당사 팬 페이지에 가입하십시오

- 조회수:

- 118

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

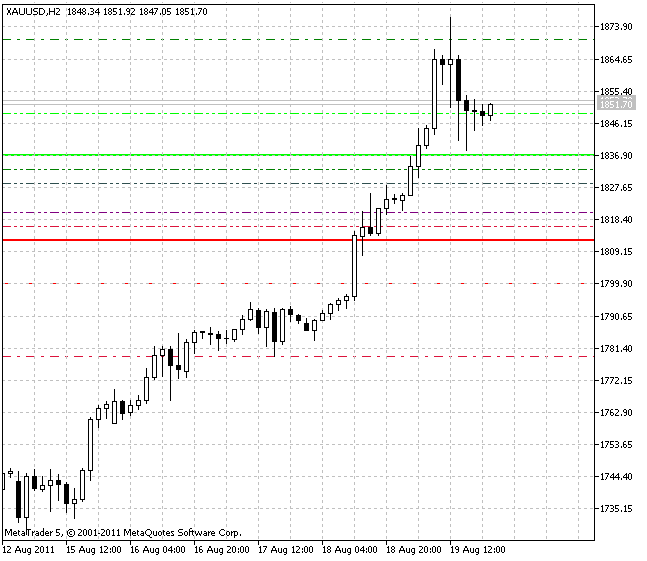

카마릴라 방정식 시스템은 지난 80년대 후반 닉 스토트가 트레이더에게 소개했습니다.

카마릴라 방정식은 처음에는 8개, 이후 수정에서는 어제 세션의 시가, 종가, 최대 및 최소값과 거래에서 이러한 수준을 사용하는 방법에 대한 일련의 권장 사항을 사용하여 계산되는 10개의 레벨로 구성됩니다.

레벨은 두 그룹으로 나뉩니다. 첫 번째 그룹은 어제 세션의 종가에서 아래쪽으로 형성되며 문자 L("낮음"에서)로 표시되고 1에서 5까지 번호가 매겨집니다. 마찬가지로 두 번째 레벨 그룹은 어제 종가로부터 위쪽으로 형성되며 문자 H("높음"에서)로 표시되고 1에서 5까지 번호가 매겨집니다.

레벨 1과 2는 상대적으로 값이 작기 때문에 고려 대상에서 제외되는 경우가 많다는 점에 유의해야 합니다. 반대로 레벨 L5와 H5는 많은 출처에서 고려 대상에서 제외하지만 절대적으로 배제해서는 안 됩니다.

카마릴라 방정식 레벨은 다음 공식을 사용하여 계산합니다:

H1 = close + (high-low)*1.1 /12

H2 = close + (high-low)*1.1 /6

H3 = close + (high-low)*1.1 /4

H4 = close + (high-low)*1.1 /2

H5 = (high/low)*close

L1 = close - (high-low)*1.1 /12

L2 = close - (high-low)*1.1 /6

L3 = close - (high-low)*1.1 /4

L4 = close - (high-low)*1.1 /2

L5 = close - (H5 - close)

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/469

X2MA

X2MA

두 개의 평균이 있는 범용 이동 평균과 수십 가지 가능한 변형 중에서 각 평균을 선택할 수 있습니다.

AT_CF

AT_CF

V.Kravchuk의 AT&CF 방식의 기초가 되는 네 가지 디지털 필터를 하나의 별도 창에서 확인할 수 있습니다.

2 Moving Averages with Bollinger Bands

2 Moving Averages with Bollinger Bands

"볼린저 밴드가 있는 2이동평균"은 구성 가능한 두 개의 이동평균과 옵션인 볼린저 밴드를 결합한 맞춤형 MT5 인디케이터입니다. 크로스오버가 발생하면 실시간 매수 및 매도 화살표가 생성되며 경고, 소리 및 이메일 알림(선택 사항)이 제공됩니다. 모든 차트주기와 심볼에 적합

Buffers for each hour (binary) and an hour buffer from 0-23 - for data collection purposes

Buffers for each hour (binary) and an hour buffer from 0-23 - for data collection purposes

데이터 수집을 위한 프로토타입. 하루 중 한 시간 동안의 데이터 창(데이터 수집 목적)을 위한 더미 버퍼와 하루 중 한 시간 동안의 추가 버퍼입니다. 하루 중 시간을 코멘트합니다.