Steve Rosenstock / 프로필

- 정보

|

7+ 년도

경험

|

10

제품

|

116

데몬 버전

|

|

0

작업

|

0

거래 신호

|

0

구독자

|

Quantitative Trader

저는 10년 이상의 트레이딩 경력을 가진 숙련된 포트폴리오 매니저이자 열정적인 트레이더입니다.

트레이딩의 어려움과 흥분을 잘 알고 있습니다. 제 경험을 활용하세요.

아이디어를 교환할 수 있도록 친구 요청을 보내주세요.

https://mql5.com/ko/channels/autoxpert

트레이딩의 어려움과 흥분을 잘 알고 있습니다. 제 경험을 활용하세요.

아이디어를 교환할 수 있도록 친구 요청을 보내주세요.

https://mql5.com/ko/channels/autoxpert

Steve Rosenstock

February 2, 2026 – February 6, 2026

The 50k Dow & The Greenland Gambit: Trading in a Hall of Mirrors

Forex: The "Warsh-ed Up" Dollar and the Hawkish Kangaroo The currency markets spent the week behaving like a group of traders who accidentally drank decaf—mostly confused and slightly irritable. The US Dollar Index (DXY) took a breather, sliding down to 97.63 as the initial "Kevin Warsh Euphoria" wore off. It turns out that nominating a hawk to lead the Fed is only exciting until you realize he might actually raise rates. EUR/USD staged a desperate "dead cat bounce" from its yearly lows, halting at pivotal support around 1.1550, while the Australian Dollar became the unexpected star of the show. The AUD surged toward 0.7000 because the RBA decided to be the only adult in the room, threatening interest rate hikes while the rest of the world is busy weaponizing their currencies. If your MQL5 grid bot survived the Yen’s failed attempt to break 160.00, you should probably go buy a lottery ticket; the USD/JPY "fake-out" was so precise it looked like it was hand-drawn by a liquidity hunter.

Gold: The $5,000 Heartbeat Sensor Gold’s week was a masterclass in psychological warfare. We opened the week with a "Monday Meltdown," where the yellow metal wicked down to a terrifying $4,400 during the Asian session, triggering "stop-loss cascades" across the MQL5 signal board. Just as the bears started picking out their new Ferraris, the "Defensive Bid" returned on Tuesday. Gold spent the mid-week carving out a massive V-shape recovery, fueled by job cuts jumping to 108k in the US and a sudden realization that "Soft Landing" is just a code word for "We’re crashing, but into a giant marshmallow." By Friday, Gold had rallied over 3.5% to reclaim the $4,950 level. It was a week of sharp, two-way moves that rewarded only the traders who were brave enough to buy when the world seemed to be ending and wise enough to take profit before the next "Truth Social" update.

Macro: Tariffs, Tundra, and the 50k Milestone The macro-economic landscape has officially transitioned into a reality TV show. President Trump spent the week reminding Canada and Mexico that his 25% "Fentanyl Tariffs" are a permanent lifestyle choice, not a negotiation tactic. We also saw a new executive order threatening tariffs on any country bold enough to sell oil to Cuba—essentially a geopolitical "unfriend" button. The average effective tariff rate in the US has now hit 9.9%, the highest since 1946, making "Free Trade" a vintage concept found only in history books and discarded MQL5 manuals. Meanwhile, the Dow Jones Industrial Average crossed the 50,000 threshold for the first time on Friday, because apparently, the market believes that if you tax everything coming into the country, the numbers on the screen just go up forever. It’s a beautiful, debt-fueled hallucination where we hit record highs while the Supreme Court debates if the President is actually allowed to tax our morning coffee.

The 50k Dow & The Greenland Gambit: Trading in a Hall of Mirrors

Forex: The "Warsh-ed Up" Dollar and the Hawkish Kangaroo The currency markets spent the week behaving like a group of traders who accidentally drank decaf—mostly confused and slightly irritable. The US Dollar Index (DXY) took a breather, sliding down to 97.63 as the initial "Kevin Warsh Euphoria" wore off. It turns out that nominating a hawk to lead the Fed is only exciting until you realize he might actually raise rates. EUR/USD staged a desperate "dead cat bounce" from its yearly lows, halting at pivotal support around 1.1550, while the Australian Dollar became the unexpected star of the show. The AUD surged toward 0.7000 because the RBA decided to be the only adult in the room, threatening interest rate hikes while the rest of the world is busy weaponizing their currencies. If your MQL5 grid bot survived the Yen’s failed attempt to break 160.00, you should probably go buy a lottery ticket; the USD/JPY "fake-out" was so precise it looked like it was hand-drawn by a liquidity hunter.

Gold: The $5,000 Heartbeat Sensor Gold’s week was a masterclass in psychological warfare. We opened the week with a "Monday Meltdown," where the yellow metal wicked down to a terrifying $4,400 during the Asian session, triggering "stop-loss cascades" across the MQL5 signal board. Just as the bears started picking out their new Ferraris, the "Defensive Bid" returned on Tuesday. Gold spent the mid-week carving out a massive V-shape recovery, fueled by job cuts jumping to 108k in the US and a sudden realization that "Soft Landing" is just a code word for "We’re crashing, but into a giant marshmallow." By Friday, Gold had rallied over 3.5% to reclaim the $4,950 level. It was a week of sharp, two-way moves that rewarded only the traders who were brave enough to buy when the world seemed to be ending and wise enough to take profit before the next "Truth Social" update.

Macro: Tariffs, Tundra, and the 50k Milestone The macro-economic landscape has officially transitioned into a reality TV show. President Trump spent the week reminding Canada and Mexico that his 25% "Fentanyl Tariffs" are a permanent lifestyle choice, not a negotiation tactic. We also saw a new executive order threatening tariffs on any country bold enough to sell oil to Cuba—essentially a geopolitical "unfriend" button. The average effective tariff rate in the US has now hit 9.9%, the highest since 1946, making "Free Trade" a vintage concept found only in history books and discarded MQL5 manuals. Meanwhile, the Dow Jones Industrial Average crossed the 50,000 threshold for the first time on Friday, because apparently, the market believes that if you tax everything coming into the country, the numbers on the screen just go up forever. It’s a beautiful, debt-fueled hallucination where we hit record highs while the Supreme Court debates if the President is actually allowed to tax our morning coffee.

Steve Rosenstock

January 26, 2026 – January 30, 2026

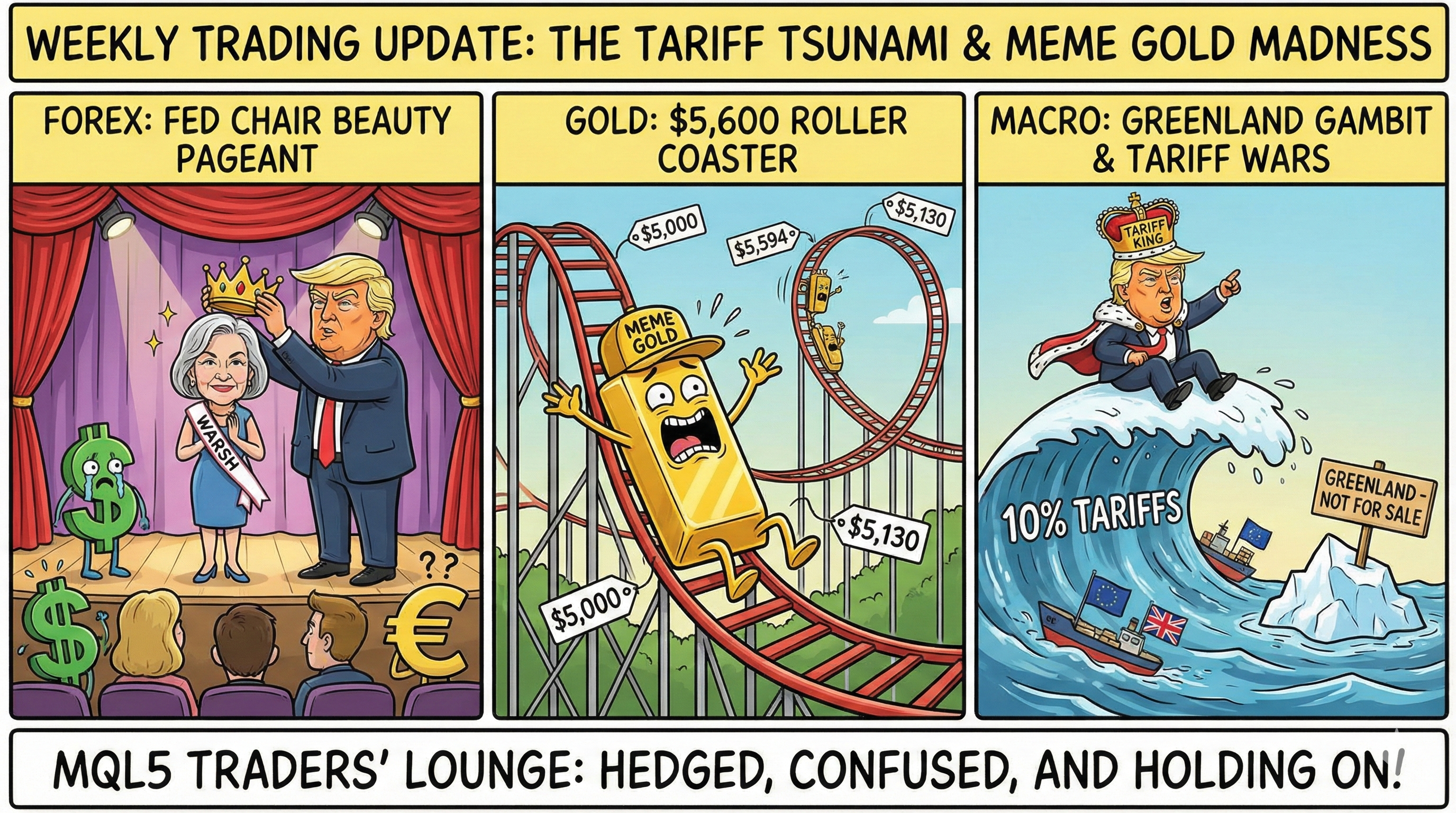

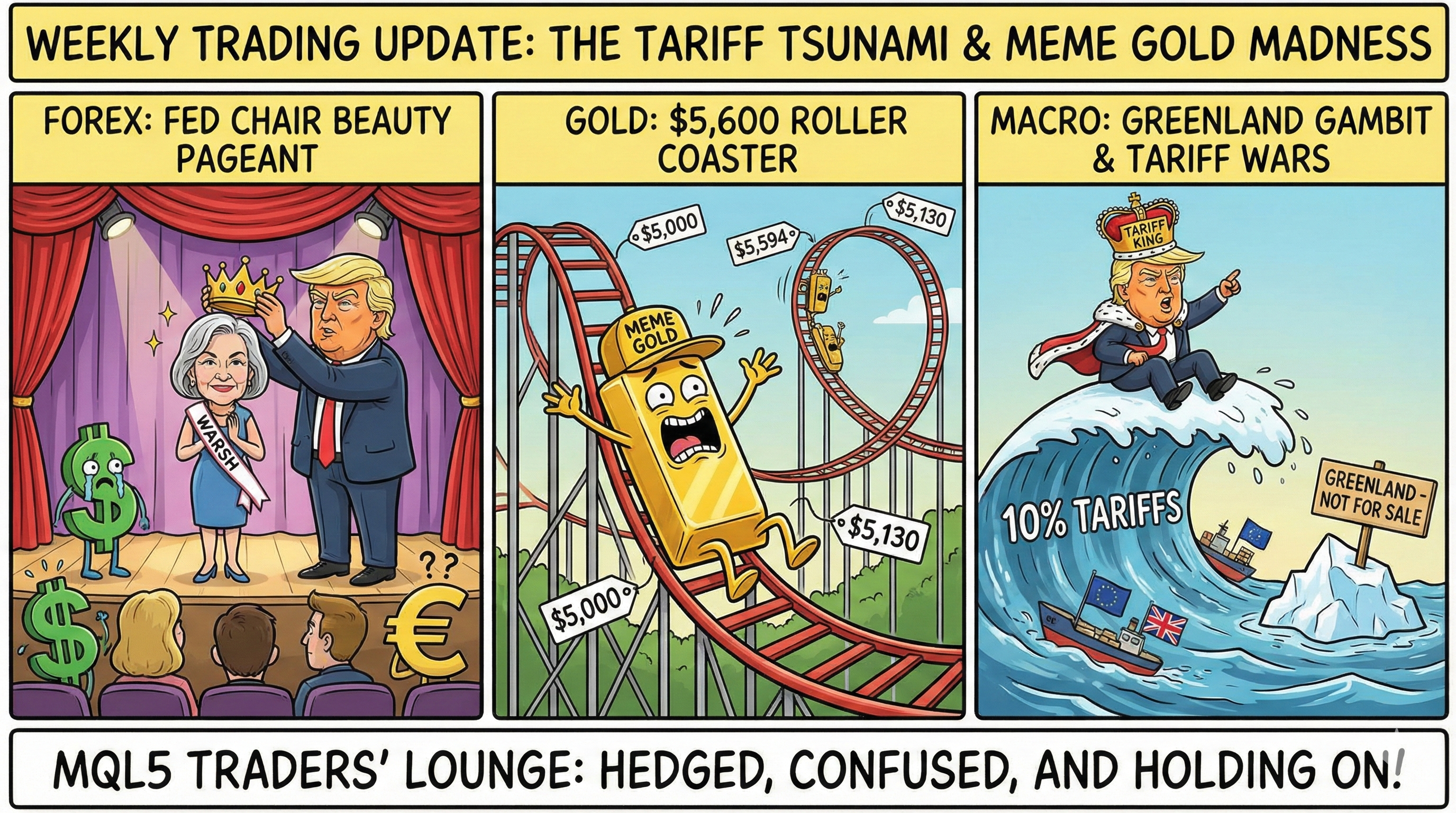

The Tariff Tsunami: When 'Making America Great' Meets Margin Calls

Forex: The Kevin Warsh Beauty Pageant The currency market spent this week in a state of terminal agitation, mostly because Donald Trump finally decided who would be the next Fed Chair. The "Warsh-Up" began early, with the Dollar finding legs solely on the anticipation that Kevin Warsh would bring a slightly less "money-printer-go-brrr" attitude than the other candidates. EUR/USD, which was flirting with the 1.1900 level like an optimistic teenager, got slapped back down toward the 1.1500s as the "Dollar Debasement" narrative hit a temporary speed bump. Meanwhile, the Yen is still doing its best impression of a jumpy ghost, reacting to Japanese bond yields that are currently as stable as a house of cards in a hurricane. On MQL5, the signal providers are busy explaining that their Yen-short positions were actually a "long-term carry trade" and not a tragic miscalculation of central bank intervention.

Gold: The $5,600 'Meme Stock' Phase Gold’s weekly chart this week looked like a heart monitor during a horror movie. We started Monday with the metal casually breaking $5,000, as if it were just another round number. By mid-week, the "anti-fiat" rally went into hyperdrive, with Gold screaming past $5,300 and briefly testing $5,594—making it trade with the volatility of a bankrupt biotech stock. Then came the "Thursday Thump." Traders who had been high-fiving their gains since Tuesday suddenly realized that "profit-taking" is a thing, and we saw a corrective decline back toward the $5,130 support zone. It was a disorderly, unforgiving move that wiped out every "tight stop" in the MQL5 ecosystem. If your EA survived this $400 swing without blowing up, you’re either a god of risk management or you forgot to plug it in. At this point, Gold isn't a safe haven; it's a high-stakes casino where the house (the Fed) just changed the rules mid-game.

Macro: The Greenland Gambit and Trade War 2.0 In the world of macro, reality has officially left the building. President Trump spent the week threatening a 10% tariff on the UK and most of Europe because they wouldn't agree to hand over Greenland—a geopolitical move that makes a game of Risk look sensible. After a "productive meeting" with NATO, the tariffs were briefly suspended, only for new threats to emerge against any country that so much as looks at Cuba or Iran. The market is currently trying to price in "Reciprocal Tariffs" while the Supreme Court debates if they are even legal. Meanwhile, the trade deficit is doing exactly what it wants, supply chains are being rearranged like deck chairs on the Titanic, and the Swiss were hit with a 39% tariff on luxury goods—arbitrarily lowered to 15% after a few "gold bars and Rolexes" allegedly made their way into the mix. It's a beautiful, chaotic world of "Trumponomics" where bad news is just an opportunity for a louder tweet, and the only thing more inflated than the Dollar is the ego of the people running the show.

The Tariff Tsunami: When 'Making America Great' Meets Margin Calls

Forex: The Kevin Warsh Beauty Pageant The currency market spent this week in a state of terminal agitation, mostly because Donald Trump finally decided who would be the next Fed Chair. The "Warsh-Up" began early, with the Dollar finding legs solely on the anticipation that Kevin Warsh would bring a slightly less "money-printer-go-brrr" attitude than the other candidates. EUR/USD, which was flirting with the 1.1900 level like an optimistic teenager, got slapped back down toward the 1.1500s as the "Dollar Debasement" narrative hit a temporary speed bump. Meanwhile, the Yen is still doing its best impression of a jumpy ghost, reacting to Japanese bond yields that are currently as stable as a house of cards in a hurricane. On MQL5, the signal providers are busy explaining that their Yen-short positions were actually a "long-term carry trade" and not a tragic miscalculation of central bank intervention.

Gold: The $5,600 'Meme Stock' Phase Gold’s weekly chart this week looked like a heart monitor during a horror movie. We started Monday with the metal casually breaking $5,000, as if it were just another round number. By mid-week, the "anti-fiat" rally went into hyperdrive, with Gold screaming past $5,300 and briefly testing $5,594—making it trade with the volatility of a bankrupt biotech stock. Then came the "Thursday Thump." Traders who had been high-fiving their gains since Tuesday suddenly realized that "profit-taking" is a thing, and we saw a corrective decline back toward the $5,130 support zone. It was a disorderly, unforgiving move that wiped out every "tight stop" in the MQL5 ecosystem. If your EA survived this $400 swing without blowing up, you’re either a god of risk management or you forgot to plug it in. At this point, Gold isn't a safe haven; it's a high-stakes casino where the house (the Fed) just changed the rules mid-game.

Macro: The Greenland Gambit and Trade War 2.0 In the world of macro, reality has officially left the building. President Trump spent the week threatening a 10% tariff on the UK and most of Europe because they wouldn't agree to hand over Greenland—a geopolitical move that makes a game of Risk look sensible. After a "productive meeting" with NATO, the tariffs were briefly suspended, only for new threats to emerge against any country that so much as looks at Cuba or Iran. The market is currently trying to price in "Reciprocal Tariffs" while the Supreme Court debates if they are even legal. Meanwhile, the trade deficit is doing exactly what it wants, supply chains are being rearranged like deck chairs on the Titanic, and the Swiss were hit with a 39% tariff on luxury goods—arbitrarily lowered to 15% after a few "gold bars and Rolexes" allegedly made their way into the mix. It's a beautiful, chaotic world of "Trumponomics" where bad news is just an opportunity for a louder tweet, and the only thing more inflated than the Dollar is the ego of the people running the show.

Steve Rosenstock

January 19, 2026 – January 23, 2026

The Volatility Trap: Where "Certainty" Goes to Die

Forex: The Great Liquidity Mirage This week in the currency markets was a masterclass in psychological torture. The EUR/USD spent four days pretending to be a stablecoin, only to perform a violent 80-pip "stop-hunt" on Thursday that seemed specifically designed to liquidate anyone who dared to use a reasonable stop-loss. The Japanese Yen continued its transformation into a chaos-index, ignoring every fundamental data point from the BoJ in favor of following the whims of rogue institutional algorithms. On MQL5, the signal provider comments were a tragicomedy of errors, with many explaining that their "systematic" 500-pip drawdown was actually just a "complex liquidity grab." If you traded the Pound this week, I hope you enjoy unprovoked 1% swings based on headlines that turned out to be rumors—it’s the algorithmic version of Whack-A-Mole, and the market has a very heavy hammer.

Gold: The $4,600 Fever Dream Gold is no longer just a metal; it has become a full-blown cult. This week, it breached $4,550 with the casual arrogance of a market that knows the global debt clock is ticking faster than a high-frequency trading bot. Every time an analyst mentioned "stabilizing inflation," Gold investors simply bought more, apparently operating on the belief that paper money will soon be used primarily as wallpaper. We saw massive volatility around the mid-week sessions where Gold would drop $40 in ten minutes, only to recover $50 in five—a perfect "V-shape" designed to destroy both the bears and the over-leveraged bulls. For the systematic traders using EAs on MQL5, the week was a test of whether your "trailing stop" was wide enough to survive a hurricane or tight enough to ensure you missed the entire rally.

Macro: The "Soft Landing" Myth Meets Reality The macro narrative this week reached peak absurdity. Central bankers spent their speaking engagements trying to convince us that the "economic landing" will be so soft we won't even feel the impact—ignoring the fact that the "runway" is currently on fire. The latest retail data suggested consumers are still spending money they don't have on things they don't need, which the market interpreted as a sign of "robust health." Meanwhile, the bond market is screaming at anyone who will listen, but most equity traders have their fingers in their ears, humming the "Buy the Dip" anthem. We are living in a financial hallucination where bad earnings are "priced in" and good earnings are a reason to double the leverage. It was a week where the only thing more inflated than the asset prices was the confidence of the "experts" on financial news networks.

The Volatility Trap: Where "Certainty" Goes to Die

Forex: The Great Liquidity Mirage This week in the currency markets was a masterclass in psychological torture. The EUR/USD spent four days pretending to be a stablecoin, only to perform a violent 80-pip "stop-hunt" on Thursday that seemed specifically designed to liquidate anyone who dared to use a reasonable stop-loss. The Japanese Yen continued its transformation into a chaos-index, ignoring every fundamental data point from the BoJ in favor of following the whims of rogue institutional algorithms. On MQL5, the signal provider comments were a tragicomedy of errors, with many explaining that their "systematic" 500-pip drawdown was actually just a "complex liquidity grab." If you traded the Pound this week, I hope you enjoy unprovoked 1% swings based on headlines that turned out to be rumors—it’s the algorithmic version of Whack-A-Mole, and the market has a very heavy hammer.

Gold: The $4,600 Fever Dream Gold is no longer just a metal; it has become a full-blown cult. This week, it breached $4,550 with the casual arrogance of a market that knows the global debt clock is ticking faster than a high-frequency trading bot. Every time an analyst mentioned "stabilizing inflation," Gold investors simply bought more, apparently operating on the belief that paper money will soon be used primarily as wallpaper. We saw massive volatility around the mid-week sessions where Gold would drop $40 in ten minutes, only to recover $50 in five—a perfect "V-shape" designed to destroy both the bears and the over-leveraged bulls. For the systematic traders using EAs on MQL5, the week was a test of whether your "trailing stop" was wide enough to survive a hurricane or tight enough to ensure you missed the entire rally.

Macro: The "Soft Landing" Myth Meets Reality The macro narrative this week reached peak absurdity. Central bankers spent their speaking engagements trying to convince us that the "economic landing" will be so soft we won't even feel the impact—ignoring the fact that the "runway" is currently on fire. The latest retail data suggested consumers are still spending money they don't have on things they don't need, which the market interpreted as a sign of "robust health." Meanwhile, the bond market is screaming at anyone who will listen, but most equity traders have their fingers in their ears, humming the "Buy the Dip" anthem. We are living in a financial hallucination where bad earnings are "priced in" and good earnings are a reason to double the leverage. It was a week where the only thing more inflated than the asset prices was the confidence of the "experts" on financial news networks.

Steve Rosenstock

January 12, 2026 – January 16, 2026

The Volatility Mirage: Hunting Liquidty in a Hall of Mirrors

Forex: The Carry Trade’s Mid-Life Crisis This week in the Forex markets felt like trying to solve a Rubik's cube while riding a mechanical bull. The USD/JPY decided to revisit its roots as a chaos generator, executing a series of "fake-outs" that left trend-following EAs on MQL5 questioning their existence. Every time a retail trader muttered the words "overbought," the pair spiked another 40 pips just to spite them. Meanwhile, the EUR/USD spent most of its time stuck in a range tighter than a central banker’s wallet, only to experience "liquidity events" during the London-New York overlap that seemed designed specifically to hit stop-losses and then immediately reverse. If your systematic approach survived this week without a margin call, you either have an incredible filter for institutional noise or your broker was down for maintenance.

Gold: The $4,500 Psychological Warfare Gold spent the week flirting with the $4,500 level, behaving like a teenager who refuses to come home past curfew. Every minor headline regarding global debt or geopolitical "friction" acted as high-octane fuel for the yellow metal. We’ve reached a point where the "Gold is a bubble" crowd has been so thoroughly liquidated that their tears are now being used as a leading indicator for further rallies. Trading Gold this week was an exercise in extreme FOMO; those who waited for a "healthy pullback" are still waiting, while those who bought the top are currently praying to the gods of support levels. On the MQL5 signals page, the Gold-focused accounts are either up 50% or down 90%—there is no middle ground in this shiny, yellow madness.

Macro: The "Data-Dependent" Comedy Tour The macro-economic landscape this week was dominated by central bankers performing linguistic gymnastics. We were told that the economy is "resilient" (which means things are expensive but people are still buying them on credit) and that future moves are "data-dependent" (which means they have no idea what’s going to happen and are checking Twitter just like the rest of us). The inflation numbers came in with a "mixed" result, which the market interpreted as a green light to buy stocks, sell the Dollar, and then do the exact opposite ten minutes later. It’s a beautiful, debt-fueled fantasy where bad news means more stimulus and good news means the "soft landing" is working. As we close the week, the only certainty is that the institutional order flow remains the only thing worth watching while the retail crowd continues to chase the ghost of "fair value."

The Volatility Mirage: Hunting Liquidty in a Hall of Mirrors

Forex: The Carry Trade’s Mid-Life Crisis This week in the Forex markets felt like trying to solve a Rubik's cube while riding a mechanical bull. The USD/JPY decided to revisit its roots as a chaos generator, executing a series of "fake-outs" that left trend-following EAs on MQL5 questioning their existence. Every time a retail trader muttered the words "overbought," the pair spiked another 40 pips just to spite them. Meanwhile, the EUR/USD spent most of its time stuck in a range tighter than a central banker’s wallet, only to experience "liquidity events" during the London-New York overlap that seemed designed specifically to hit stop-losses and then immediately reverse. If your systematic approach survived this week without a margin call, you either have an incredible filter for institutional noise or your broker was down for maintenance.

Gold: The $4,500 Psychological Warfare Gold spent the week flirting with the $4,500 level, behaving like a teenager who refuses to come home past curfew. Every minor headline regarding global debt or geopolitical "friction" acted as high-octane fuel for the yellow metal. We’ve reached a point where the "Gold is a bubble" crowd has been so thoroughly liquidated that their tears are now being used as a leading indicator for further rallies. Trading Gold this week was an exercise in extreme FOMO; those who waited for a "healthy pullback" are still waiting, while those who bought the top are currently praying to the gods of support levels. On the MQL5 signals page, the Gold-focused accounts are either up 50% or down 90%—there is no middle ground in this shiny, yellow madness.

Macro: The "Data-Dependent" Comedy Tour The macro-economic landscape this week was dominated by central bankers performing linguistic gymnastics. We were told that the economy is "resilient" (which means things are expensive but people are still buying them on credit) and that future moves are "data-dependent" (which means they have no idea what’s going to happen and are checking Twitter just like the rest of us). The inflation numbers came in with a "mixed" result, which the market interpreted as a green light to buy stocks, sell the Dollar, and then do the exact opposite ten minutes later. It’s a beautiful, debt-fueled fantasy where bad news means more stimulus and good news means the "soft landing" is working. As we close the week, the only certainty is that the institutional order flow remains the only thing worth watching while the retail crowd continues to chase the ghost of "fair value."

소셜 네트워크에 공유 · 1

Steve Rosenstock

January 5, 2026 – January 9, 2026

The Post-Holiday Reality Check: NFPs and the Great Expectations Gap

Forex: The NFP Slip-n-Slide The first full trading week of 2026 was a masterclass in why retail traders should never trust a "clean" technical breakout. The EUR/USD spent most of the week teasing a move toward 1.1700, only to be hit by a Non-Farm Payrolls print that was so confusing even the economists started speaking in riddles. The resulting volatility was essentially an algorithmic meat grinder, hunting stops above and below the range with ruthless efficiency. On MQL5, the signal comments were filled with the usual "Market Manipulation!" cries from traders whose EAs weren't built to handle a 60-pip candle in three seconds. The Yen continued its role as the market's favorite chaos agent, strengthening just enough to make every carry trade enthusiast sweat before reversing for no discernible reason other than spite.

Gold: Scaling the Wall of Worry at $4,450 Gold spent the week proving that it doesn't care about your "overbought" RSI readings. While the Dollar attempted a half-hearted recovery, Gold traders simply shrugged and kept buying the dips, pushing the metal toward the $4,450 mark. It’s reached a point where Gold is no longer a commodity; it’s a religion. Every time a macro headline mentioned "debt," "deficit," or "instability," Gold caught a bid. For those running systematic trend-followers on MQL5, it was a profitable week—provided your stop-losses weren't tight enough to be tickled by the mid-week liquidity gaps. The "Gold Bugs" are now so confident they’ve started pricing their groceries in troy ounces, while the bears are currently looking for employment in less volatile industries, like professional lion taming.

Macro: The Soft Landing Paradox The macro-economic narrative this week shifted from "will they cut?" to "did they wait too long?" The data suggested an economy that is simultaneously too hot and too cold—a Goldilocks scenario where the bear actually eats the house. Employment remains high enough to keep inflation sticky, but low enough to make the central banks nervous about a hard landing. Meanwhile, the S&P 500 continued its tradition of ignoring gravity, fueled by the blind faith that the Fed will bail out the market if anyone so much as stubs their toe. As we closed out the week, the realization began to sink in: the "pivot" everyone wanted might just be a pivot into more confusion. It was a week where the smartest trade was often the one you didn't take, leaving the "Hedged & Confused" crowd once again contemplating the existential dread of a zero-sum game.

The Post-Holiday Reality Check: NFPs and the Great Expectations Gap

Forex: The NFP Slip-n-Slide The first full trading week of 2026 was a masterclass in why retail traders should never trust a "clean" technical breakout. The EUR/USD spent most of the week teasing a move toward 1.1700, only to be hit by a Non-Farm Payrolls print that was so confusing even the economists started speaking in riddles. The resulting volatility was essentially an algorithmic meat grinder, hunting stops above and below the range with ruthless efficiency. On MQL5, the signal comments were filled with the usual "Market Manipulation!" cries from traders whose EAs weren't built to handle a 60-pip candle in three seconds. The Yen continued its role as the market's favorite chaos agent, strengthening just enough to make every carry trade enthusiast sweat before reversing for no discernible reason other than spite.

Gold: Scaling the Wall of Worry at $4,450 Gold spent the week proving that it doesn't care about your "overbought" RSI readings. While the Dollar attempted a half-hearted recovery, Gold traders simply shrugged and kept buying the dips, pushing the metal toward the $4,450 mark. It’s reached a point where Gold is no longer a commodity; it’s a religion. Every time a macro headline mentioned "debt," "deficit," or "instability," Gold caught a bid. For those running systematic trend-followers on MQL5, it was a profitable week—provided your stop-losses weren't tight enough to be tickled by the mid-week liquidity gaps. The "Gold Bugs" are now so confident they’ve started pricing their groceries in troy ounces, while the bears are currently looking for employment in less volatile industries, like professional lion taming.

Macro: The Soft Landing Paradox The macro-economic narrative this week shifted from "will they cut?" to "did they wait too long?" The data suggested an economy that is simultaneously too hot and too cold—a Goldilocks scenario where the bear actually eats the house. Employment remains high enough to keep inflation sticky, but low enough to make the central banks nervous about a hard landing. Meanwhile, the S&P 500 continued its tradition of ignoring gravity, fueled by the blind faith that the Fed will bail out the market if anyone so much as stubs their toe. As we closed out the week, the realization began to sink in: the "pivot" everyone wanted might just be a pivot into more confusion. It was a week where the smartest trade was often the one you didn't take, leaving the "Hedged & Confused" crowd once again contemplating the existential dread of a zero-sum game.

소셜 네트워크에 공유 · 1

Steve Rosenstock

December 29, 2025 – January 2, 2026

The New Year Hangover: Resolution-Breaking Volatility

Forex: The Algorithmic Hunger Games Begins While the rest of the world was busy making resolutions they’ll break by Tuesday, the Forex markets kicked off 2026 by reminding us why we all have high blood pressure. The liquidity vacuum of the holiday transition turned EUR/USD into a playground for rogue institutional bots, resulting in "flash-lite" spikes that triggered every sloppy stop-loss within a 100-pip radius. The Yen, true to form, behaved like a caffeinated squirrel on a rollercoaster, ignoring every technical level that retail traders spent their New Year's Day drawing. On MQL5, signal providers are already busy explaining why their "low-risk" drawdown suddenly looks like a ski slope. It’s the annual tradition of the market punishing anyone who thought they could trade the thin year-end volume with a "surefire" strategy.

Gold: The $4,400 Champagne Toast Gold entered 2026 with the ego of a rockstar, briefly breaching the $4,400 mark as the "ultimate hedge" against... well, everything. It seems the market’s collective New Year's resolution was to buy anything shiny and physical. Every minor geopolitical whisper sent the yellow metal into a frenzy, leaving the "short at resistance" crowd crying into their leftover party favors. Trading Gold this week was less about technical analysis and more about guessing which central bank would sneeze next. If your MQL5 EA didn’t have a "don’t sell the moon" filter, you likely spent the week watching your margin level shrink faster than a holiday bonus. At this point, Gold isn't just a safe haven; it’s a permanent residency for the paranoid.

Macro: Printing Money and Faking Stability The macro-economic landscape for the first week of the year was a masterclass in creative accounting. Governments and central banks released data that suggested everything is "under control," provided you don't look at the actual prices of energy, housing, or anything else people need to survive. The prevailing narrative is that 2026 will be the year of the "softest landing ever," which usually means we are currently in freefall but haven't hit the ground yet. The S&P 500 stayed suspiciously buoyant, fueled by the hope that the Fed will eventually just start mailing cash directly to Wall Street. For traders, the takeaway was clear: the numbers are made up, the points don’t matter, and the institutional order flow is the only truth in a sea of statistical fiction.

The New Year Hangover: Resolution-Breaking Volatility

Forex: The Algorithmic Hunger Games Begins While the rest of the world was busy making resolutions they’ll break by Tuesday, the Forex markets kicked off 2026 by reminding us why we all have high blood pressure. The liquidity vacuum of the holiday transition turned EUR/USD into a playground for rogue institutional bots, resulting in "flash-lite" spikes that triggered every sloppy stop-loss within a 100-pip radius. The Yen, true to form, behaved like a caffeinated squirrel on a rollercoaster, ignoring every technical level that retail traders spent their New Year's Day drawing. On MQL5, signal providers are already busy explaining why their "low-risk" drawdown suddenly looks like a ski slope. It’s the annual tradition of the market punishing anyone who thought they could trade the thin year-end volume with a "surefire" strategy.

Gold: The $4,400 Champagne Toast Gold entered 2026 with the ego of a rockstar, briefly breaching the $4,400 mark as the "ultimate hedge" against... well, everything. It seems the market’s collective New Year's resolution was to buy anything shiny and physical. Every minor geopolitical whisper sent the yellow metal into a frenzy, leaving the "short at resistance" crowd crying into their leftover party favors. Trading Gold this week was less about technical analysis and more about guessing which central bank would sneeze next. If your MQL5 EA didn’t have a "don’t sell the moon" filter, you likely spent the week watching your margin level shrink faster than a holiday bonus. At this point, Gold isn't just a safe haven; it’s a permanent residency for the paranoid.

Macro: Printing Money and Faking Stability The macro-economic landscape for the first week of the year was a masterclass in creative accounting. Governments and central banks released data that suggested everything is "under control," provided you don't look at the actual prices of energy, housing, or anything else people need to survive. The prevailing narrative is that 2026 will be the year of the "softest landing ever," which usually means we are currently in freefall but haven't hit the ground yet. The S&P 500 stayed suspiciously buoyant, fueled by the hope that the Fed will eventually just start mailing cash directly to Wall Street. For traders, the takeaway was clear: the numbers are made up, the points don’t matter, and the institutional order flow is the only truth in a sea of statistical fiction.

소셜 네트워크에 공유 · 1

Steve Rosenstock

December 22, 2025 – December 26, 2025

The Post-Santa Slump: When Hopes Meet Hard Stops

Forex: The Ghosts of Christmas Trading Past This week in Forex felt less like trading and more like an archaeological dig through thinly traded markets. With most of Europe and North America still nursing a holiday hangover, liquidity vanished faster than a new year's resolution. The EUR/USD decided to play a game of "how few pips can we move in 24 hours?" before suddenly deciding to execute a 50-pip stop hunt on Thursday morning, just to remind everyone that even on holiday, the algorithms never sleep. GBP/JPY, the usual fireworks display, resembled a damp squib, refusing to pick a direction with any conviction, much to the chagrin of anyone hoping for a quick scalp. If your MQL5 robot made money this week, it either has predictive AI powers or it was just incredibly lucky. The rest of us just watched charts that looked like flat ECGs, occasionally punctuated by a random spike that meant absolutely nothing.

Gold: The Golden Slumber at $4,380 Gold, having reached stratospheric levels, decided this week was a good time for a well-deserved nap. After last week's dramatic climb, it spent the holiday-shortened week consolidating in a range tighter than a cheap suit. Trading around the $4,380 mark, it was almost as if the market was collectively saying, "We’ve made our point; now let’s wait for January." The usual fear-mongers and doom-preppers were quiet, probably enjoying their fortified bunkers. For those trying to trade Gold, it was a test of patience, or perhaps a demonstration of futility. Any MQL5 expert advisor that wasn’t coded to "do nothing" likely spent the week generating tiny profits or equally tiny losses, perfectly offset by commissions. It seems even Gold gets tired of defying gravity.

Macro: The Sound of Silence Before the Storm The macro news calendar this week was as empty as a retail trader’s account after chasing an ill-advised FOMC trade. With major data releases on hiatus, central bankers presumably spent the week enjoying eggnog and pretending they don't see the incoming economic data for Q1 2026. This period of eerie quiet is always unsettling for traders; it's like the calm before a very complicated storm. We all know that January will bring a barrage of inflation updates, employment figures, and the inevitable "hawkish pivot" rhetoric that will send markets into a frenzy. For now, we are in a temporary truce, a brief moment of peace before the next round of quantitative easing, tightening, or whatever linguistic gymnastics the Fed comes up with next. Enjoy the silence, because it won't last.

The Post-Santa Slump: When Hopes Meet Hard Stops

Forex: The Ghosts of Christmas Trading Past This week in Forex felt less like trading and more like an archaeological dig through thinly traded markets. With most of Europe and North America still nursing a holiday hangover, liquidity vanished faster than a new year's resolution. The EUR/USD decided to play a game of "how few pips can we move in 24 hours?" before suddenly deciding to execute a 50-pip stop hunt on Thursday morning, just to remind everyone that even on holiday, the algorithms never sleep. GBP/JPY, the usual fireworks display, resembled a damp squib, refusing to pick a direction with any conviction, much to the chagrin of anyone hoping for a quick scalp. If your MQL5 robot made money this week, it either has predictive AI powers or it was just incredibly lucky. The rest of us just watched charts that looked like flat ECGs, occasionally punctuated by a random spike that meant absolutely nothing.

Gold: The Golden Slumber at $4,380 Gold, having reached stratospheric levels, decided this week was a good time for a well-deserved nap. After last week's dramatic climb, it spent the holiday-shortened week consolidating in a range tighter than a cheap suit. Trading around the $4,380 mark, it was almost as if the market was collectively saying, "We’ve made our point; now let’s wait for January." The usual fear-mongers and doom-preppers were quiet, probably enjoying their fortified bunkers. For those trying to trade Gold, it was a test of patience, or perhaps a demonstration of futility. Any MQL5 expert advisor that wasn’t coded to "do nothing" likely spent the week generating tiny profits or equally tiny losses, perfectly offset by commissions. It seems even Gold gets tired of defying gravity.

Macro: The Sound of Silence Before the Storm The macro news calendar this week was as empty as a retail trader’s account after chasing an ill-advised FOMC trade. With major data releases on hiatus, central bankers presumably spent the week enjoying eggnog and pretending they don't see the incoming economic data for Q1 2026. This period of eerie quiet is always unsettling for traders; it's like the calm before a very complicated storm. We all know that January will bring a barrage of inflation updates, employment figures, and the inevitable "hawkish pivot" rhetoric that will send markets into a frenzy. For now, we are in a temporary truce, a brief moment of peace before the next round of quantitative easing, tightening, or whatever linguistic gymnastics the Fed comes up with next. Enjoy the silence, because it won't last.

소셜 네트워크에 공유 · 1

Steve Rosenstock

December 15, 2025 – December 19, 2025

The Santa Rally’s Identity Crisis: Liquidity Dreams and Reality Screams Date

The Forex Zoo: Algorithms vs. The Ghost of Christmas Future The major currency pairs spent this week behaving like a tired toddler—prone to sudden, violent outbursts followed by long periods of stubborn refusal to move. EUR/USD attempted a festive breakout above the 1.1650 handle, only to be slapped back down by a Dollar that refuses to die, despite the Fed’s best efforts to sound "dovish-adjacent." Most MQL5 signals this week looked like a heart monitor for a patient having a mild panic attack. The institutional order flow was clearly thinning out, leaving the market to be run by rogue HFT bots and retail traders trying to "catch the turn" in GBP/USD. If you traded the Yen this week, I hope you enjoy high-speed volatility that makes absolutely no sense; the BoJ remains the final boss of market unpredictability, leaving every "systematic" trend-follower wondering if their code has developed a drinking problem.

Gold: The Shiny Security Blanket at $4,350 Gold continues its majestic climb into the stratosphere, currently treating the $4,300 level like it’s a basement apartment. This week, we saw the "Golden Cross" enthusiasts high-fiving each other while the rest of us wondered if the metal is now priced in "post-apocalyptic bottle caps" rather than Dollars. Every time a macro-headlined "risk-off" event flickered on the Bloomberg terminal, Gold jumped $30 in four minutes, wiping out any short-sellers who still believe in "mean reversion." At this point, Gold isn't an investment; it’s a global vote of no confidence in anything printed on paper. For the MQL5 community, the "Gold-Only" EAs had a field day, provided they were programmed with the blind optimism of a lottery winner and didn't hit a trailing stop during the Tuesday afternoon liquidity vacuum.

Macro Mayhem: The Fed’s Gift-Wrapped Confusion The macro-economic landscape this week felt like a family dinner where nobody wants to talk about the debt ceiling. We received a flurry of data points that all pointed in different directions: inflation is "stabilizing" (at prices that make a sandwich cost as much as a small car), and employment is "robust" (mostly consisting of people working three jobs to afford said sandwich). The central banks are desperately trying to pivot without looking like they’ve lost control of the steering wheel. Meanwhile, the S&P 500 is hovering near all-time highs because the market has collectively decided that reality is optional as long as the "Buy the Dip" bot is still plugged in. It’s a beautiful, fragile hallucination, and we’re all just one "hot" CPI print away from a very cold shower.

The Santa Rally’s Identity Crisis: Liquidity Dreams and Reality Screams Date

The Forex Zoo: Algorithms vs. The Ghost of Christmas Future The major currency pairs spent this week behaving like a tired toddler—prone to sudden, violent outbursts followed by long periods of stubborn refusal to move. EUR/USD attempted a festive breakout above the 1.1650 handle, only to be slapped back down by a Dollar that refuses to die, despite the Fed’s best efforts to sound "dovish-adjacent." Most MQL5 signals this week looked like a heart monitor for a patient having a mild panic attack. The institutional order flow was clearly thinning out, leaving the market to be run by rogue HFT bots and retail traders trying to "catch the turn" in GBP/USD. If you traded the Yen this week, I hope you enjoy high-speed volatility that makes absolutely no sense; the BoJ remains the final boss of market unpredictability, leaving every "systematic" trend-follower wondering if their code has developed a drinking problem.

Gold: The Shiny Security Blanket at $4,350 Gold continues its majestic climb into the stratosphere, currently treating the $4,300 level like it’s a basement apartment. This week, we saw the "Golden Cross" enthusiasts high-fiving each other while the rest of us wondered if the metal is now priced in "post-apocalyptic bottle caps" rather than Dollars. Every time a macro-headlined "risk-off" event flickered on the Bloomberg terminal, Gold jumped $30 in four minutes, wiping out any short-sellers who still believe in "mean reversion." At this point, Gold isn't an investment; it’s a global vote of no confidence in anything printed on paper. For the MQL5 community, the "Gold-Only" EAs had a field day, provided they were programmed with the blind optimism of a lottery winner and didn't hit a trailing stop during the Tuesday afternoon liquidity vacuum.

Macro Mayhem: The Fed’s Gift-Wrapped Confusion The macro-economic landscape this week felt like a family dinner where nobody wants to talk about the debt ceiling. We received a flurry of data points that all pointed in different directions: inflation is "stabilizing" (at prices that make a sandwich cost as much as a small car), and employment is "robust" (mostly consisting of people working three jobs to afford said sandwich). The central banks are desperately trying to pivot without looking like they’ve lost control of the steering wheel. Meanwhile, the S&P 500 is hovering near all-time highs because the market has collectively decided that reality is optional as long as the "Buy the Dip" bot is still plugged in. It’s a beautiful, fragile hallucination, and we’re all just one "hot" CPI print away from a very cold shower.

소셜 네트워크에 공유 · 1

Steve Rosenstock

December 8, 2025 – December 12, 2025

Waiting for Powell: The Art of Doing Nothing at High Altitude Date

The Forex Stare-Down If you enjoyed watching paint dry this week, you probably loved the EUR/USD chart. The pair spent most of the week "consolidating" between 1.1550 and 1.1641, which is trader-speak for "we are terrified to move until Daddy Powell speaks." The entire market was paralyzed by the FOMC meeting, with a 90% probability of a rate cut priced in—because apparently, the other 10% of the market lives in a cave without Wi-Fi. We saw the usual pre-news jitters where the algorithm boys hunted stops on both sides, ensuring that retail traders trying to guess the "drift" got chopped up nicely before the actual news even hit. If your EA made money on this flatline, it’s either a genius or a ticking time bomb of a grid system.

Gold: The $4,200 "Boring" Zone Gold is trading comfortably above $4,200, and the audacity of the market is that we are calling this "range-bound." Remember when $2,000 was considered a psychological barrier? Now we are flirting with $4,300 targets, and analysts are yawning. The metal spent the week teasing a breakout, testing resistance near $4,240 but largely just sitting there collecting swap fees from anyone foolish enough to hold a position too long. It seems the only thing keeping Gold from rocketing to the moon or crashing back to reality is the collective breath-holding for the Fed’s 2026 outlook. It’s a "bullish consolidation," they say—which translates to "buy the dip, but please don't look at the RSI."

Macro Reality vs. Market Fantasy The S&P 500 slipped from its record highs because, heaven forbid, investors take profit before a major central bank decision. Inflation data came in "tame," which is a hilarious word to use for prices that are permanently stuck at "expensive." Meanwhile, the macro narrative has shifted from "recession fear" to "how many cuts can we bully the Fed into giving us?" The consensus seems to be that bad news is good news, good news is bad news, and no news is an excuse to sell. As we wrap up the week, the smart money has likely hedged everything, while the retail crowd is left wondering why their "guaranteed" news-trading setup hit stop-loss in both directions.

Waiting for Powell: The Art of Doing Nothing at High Altitude Date

The Forex Stare-Down If you enjoyed watching paint dry this week, you probably loved the EUR/USD chart. The pair spent most of the week "consolidating" between 1.1550 and 1.1641, which is trader-speak for "we are terrified to move until Daddy Powell speaks." The entire market was paralyzed by the FOMC meeting, with a 90% probability of a rate cut priced in—because apparently, the other 10% of the market lives in a cave without Wi-Fi. We saw the usual pre-news jitters where the algorithm boys hunted stops on both sides, ensuring that retail traders trying to guess the "drift" got chopped up nicely before the actual news even hit. If your EA made money on this flatline, it’s either a genius or a ticking time bomb of a grid system.

Gold: The $4,200 "Boring" Zone Gold is trading comfortably above $4,200, and the audacity of the market is that we are calling this "range-bound." Remember when $2,000 was considered a psychological barrier? Now we are flirting with $4,300 targets, and analysts are yawning. The metal spent the week teasing a breakout, testing resistance near $4,240 but largely just sitting there collecting swap fees from anyone foolish enough to hold a position too long. It seems the only thing keeping Gold from rocketing to the moon or crashing back to reality is the collective breath-holding for the Fed’s 2026 outlook. It’s a "bullish consolidation," they say—which translates to "buy the dip, but please don't look at the RSI."

Macro Reality vs. Market Fantasy The S&P 500 slipped from its record highs because, heaven forbid, investors take profit before a major central bank decision. Inflation data came in "tame," which is a hilarious word to use for prices that are permanently stuck at "expensive." Meanwhile, the macro narrative has shifted from "recession fear" to "how many cuts can we bully the Fed into giving us?" The consensus seems to be that bad news is good news, good news is bad news, and no news is an excuse to sell. As we wrap up the week, the smart money has likely hedged everything, while the retail crowd is left wondering why their "guaranteed" news-trading setup hit stop-loss in both directions.

소셜 네트워크에 공유 · 1

Steve Rosenstock

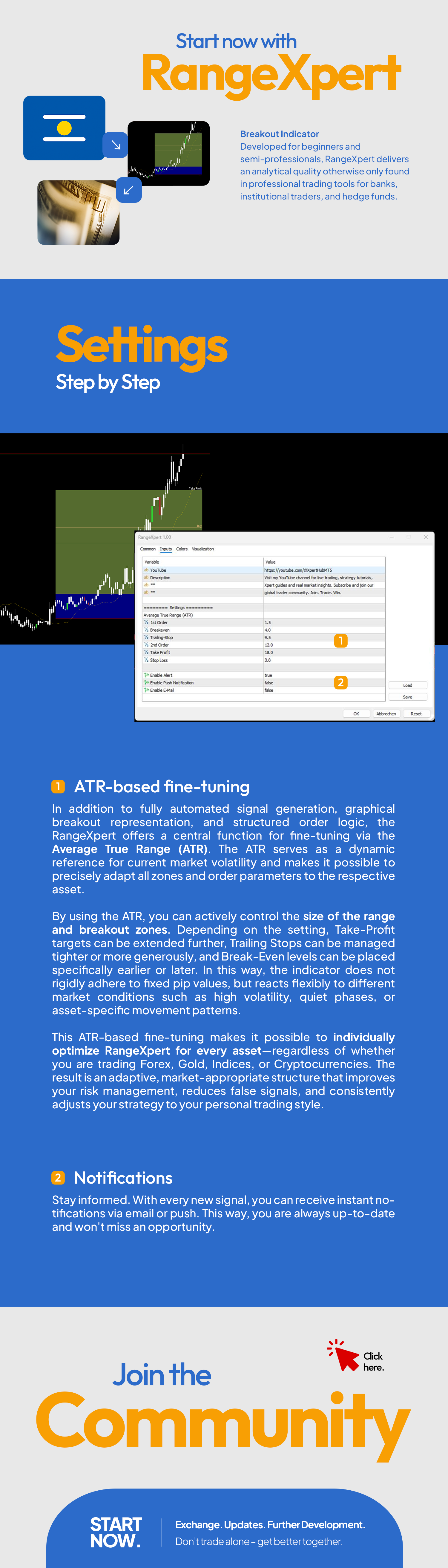

No tricks. No artificial "10 spots". No time pressure. No FOMO.

That’s why the indicator costs permanently only $149 for you. So that every trader can benefit.

Fair, transparent and accessible for everyone. I am building a long-term community.

https://www.mql5.com/en/market/product/139498

That’s why the indicator costs permanently only $149 for you. So that every trader can benefit.

Fair, transparent and accessible for everyone. I am building a long-term community.

https://www.mql5.com/en/market/product/139498

Steve Rosenstock

Take a look at my 8 free products, which I developed for you after consulting with the Xpert community:

https://www.mql5.com/en/users/steverosenstock/seller

If you like them, I would appreciate a review. Thank you.

https://www.mql5.com/en/users/steverosenstock/seller

If you like them, I would appreciate a review. Thank you.

Steve Rosenstock

https://www.mql5.com/en/market/product/154658

ZoneXpert is your visual market analyst for MetaTrader 5 - developed to automatically detect Support and Resistance zones, highlight them visually, and update them in real time. The indicator analyzes price structures, highs, lows and volume areas to show you exactly where the market reacts - and where it breaks through. With ZoneXpert you instantly see where market forces accumulate - and you trade where real decisions are made, not where randomness rules. Instead of manually drawing lines or comparing old levels, ZoneXpert gives you a dynamic, clear zone system directly on the chart. Each zone is automatically limited and adjusted to current market movements - ideal for planning entries and exits, limiting risk, and understanding market reactions. Whether in Forex, Gold or Index trading - ZoneXpert uncovers the invisible price areas where markets truly decide. Perfect for traders who appreciate structure, timing and visual clarity.

ZoneXpert is your visual market analyst for MetaTrader 5 - developed to automatically detect Support and Resistance zones, highlight them visually, and update them in real time. The indicator analyzes price structures, highs, lows and volume areas to show you exactly where the market reacts - and where it breaks through. With ZoneXpert you instantly see where market forces accumulate - and you trade where real decisions are made, not where randomness rules. Instead of manually drawing lines or comparing old levels, ZoneXpert gives you a dynamic, clear zone system directly on the chart. Each zone is automatically limited and adjusted to current market movements - ideal for planning entries and exits, limiting risk, and understanding market reactions. Whether in Forex, Gold or Index trading - ZoneXpert uncovers the invisible price areas where markets truly decide. Perfect for traders who appreciate structure, timing and visual clarity.

Steve Rosenstock

https://www.mql5.com/en/market/product/152915

StrongXpert is your precise real-time strength monitor for the global currency market. It was developed to show you where capital is actually flowing – and where it is leaving the market. The indicator measures the relative strength of all major currencies (USD, EUR, GBP, JPY, AUD, CAD, CHF, NZD) and transforms complex price movements into a simple, readable visual dashboard – directly on the chart. Identify the strongest and weakest currency within seconds – ideal for confirming setups, filtering trend directions or spotting reversal points. No guessing, no assumptions – just clear market structure in real time. While many strength indicators only display simple calculations or delayed values, StrongXpert works with a continuous real-time analysis that adapts dynamically to market phases. Every second it delivers an up-to-date, precise picture of relative currency flows – without lag, without repainting, without compromises. This allows you to react quickly, before market movements fully unfold.

StrongXpert is your precise real-time strength monitor for the global currency market. It was developed to show you where capital is actually flowing – and where it is leaving the market. The indicator measures the relative strength of all major currencies (USD, EUR, GBP, JPY, AUD, CAD, CHF, NZD) and transforms complex price movements into a simple, readable visual dashboard – directly on the chart. Identify the strongest and weakest currency within seconds – ideal for confirming setups, filtering trend directions or spotting reversal points. No guessing, no assumptions – just clear market structure in real time. While many strength indicators only display simple calculations or delayed values, StrongXpert works with a continuous real-time analysis that adapts dynamically to market phases. Every second it delivers an up-to-date, precise picture of relative currency flows – without lag, without repainting, without compromises. This allows you to react quickly, before market movements fully unfold.

Steve Rosenstock

https://www.mql5.com/en/market/product/152914

The SignalXpert was developed by me to provide traders who use the indicator RangeXpert with a powerful analysis tool. RangeXpert serves as the foundation of the system – it detects precise market areas and provides the data that SignalXpert evaluates in real time to generate clear, actionable signals. This enables the simultaneous monitoring of up to 25 different assets in various timeframes and detects the most important market movements in real time. Thanks to the integrated alert function, notifications can be sent via alert, push or email, ensuring you never miss trading opportunities again. By installing it on a MetaTrader VPS, SignalXpert runs around the clock and provides reliable signal monitoring. Whether you are planning entries or exits - SignalXpert gives you fast and targeted support, allowing you to trade confidently even in volatile markets.

The SignalXpert was developed by me to provide traders who use the indicator RangeXpert with a powerful analysis tool. RangeXpert serves as the foundation of the system – it detects precise market areas and provides the data that SignalXpert evaluates in real time to generate clear, actionable signals. This enables the simultaneous monitoring of up to 25 different assets in various timeframes and detects the most important market movements in real time. Thanks to the integrated alert function, notifications can be sent via alert, push or email, ensuring you never miss trading opportunities again. By installing it on a MetaTrader VPS, SignalXpert runs around the clock and provides reliable signal monitoring. Whether you are planning entries or exits - SignalXpert gives you fast and targeted support, allowing you to trade confidently even in volatile markets.

Steve Rosenstock

https://www.mql5.com/en/market/product/141020

NewsXpert was developed to give traders a clear, structured overview of all upcoming economic events directly on the chart. Your real-time news filter for MetaTrader 5. The indicator automatically detects all relevant news for the selected currencies and marks them with color-coded lines (Low, Medium, High Impact). This way, you always know exactly when and which news will move the market – without opening external calendars or tabs. NewsXpert makes economic uncertainty predictable by delivering all relevant market information precisely where you need it – directly on the chart and in real time. Thanks to clear visualization, precise lead times, and the ability to filter only the most important currencies and events, your trading becomes calmer, more structured, and significantly more professional. Instead of reacting, you can act proactively with NewsXpert – prepared, informed, and supported by a system that reliably protects you from strong market movements. It provides real-time information, countdown timers, and notifications before important events – via alert, push, or email. With it, you’ll never miss a market reaction again and can control your risk with precision.

NewsXpert was developed to give traders a clear, structured overview of all upcoming economic events directly on the chart. Your real-time news filter for MetaTrader 5. The indicator automatically detects all relevant news for the selected currencies and marks them with color-coded lines (Low, Medium, High Impact). This way, you always know exactly when and which news will move the market – without opening external calendars or tabs. NewsXpert makes economic uncertainty predictable by delivering all relevant market information precisely where you need it – directly on the chart and in real time. Thanks to clear visualization, precise lead times, and the ability to filter only the most important currencies and events, your trading becomes calmer, more structured, and significantly more professional. Instead of reacting, you can act proactively with NewsXpert – prepared, informed, and supported by a system that reliably protects you from strong market movements. It provides real-time information, countdown timers, and notifications before important events – via alert, push, or email. With it, you’ll never miss a market reaction again and can control your risk with precision.

Steve Rosenstock

https://www.mql5.com/en/market/product/141022

ShowXpert is your visual control center for MetaTrader 5. ShowXpert is an intelligent visualization tool that displays all your closed Buy and Sell trades directly on the chart including the result in points and currency. Profitable trades appear in green, losses in red and clear, intuitive, and updated in real time. At a glance, you can see which setups worked and how your current trade is developing. Whether for strategy analysis, live monitoring, or simply to make your trading visually tangible. ShowXpert brings structure and clarity to your charts. All elements are fully customizable: colors, fonts, line styles, and display format (Pips or USD). The result is your personal performance display precise, transparent, and motivating. ShowXpert turns raw data into visible results making trading truly experienceable and is part of the professional Xpert-Series designed for traders who demand more. ShowXpert reveals your trading clearer than ever before – a customizable, powerful tool that makes your results visible and helps you analyze the markets with precision, structure, and confidence.

ShowXpert is your visual control center for MetaTrader 5. ShowXpert is an intelligent visualization tool that displays all your closed Buy and Sell trades directly on the chart including the result in points and currency. Profitable trades appear in green, losses in red and clear, intuitive, and updated in real time. At a glance, you can see which setups worked and how your current trade is developing. Whether for strategy analysis, live monitoring, or simply to make your trading visually tangible. ShowXpert brings structure and clarity to your charts. All elements are fully customizable: colors, fonts, line styles, and display format (Pips or USD). The result is your personal performance display precise, transparent, and motivating. ShowXpert turns raw data into visible results making trading truly experienceable and is part of the professional Xpert-Series designed for traders who demand more. ShowXpert reveals your trading clearer than ever before – a customizable, powerful tool that makes your results visible and helps you analyze the markets with precision, structure, and confidence.

Steve Rosenstock

https://www.mql5.com/en/market/product/141021

TimeXpert is a fully free tool for MetaTrader 5 that displays the global trading sessions – Tokyo, Sydney, London, and New York – directly on your chart. Instead of calculating times manually, you get an automatic, color-coded overview that shows at a glance when markets open, overlap, or close. This allows you to instantly identify where volatility emerges, when liquidity increases, and which periods best fit your trading strategy. All elements are fully customizable – from colors and line styles to the number of sessions displayed – making TimeXpert a flexible companion for every trader. TimeXpert helps you perfect the timing of your trades by showing exactly when movement begins and which sessions deliver the strongest market impulses – an essential tool for any professional setup. With its clean, minimalist design, TimeXpert transforms your MetaTrader 5 into a visual world map of the markets – precise, intuitive, and 100% free.

TimeXpert is a fully free tool for MetaTrader 5 that displays the global trading sessions – Tokyo, Sydney, London, and New York – directly on your chart. Instead of calculating times manually, you get an automatic, color-coded overview that shows at a glance when markets open, overlap, or close. This allows you to instantly identify where volatility emerges, when liquidity increases, and which periods best fit your trading strategy. All elements are fully customizable – from colors and line styles to the number of sessions displayed – making TimeXpert a flexible companion for every trader. TimeXpert helps you perfect the timing of your trades by showing exactly when movement begins and which sessions deliver the strongest market impulses – an essential tool for any professional setup. With its clean, minimalist design, TimeXpert transforms your MetaTrader 5 into a visual world map of the markets – precise, intuitive, and 100% free.

Steve Rosenstock

https://www.mql5.com/en/market/product/102902

DashXpert is a completely free, powerful dashboard for MetaTrader 5, displaying all essential market data, account information, and performance statistics directly on your chart. Instead of switching between windows and tabs, DashXpert gives you a central, intelligent overview – optimized for maximum clarity, minimal distraction, and a professional look. It provides a real-time, clear overview of your open positions, profits and losses, success rate, and account balance. This makes DashXpert not just a practical everyday tool but also a complete performance monitor that helps you understand, improve, and transparently visualize your trading. In addition, the dashboard automatically displays the most important trading sessions (Sydney, Tokyo, London, New York) including status – so you can instantly see when and where the market is moving. With its modern, minimalist design, clear color scheme, and perfect readability on all chart types, DashXpert transforms your MetaTrader into a true trading cockpit – clean, professional, and 100% free.

DashXpert is a completely free, powerful dashboard for MetaTrader 5, displaying all essential market data, account information, and performance statistics directly on your chart. Instead of switching between windows and tabs, DashXpert gives you a central, intelligent overview – optimized for maximum clarity, minimal distraction, and a professional look. It provides a real-time, clear overview of your open positions, profits and losses, success rate, and account balance. This makes DashXpert not just a practical everyday tool but also a complete performance monitor that helps you understand, improve, and transparently visualize your trading. In addition, the dashboard automatically displays the most important trading sessions (Sydney, Tokyo, London, New York) including status – so you can instantly see when and where the market is moving. With its modern, minimalist design, clear color scheme, and perfect readability on all chart types, DashXpert transforms your MetaTrader into a true trading cockpit – clean, professional, and 100% free.

Steve Rosenstock

https://www.mql5.com/en/market/product/152298

InfoXpert is a free and intelligent tool for MetaTrader 5 that displays all essential trading data directly on your chart – live, clear, and precise. You can instantly see your profit or loss (in currency and percentage), the spread, and the remaining candle time – perfect for quick decisions in active trading. All elements are fully customizable – you decide which data to display, what colors to use, and where the information appears on your chart – at the top, bottom, or directly next to the price. This way, InfoXpert adapts to your style, not the other way around. With its modern, minimalist design, InfoXpert becomes the head-up display of your trading – precise, efficient, and 100% free. An essential tool for traders who value clarity, control and perfect timing. InfoXpert combines functionality and style – built for traders who want to see every detail of their success.

InfoXpert is a free and intelligent tool for MetaTrader 5 that displays all essential trading data directly on your chart – live, clear, and precise. You can instantly see your profit or loss (in currency and percentage), the spread, and the remaining candle time – perfect for quick decisions in active trading. All elements are fully customizable – you decide which data to display, what colors to use, and where the information appears on your chart – at the top, bottom, or directly next to the price. This way, InfoXpert adapts to your style, not the other way around. With its modern, minimalist design, InfoXpert becomes the head-up display of your trading – precise, efficient, and 100% free. An essential tool for traders who value clarity, control and perfect timing. InfoXpert combines functionality and style – built for traders who want to see every detail of their success.

: