거래 로봇을 무료로 다운로드 하는 법을 시청해보세요

당사를 Facebook에서 찾아주십시오!

당사 팬 페이지에 가입하십시오

당사 팬 페이지에 가입하십시오

스크립트가 마음에 드시나요? MetaTrader 5 터미널에서 시도해보십시오

- 게시자:

- Nikolay Kositsin

- 조회수:

- 96

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

실제 작성자:

적립 외환

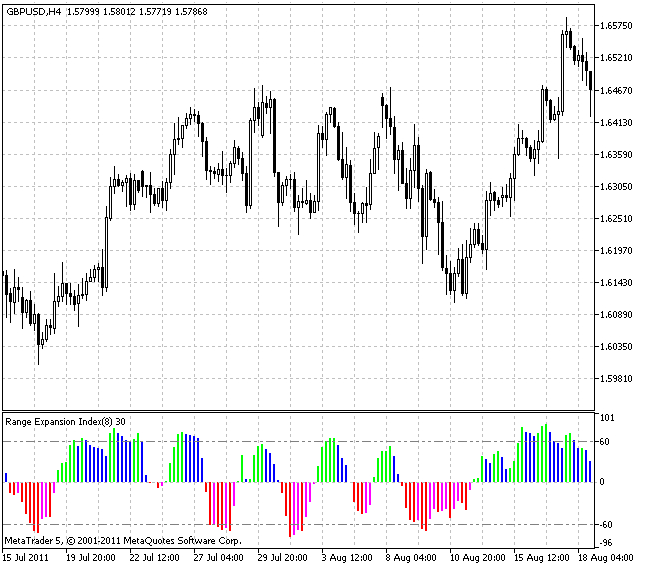

범위 확장 지수 (REI)는 가격 변화율을 측정하고 가격이 약세 또는 강세를 보이는 경우 과매수 / 과매도 상태를 나타내는 상대 오실레이터입니다. Tom DeMark가 개발했으며 "기술적 분석 - 새로운 과학"이라는 책에 설명되어 있습니다.

지표 값은 -100에서 +100까지 다양합니다. REI는 횡보 추세에서 중립을 유지하며 중요한 고점 또는 저점에 도달했을 때만 신호를 표시하므로 개선된 오실레이터입니다.

입력 매개변수:

- REI_기간(기본값 = 8) - 인디케이터의 주기입니다. 값이 증가하면 신호 수는 감소하지만 정확도는 증가합니다. 감소할 때 - 반대로 신호 수는 증가하지만 정확도는 감소합니다.

톰 드마크는 기본 기간을 8로 사용할 것을 제안합니다. 가격이 60 수준 이상으로 상승했다가 그 이하로 떨어지면 매도할 수 있습니다. 가격이 -60 아래로 떨어졌다가 이 수준 이상으로 상승하면 매수할 수 있습니다.

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/529

지그재그 웨이브 크기

지그재그 웨이브 크기

핍, 레벨 및 다양한 경고 로직의 파장에 대한 정보를 추가하여 표준 지그재그 표시기를 수정했습니다.

적응형 CCI

적응형 CCI

적응형 CCI - 시장 변동성에 따라 상한과 하한을 동적으로 조정하는 원자재 채널 지수입니다. EMA 평활화 고점과 저점을 사용하여 고정된 임계값(예: 100/-100)을 없애고 각 자산의 현재 변동성에 맞춰 보다 안정적인 과매수/과매도 신호를 제공합니다. 적응형 확인 레벨로 높은 확률의 반전 지점을 식별하는 데 적합합니다.