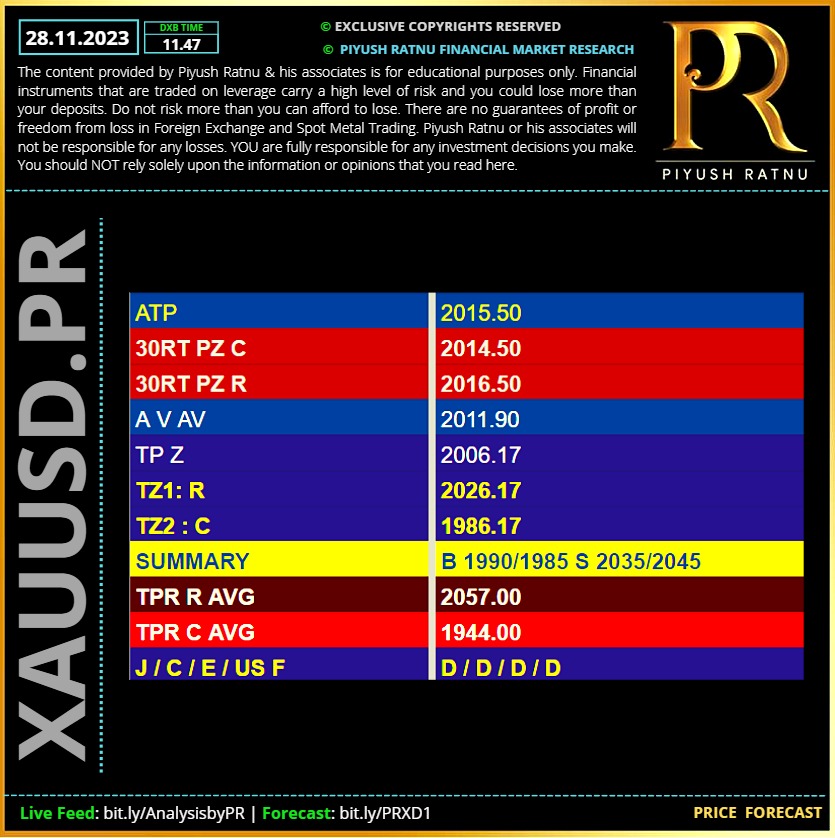

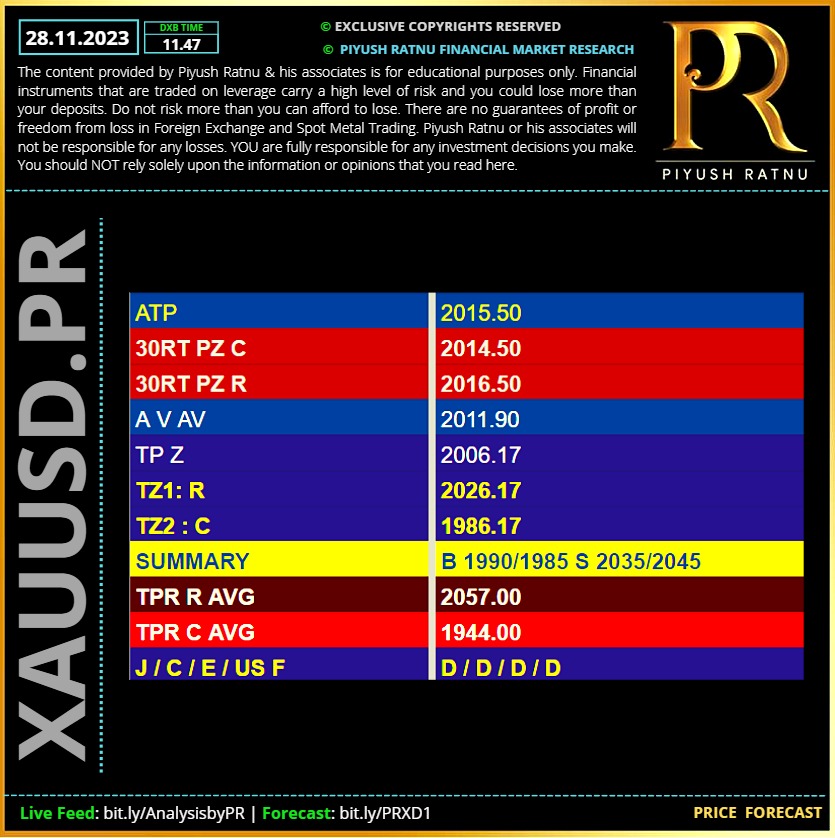

28.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

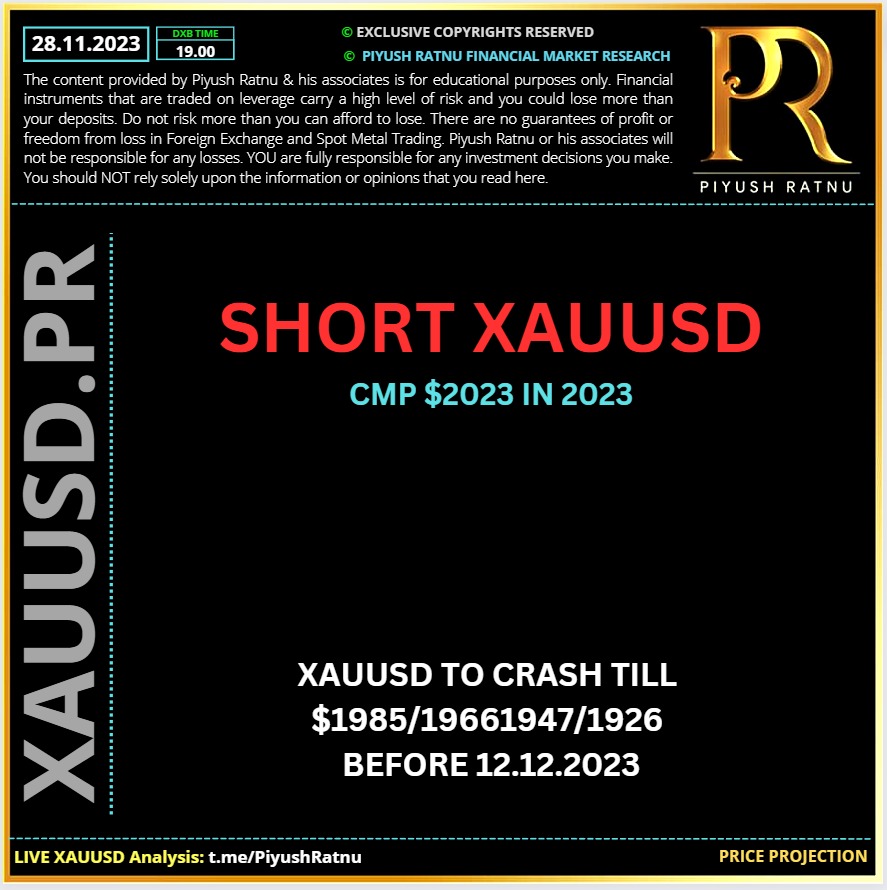

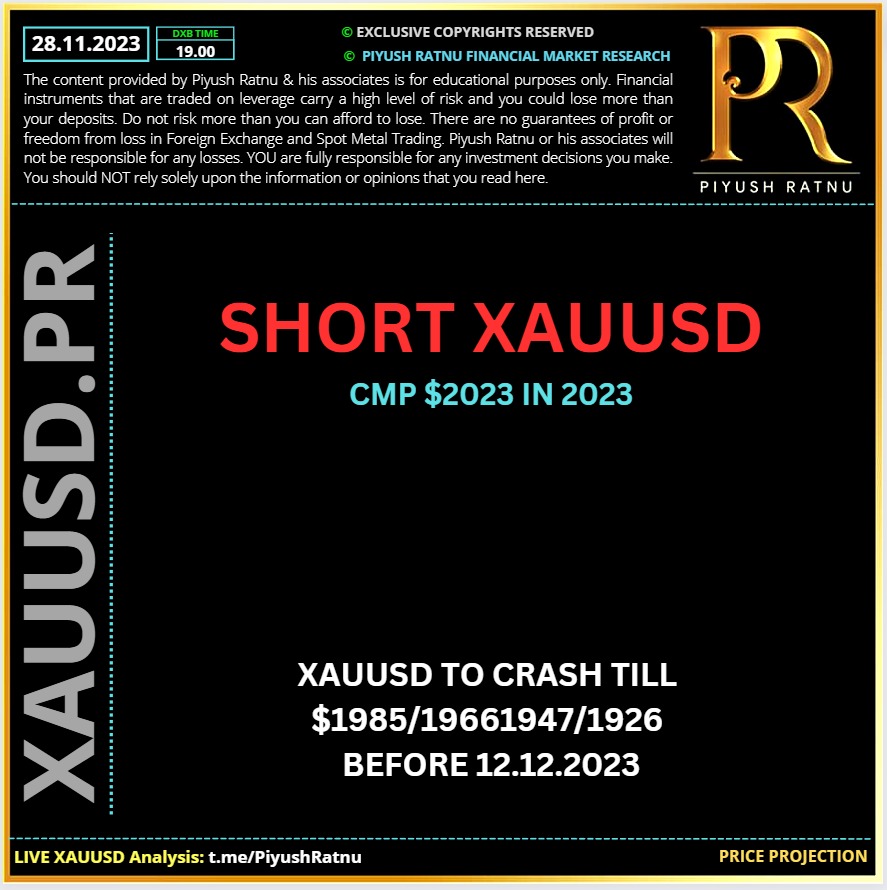

28.11.2023 | XAUUSD: Price Projection | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘ALERT:

USDJPY crashed 1200 pips today CMP 147.630

Crash observed from 148.880

Possible IMPACT as per Co-relation:

$30+ movement in XAUUSD

$2010 + 30= 2040

🆘🟢CMP $2036

USDJPY crashed 1200 pips today CMP 147.630

Crash observed from 148.880

Possible IMPACT as per Co-relation:

$30+ movement in XAUUSD

$2010 + 30= 2040

🆘🟢CMP $2036

Piyush Lalsingh Ratnu

28.11.2023 | XAUUSD: Analysis Accuracy Review | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🆘 Co-relations Alert:

USDJPY CMP $148.300 (23.10.2023 range)

XAUUSD was at $1926 on 23.10.2023

USDJPY CMP $148.300 (23.10.2023 range)

XAUUSD was at $1926 on 23.10.2023

Piyush Lalsingh Ratnu

In 2020, the gold's record rally was fueled by pandemic-related fears and the Fed's cheap liquidity. COVID-19 gave rise to much uncertainty, favorable to safe-haven assets, while the Fed's aspiration to save the US economy using huge monetary stimuli weakened the greenback and reduced treasury yields. I have a sense of déjà vu at the end of 2023: the central bank is expected to loosen policy while geopolitics pushes investors to safe havens. Will gold update its historical peak, then?

Even if the evolution of many assets, starting with oil and shekel and ending with gold, indicates a de-escalation of the military conflict in the Middle East, the worst is yet to come. The truce will not last forever, while the advance of the Israeli army in Gaza will hardly be as fast as it has been so far.

In any case, geopolitics will remain the focus of investors’ attention. In 2024, we’ll have to deal with politics, too: nearly half the world's population will elect presidents. The developments in Mexico, Russia, the US, and elsewhere can shake up financial markets.

However, the Fed's loosening its policy seems to remain the main factor in the XAUUSD's rally. The odds of a Fed funds rate cut in 2024 increased drastically upon the publication of US inflation data for October. The derivatives predict a 100-point cut to 4.5%, with the first monetary expansion act scheduled for May.

Unsurprisingly, the yield on 10-year treasuries failed to consolidate above 5%, and the US dollar lost more than 3% of its value against major currencies and is about to close November with the worst monthly performance in two years. Gold usually thrives against such a background.

So, bullish sentiment dominates the market. ING forecasts an average price of $2,100 an ounce in Q4 2024. Goldman Sachs's estimate is $2,050 throughout the year on average, provided that the Fed drops the funds rate no earlier than October-December. Falling real bond yields and a weakening US dollar will support the precious metal.

If we add to this the increased activity of the People's Bank of China, which increased its gold reserves by 181 tonnes to 2,192 tonnes from January to September, as well as the high demand for gold in China, the prospects for the XAUUSD seem bullish ⚠️.

🟢 Hence, XAUUSD is forecast to reach new peaks as the demand is growing amid the geopolitical and political situation, central banks are showing support and the Fed's expected to introduce monetary stimuli. Let’s discuss it and make a trading plan.

Even if the evolution of many assets, starting with oil and shekel and ending with gold, indicates a de-escalation of the military conflict in the Middle East, the worst is yet to come. The truce will not last forever, while the advance of the Israeli army in Gaza will hardly be as fast as it has been so far.

In any case, geopolitics will remain the focus of investors’ attention. In 2024, we’ll have to deal with politics, too: nearly half the world's population will elect presidents. The developments in Mexico, Russia, the US, and elsewhere can shake up financial markets.

However, the Fed's loosening its policy seems to remain the main factor in the XAUUSD's rally. The odds of a Fed funds rate cut in 2024 increased drastically upon the publication of US inflation data for October. The derivatives predict a 100-point cut to 4.5%, with the first monetary expansion act scheduled for May.

Unsurprisingly, the yield on 10-year treasuries failed to consolidate above 5%, and the US dollar lost more than 3% of its value against major currencies and is about to close November with the worst monthly performance in two years. Gold usually thrives against such a background.

So, bullish sentiment dominates the market. ING forecasts an average price of $2,100 an ounce in Q4 2024. Goldman Sachs's estimate is $2,050 throughout the year on average, provided that the Fed drops the funds rate no earlier than October-December. Falling real bond yields and a weakening US dollar will support the precious metal.

If we add to this the increased activity of the People's Bank of China, which increased its gold reserves by 181 tonnes to 2,192 tonnes from January to September, as well as the high demand for gold in China, the prospects for the XAUUSD seem bullish ⚠️.

🟢 Hence, XAUUSD is forecast to reach new peaks as the demand is growing amid the geopolitical and political situation, central banks are showing support and the Fed's expected to introduce monetary stimuli. Let’s discuss it and make a trading plan.

Piyush Lalsingh Ratnu

CMP $2019: I will wait till 19.00 hours for economic data before opening a trade set.

🆘Crucial Price Stops:

C: $2000/1996

R: $2030/2036

🆘Crucial Price Stops:

C: $2000/1996

R: $2030/2036

Piyush Lalsingh Ratnu

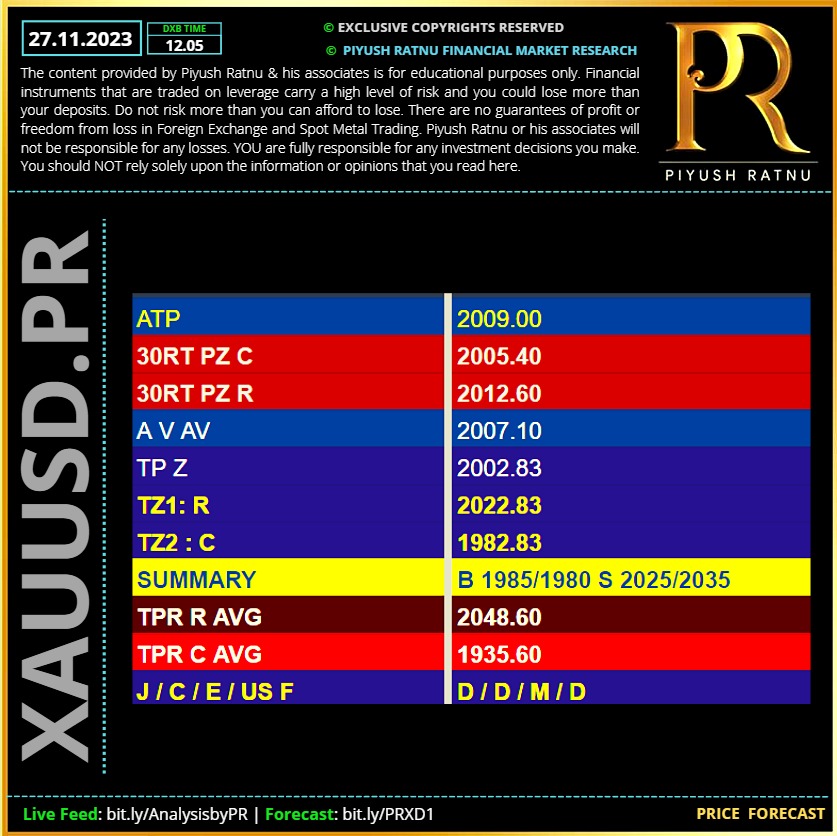

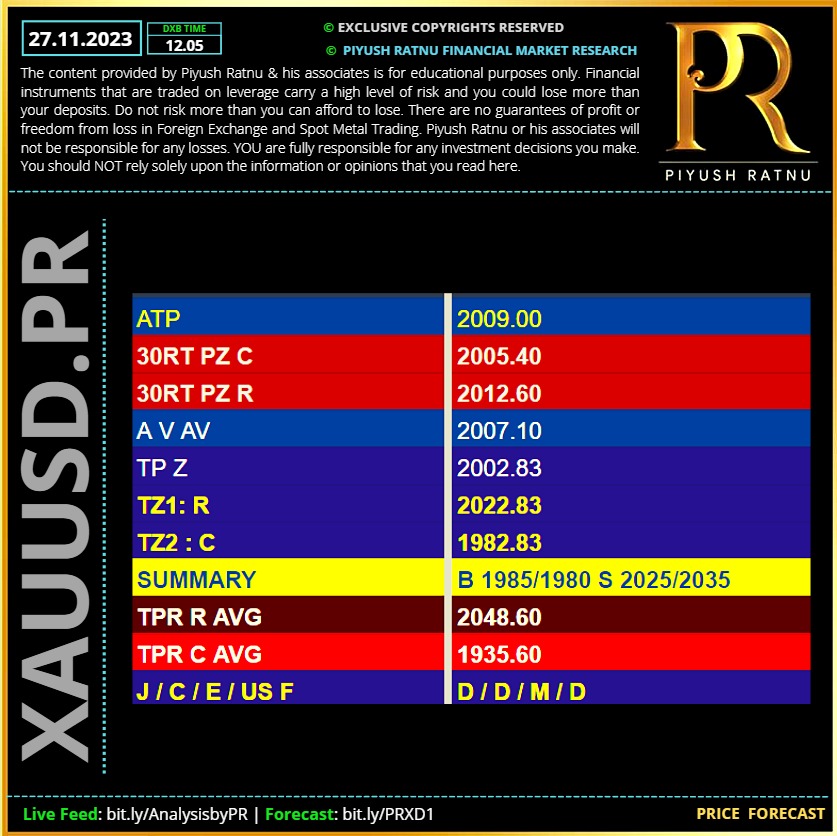

27.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

$2019 - 2009 zone achieved as projected on 24.11.2023

🟢 Low of $2009.50 achieved at 17.44 hours

Selling at 2019, NAP Exit at 2011

Buying at 2009, Nap Exit CMP 2013

🆘 Both trades gave us NAP of 1200 pips today.

🟢 Low of $2009.50 achieved at 17.44 hours

Selling at 2019, NAP Exit at 2011

Buying at 2009, Nap Exit CMP 2013

🆘 Both trades gave us NAP of 1200 pips today.

Piyush Lalsingh Ratnu

$2005/2000 crucial NEXT BUY ZONE, 1996/ RT 2000

Looks like a possible scenario.

In my opinion GR 11 22 33 should work well.

CMP $2011 | XAUUSD

Looks like a possible scenario.

In my opinion GR 11 22 33 should work well.

CMP $2011 | XAUUSD

Piyush Lalsingh Ratnu

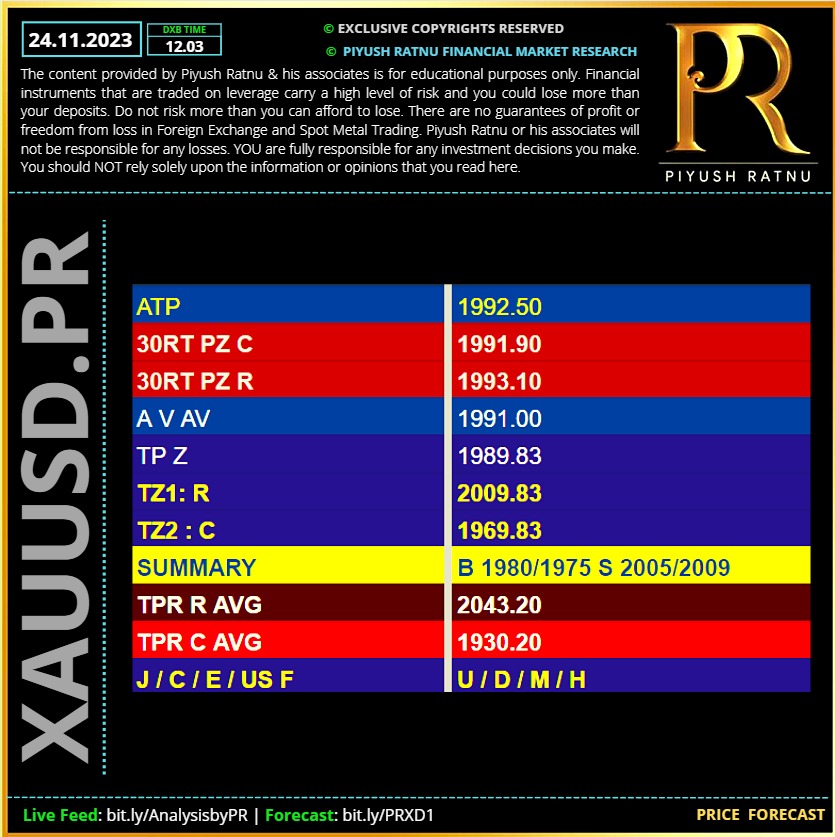

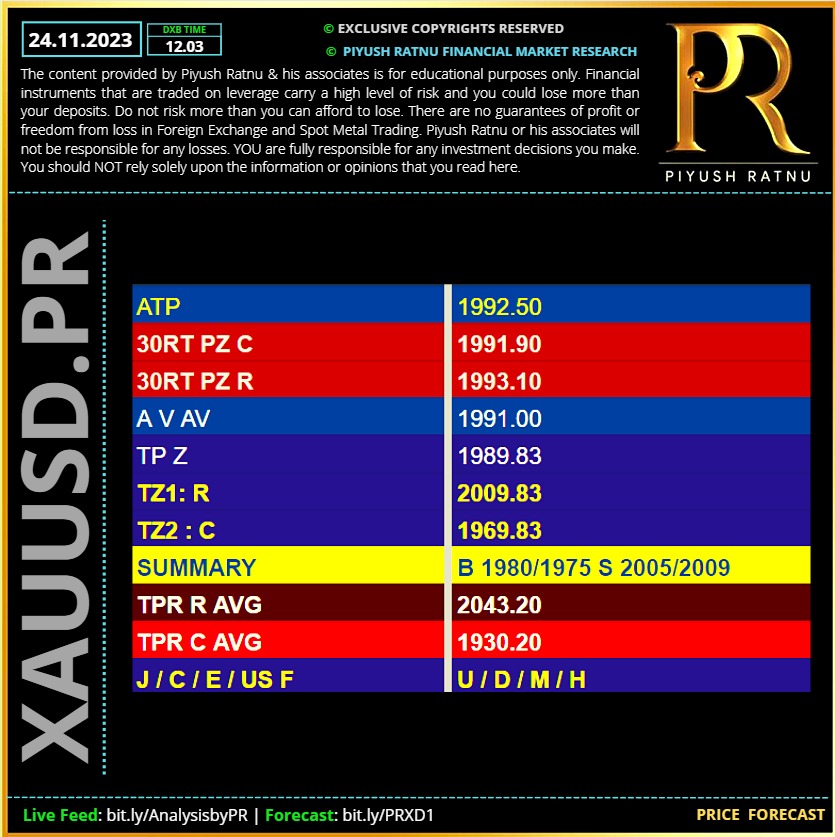

24.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

Piyush Lalsingh Ratnu

🔘Gold price struggles to gain any meaningful traction on the last day of the week.

🔘 A pickup in US bond yields acts as a headwind for the XAU/USD.

🔘The Fed rates uncertainty and a softer risk tone lend some support to the metal.

Gold price (XAU/USD) struggles to capitalize on the previous day's modest gains and oscillates in a narrow trading band, below the $2,000 psychological mark through the first half of the European session. Investors now seem reluctant to place aggressive directional bets and are seeking more clarity over the Federal Reserve's (Fed) rate-hike path.

The FOMC minutes released on Tuesday struck a more hawkish tone. Adding to this, Wednesday's upbeat US labor market and consumer sentiment data fueled speculations that the Fed will keep interest rates higher for longer. This, along with a goodish pickup in the US Treasury bond yields, turns out to be a key factor acting as a headwind for the non-yielding Gold price on the last day of the week.

⚠️ Daily XAUUSD Market Price Movers:

• A combination of diverging forces fails to provide any meaningful impetus to the Gold price and leads to a subdued/range-bound price action during the Asian session on Friday.

• A disconnect between the Federal Reserve's hawkish outlook and market expectations for rate cuts in 2024 is holding back traders from placing directional bets around the XAU/USD.

• The FOMC meeting minutes released on Tuesday revealed that policymakers backed the case to keep interest rates higher for longer to tame inflation.

• Bets for a rate hike in December shrunk to zero following the release of the October inflation report. Moreover, the markets are pricing over a 25% chance of a rate cut as early as March 2024.

• Wednesday's upbeat US labor market and consumer sentiment data, along with rebounding US Treasury bond yields, lend support to the USD and cap gains for the precious metal.

• Dovish Fed expectations, meanwhile, warrant some caution for the USD bulls and might continue to lend some support to the commodity ahead of the flash US PMI prints for November.

🔘 A pickup in US bond yields acts as a headwind for the XAU/USD.

🔘The Fed rates uncertainty and a softer risk tone lend some support to the metal.

Gold price (XAU/USD) struggles to capitalize on the previous day's modest gains and oscillates in a narrow trading band, below the $2,000 psychological mark through the first half of the European session. Investors now seem reluctant to place aggressive directional bets and are seeking more clarity over the Federal Reserve's (Fed) rate-hike path.

The FOMC minutes released on Tuesday struck a more hawkish tone. Adding to this, Wednesday's upbeat US labor market and consumer sentiment data fueled speculations that the Fed will keep interest rates higher for longer. This, along with a goodish pickup in the US Treasury bond yields, turns out to be a key factor acting as a headwind for the non-yielding Gold price on the last day of the week.

⚠️ Daily XAUUSD Market Price Movers:

• A combination of diverging forces fails to provide any meaningful impetus to the Gold price and leads to a subdued/range-bound price action during the Asian session on Friday.

• A disconnect between the Federal Reserve's hawkish outlook and market expectations for rate cuts in 2024 is holding back traders from placing directional bets around the XAU/USD.

• The FOMC meeting minutes released on Tuesday revealed that policymakers backed the case to keep interest rates higher for longer to tame inflation.

• Bets for a rate hike in December shrunk to zero following the release of the October inflation report. Moreover, the markets are pricing over a 25% chance of a rate cut as early as March 2024.

• Wednesday's upbeat US labor market and consumer sentiment data, along with rebounding US Treasury bond yields, lend support to the USD and cap gains for the precious metal.

• Dovish Fed expectations, meanwhile, warrant some caution for the USD bulls and might continue to lend some support to the commodity ahead of the flash US PMI prints for November.

Piyush Lalsingh Ratnu

🆘RISK SENTIMENT FAQS

🔘 What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

🔘 What are the key assets to track to understand risk sentiment dynamics?

Which currencies strengthen when sentiment is "risk-on"?

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

🔘Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

🔘 What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

🔘 What are the key assets to track to understand risk sentiment dynamics?

Which currencies strengthen when sentiment is "risk-on"?

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

🔘Which currencies strengthen when sentiment is "risk-off"?

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Piyush Lalsingh Ratnu

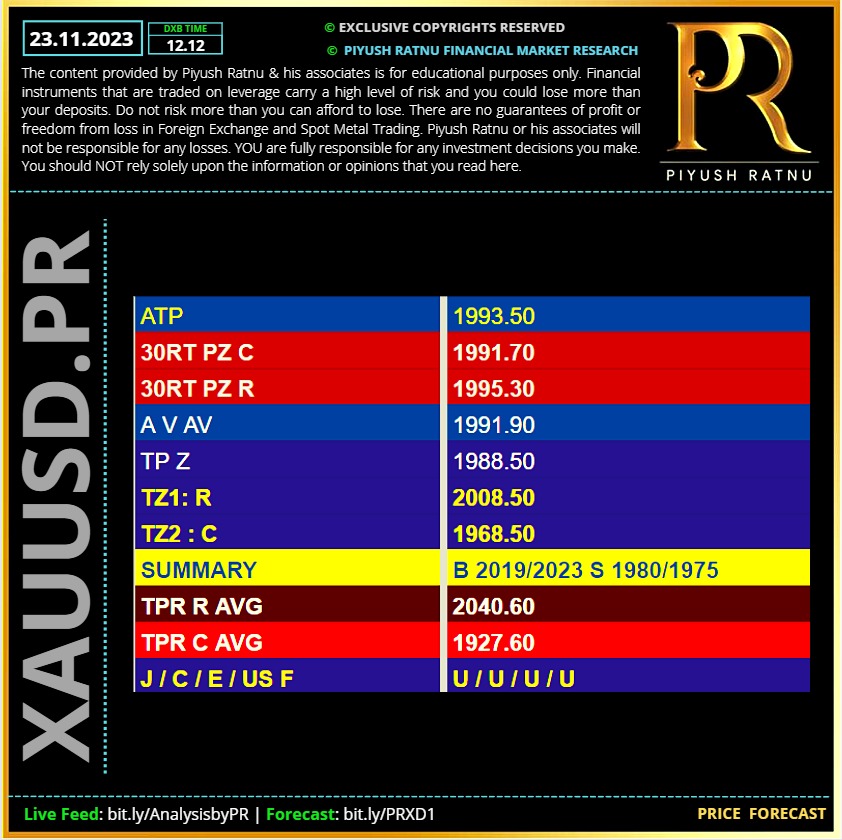

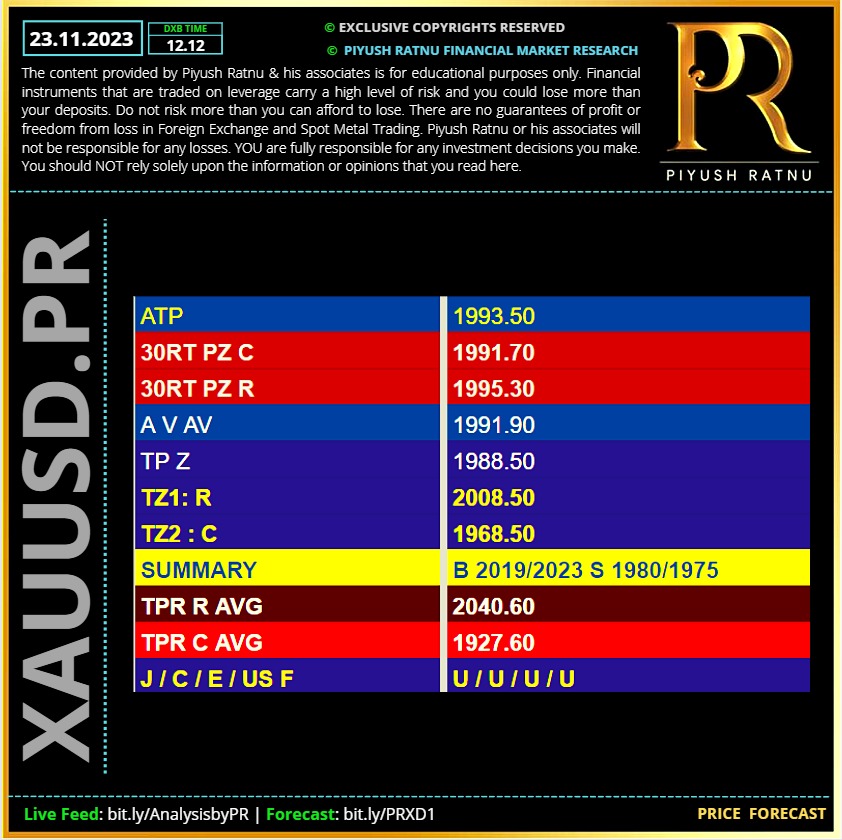

23.11.2023 | XAUUSD : Price Forecast | XAUUSD Analysis | Daily Price Projection | Spot Gold Analysis by Piyush Ratnu

Subscribe to our Telegram channel to receive live analysis without delay

Subscribe to our Telegram channel to receive live analysis without delay

: